Who Knows the Future?

No one, outside of God, knows the future. We can increase in wisdom to help us make decisions in the present that often influence our future. One of the Old Testament Proverbs gives us some sound advice for all of life. Of course, there are also those who spread lies and misinformation, so the source of “information” matters greatly.

“Listen to advice and accept instruction, that you may gain wisdom in the future.” Proverbs 19:20

“An evildoer listens to wicked lips, and a liar gives ear to a mischievous tongue.” Proverbs 17:4

Many Voices

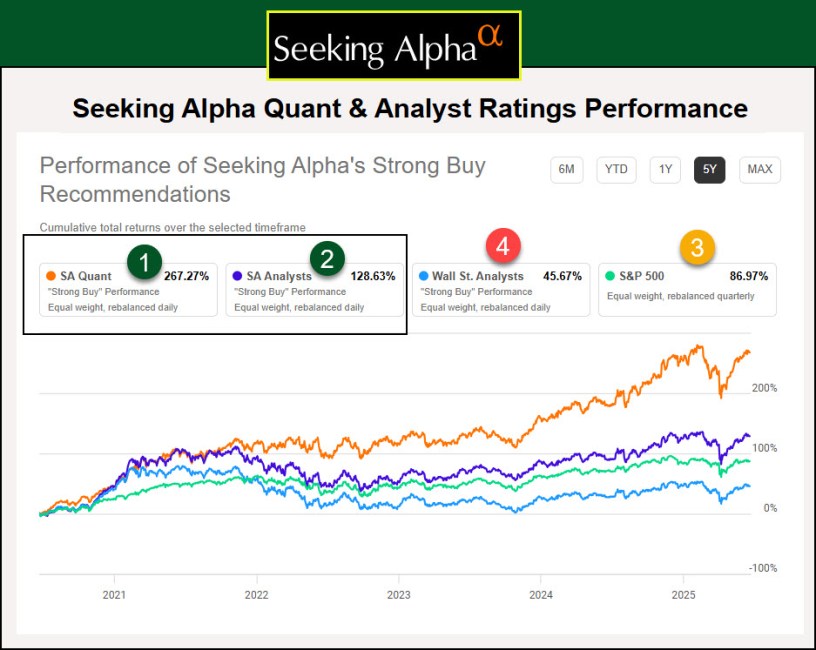

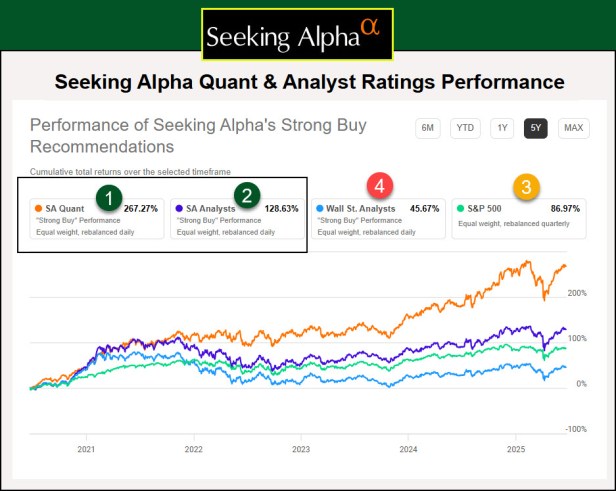

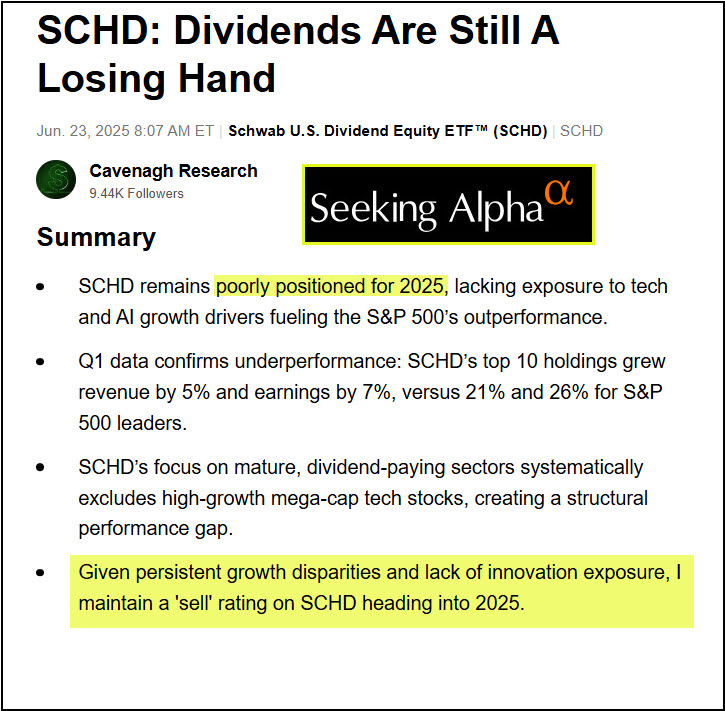

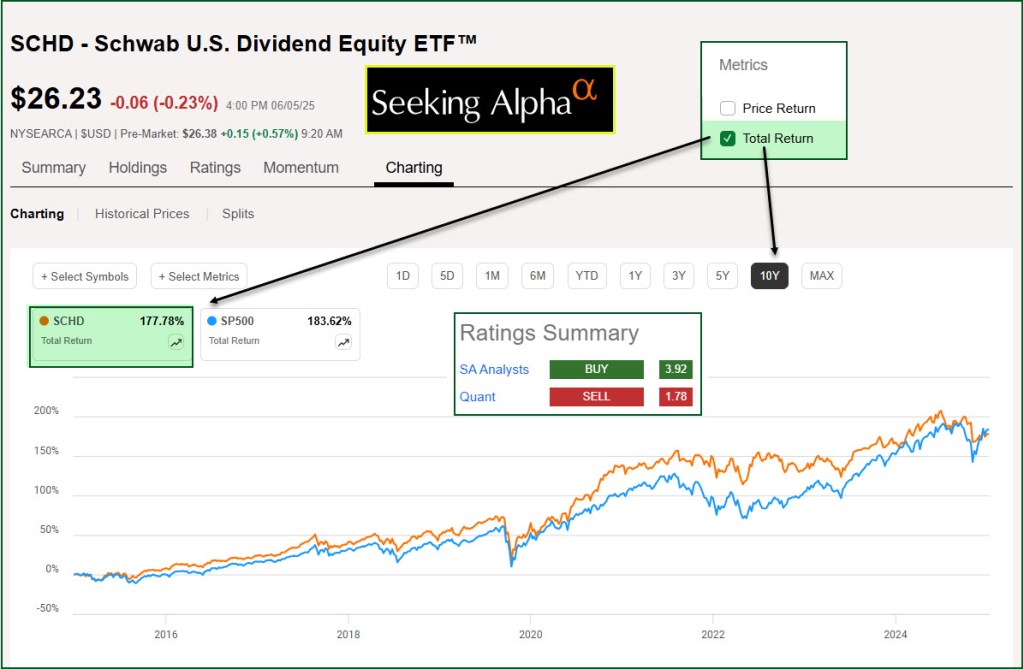

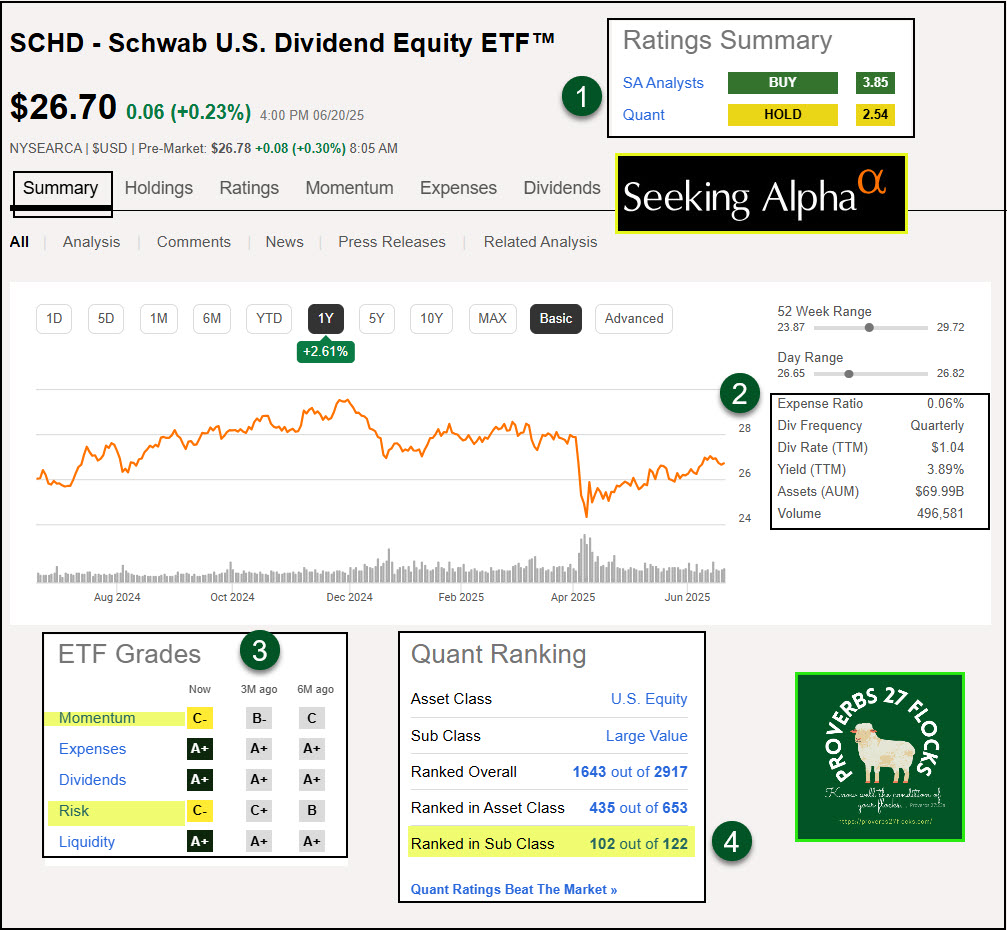

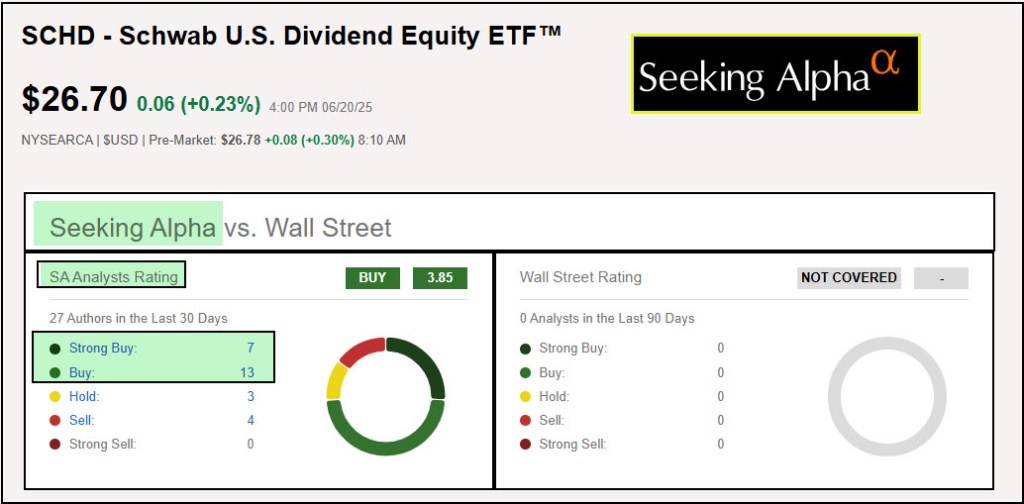

Seeking Alpha makes it easier to see some of the voices. Three key groups are usually stating opinions. They are a computer-generated QUANT rating, the views of Seeking Alpha analysts, and the overview from Wall Street. In general, I want to focus on the QUANT rating with a listening ear towards the Seeking Alpha analysts.

Wall Street, I believe, often has an agenda that is not aligned with our best interests. One of the problems is that they are in the business of making money and each time they do a trade or encourage or hype an investment. That isn’t to say their opinions are meaningless, but I tend to be a bit more skeptical of both their enthusiasm or pessimism. Part of this is due to the tendency of these analysts to focus on the short-term more than the long-term. Of course, that is a huge blanket statement, and there are Wall Street analysts that don’t think that way.

