Was Q2 Successful?

Successful investing starts with a goal, followed by a strategy, that is then supported by tactical decisions. My primary goal has two elements: 1) To grow our dividend income with minimal work and 2) to have sufficient income in my traditional IRA to cover each year’s RMD withdrawal. One additional goal helps keep income taxes low: I use QCD giving (Qualified Charitable Distributions) to minimize the income taxes on my IRA RMD withdrawals. I want everything to be “easy.”

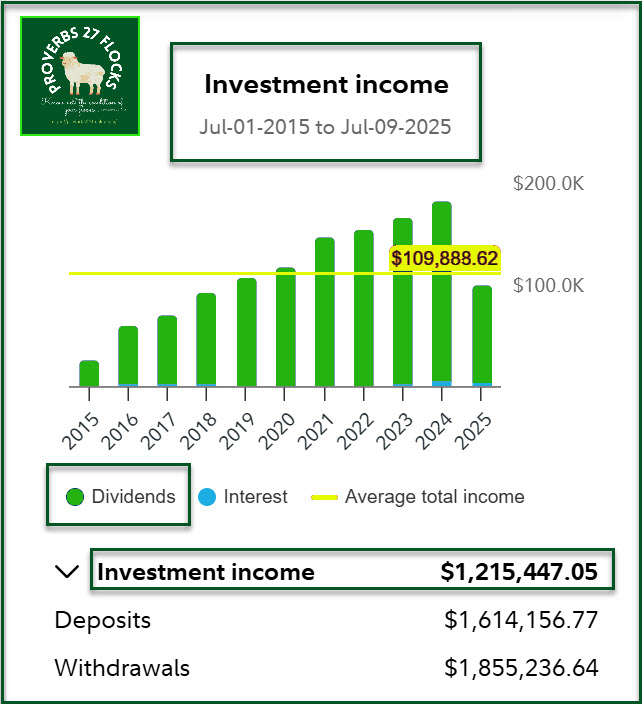

It does very little good to have a goal and then fail to measure progress on the goal. Do you know if you are achieving your goal? At the present time the expected 12-month dividends for my traditional IRA are over $85K. That is more than sufficient to cover next year’s RMD.

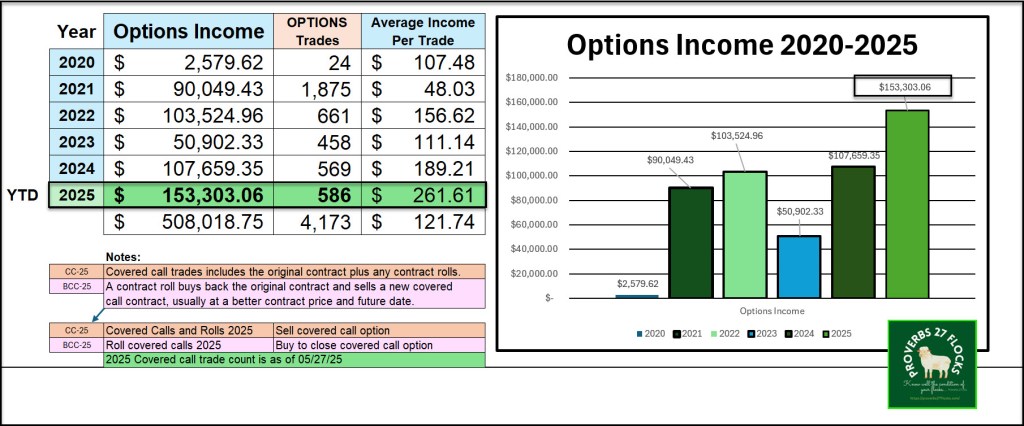

Options Trading Income – More than $150K

The first half of 2025 has been amazing. Even though the year is only half over, I have already exceeded the total options income for each of the preceding five years. Even more amazing, none of my options have been called. That means I have (so far in 2025) not lost any of my shares do to having the strike price rise to the contract price by the contract expiration date.

ROTH IRA Rollover Status

I am getting close to the day when I can start my 2025 ROTH conversions. With a few more charitable gifts to go, I will have met the RMD requirements for 2025. At that point I will have zero tax obligations for my RMD. When that happens I can selectively move stocks and ETFs from my traditional IRA to my ROTH. This accomplishes several things. The best thing, of course, is that all future dividend income and capital gains are tax-free.

