A Look Back to 2009

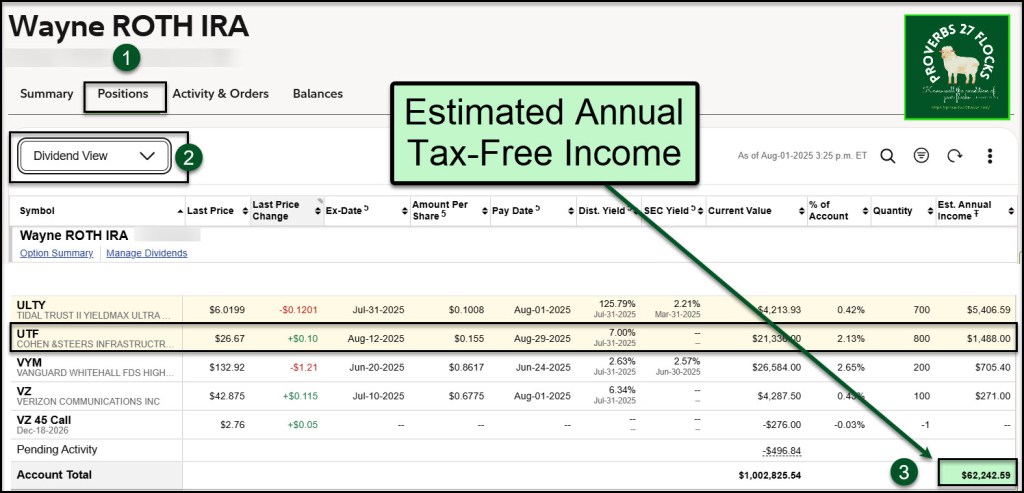

In September 2009 my ROTH IRA contained a majestic total of $5,984.98. It now has a balance of $1,002,825.54. How did that happen in sixteen years? It wasn’t primarily from the cash I added during my working years. Most of it is a combination of ROTH conversions and buying quality dividend growth stocks. At the end of this post I will talk more about the details.

Multiple Reasons for ROTH Conversions

If you have a traditional IRA or will have one when you roll your traditional 401(k) into a rollover IRA, you should consider moving shares of your ETFs and stocks from the IRA to a ROTH IRA. There are two primary considerations before you do this.

The first is that you want to be ready to pay the income taxes on the value of the shares. The IRS views this as income and it must be reported as such. Form 1099-R is sent to the IRS, so they know about your IRA withdrawal income.

The second is that you have to consider where you are in age. If you don’t have to take RMDs yet, then it is easy. If the taxes you have to pay for withdrawals from your IRA make sense, convert the shares to the ROTH. If you have to take RMDs (like me) then you need to fulfill your RMD obligation before you do any conversions.

I used QCD giving to fulfill my 2025 RMD so I can now start to move stocks and ETFs from my traditional rollover IRA to my ROTH.