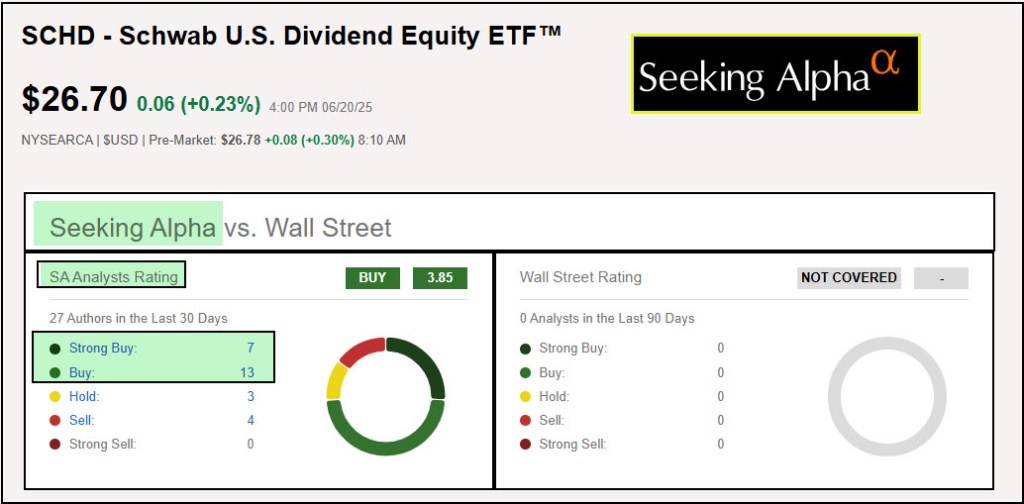

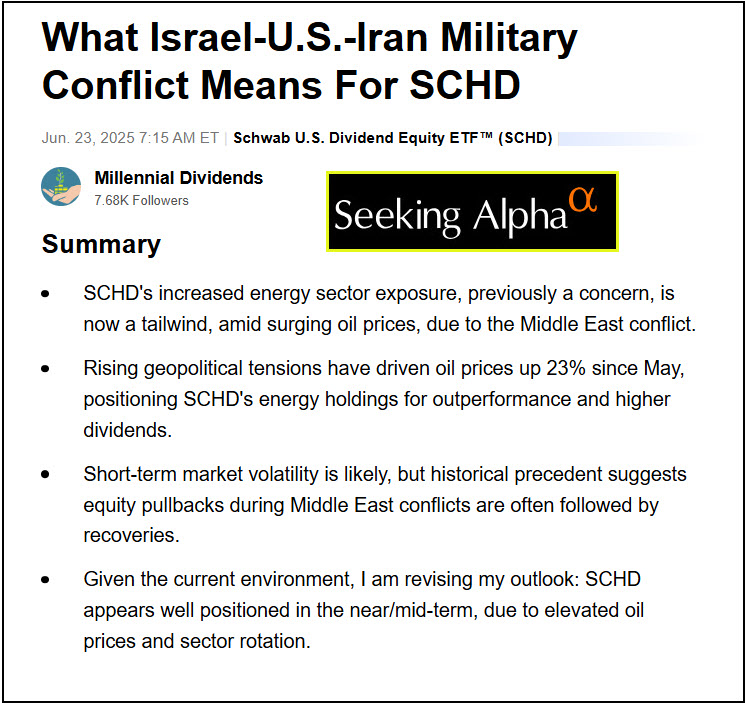

Seeking Alpha Analysts

The opinions vary widely. One author is turning positive while another is clearly bearish or negative. Who should we believe. In the short-term either one can be right. The goal is not trying to be right in the short-term but rather to have a long-term perspective. We don’t know how long energy prices will be moving in a positive direction, but I do think energy is undervalued at the present time. Therefore, I belong to the camp of the analyst who thinks SCHD is positioned well for sustainable growing dividends. Some links for Seeking Alpha opinions: Positive Opinion Negative Opinion

