Easy Income Keeps Cruising Along

Yesterday I wrote a post that talked about CSWC – Capital Southwest. This investment is in the Financials sector with an industry focus of “Asset Management and Custody Banks.” That is a fancy way of saying it is a Business Development Company (BDC). Today’s investment update is for a similar investment: SAR (Saratoga Investment Corp.)

Although a BDC (Business Development Company) is not an ETF and is a single investment, you might say it has some similarities to a good ETF. Not all BDCs are good investments in the same way that not all ETFs qualify for that honor. However, just like yesterday’s update about CSWC, today’s BDC is a good option for diversification, dividend yield and monthly dividends.

Like CSWC, SAR is in the Financials sector in the “Industry Asset Management and Custody Banks” industry. That means it is a BDC.

Our SAR Ownership

Cindie and I own a combined total of 1,500 shares of SAR. On a total investment dollar basis, this is a smaller investment than our CSWC holdings.

Our SAR Monthly Dividends

Because we own 1,500 shares of SAR, we will receive $375 per month in dividends on the following dates: July 24, August 21, and September 24.

From the SAR Investor Presentation

Sometimes I look at investor presentations for a high-level perspective about the BDC. There are six slides that follow. Here is what to look for when you read an investor presentation: Quality, growth, diversification, and credit quality.

