Double Your Investment Dollars Every Seven Years

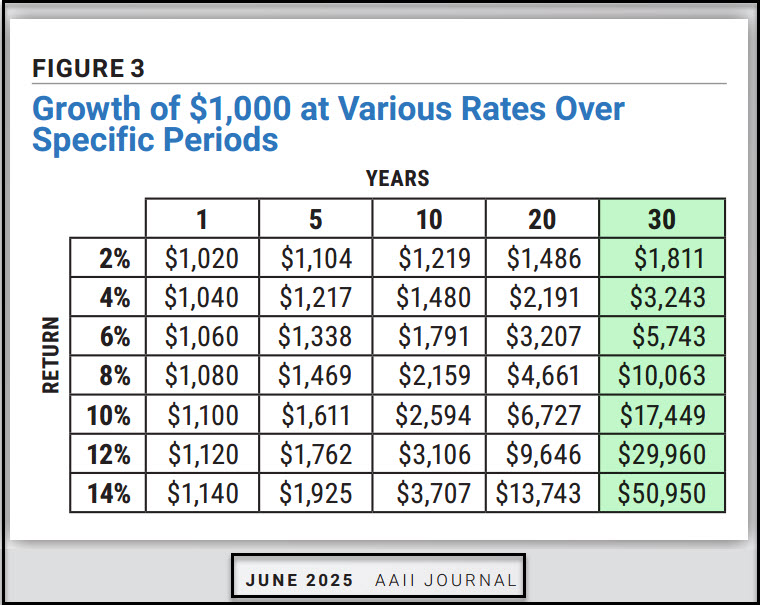

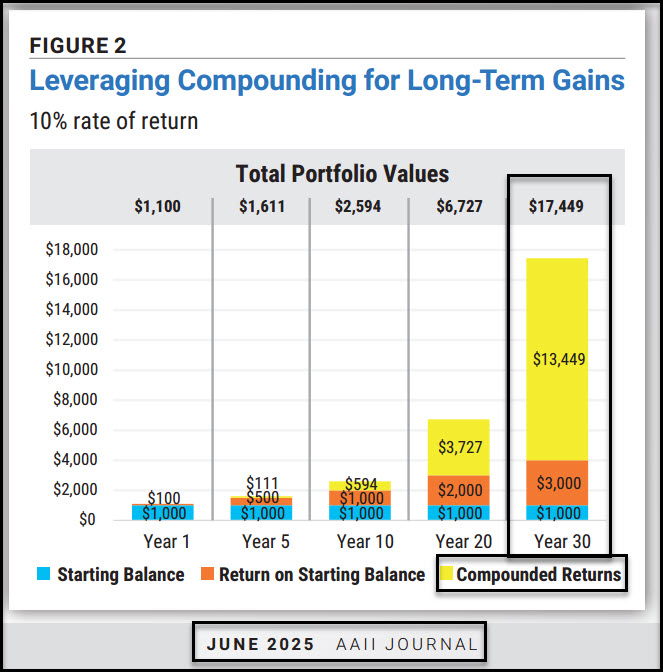

Do you know how to grow $100,000 to $200,000 in seven years without adding any additional money? How about growing $500,000 to $1,000,000? Most of the dollars in my traditional and ROTH IRA accounts are not added dollars. They are compounded dollars. The way to do this is to select quality investments that have an average annual growth of ten percent. That isn’t as hard as it seems.

If you only put your money in a money market fund that earns four percent, your money will double in eighteen years. That is a bad choice, because inflation is eating away at each dollar. Your money, even doubled in eighteen years, has less buying power due to inflation.

If you select equity investments and ETFs that are likely to grow at 10% or better, you not only double your account value faster, but you also have the benefit of compounding working to your advantage. That is one reason that I like dividend growth investments like VYM, DGRO, and SCHD. SCHD, for example, has a Dividend Growth 5 Yr (CAGR) of 10.87%. It also has a 10 Year Price Performance of 111.4%. That is more than sufficient to double the value of the assets in seven years.

VYM, by way of comparison, has a 10 Year Price Performance of 99.2% and DGRO is a superstar at 150.07%. If your assets grow at 15% per year, they will double in just under five years using the “Rule of 72.”