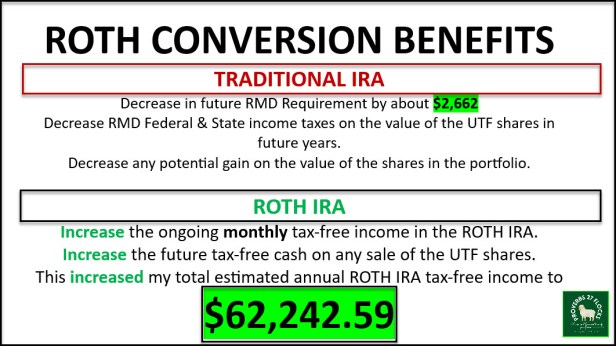

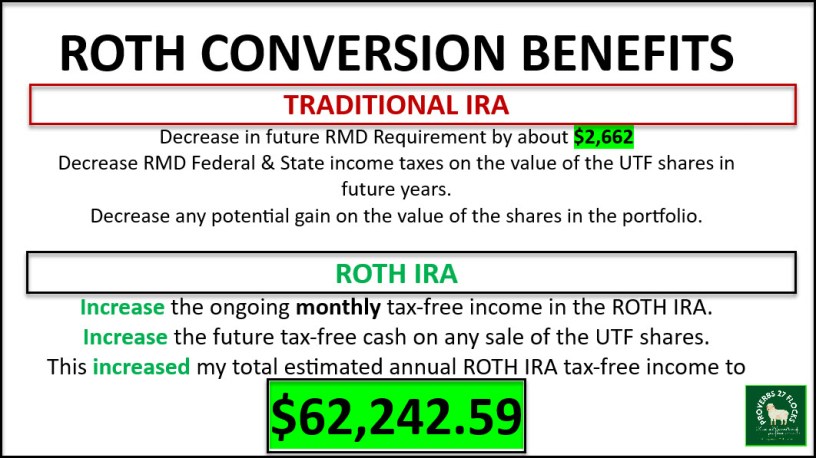

ROTH Conversion Benefits: Look at the TRADITIONAL IRA

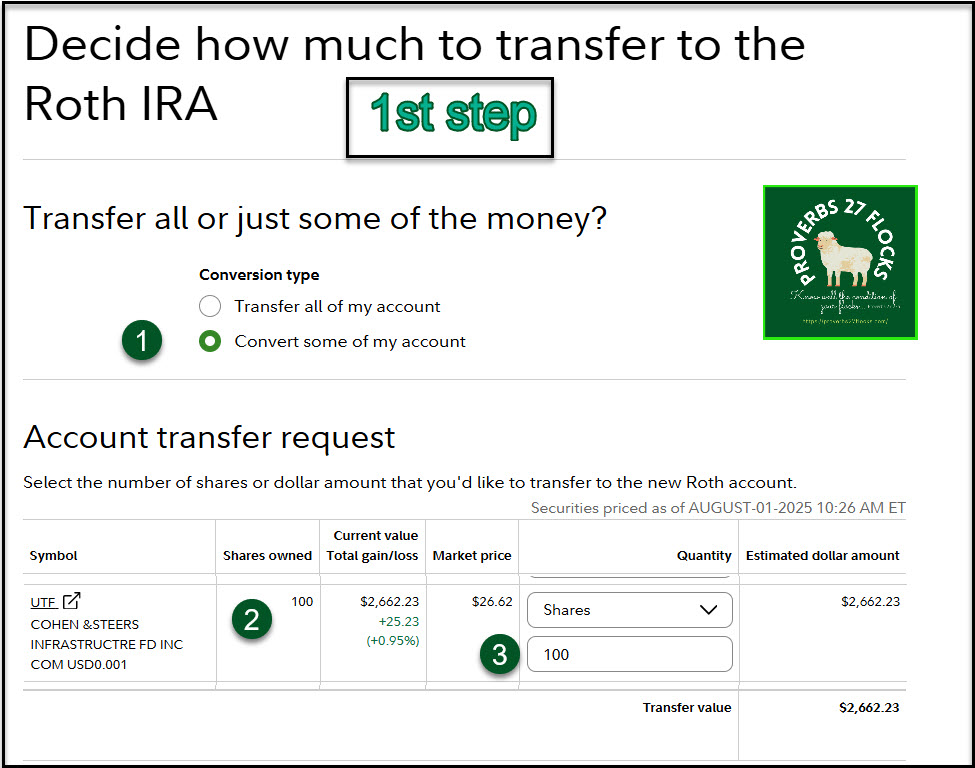

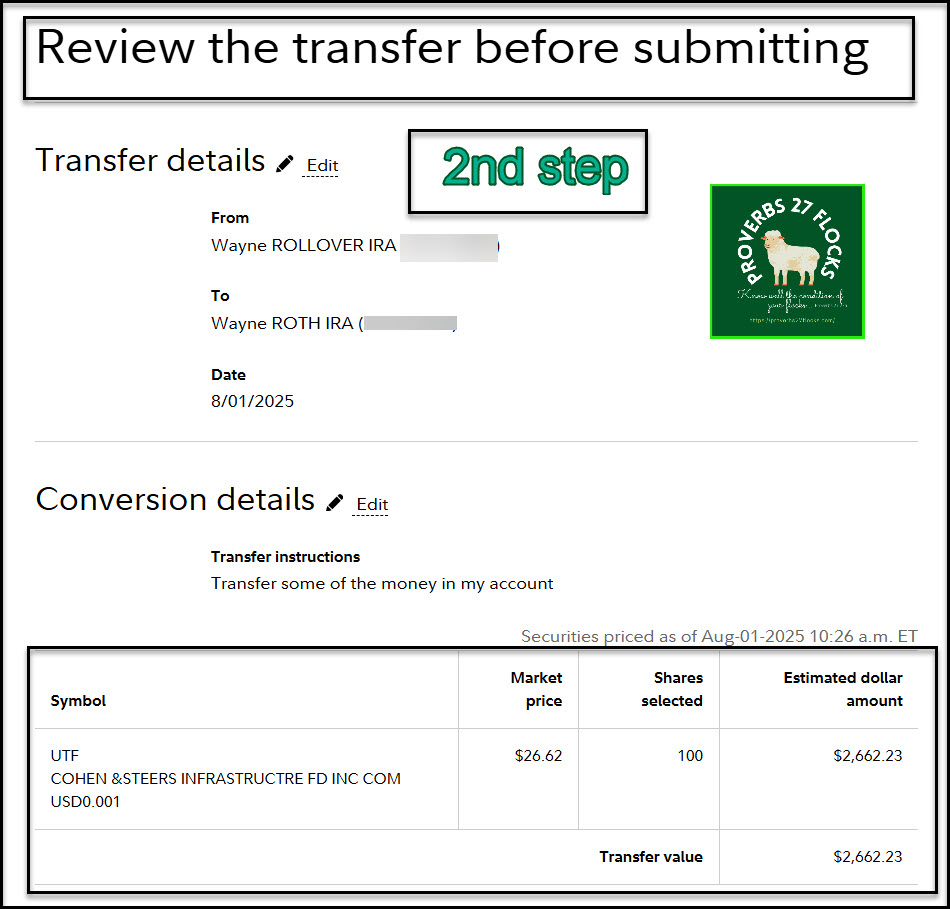

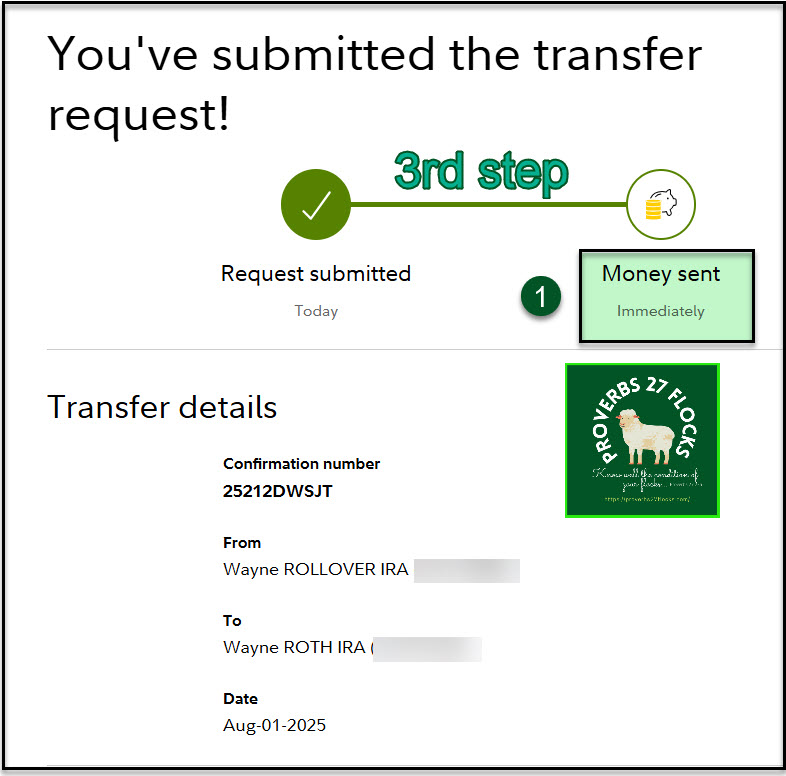

I moved 100 shares of ETF “UTF” today. When the market closes this afternoon, I will have a tax liability equal to the closing price of the shares times 100 shares. This is likely to be about $2,662. So I will have to pay regular income taxes on that amount. This is already part of the plan when I make my quarterly estimated income tax payments.

However, this also means that the value of those shares will not be part of my total balance at the end of 2025. This means my RMD will be decreased by around $108 if they stay at the same price until then. This may not seem like much but remember that the RMD amount increases every year.

