What Are Earnings?

Earnings are foundational for determining if a stock is worth buying. The earnings trend and forecast are also important to investors. Investopedia says that “A company’s earnings are, quite simply, its profits. Take a company’s revenue from selling something, subtract all the costs to produce that product, and, voila, you have earnings! Of course, the details of accounting get a lot more complicated, but earnings always refer to how much money a company makes minus costs.” – Investopedia

Earnings are also part of important ratios like the Price/Earnings (P/E) ratio. If the P/E is too big, relative to the growth of earnings, the fall of the company’s share price can be substantial.

Why is the Earnings Date Important?

A company’s earnings date is important because it signals when the company will report its financial performance. The announcement can significantly impact its stock price and investor sentiment. Sometimes the news and forecast are very good, and that can cause the share price to increase significantly. Investors closely monitor the earnings dates to gauge the company’s profitability and make informed trading decisions based on the results.

StockInvest.us is a research service that provides financial data and technical analysis of publicly traded stocks. Although I don’t use this resource, it is possible to learn more about the earnings date from StockInvest.

“An earnings date is a day on which a company releases its financial report for a particular period, typically one quarter or year. The report contains information about the company’s revenue, expenses, and profits over this time period.” – StockInvest.us

How does earnings date affect stock price?

It isn’t just the earnings that change the direction and scale of stock prices, but the related information provided by the company’s management. Management tries to determine what next quarter will look like and sometimes will discuss the next year’s potentials or shortfalls. Also, it takes time for most investors to digest the information a company provides. Again, StockInvest helps understand the impact of the earnings date.

“The earnings date can significantly impact a company’s stock price. If a company releases strong earnings, its stock price will likely go up. On the other hand, if a company releases weak earnings, its stock price will likely go down.” – StockInvest.us

“Second, releasing earnings after markets close gives investors time to digest the information and make informed decisions about buying or selling shares.” – StockInvest.us

What Investors Do After They Know the Earnings Date

Wise investors use the date to prepare and think in the following ways:

- Be prepared to buy or sell shares after earnings are announced. At the very least, don’t be shocked and panic sell just because of a negative reaction to one quarter’s earnings. More often than not I am thinking, “What can I buy at a better price?”

- Think about the changes that happen on any covered call options. If the share price rises quickly, your shares may be called for open options contracts. Therefore, I am more cautious about entering covered call options contracts that fall immediately after a earnings date.

- Review any cash covered put options you might sell. As a general rule, selling a put option just before earnings are announced could hurt. If the price per share drops below your put contract price, you may not be buying your shares at a great or even a good price.

The easiest way for me to see the big picture for these actions is to use StockRover and Seeking Alpha.

StockRover and Earnings

Because I use StockRover and this service is linked to our Fidelity Investments holdings, I can quickly see the earnings calendar for the upcoming week or even the following week or weeks. The following images show this week’s earnings dates and next weeks. Eighteen of our holdings are scheduled to announce earnings this week, and twenty-one are expected to announce earnings next week. Notice also that StockRover lets me know when earnings will be announced. I prefer to see earnings announced after the market closes, as this helps me see what is likely to happen when the market opens the following day.

