ULTY YieldMax Ultra Option Income Strategy ETF

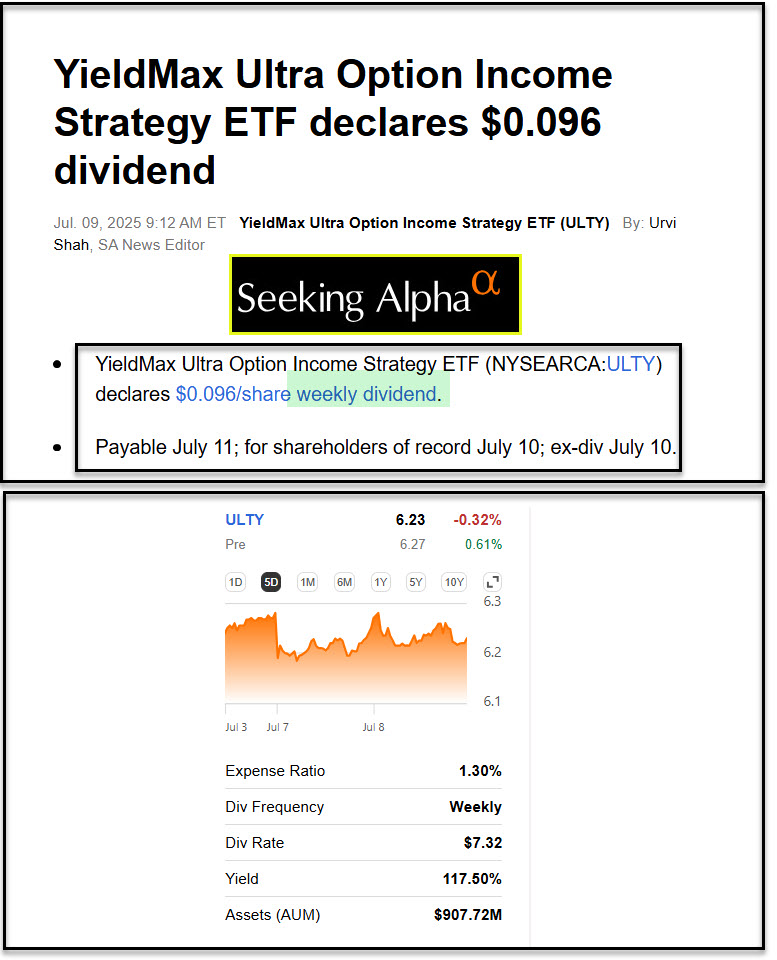

Most ETFs pay a quarterly dividend. Some pay monthly dividends. I recently stumbled upon an ETF that is currently paying a weekly dividend. The ETF is ULTY. Before you rush out and buy shares, don’t buy them just because I did! Yesterday I purchased 100 shares of ULTY for $6.22 per share in my ROTH IRA. That means my cost basis is $622.