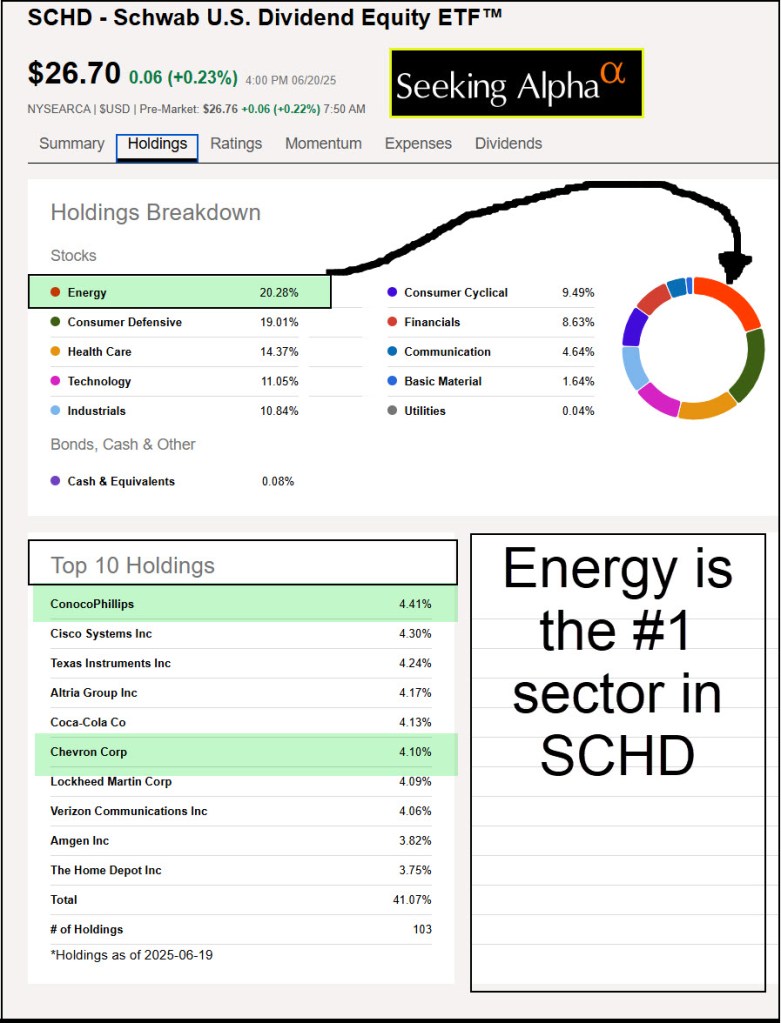

What Stocks Are Included?

Seeking Alpha makes it easy to see any ETF’s top ten holdings. The downside is that you cannot see beyond those top ten. However, there are other websites that offer more details. For example, “Stock Analysis” offers a more comprehensive view of SCHD’s holdings. Here is a link to STOCK ANALYSIS. As you can see, some of the top energy holdings are COP, CVX, EOG, OKE, and VLO.

