Getting “Synthetic” Dividends

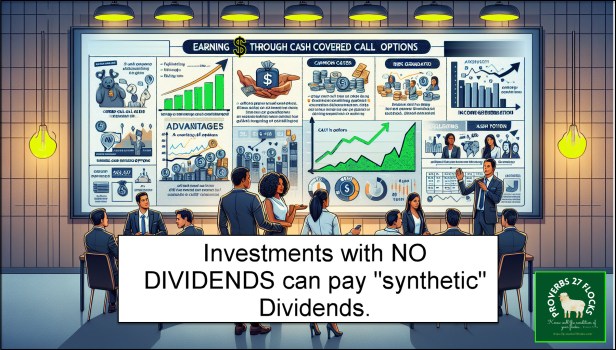

Here is a list of the stocks I own in my traditional IRA and ROTH IRA that do not pay a dividend: AMZN, AVXL, CLF, CLOV, FSLR, FTNT, IMMP, PYPL, QRVO, RPD, SMCI, and UAL. Most of you will recognize AMZN as Amazon, and perhaps some of you know PYPL (PayPal) and UAL (United Airlines.)

While I focus on dividend income and dividend growth, that doesn’t mean we only own stocks that pay a dividend. The two reasons to own non-dividend investments are profits and income. The first is that you expect the shares to grow in value so that you can sell them at a profit. The second is that I can trade covered call options (or trade cash covered put options) on non-dividend stocks to make more income.

Consider AMZN

Amazon does not pay a dividend. The only way to make money on Amazon shares is to buy low and sell high. Well, actually, there is another way. You can buy low and then enter covered call contracts to sell high. You can also make money without owning AMZN shares by selling cash-covered put options.

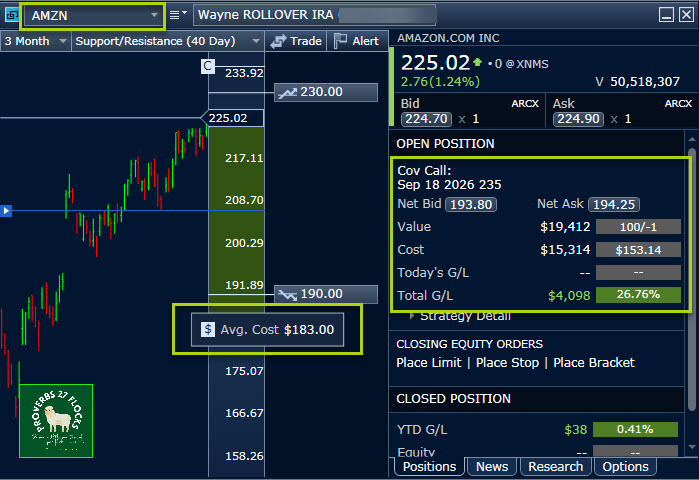

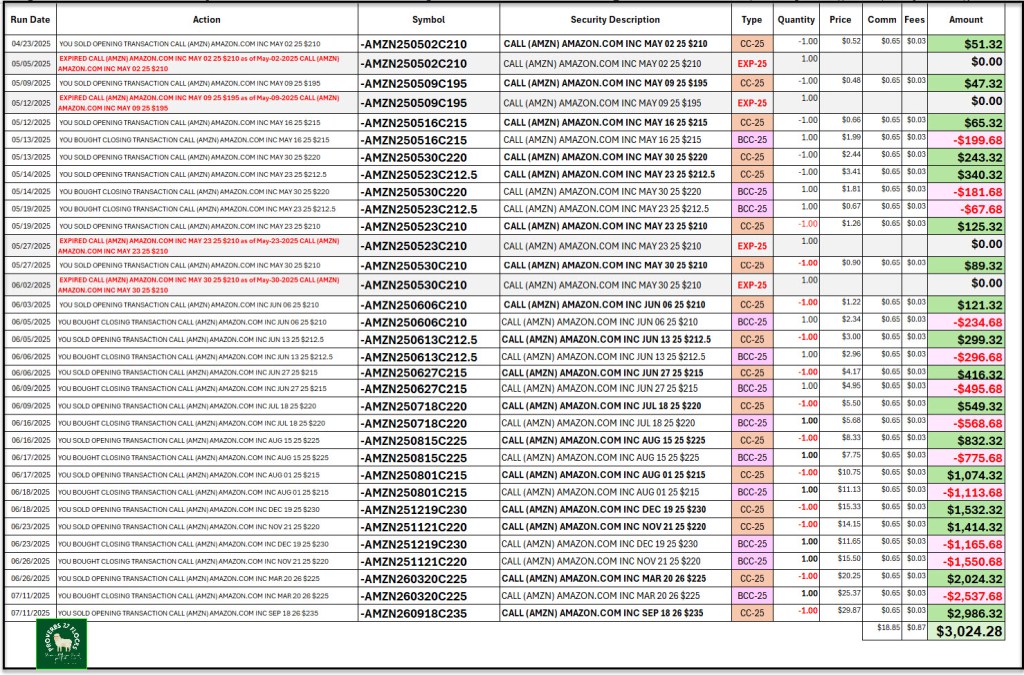

This year I have received a total of $3,024.28 in covered call options income for my 100 traditional IRA shares. That is $30.24 per share in the first six months of the year. The current price of my shares is about $225. That gives me a synthetic (options) dividend of around 13%. Here are three images from Fidelity’s Active Trader Pro (Trade Armor) that show my cost basis, the current options contract, and Fidelity’s Equity Summary Score. Just because analysts are “Bearish” doesn’t mean I have to be.

