VYM Vanguard High Dividend Yield Index Fund ETF Shares

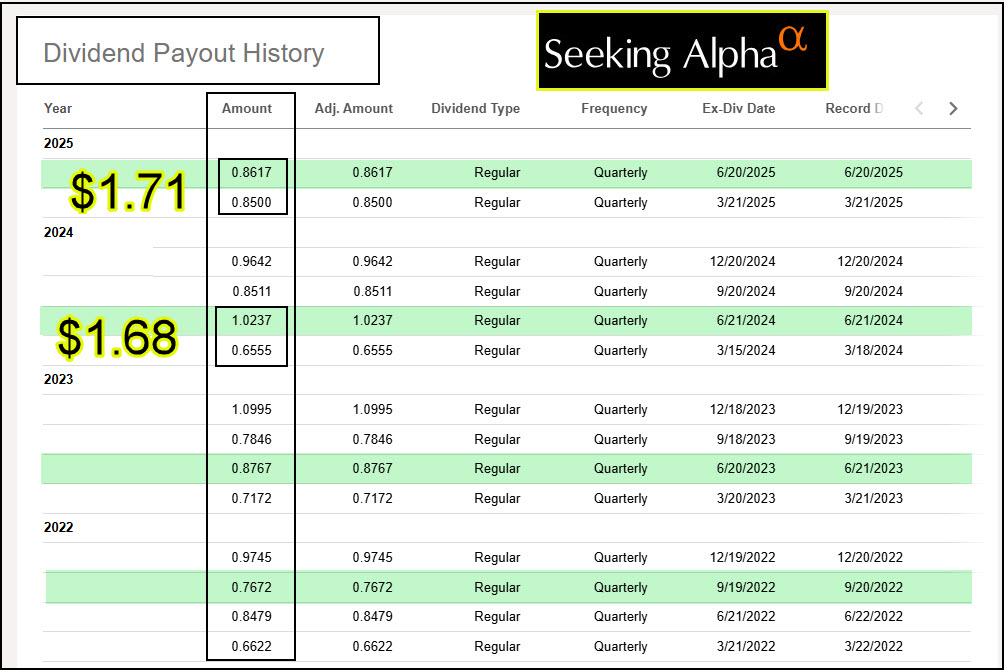

Each quarter, when an ETF VYM announces a dividend I compare the dividend with the same quarter’s dividend from the previous year. This year, for Q2, VYM’s dividend decreased, but the YTD dividend is still better than 2024’s dividend at the same point. The distribution is well above Q1 of 2024. We will see the dividend in our accounts on June 24.

