A Dividend Increase Makes Me Smile

Just sitting back and collecting the dividends is my idea of a good day’s work. Of course, I am not really sitting back very often. There are so many wonderful ways to devote my time. I just don’t want to spend time managing and repairing real estate. I also don’t want to pay property taxes or have to buy property insurance. In addition, I won’t have to evaluate tenants and then have to evict the ones who are a problem. NNN takes care of all of the details for me.

Our Ownership of NNN

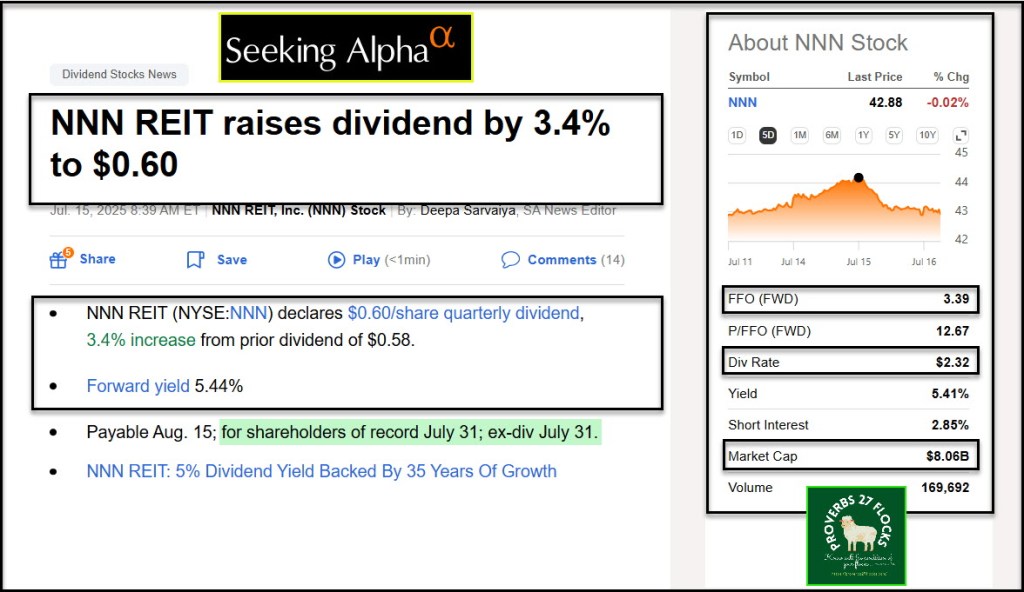

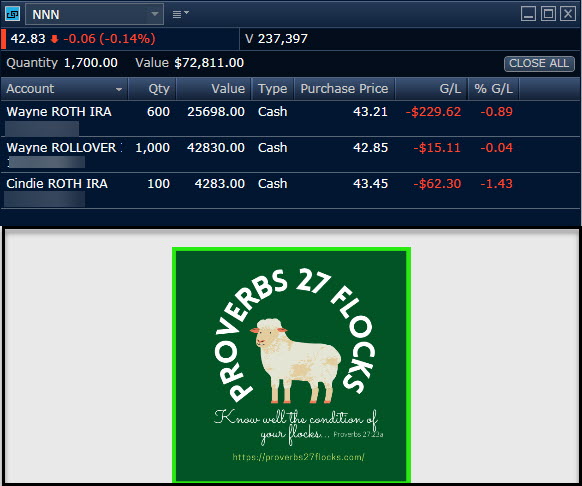

Cindie and I own 1,700 shares of NNN that are currently worth $72,879. With the dividend increase to $0.60 per share, we will receive $1,020 on the dividend pay date. You have to own the shares by the Ex-Dividend date to reap the benefit of the next dividend. I also trade covered call options on my holdings for “synthetic” dividends.

Another Opinion from Seeking Alpha

“NNN REIT demonstrates resilience, managing tenant issues effectively and highlighting the strengths of the net lease model amid interest rate headwinds.” – Julian Lin, Seeking Alpha

“NNN is a triple net lease REIT (‘NNN REIT’) meaning that its tenants are responsible for the real estate taxes, insurance, and maintenance expenses. The assets tend to be single, freestanding properties with a focus on e-commerce resistant uses.” – Julian Lin, Seeking Alpha