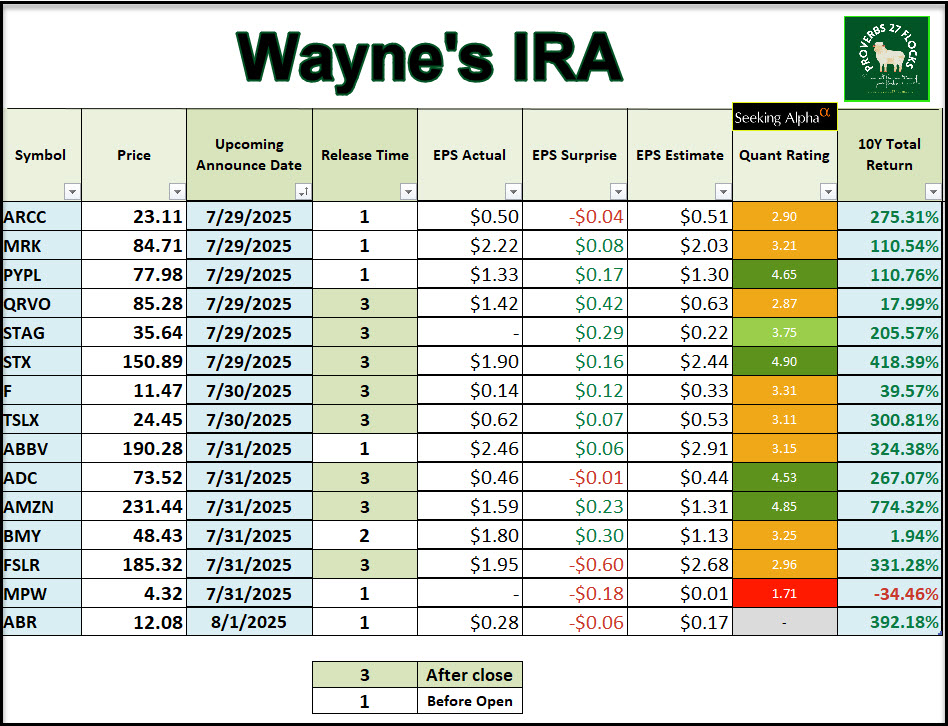

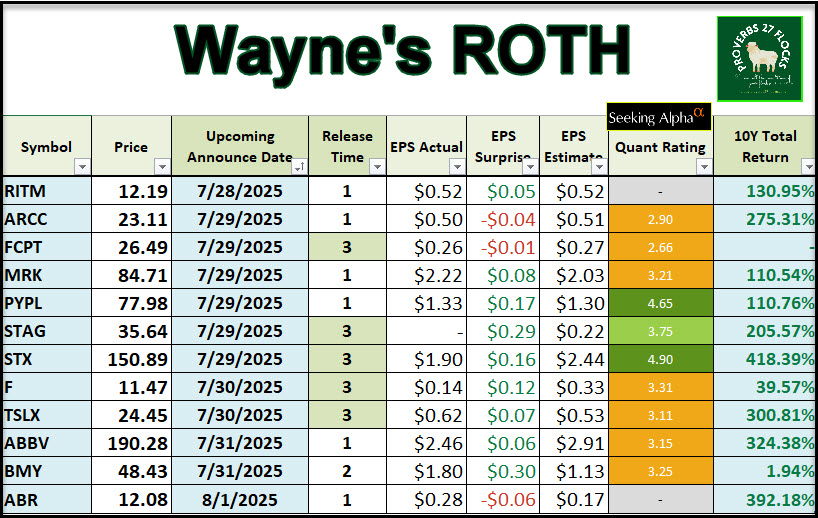

Seeking Alpha and Earnings

In a similar fashion, I can learn about earnings dates and the QUANT ratings plus the 10-year total return of holdings in each of our accounts. The following two images show a custom view I created to look at my traditional IRA and ROTH IRA. Because I hold shares of ABBV, F, MRK, PYPL and BMY in both accounts, I can see them by account. I could do the same for Cindie’s accounts.

The nice thing about this Seeking Alpha feature is that I choose the values that I want to see. Seeking includes some default views, including “Summary”, “Health Score”, “Ratings”, “Holdings”, and “Dividends.” There is also a “Add/Edit Views” option. I used that to create a view I called “EarningsDates.”

After creating EarningsDates, I am able to apply that view to as many of our accounts as I desire without reentering the fields. That view, and the Seeking Alpha default views can then be downloaded as a csv file for analysis in a spreadsheet.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

Stock Rover has a calendar view of earnings dates but I like the view that you show which is list view. Thanks!

LikeLike