What Are the Signs?

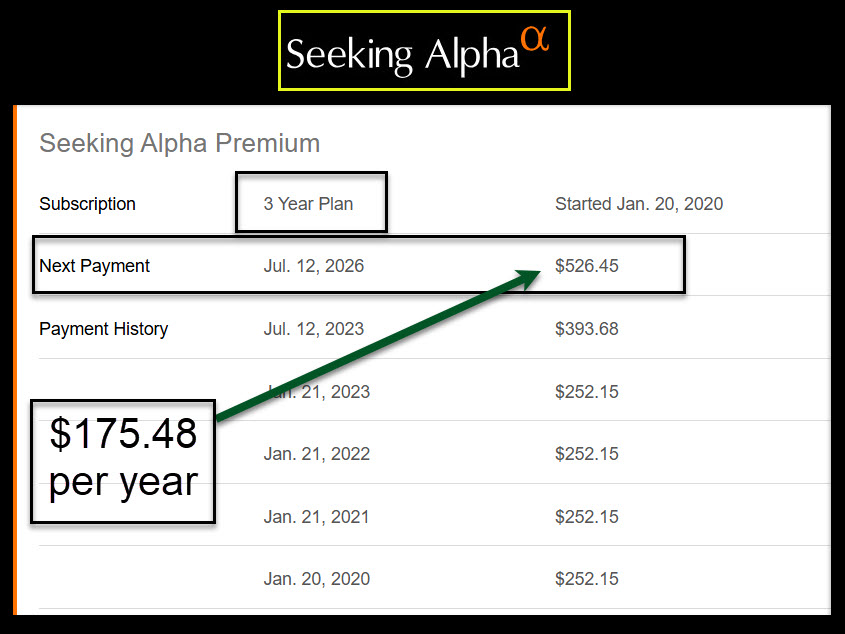

If you could avoid a $1,000 mistake would you spend $175 to save $825? What if you could avoid multiple $1,000 mistakes? It doesn’t take long for an investor, even a professional advisor, to buy an investment that isn’t a good idea. Part of that is due to the uncertainty of the future, but a part is also knowing what to look for before you buy.

I would like to avoid high risk and mistakes. The easiest way to do this as an investor is to pay for a subscription to a service that helps avoid questionable investments. This is cost of “doing business” as an investor. It is a lower cost than having an advisor manage our investments. If I hired an advisor with a cost of 0.80%, our annualized investment costs would be at least $28,000. That would be a huge chunk of the $175,000 of the dividends we receive each year, and it would also eliminate the income I receive from trading options. I doubt most advisors would settle for 0.80% for trading options.