Three Types of Transactions for AMZN: EXP-25, CC-25, and BCC-25

There are three types of transactions that have occurred during this year. I can sell a covered call option, buy back the covered call contract, and let the contract expire and keep my shares. If I miscalculate, it is also possible that my shares will be called away, but that hasn’t happened in the first half of 2025.

- Four of the AMZN contracts have “expired” and I code them as EXP-25. Therefore, from April through June four contracts for the same 100 shares expired and I kept my shares.

- When I enter a new contract, or roll an existing contract, it is coded as “CC-25.” This is a transaction where I sold an covered call contract and received income from that sale.

- When I roll a contract there are two entries. One is “BCC-25” which is buying a “closing transaction” to end an existing covered call contract. Because it is a “roll”, the BCC-25 is paired with a new “CC-25.” This is entered as a single transaction on Fidelity’s Active Trader Pro. With about fifteen minutes of training anyone can do this. It isn’t as difficult as it may seem.

Cost Basis of and the ROI on my AMZN Shares

I purchased my 100 shares of AMZN on April 23, 2025 for $183 per share. Therefore, my cost basis for the shares is $18,300. The shares are currently worth $22,500. I have a paper gain of $4,200. However, I cannot sell my shares because they are “covered” by the contract known as AMZN260918C235. If the shares go up to or above $235 by September 18, 2026, the contract will cause my shares to be sold at $235. That will be a nice influx of cash of $23,500, or $5,200 of profit. That is in addition to the options income of $3,024 I have already received.

Look at it this way: My total income from AMZN could be at least $8,224 on an initial investment of $18,300. That is a total profit of 44.9%. The ROI was improved by trading options on the shares. If I just sold the shares for $235 it would be a profit of 28.4%. While that is a good ROI, if the shares sell, I can increase my profits by trading covered call options and by rolling options.