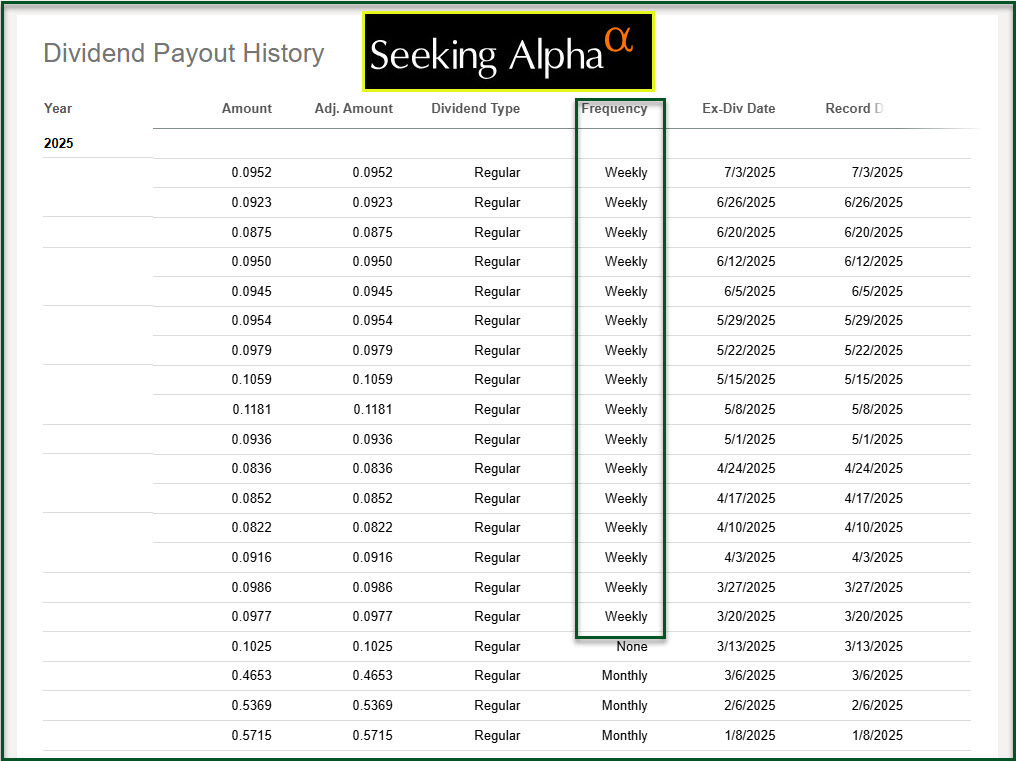

Based on my purchase, I will be receiving the next weekly dividend. YieldMax Ultra Option Income Strategy ETF (ULTY) declared a $0.096/share weekly dividend. The dividend I will receive is $9.60. That is crazy. If the next 52 weeks of dividends is at least $0.09 per share, the income will be $4.68 per share or $468 for a year.

Some Basics

Let me repeat – don’t buy shares just because I did. $622 is just a sliver of the total assets in my ROTH IRA. The current balance of my ROTH is over $1M and most of that is invested in dividend growth stocks or dividend growth ETFs. It is hard to ignore an ETF like this and it might prove to be a better solution for anyone who wants options income without trading options.

Having said that, know the following basics about this ETF: Expense Ratio 1.30%; Div Rate (TTM) $7.32; Assets (AUM) $907.72M and a daily trading volume that is very robust. As I type this about 9AM on Wednesday morning already eight million shares have traded on the market.

What the Bulls and Bears Say (From Seeking Alpha)

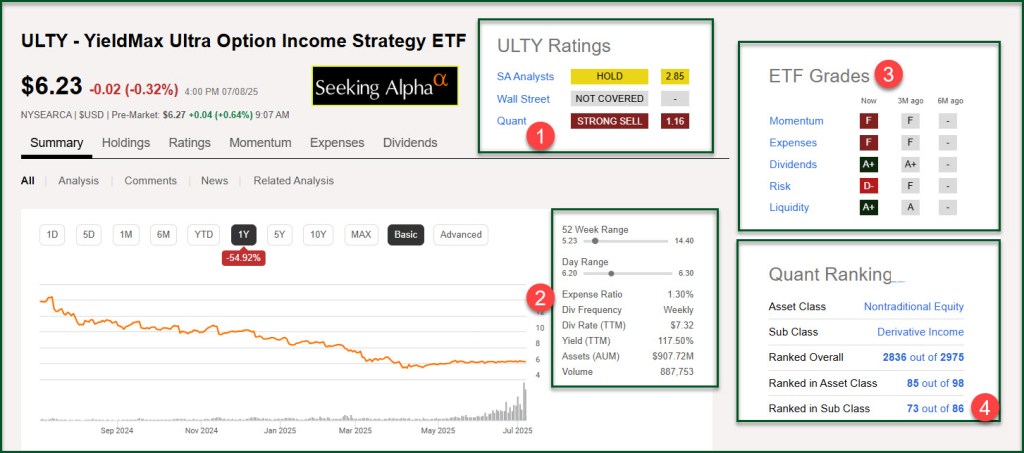

Bulls Say: “ULTY offers reduced volatility, limited exposure to high-growth stocks, and high income.”

Bears Say: “Even with weekly payouts, ULTY underperforms the S&P 500, takes on higher risk through derivatives, and depends too much on timing. Great income, weak total return.”

Wayne Says: “This is a very tempting income investment.” I won’t be loading up on the shares, but I may add some each week as the dividends arrive. I think of it this way, when I get the next weekly dividend I could buy one more share if the share price does not shoot higher.

YieldMax – Full list of ETFs

“YieldMax™ ETFs seek to generate monthly income by pursuing options-based strategies on one or more underlying securities. YieldMax™ ETFs aim to harvest compelling yields from assets that are not typically associated with monthly income.” – Source: YieldMax

The funds do not invest directly in the underlying stock or ETF.