AAII Articles

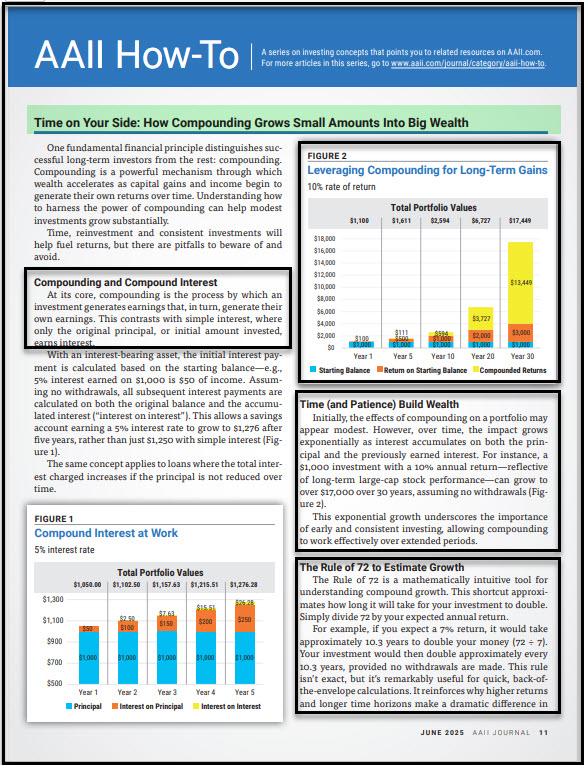

AAII articles help illustrate wise investment principles. They also point out the mistakes that investors make when investing. The title of one June 2025 article was “Time on Your Side: How Compounding Grows Small Amounts Into Big Wealth.” The illustrations are helpful, as are the “pitfalls” the article discusses. I will summarize the contents in this post.

Understanding the power of compounding is illustrated in the article. Don’t think modest gains are inconsequential. They are powerful when compounding is involved over time.

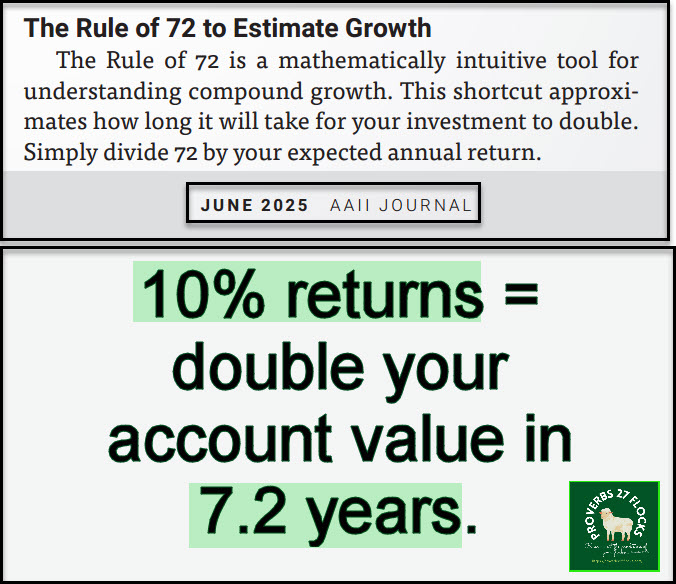

The Rule of 72 to Estimate Growth

“The Rule of 72 is a mathematically intuitive tool for understanding compound growth. This shortcut approximates how long it will take for your investment to double. Simply divide 72 by your expected annual return.” (AAII)

Pitfalls of the Compounding Effect

Some mistakes are obvious if you think about the math. Some are more subtle and work against your buying power over time. When combined, the pitfalls turn your investment growth into investment stagnation. Don’t make the mistakes that cause the sabotage of your investment portfolio. “Despite its power, compounding can be undermined by a few common mistakes. It’s important to watch for these dangers and sidestep them.” – AAII

Fees Are Saboteurs

In addition to discussing the power of compounding, the article highlights some of the ways you can sabotage your results. One of the most common ways is overpaying for investing “advice” and paying too much in fund expenses. I see this frequently when helping others. They don’t think 1% is too much to pay for advice. That may be true in the first year when your account balance is small, but it becomes increasingly more odious as time passes.

Inflation is an Invader

AAII reminds the reader that, “If your investments don’t outpace inflation, your purchasing power erodes. Look for assets that historically beat inflation, like equities.” (AAII) This means that cash, money market accounts, bonds, bond funds, and many other types of assets are hurting your long-term compounding. They don’t keep pace with inflation.

Taking a Withdrawal

If you start withdrawals you are depleting your asset base for compounding. One of the reasons I took Social Security early (age 62) was to have cash for everyday expenses so that our retirement funds could continue to compound. Another bad actor is taking a loan from your 401(k). There is no reason for doing that 99% of the time.

Market timing

Trying to time the market is a fool’s errand. If you think you know when to exit and reenter the market, you must know the future. No one can really do that well.

Emotional investing

Far too many poor decisions are made using emotions rather than data, facts, and a plan. “Selling during downturns … can sabotage compounding. A quote attributed to Charlie Munger says it all: ‘The first rule of compounding: Never interrupt it unnecessarily.’” (AAII)

Portfolio allocation

The worst allocation is the one that focuses too heavily in any underperforming asset. I frequently see large allocations to cash and bonds. Those contribute to the erosion of your buying power in future years.

Recommendation

Evaluate your portfolio using the tools on Seeking Alpha. It is easy to use Seeking Alpha to find key metrics for ETFs like the ones mentioned above and for good quality stocks.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

There is no reason for doing that 99% of the time.

I am nitpicking-most of the time instead of 99% might be better Wayne. Someone could have a medical emergency necessitating the withdrawal of 401K funds.

Take care,

Philip

LikeLiked by 1 person

Most withdrawals are not for medical. I agree that there is a 1% chance that a withdrawal might be needed for a medical emergency. Most do it for large purchases and they don’t think through the implications. 🙂

LikeLike