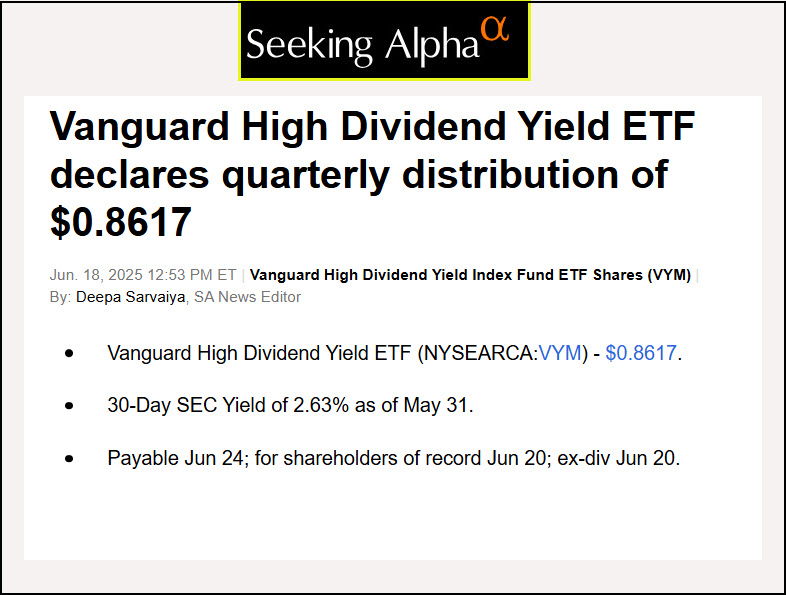

VYM declares quarterly distribution of $0.8617

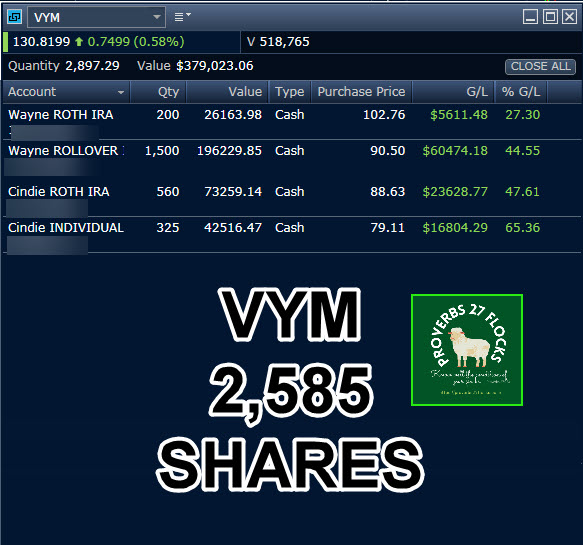

The 30-Day SEC Yield is 2.63% as of May 31. The dividend is payable June 24; for shareholders of record June 20; ex-div June 20. Because we own 2,585 shares of VYM, we will receive $2,277.49 in dividends on June 24.

Fund Profile

Vanguard High Dividend Yield ETF is an exchange traded fund launched and managed by The Vanguard Group, Inc. It invests in public equity markets of the United States. The fund invests in stocks of companies operating across diversified sectors. The fund invests in growth and value stocks of companies across diversified market capitalization. The fund invests in dividend paying stocks of companies. The fund seeks to track the performance of the FTSE High Dividend Yield Index, by using full replication technique. Vanguard Whitehall Funds – Vanguard High Dividend Yield ETF was formed on November 10, 2006 and is domiciled in the United States.

Covered Call Options Plus Dividends

I sometimes trade covered call options on my VYM shares. At the present time Cindie’s ROTH IRA has an open covered call option contract with a strike price of $140 that expires October 17. There is only a 30% chance that her shares will be called. However, Cindie owns 560 shares of VYM, so she has 460 shares that are not optioned.

If I wanted to add to Cindie’s option income, I could sell four more contracts with a strike price of $140 and an expiration date of October 17 and earn Cindie another $197.40 in “synthetic dividends.” The ticker symbol for this trade would look like this: –VYM251017C140. That is interpreted (VYM 251017 C 140) as a covered call “C” contract for VYM shares with an expiration date of 25/10/17 and a strike price of $140.

VYM Diversification

It is wise to look at the sector diversification, the top ten investments in the fund and the total number of stocks held by the ETF. VYM is well diversified.

In the case of VYM, four of the top ten are stocks I also own in my traditional IRA: ABBV, AVGO, JNJ, and KO. Furthermore, Cindie and I are heavily invested in AVGO and ABBV. We own 1,200 shares of AVGO currently worth $301K and 1,230 shares of ABBV worth $228K. The beauty of VYM is that you get even more diversification into almost 600 companies.

