Why Investors Buy and Sell Put Options

Covered call options are very simple. You are selling someone a contract that gives them the right to buy your shares at a specific price by a specific date. If, for example, I own 100 shares of the XYZ company, and those shares are currently worth $25 per share, I can sell one covered call contract that expires next Friday with a contract price of $27. Let’s say I paid $23 per share for my shares. If the price of the shares next Friday is $27 or more, then I will see my shares sell and I will receive $2,700 for my investment of $2,300. The money I received for selling the contract is mine to keep as well.

A cash covered put is a different type of options contract. It says “I am willing to buy your shares if they fall to a price I am willing to pay.” If the shares of XYZ are currently selling for $25 per share, and the owners of the shares are nervous that the price might decline, I can do a “sell” that sounds like this: YOU SOLD OPENING TRANSACTION PUT (XYZ) THE XYZ COMPANY AUG 15 25 $23.

The nervous investor will pay me for the possibility that their shares will fall in value. If the shares fall to $23 or less, I have to pay the $23 per share. That means I have to have sufficient cash (because this is a cash-covered option) to buy the shares if that happens. So, for 100 shares, I need to have $2,300 in cash on hand. IF that happens, I still keep the money the nervous investor gave me.

What is the Risk?

With a covered call option contract, the only “risk” is that my shares will be sold. Most of the time you are not really exposed to true risk, because you get the dollars you agreed you wanted for your shares. Of course, if the share price goes up dramatically, you may have seller’s remorse, thinking that you could have received even more simply by holding your shares. I suppose you can think that is risk, but I don’t think like that.