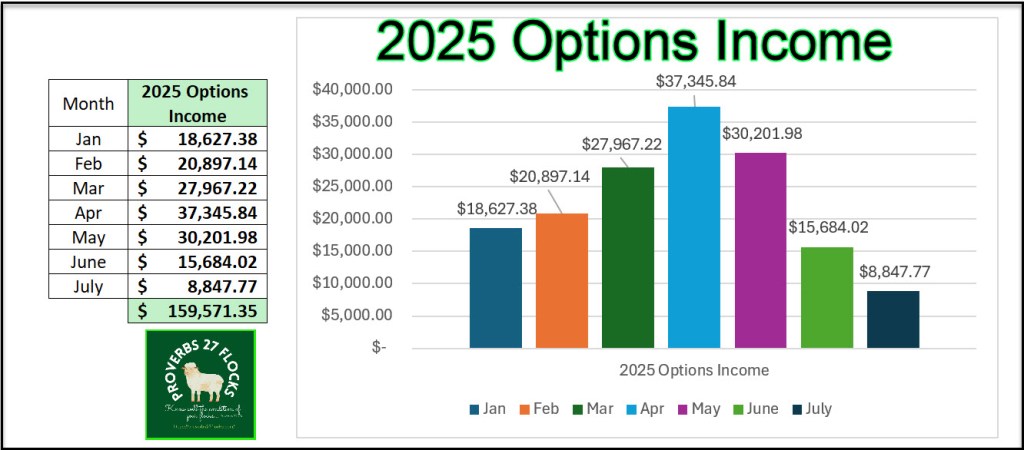

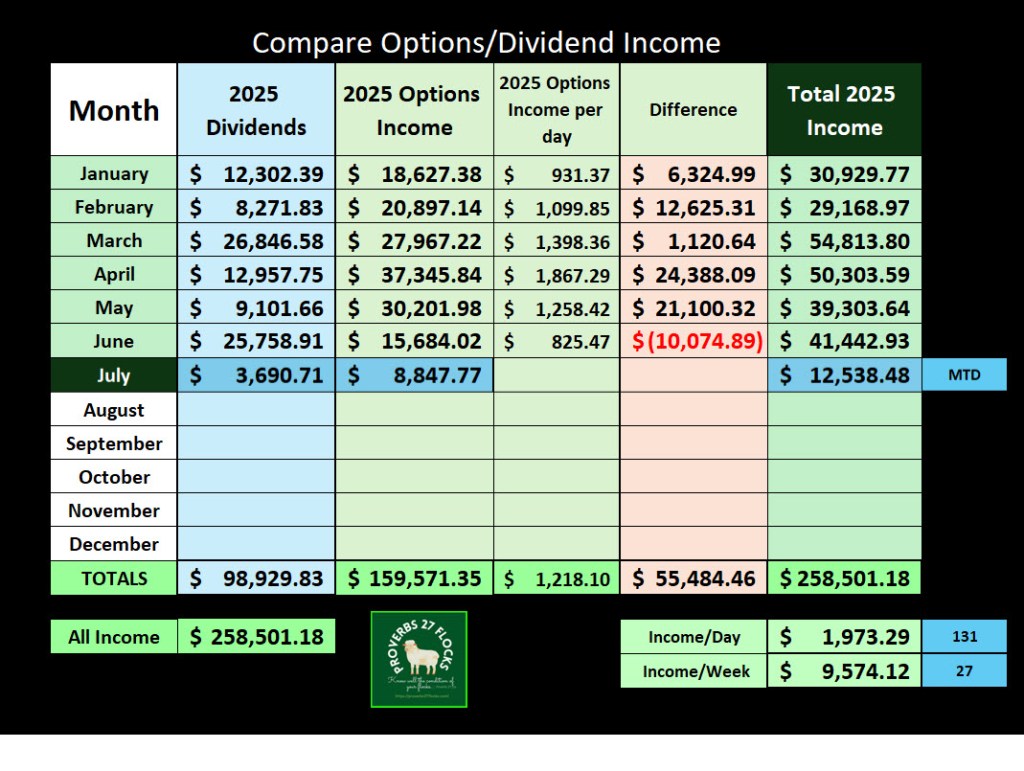

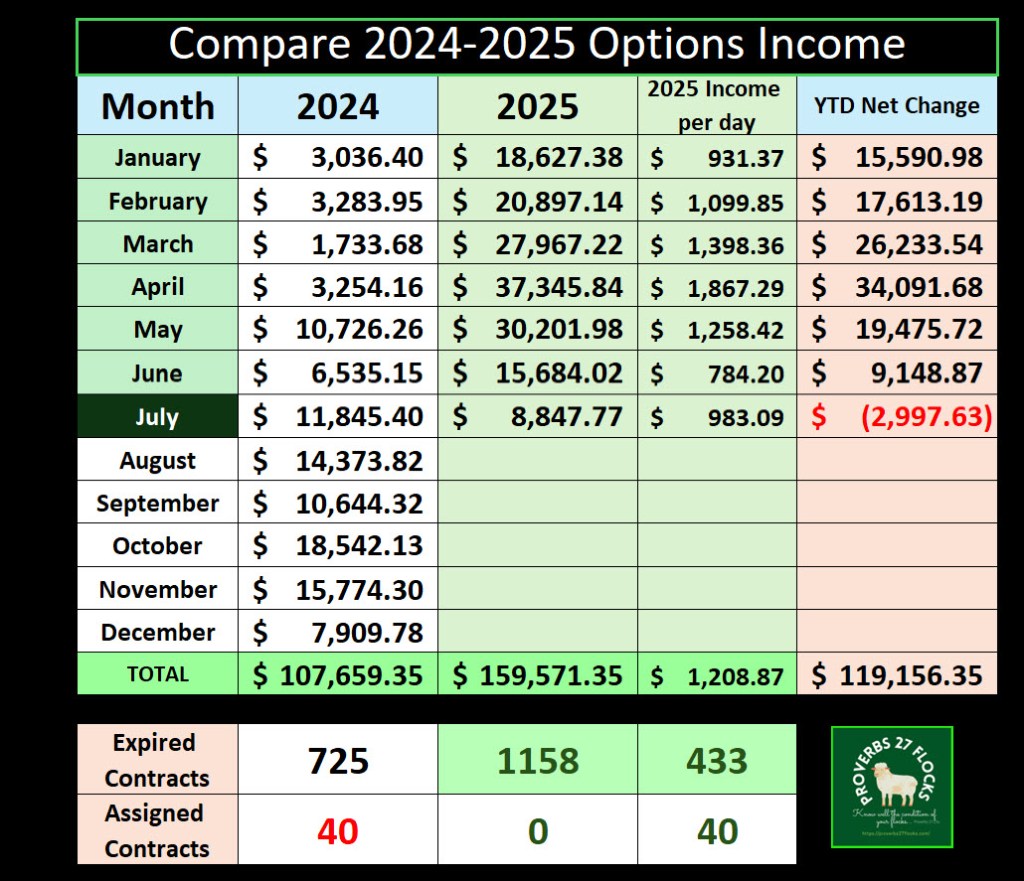

2025 Total Options Income

The real power of options trading is that just about every stock and many ETFs can be traded in the options market. My YTD options income is now $159,571. YTD dividend income is “only” $98.929. When you add the two together, the total is an amazing $258,500.

The good news is that I don’t have to pay taxes on the options income for options traded in our ROTH IRAs and we will only pay taxes on the income in the traditional IRAs when we withdraw the funds. I avoid most of the taxes by giving away a large portion of that cash using Qualified Charitable Distributions (QCD).

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.