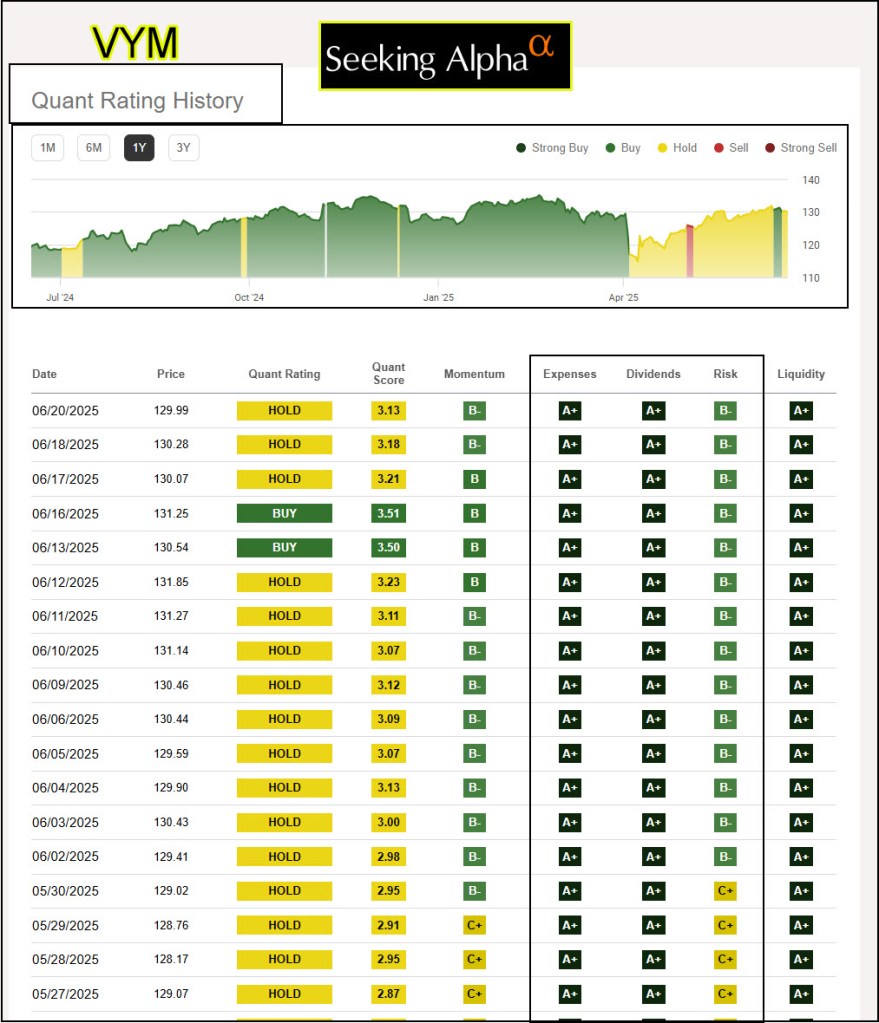

The ETF Ratings on Seeking Alpha

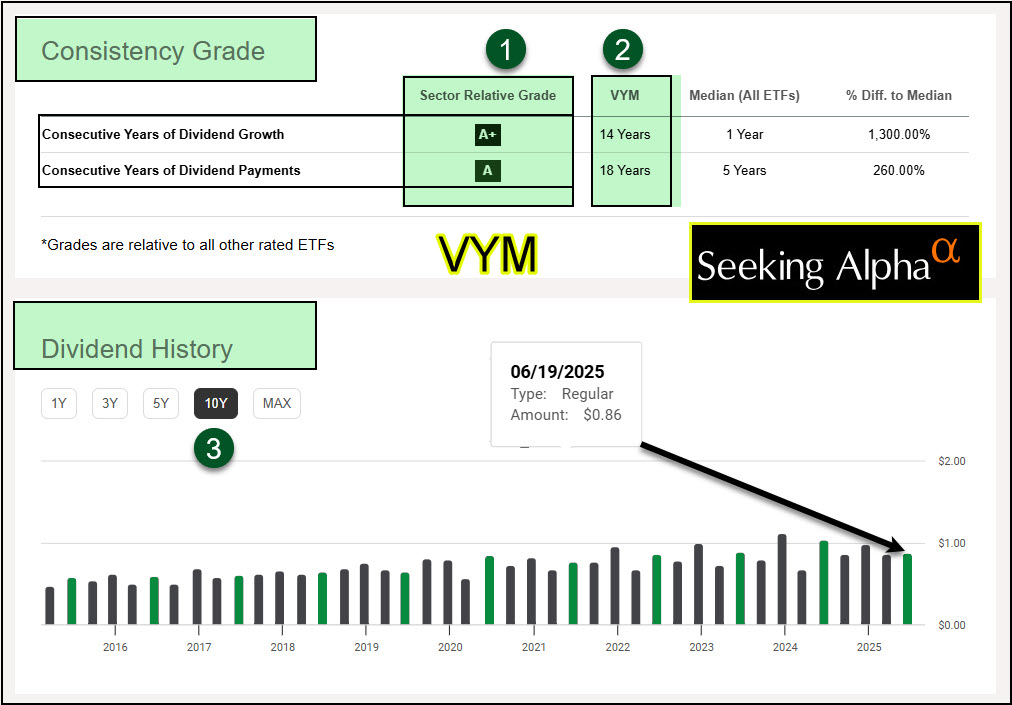

Rock solid in every respect. Volatile markets generally don’t hurt VYM.