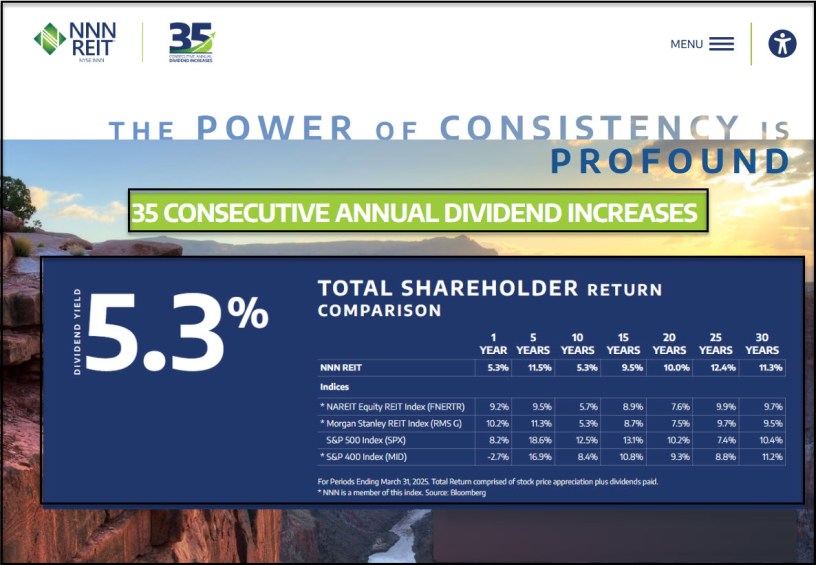

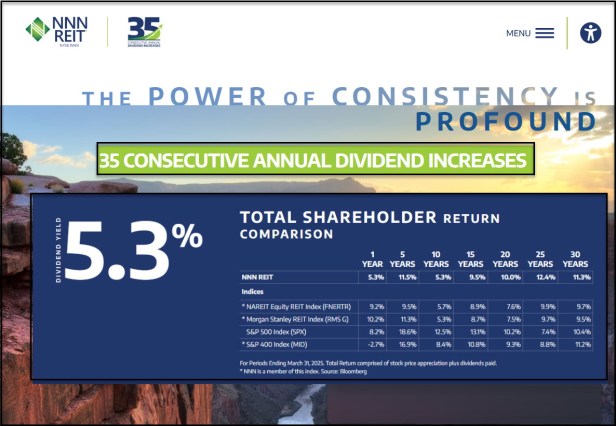

Business Profile

NNN invests in high-quality properties subject generally to long-term, net leases with minimal ongoing capital expenditures. As of March 31, 2025, the Company owned 3,641 properties in 50 states with a gross leasable area of approximately 37,311,000 square feet and a weighted average remaining lease term of 10 years. NNN is one of only three publicly traded real estate investment trusts to have increased annual dividends for 35 or more consecutive years.

Recommendation

If you don’t already own shares of NNN, I highly recommend that you consider adding this to your retirement portfolio. Don’t go crazy with your buys. One way to enter is to sell cash covered put options. The downside is that the current price is $42.89, and you don’t want to buy the $45 put. The best put option price would be $40, and it is highly unlikely that you will get shares that way. You definitely won’t gain shares before the Ex-Dividend Date.

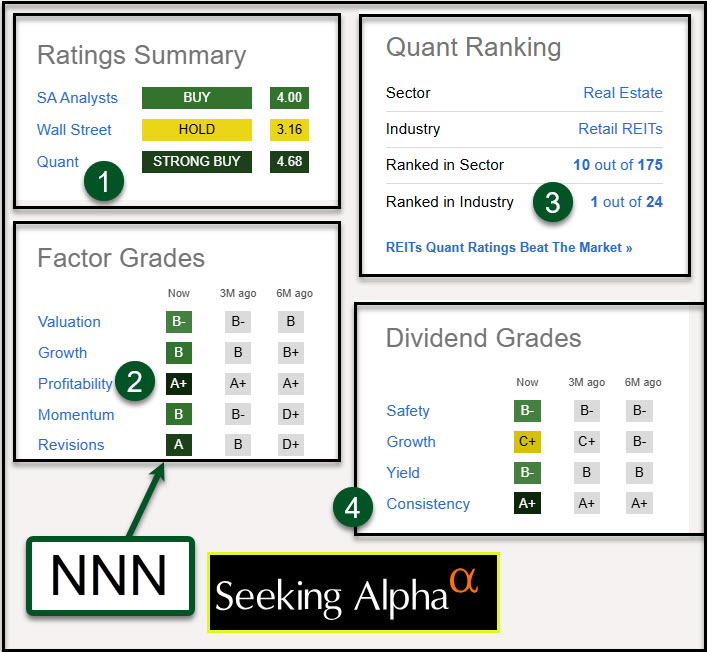

Seeking Alpha Highlights

Finally, as you would expect, I look at Seeking Alpha before buying or selling an investment. NNN has a very, very long history of paying increasing dividends. The payout ratio is perfect: 69.19%, and the yield is a decent 5.41%. Bear in mind that my “yield” is greater than that due to options trades.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.