By the time I am 85 (if I live that long) the RMD amount will be $166. So every year I have a slightly lower total IRA balance because I removed something that can grow in value from the traditional IRA.

If I sell shares in my traditional IRA, and withdraw the cash, I have to pay income taxes on the total amount of cash. At that point I’d possibly have shares worth more than $2,662, so that entire amount would be taxable.

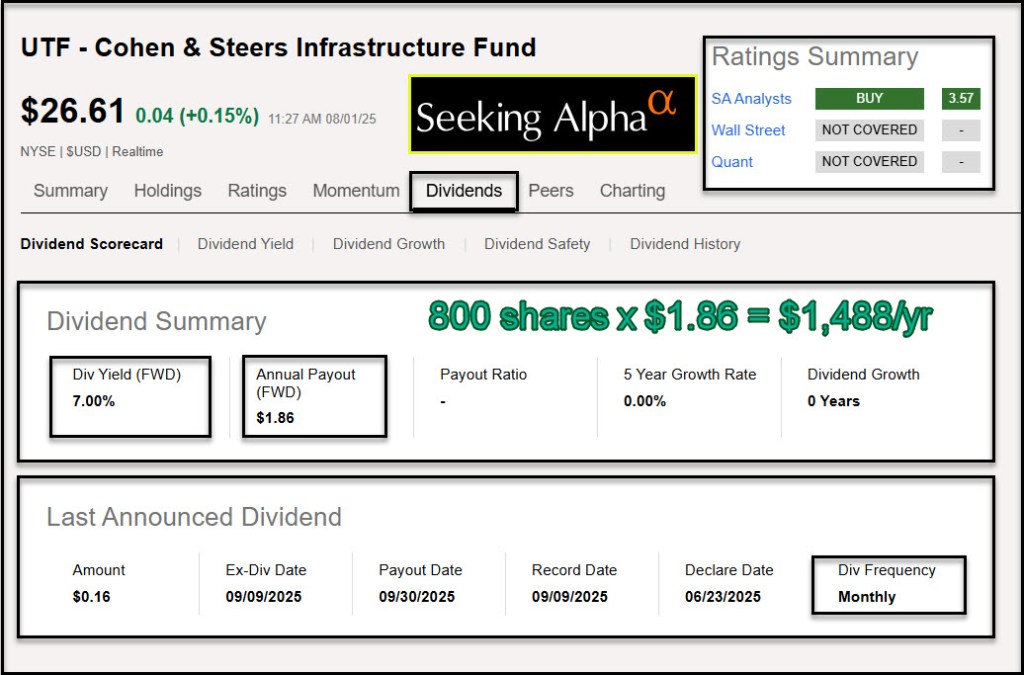

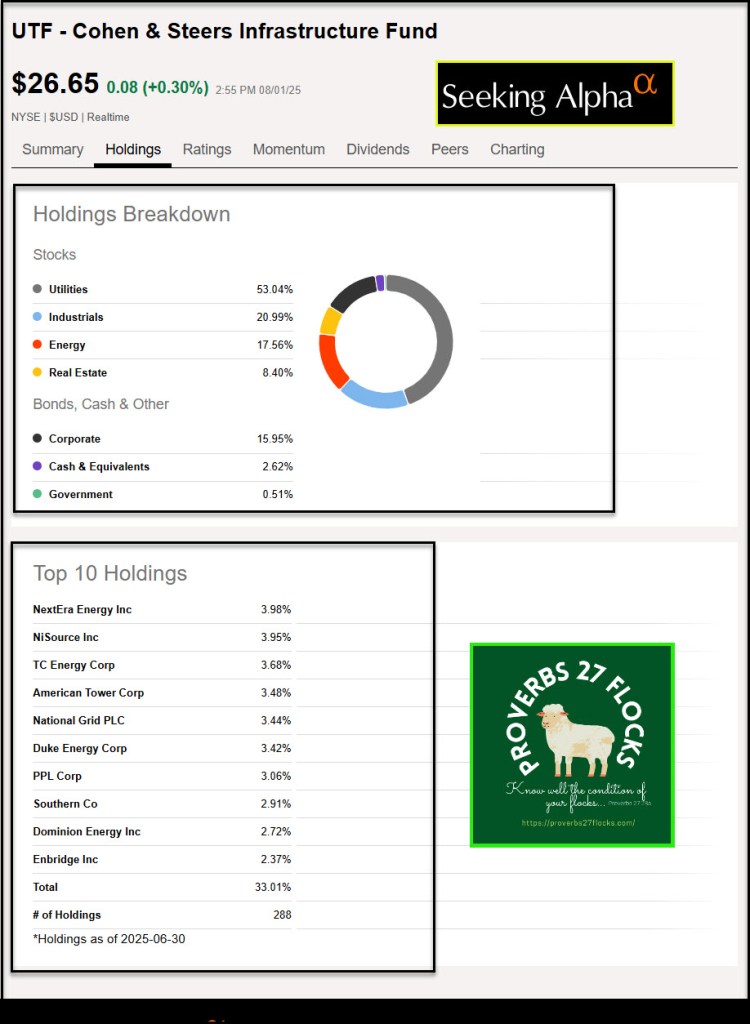

Finally, I would not convert UTF to my ROTH if I did not expect the shares to increase in value. Admittedly this won’t be a huge increase, as UTF is primarily a current income investment rather than a growth investment. However, with a yield of 7.0%, holding UTF is far better than cash in a money market account or in CDs.

Now let’s consider how this reaps benefits on the flip side. Why is this so significant in the ROTH?

ROTH Conversion Benefits: The ROTH IRA Perspective

The most obvious thing is that the 100 shares increases the ROTH’s ongoing monthly tax-free income. Because the annual estimated income from one share is $1.86, I have added $186 in tax-free income to our income stream. I already had 700 shares of UTF in my ROTH, so this brings the total UTF monthly dividend to $128. That is enough to cover our PureTalk cell phone bill (a total of $39.20 for two phones) and our Spectrum internet service ($49.99), leaving enough for a tank of gasoline ($38.81).

Less obvious but noted above is that the future sale of the 100 shares results in tax-free cash on any sale. Who thinks taxes will decrease? Not me. Therefore, the potential long-term savings may be substantial. Also bear in mind that my wife will probably outlive me. She will have to file as a single, not a married person. That will also increase her income taxes substantially.

Finally, although the dividend for year one is not significant, over ten years $186 could total $1,860. Again, none of those dividends is taxed. Therefore, my increased total estimated annual ROTH IRA tax-free income is now $62,242.59.

How did this Happen?