Performance Should Be Compared

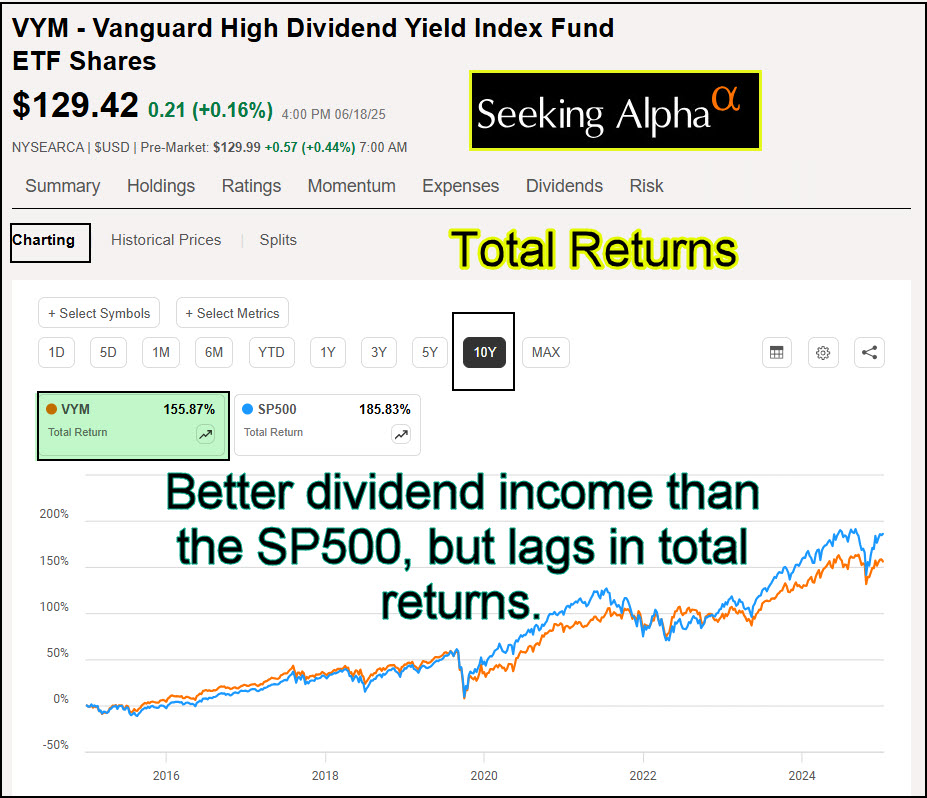

I am interested in 10-year total returns. If an investment cannot hit 90-100% ten-year total returns, then I have to ask “why?” My three favorites, VYM, SCHD, and DGRO all have solid performance over the long term. Price returns are interesting, but total returns are the key to success.

Dividends Should Grow Too

This shows that VYM has been a good dividend growth investment. That isn’t surprising, as that is the goal of this ETF.

VYM Summary

One might argue that the ten-year returns on the S&P 500 are far better than those of VYM. I don’t disagree. However in retirement you cannot pay the bills with total returns. For example, the dividend yield on a popular ETF (VOO Vanguard S&P 500 ETF) with a good expense ratio of 0.03% is only 1.27%. VYM, in contrast, has a yield of 2.73% and a far better track record for growing the dividend.

We won’t be adding shares of VYM at this time, because we own $375K of this ETF and that makes it number one in our total mix of investments. It makes more sense to add shares of SCHD, which currently yields 3.90% and only makes up about $130K in investment dollars. I like SCHD’s dividend growth history as well. My goal is to get SCHD into our top ten investments as well.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.