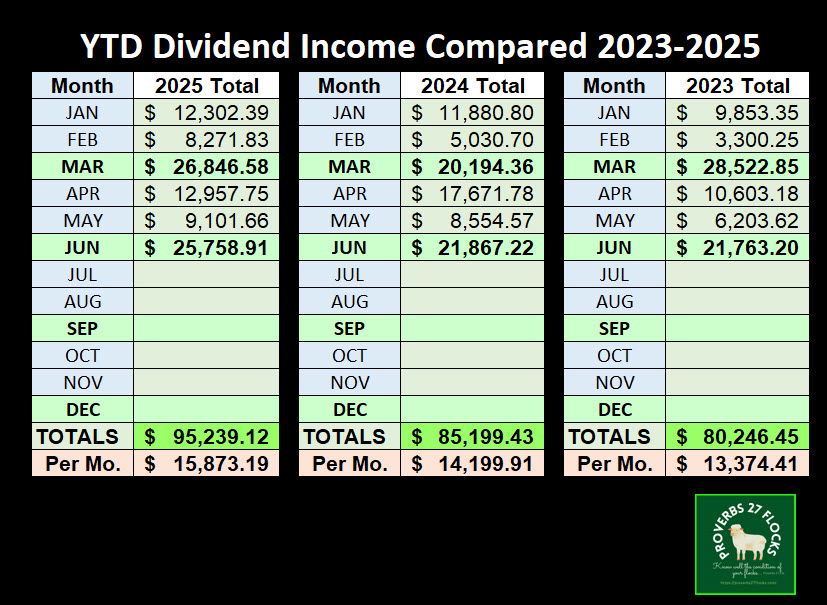

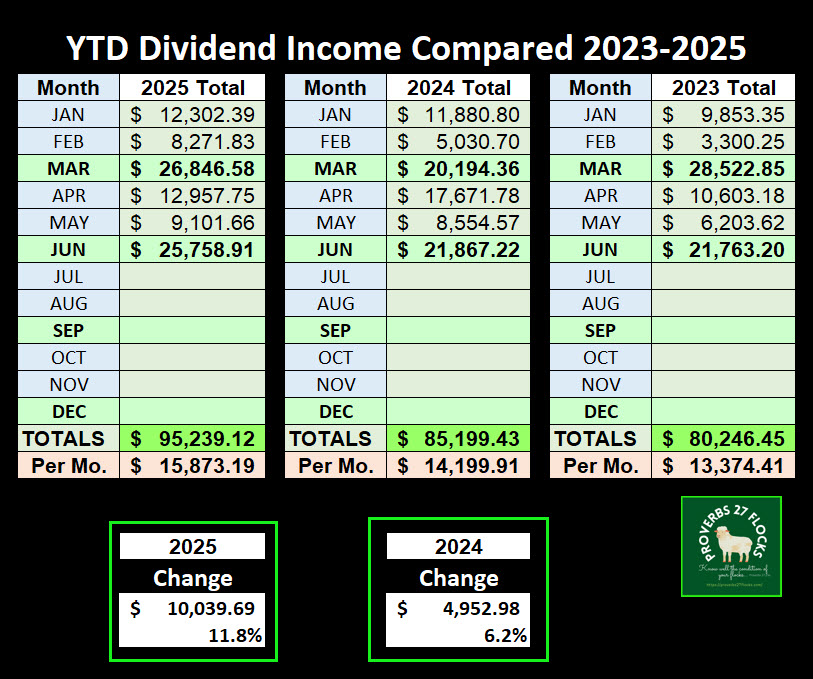

2025 Q1-Q2 Dividends Versus 2024 Q1-Q2 & 2023 Q1-Q2

Because our investment mix changes slowly over time as we buy or sell investments, this comparison is not without some noise. I believe it illustrates, however, that it is possible to grow your income passively with dividend growth investments. The vast majority of our holdings have not changed in the last three years. VYM, ABBV, AVGO, and MAIN are still in our top ten investments. We still hold investments that do not pay a dividend like SMCI.

The thing I am looking for is year-over-year, quarter-by-quarter growth. For Q1-Q2 for the six months in question, 2025 continues with a positive gain over the previous two years. This was accomplished without adding significant dollars from outside of the accounts. Most of the investment buys were funded with incoming dividends or with earnings from trading options.

Interest Income

Because most of our cash is in the SPAXX money market, very little of our income is interest. Because I don’t plan to buy any CDs I expect interest income to be minimal for 2025.

Fidelity’s Fully Paid Lending Program (FPLP)

Although Fidelity’s Fully Paid Lending Program is not a major driver of income, it did provide some income. However, it was paying less-and-less, so I turned it off for all accounts beginning in June.

RMD Progress Report

The 2025 RMD for my traditional IRA is $71,425.50. Because this is taxed at regular income rates, it is best to try to keep this off of the 1040 at income tax time. The balance of the RMD at this time is $6,000 due to QCD giving. I write checks directly from my traditional IRA to qualified 501c3 non-profts. The goal is to give the entire $71,425.50 to non-profits. Using that approach there are no income taxes.

IRS-approved QCD

The maximum QCD gift for 2025 is $108K. I hope to hit that mark by the end of the year. One of the reasons for this approach is to reduce my IRA balance going into 2026. That keeps next year’s RMD lower, further improving our income tax situation.

Dividend Growth Investing Works

Even if you don’t trade options, there are good ways to grow your income simply by purchasing good dividend growth ETFs like VYM, DGRO, and SCHD. Bear in mind that I had growing dividend income before I started trading covered call options. This is easy income.

Closing Thoughts

It pays to keep things in perspective. There are a couple of ways to do that. First of all, we live in a land of wealth and most of us receive more wealth in a year than most of the world’s population receives in a lifetime.

Secondly, wealth never really makes anyone happy or secure. If that were true, there would be more happy and secure people in this country.

If you aren’t happy today with $100 you won’t be happy with $1,000,000. Having more doesn’t make anyone really happy or satisfied.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.