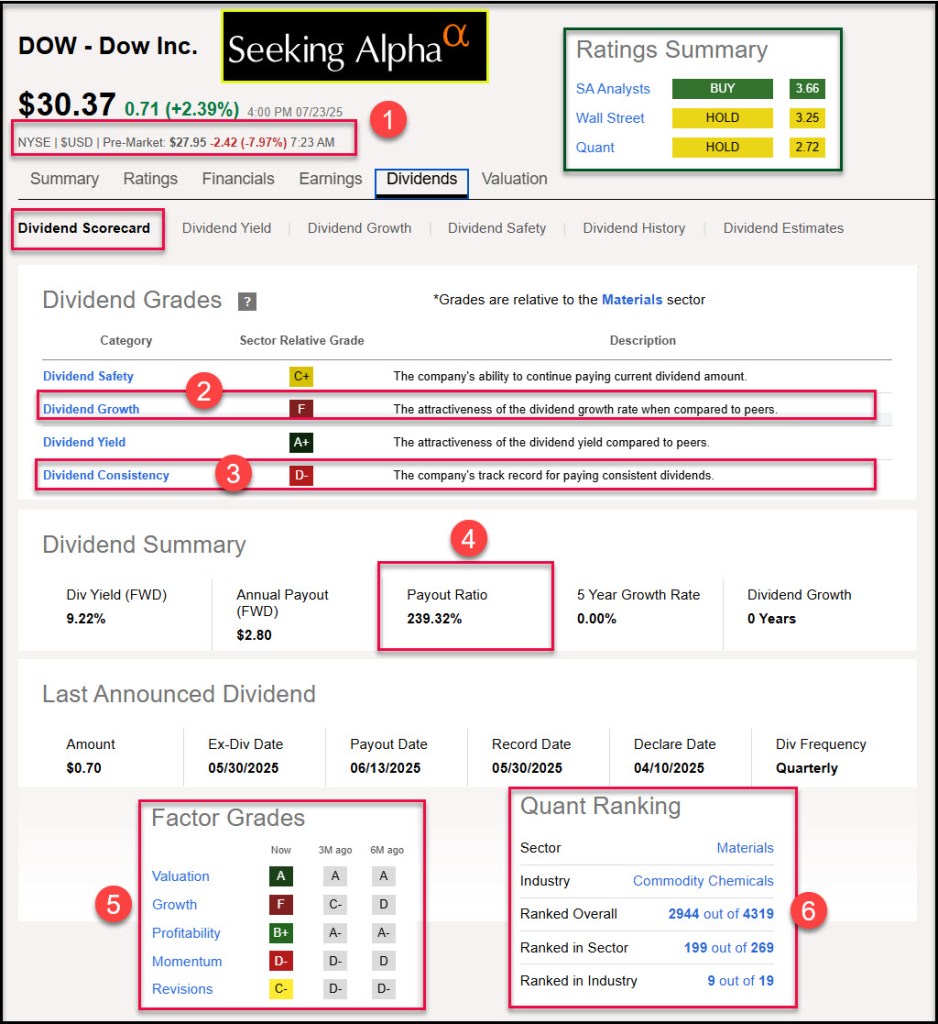

One of the reasons I use Seeking Alpha is that I can quickly look at some indicators of pending doom or at least of significant concern. Certainly one of the indicators is the QUANT rating. However, there are other indicators worthy of consideration.

What To Know About An Investment?

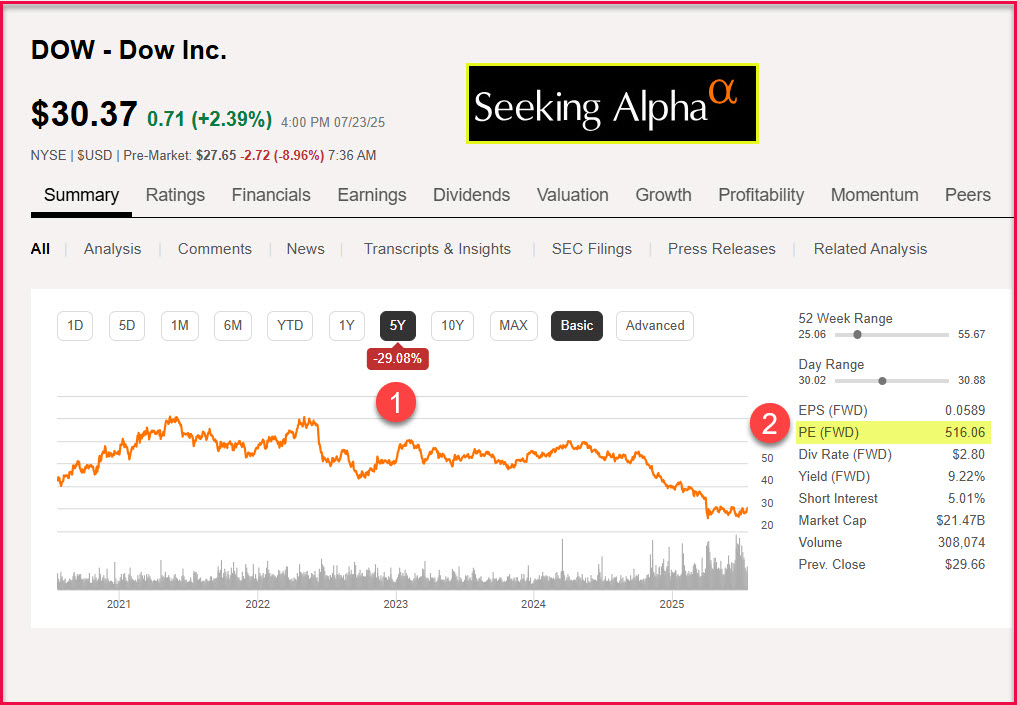

In addition to the Seeking Alpha QUANT rating, I want to see the P/E. High P/E’s are only justified if the investment is on a strong growth path. DOW’s P/E is nutty.