Three fundamentals contributed to this result: 1) Adding cash to the ROTH; 2) ROTH conversions; and 3) the growth of the dividends in the stocks/ETFs I own.

The first fundamental is that I started adding cash to the ROTH during my working years and I chose the ROTH 401(k) when I worked for my last employer. Then, to goose my results I started rolling assets from my traditional IRA to my ROTH. The power of compounding is marvelous.

In September 2009 my ROTH IRA contained the majestic total of 5,984.98. I added $6K in December 2010. I added another $6K in October 2011. In October 2013 I added $36,318.70, which was a rollover from my Parts Now ROTH 401(k).

The second fundamental is a turbocharger for growth. Now and then along the way I started to roll assets from my traditional IRA to my ROTH.

As a result, over the years either cash or stocks/ETFs were added to the tune of $624,043.39. Most of that would have been taxable in my traditional IRA at some point in time. In other words, my RMD’s would have had to be much larger than they are today.

Furthermore, since 2009 I have received $248,286.61 in non-taxable dividends. In sixteen years my total return in the ROTH has been 342%. That is over 21% per year on average.

Remember the EAI for this year is $62,242.59. In five years that will probably be $310,000. That is more income than I received from 2009-2024.

The third fundamental is the easy one: buy dividend growth assets. Even better, do the same in the traditional IRA so that when you roll those assets to the ROTH they continue to contribute to the growth of tax-free income.

YTD ROTH Options Income $38,458.88

Let’s not forget that the income I make from selling covered call options in the ROTH IRA is also tax-free. That is a bonus. You don’t have to do this, but it can create a lot of income. Look at it this way: my tax-free income from dividends and options trades over the twelve months (assuming no dramatic changes to my holdings) will easily reach $100K in 2025.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

I had several low income years in mid-life and converted what I could during those years. The payoff later made conversions a wise move.

LikeLiked by 1 person