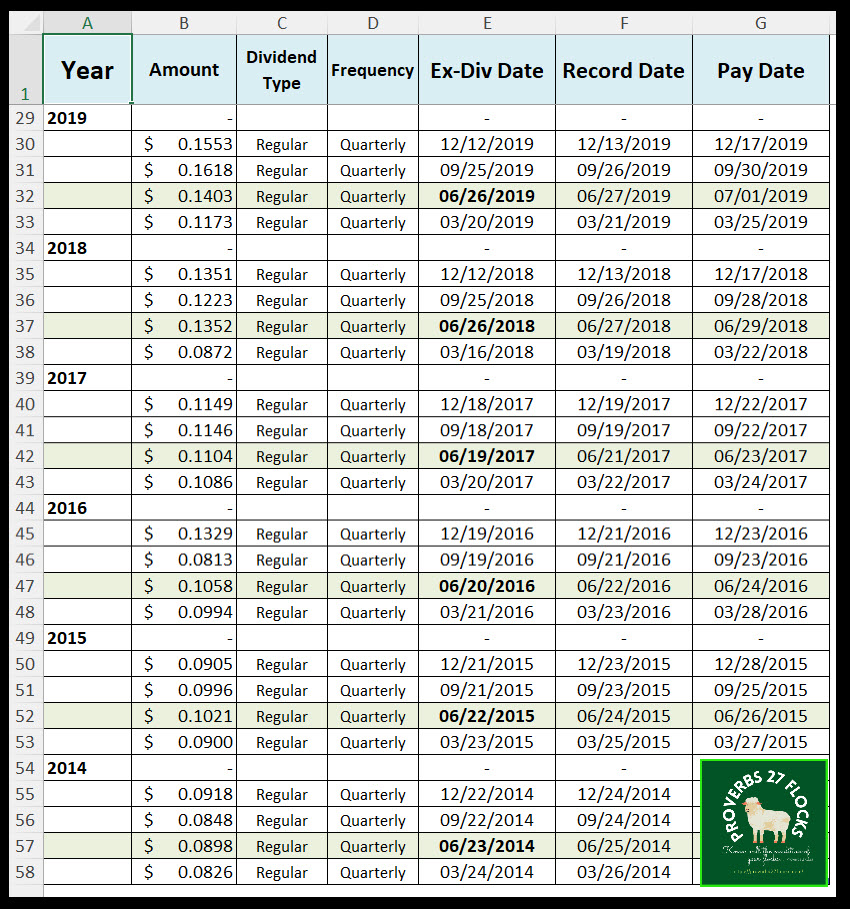

Consider SCHD’s Dividend Growth and Total Investment Growth

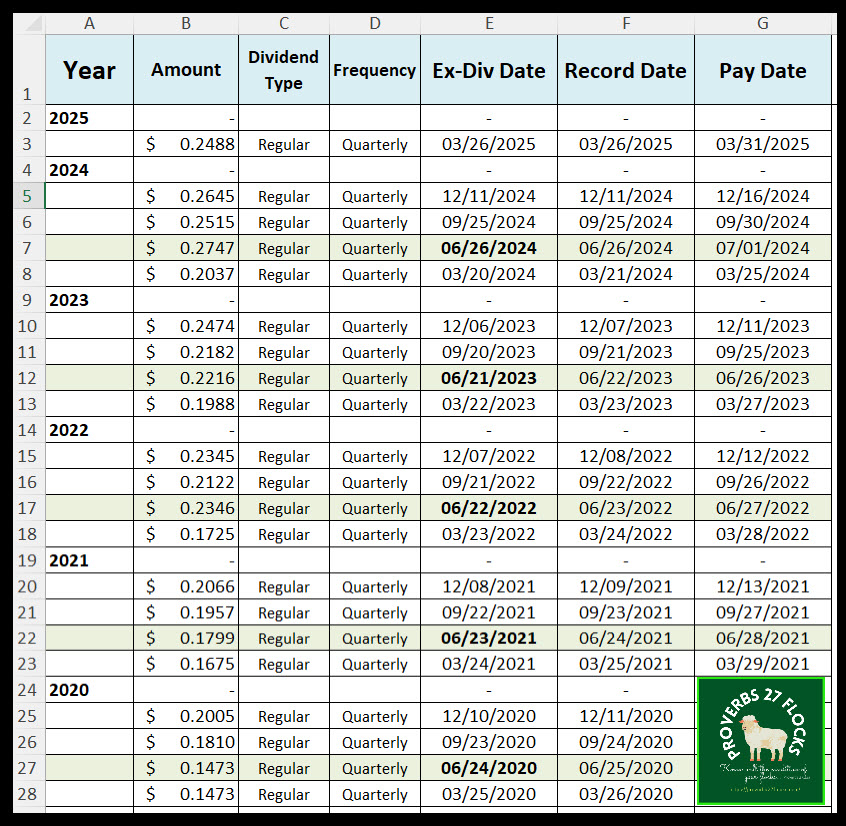

One of our holdings is the ETF with the ticker symbol SCHD. Cindie and I own a total of 5,000 shares. It is one of four ETFs that Cindie and I own. Our grandchildren also own shares of SCHD in their UTMA accounts. The following images help you understand why it is a desirable investment from a dividend and dividend growth perspective. I want to pay attention to dividend growth and total investment growth over the long-term.

You can expect to see a dividend announcement for SCHD before the end of this month. It will be interesting to see if their mix of energy investments make a difference for dividend growth or not.

Consider SCHD for Covered Call Options

I also trade covered call options on my ROTH IRA account. For 2024 plus 2025 YTD I made an additional $3,514 in options income from my 2,100 shares of SCHD. The 21 options contracts have a strike price of $28 that expires on October 17, 2025. I have a second option contract for 200 shares (2 contracts) with a strike price of $30 that expires on July 18, 2025.

Fund Profile

Schwab Strategic Trust – Schwab U.S. Dividend Equity ETF is an exchange traded fund launched and managed by Charles Schwab Investment Management, Inc. It invests in public equity markets of the United States. It invests in stocks of companies operating across energy, materials, industrials, consumer discretionary, consumer staples, health care, financials, information technology, communication services, utilities sectors. It invests in growth and value stocks of companies across diversified market capitalization. It invests in dividend paying stocks of companies. It seeks to track the performance of the Dow Jones U.S. Dividend 100 Index, by using full replication technique. Schwab Strategic Trust – Schwab U.S. Dividend Equity ETF was formed on October 20, 2011 and is domiciled in the United States.

The investment seeks to track as closely as possible, before fees and expenses, the total return of the Dow Jones U.S. Dividend 100™ Index. To pursue its goal, the fund generally invests in stocks that are included in the index. The index is designed to measure the performance of high dividend yielding stocks issued by U.S. companies that have a record of consistently paying dividends, selected for fundamental strength relative to their peers, based on financial ratios. The fund will invest at least 90% of its net assets in these stocks. Benchmark: S&P 500 TR USD

All scripture passages are from the English Standard Version except as otherwise noted.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.