I also consider three significant dividend-related metrics. One of the most important is the payout ratio. A payout ratio that is greater than 75% (for most investments) is usually not a good idea. There are exceptions for some types of investments. If the payout ratio is greater than 100%, there is something going on that should cause you to pause before you push the “BUY” button.

The dividend payout ratio is the percentage of a company’s net income that is distributed to shareholders as dividends. It helps investors understand how much of the earnings are returned to them versus how much is retained for growth and reinvestment. If the ratio is greater than 100% the company is paying more than the earnings.

Ask yourself this question: “Where are they getting the cash to pay the dividend if they don’t get it from earnings?” The answer is generally one of two: they are borrowing money to pay the dividend (a really bad idea) or they are using cash they already have. That doesn’t make sense.

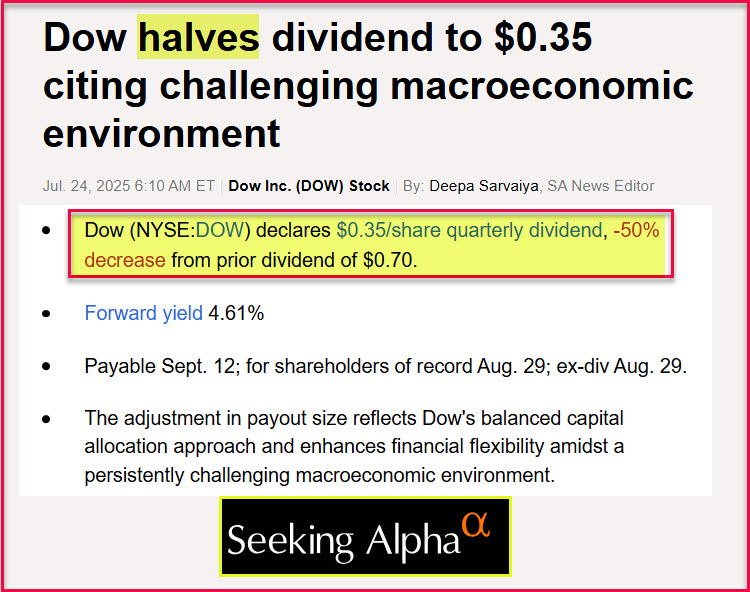

I also want to see the rate of dividend growth over the last five years and the number of years the dividend has been paid without any dividend cuts.

Another simple measurement is either the 5-year or 10-year price returns and/or total returns. DOW’s 5-year price return is -43.8%. That means $5,534 invested in October 2024 is now worth $2,715 (pre-market price this morning). That means those investors have lost $2,819 in value – if they only had 100 shares.

Dividend Cuts

Even a good company can have bad times. Management and the board of directors need to tighten the belt. That can mean that they will have to cut or suspend the dividend. As a dividend growth investor, I don’t want to own shares in a company that is working against the growth tide. DOW (Dow Inc) is a commodity chemicals company that is creating pain for their shareholders. Even though the QUANT rating is “HOLD” the data I look at says “SELL.” It certainly doesn’t scream “BUY!”

Summary

I could pay an advisor thousands of dollars. I actually did have an advisor forty years ago. He was expensive. He bought shares of two companies during the time he was “helping” me that went bankrupt. I lost over $5,000 during a time when $5,000 was a huge amount of money.

That experience made me realize that the best person to manage our investments was the person who cared the most about results. That person needed to understand some basics about investing. That person was me.

Before you say, “I can’t do it” ask yourself what you have learned during life in other areas where “I can’t” turned into “I can!” It doesn’t have to be as hard as you think.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.