TSLY, OARK, APLY,NVDY, AMZY, FBY, GOOY, CONY, NFLY, DISO, XOMO, MSFO, JPMO, AMDY, PYPY, XYZY, MRNY, AIYY, YMAX, YMAG, MSTY, ULTY, YBIT, CRSH, GDXY, SNOY, ABNY, FIAT, DIPS, BABO, YQQQ, TSMY, SMCY, PLTY, BIGY, SOXY, MARO, FEAT, FIVY, LFGY, GPTY, CVNY, SDTY, QDTY, RDTY, WNTR, CHPY, RNTY, HOOY, BRKC

Tidal Trust II – YieldMax Ultra Option Income Strategy ETF

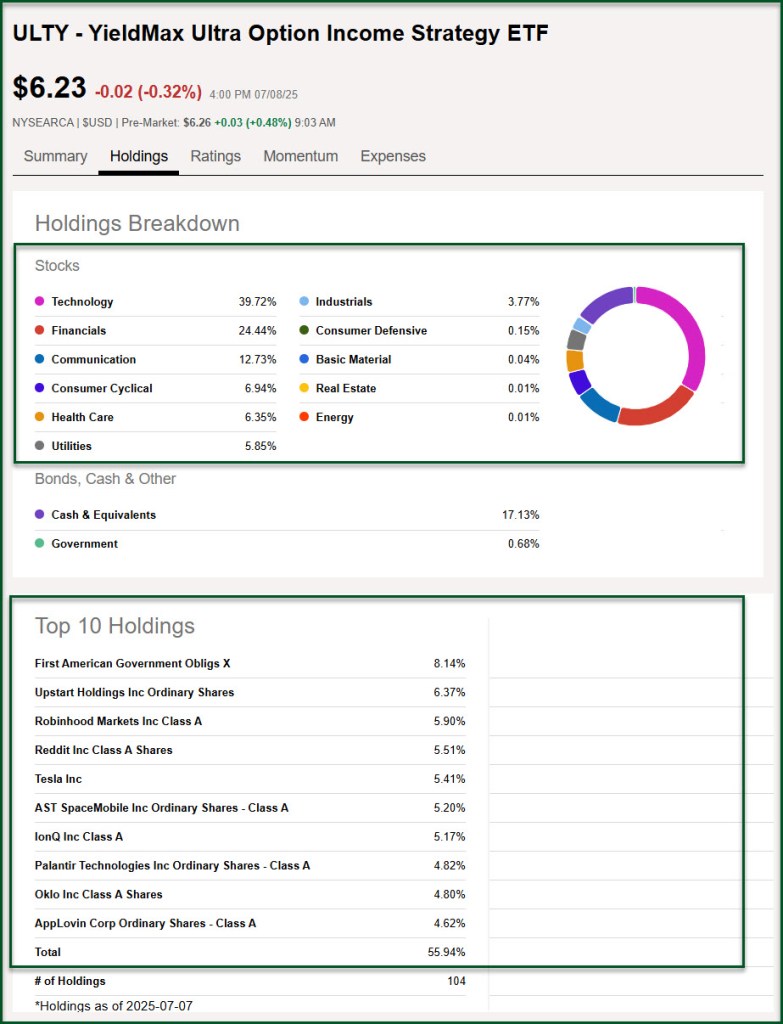

This is an exchange-traded fund launched and managed by Tidal Investments LLC. The fund invests in public equity and fixed income markets of the United States. For its equity portion, it invests through derivatives in stocks of companies operating across diversified sectors. The fund uses derivatives such as options to create its portfolio. It invests in growth and value stocks of companies across diversified market capitalization. For its fixed income portion, the fund invests in short-term U.S. treasury securities. The fund employs quantitative analysis to create its portfolio. Tidal Trust II – YieldMax Ultra Option Income Strategy ETF was formed on February 28, 2024 and is domiciled in the United States.

The investment seeks current income, secondary objective being exposure to the share price of select U.S. listed securities, subject to a limit on potential investment gains. The fund is an actively managed exchange-traded fund that seeks current income while providing direct and/or indirect exposure to the share price of select U.S. listed securities, subject to a limit on potential investment gains. It uses both traditional and synthetic covered call strategies that are designed to produce higher income levels when the underlying securities experience more volatility. The fund is non-diversified.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.