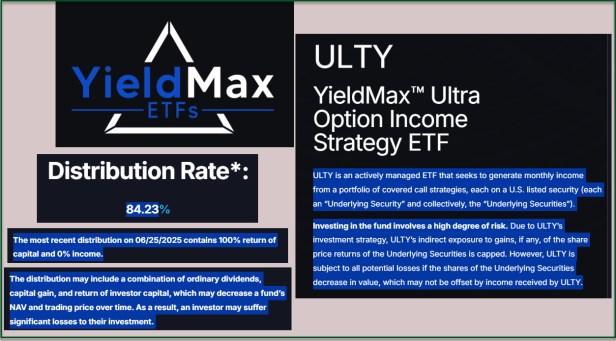

ULTY YieldMax™ Ultra Option Income Strategy ETF

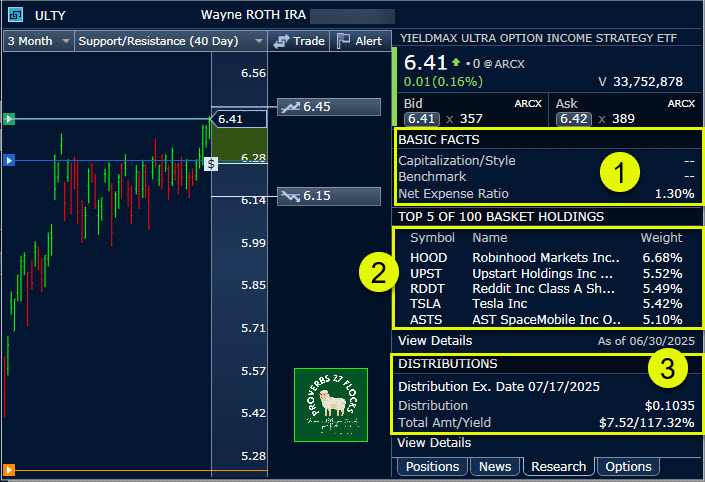

Since my first purchase of 100 ULTY shares in my ROTH IRA on July 8, I have added 100 more shares to my ROTH IRA and purchased 500 shares in my Traditional IRA. My average cost basis now stands at $6.28 per share. My total investment is $4,399. To put this in perspective, the total value of my IRA and ROTH is $2.9M, so my ULTY investment is 0.15% of my total retirement assets.

This is admittedly a higher risk investment. The holdings in this ETF can plunge in value as has been seen by the twelve-month returns. The fund is down 49% in twelve months. I think some people overpaid for this early in the fund’s history.

When the shares hit the market in February 2024, they were selling for $19.35 per share. If you bought shares then, you would be extremely disappointed if you held the shares until today. The shares are currently trading at $6.41. In other words, you would have a per share loss of $12.94. If you bought 100 shares you lost $1,294 in value.

However, since May 2025 the implosion has leveled off in the price range of $5.86 to the current price of $6.41. The one-month return is 3.07%.

Three Ways for Income

ULTY presents three opportunities for income. The most obvious is the weekly dividend. The fund uses options to create its portfolio.

But an investor can also trade options on ULTY. You can buy shares of ULTY and then trade covered call options on the shares (in lots of 100 shares per options contract.) Therefore, I can sell seven covered call options contracts on my 700 shares.

For example, if I sold five contracts on my IRA shares for a contracted price of $7 per share, I could receive $50 based on this image. There would be a commission, so the amount I receive would be a bit less.

I could also potentially add shares to my IRA by selling a cash covered put option with a contract price of $6 that expires August 15. For each contract I might expect to receive $10. If the shares drop to or below $6/share, then I would have to have $600 in my account to buy the 100 shares. If the shares dropped to $5.90 I would break even. My cost basis for the 100 shares would be just a bit more than $590 after the commission that is paid to execute the contract.

I think ULTY is a good ETF for those who want to experiment with cash covered put options. The risk is certainly present, but the overall cost of 100 shares is low compared to other ETF prices.

Fund Profile

Tidal Trust II – YieldMax™ Ultra Option Income Strategy ETF is an exchange traded fund launched and managed by Tidal Investments LLC. The fund invests in public equity and fixed income markets of the United States.

- For its equity portion, it invests through derivatives in stocks of companies operating across diversified sectors.

- The fund uses derivatives such as options to create its portfolio. It invests in growth and value stocks of companies across diversified market capitalization.

- For its fixed income portion, the fund invests in short-term U.S. treasury securities.

The fund employs quantitative analysis to create its portfolio. Tidal Trust II – YieldMax Ultra Option Income Strategy ETF was formed on February 28, 2024 and is domiciled in the United States.

The investment seeks current income, secondary objective being exposure to the share price of select U.S. listed securities, subject to a limit on potential investment gains. The fund is an actively managed exchange-traded fund that seeks current income while providing direct and/or indirect exposure to the share price of select U.S. listed securities, subject to a limit on potential investment gains. It uses both traditional and synthetic covered call strategies that are designed to produce higher income levels when the underlying securities experience more volatility. The fund is non-diversified.

Fund Overview from YieldMax™ Website

YieldMax™ Ultra Option Income Strategy ETF (ULTY) is actively managed to seek monthly income from a portfolio of covered call strategies, each on an Underlying Security. ULTY also provides direct or indirect exposure to the share price returns of the Underlying Securities, subject to a limit on potential investment gains for each such security.

ULTY’s investment sub-adviser will typically select between 15 and 30 Underlying Securities, primarily on the basis of such securities’ implied volatility levels, and will regularly review ULTY’s portfolio to determine whether one or more of its covered call strategies should be increased, decreased or eliminated, and whether any such strategy should be implemented on any new Underlying Securities.

ULTY is an actively managed ETF that seeks to generate monthly income from a portfolio of covered call strategies, each on a U.S. listed security (each an “Underlying Security” and collectively, the “Underlying Securities”).

Investing in the fund involves a high degree of risk. Due to ULTY’s investment strategy, ULTY’s indirect exposure to gains, if any, of the share price returns of the Underlying Securities is capped. However, ULTY is subject to all potential losses if the shares of the Underlying Securities decrease in value, which may not be offset by income received by ULTY.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.