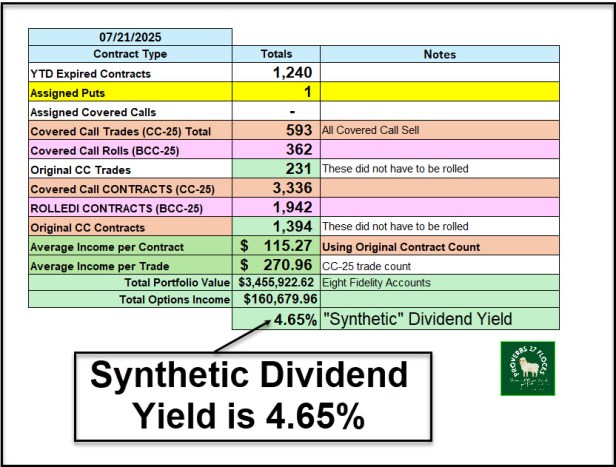

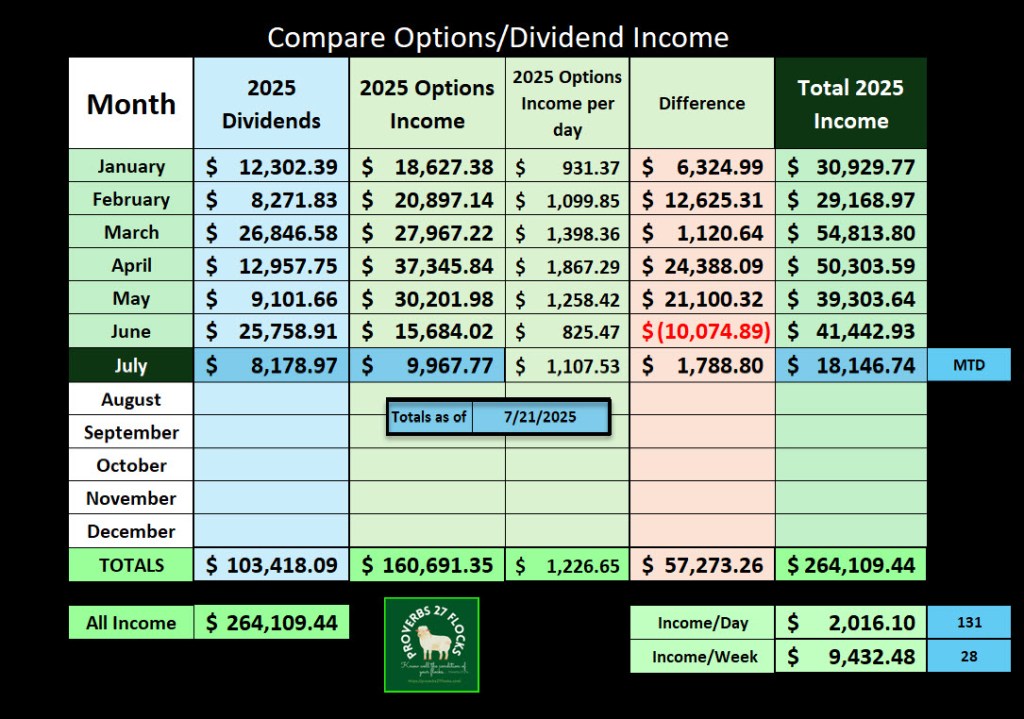

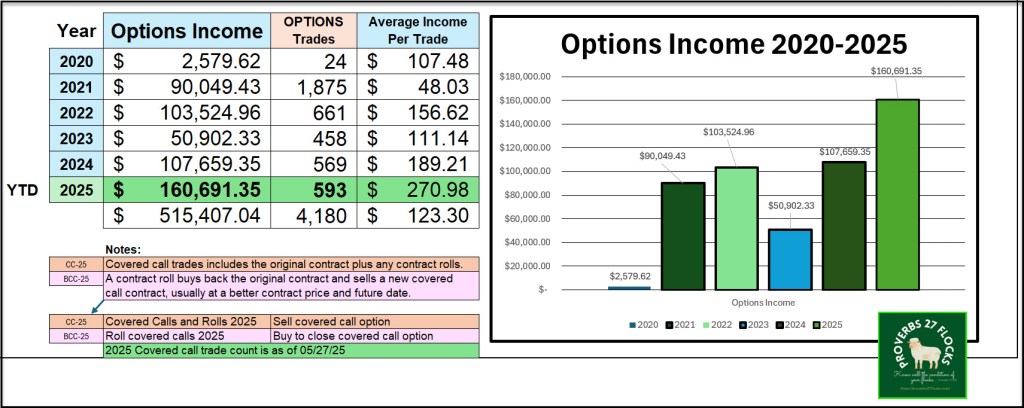

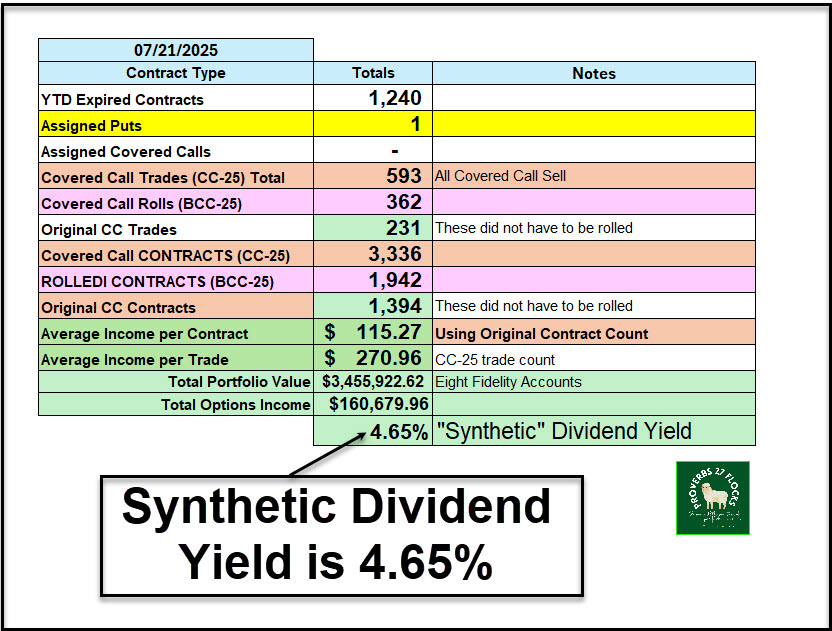

If you are prudent with your contracts, you keep the money you earned from selling the contract and you keep your shares. For example, this year I have done 593 options trades that translate into 3,336 contracts. Some trades are for 6,700 shares, so that would equal 67 contracts. The good news is that YTD I have had 1,240 contracts expire. I have earned over $160K in options income and I kept my shares and keep receiving the dividends on my shares.

With a cash covered put contract, the biggest risk is that you will pay more for the shares than you think is reasonable due to a huge price drop. In my XYZ example above, if the share price drops to $19/share, then the 100 shares are worth $1,900. However, I still will have to pay $2,300 for the shares per the contract terms. That can be painful. When this happens it pays to remember that Mr. Market is fickle. What has dropped in price this week can shoot back up a couple of months later. Nevertheless, there is certainly more risk with cash covered puts. Sometimes it is just far better to buy 100 shares and sell covered calls on the shares.

