It Isn’t What You Think It Is.

Many advisors want you to think that volatility is the same as risk or is a sign of risk. It is true that a high-risk investment is likely to be very volatile with wide price swings up and down. In addition, if you don’t have cash and need to sell an investment to raise cash in retirement, you don’t want to see the value of your investment plummet just before you sell it.

It has been some time since I devoted any space to a specific discussion about volatility. In 2021 our granddaughter Violet asked a good question about volatility. Her question from the October 2021 discussion was: “My question as I read through the article: How can you tell when a company is failing versus when it’s just going through normal ups and downs? The answer I gathered from reading a separate article called Selling Investments Rule No. 1 is that I should watch for dramatic and unpredicted drops in Dividends and the overall value of the company.” – Violet (Link to the article)

When she is talking about “Rule No. 1) she is referring to a series of posts I called “Selling Investments Rule No. x.” If you want to see this series, click on this link: SELLING RULES.

In another blog post I wrote more about “What is Volatility.” Here is a LINK.

A Recent AAII Journal Article

This article has a section titled “Volatility Isn’t the Risk You Think It Is.”

“A volatile stock, market or other financial instrument is one that incurs a big change in its value over a short period of time. The change in value can either represent a gain (upside volatility) or a loss (downside volatility). The value can also swing back and forth in a significant manner—just like the S&P 500 has done so far in 2025. Volatility is tied to risk because large downward price moves can result in a shortfall when withdrawals need to be taken. Sudden, sharp drops also unnerve investors. Evolution has made humans averse to losses.” AAII

The only statement in that paragraph that I don’t believe is “Evolution has made humans averse to losses.” Evolution has nothing to do with it. The Bible doesn’t teach evolution, but it does talk about fear. Volatility is the direct result of fear or greed or both.

A Helpful Table

AAII has a table that is a helpful illustration. “Short-term volatility gets smoothed out over longer periods. This pattern results in a higher chance of gains for investors who constantly stay invested.” – AAII

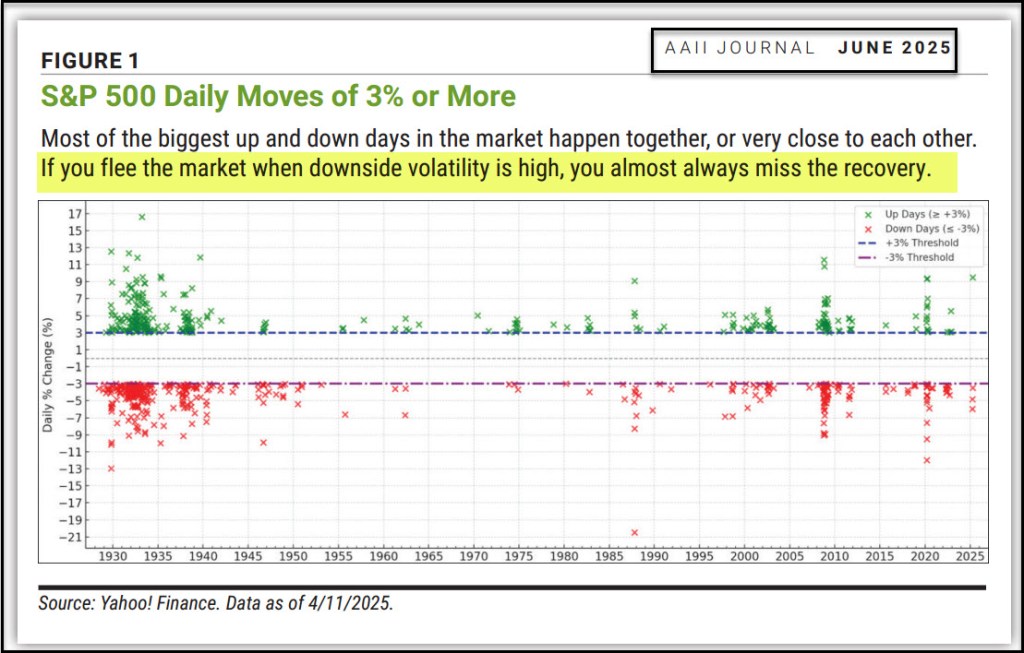

A second helpful image from the article is a helpful depiction of volatility from 1930-2025.

What Causes Sector Volatility?

Some sectors tend to be more volatile than others. Lots of things contribute to volatility, and if you look at the causes you can find a common thread: fear.

“Volatility may be caused by a variety of factors—among them are trader emotions like fear and panic. Sometimes referred to as “noise trader risk,” this is the risk associated with trend-following traders who succumb to their emotions, causing massive sell-offs or buying sprees. In a jittery, uncertain market with nervous investors, major news events, both positive and negative, can cause big price moves, either down or up.” – Investopedia

“Wars, revolutions, famines, droughts, strikes, political unrest, recessions, depressions, inflation, deflation, bankruptcies of major industries, and fluctuations in supply and demand can all cause stock prices to drop precipitously.” – Investopedia

The Investopedia article lists the high-volatility sectors, and these include energy, commodities, financials, technology and consumer discretionary stocks. Because I tend to invest heavily in the financials and technology, I expect high volatility. There are days when our investments go up $50,000 and days when they go down $50,000. However, because I am a dividend growth investor, the one thing that tends to keep going up is our influx of dividends.

What Should An Investor Do?

The first rule of wise investing should probably be “don’t buy junk.” If you buy quality investments hang on to them during times of volatility. In fact, during times like Covid, you should buy more of the quality investments when others are fearful.

Secondly, structure your investments so that you are continually receiving cash. That is certainly beneficial in retirement, but it is also helpful as you build your wealth for the future. Dividends can be used to purchase more shares of quality ETFs and stocks. That is what I am doing with some of our dividends. Some of our dividends are fuel for charitable giving.

I think people who live in fear probably are also unlikely to be charitable. They think by giving something away they are increasing their risk. I think you increase your risk in so many other ways that are more harmful to your future. Giving benefits others, and it actually causes you to think more carefully about what really matters in life.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.