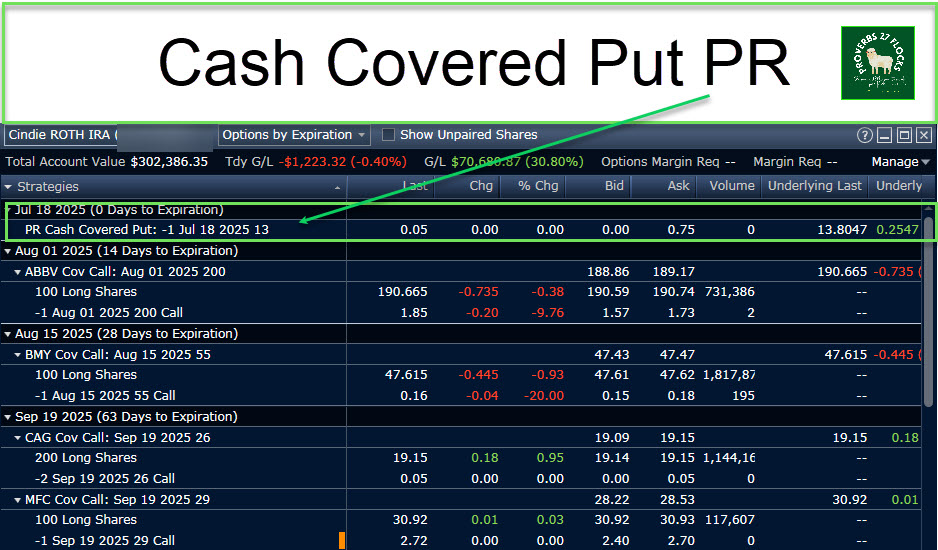

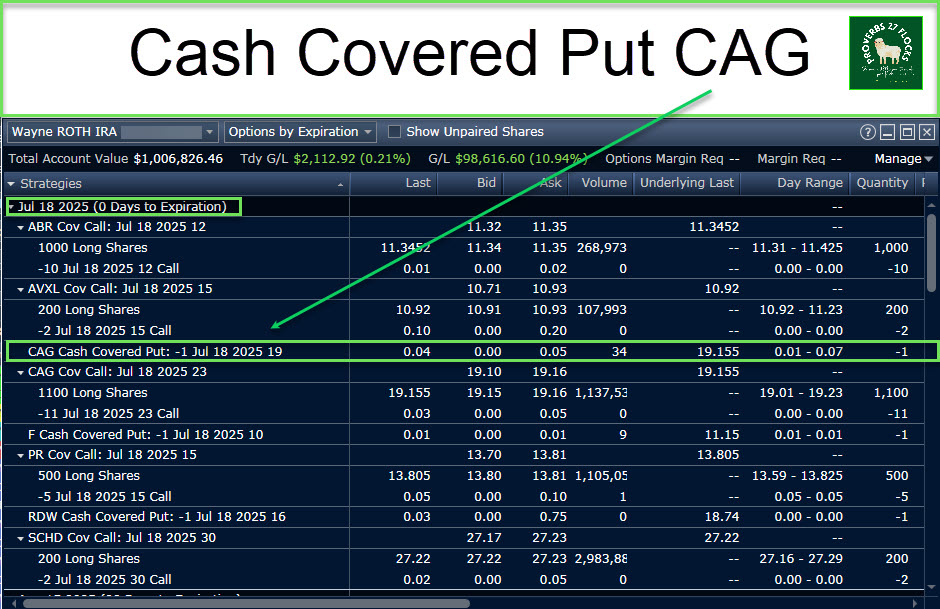

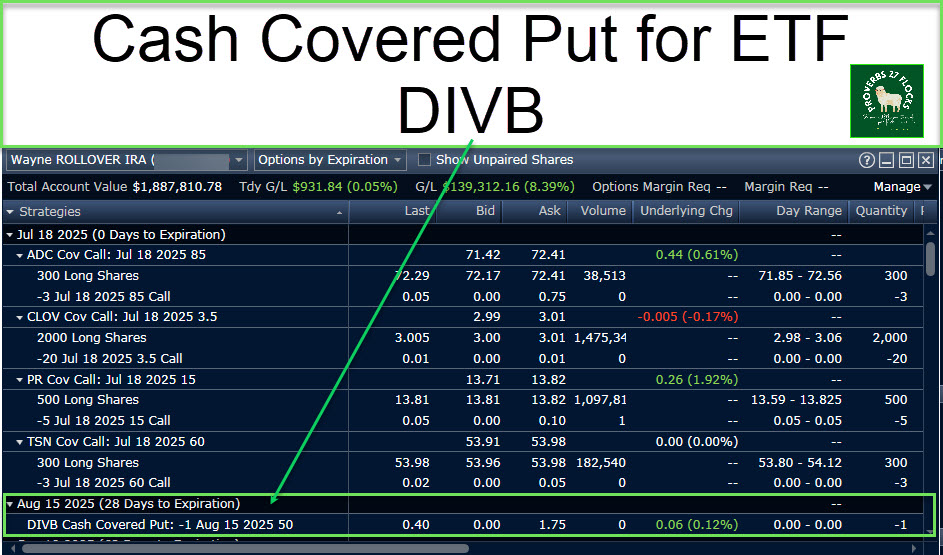

So far this year I have only purchased 100 shares of TSN at $55 per share for one PUT contract. My put contracts for 2025 were for the following ticker symbols: AVXL, BMY, CAG, DIVB, F, FTNT, HPQ, JNJ, KR, NVDA, PR, RDW, STX, and TSN. By far the biggest number of PUT trades has been NVDA. Here are images from Fidelity’s Active Trader Pro “Options By Expiration.”

By far, however, most of the 2025 options income is in covered call options. This includes covered call options for NVDA.

Synthetic Dividend Income

I like to think of the income from options trading as a “dividend” that I create by trading. This includes stocks that don’t pay a dividend. AMZN is one example of a non-dividend stock that can earn options income in our portfolio. These two images illustrate the “synthetic” dividends.

Recommendation

Start with covered call options. They entail far less “risk” because you will be paid for each contract, you can keep your shares if you are disciplined and careful about the probability that your shares will be called, and you can always rest assured that you will get your contract price if your shares are called.

Put contracts, on the other hand, can entail a bit more risk. I paid $55/share to purchase the shares for the TSN contract, and the shares are currently worth $53.41. However, I would have had even more downside if I had just purchased the shares on the market.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.