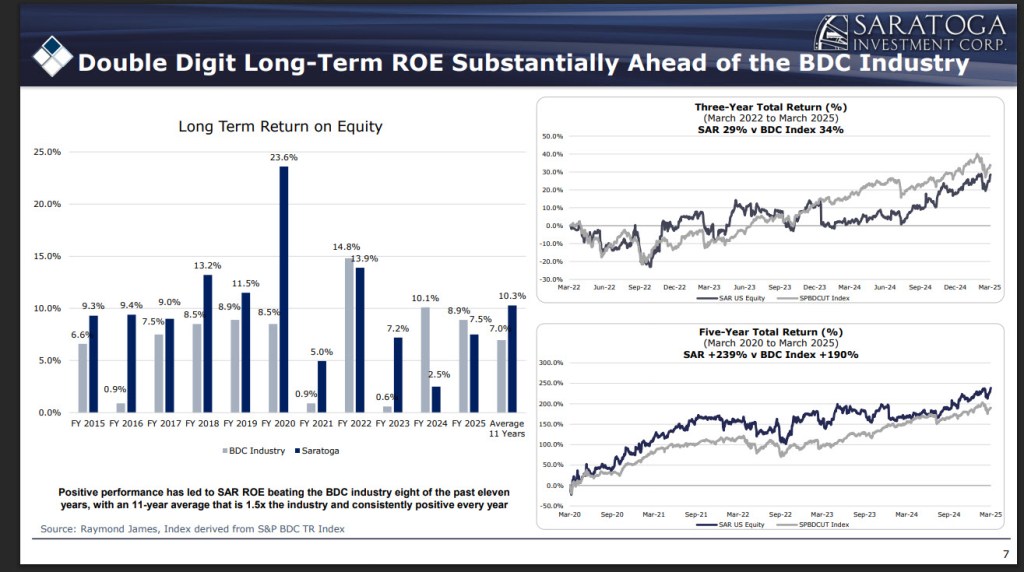

SAR Long Term ROE

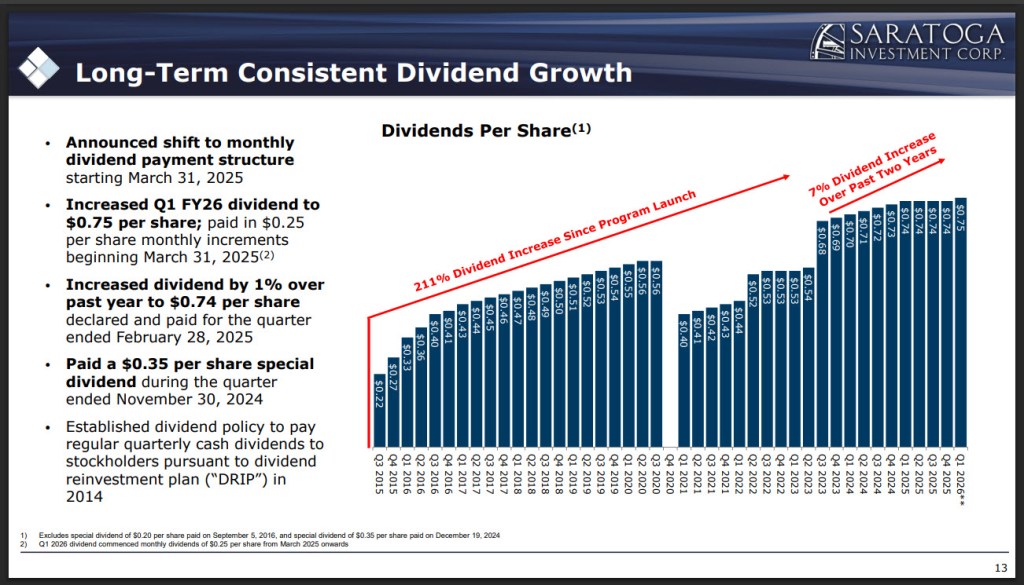

SAR Long-Term Dividend Growth

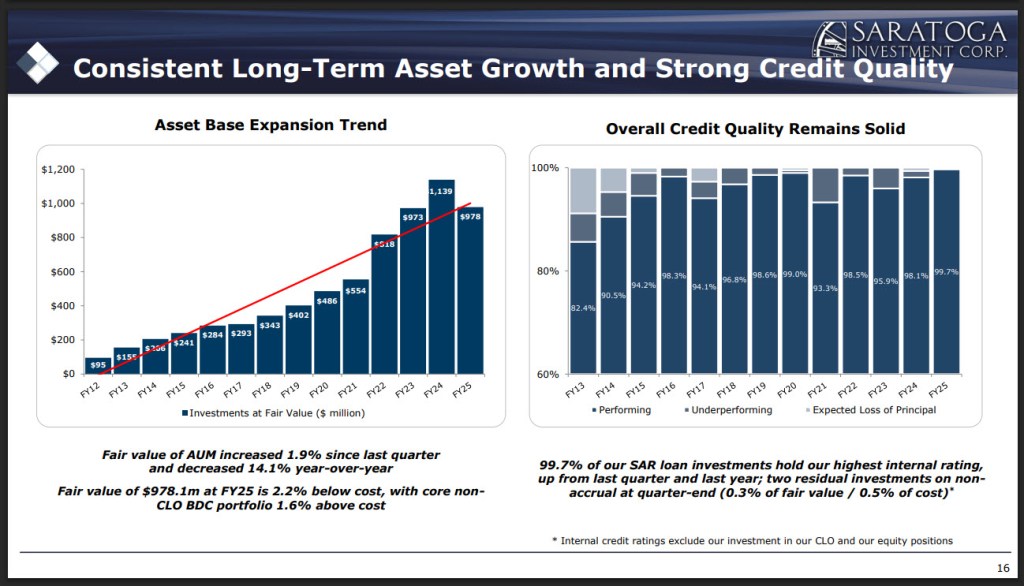

SAR Asset Growth and Credit Quality

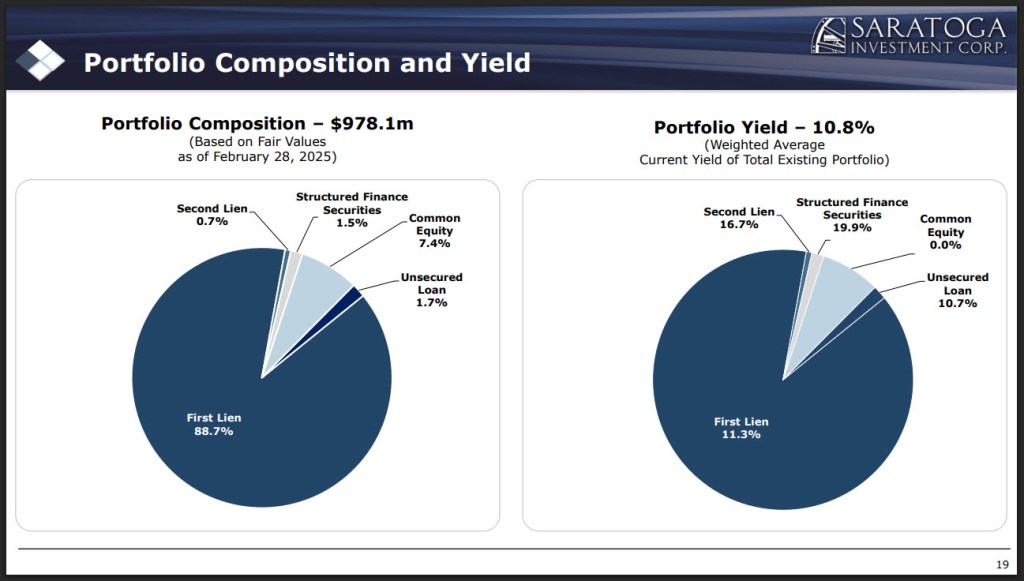

SAR Portfolio Composition and Yield

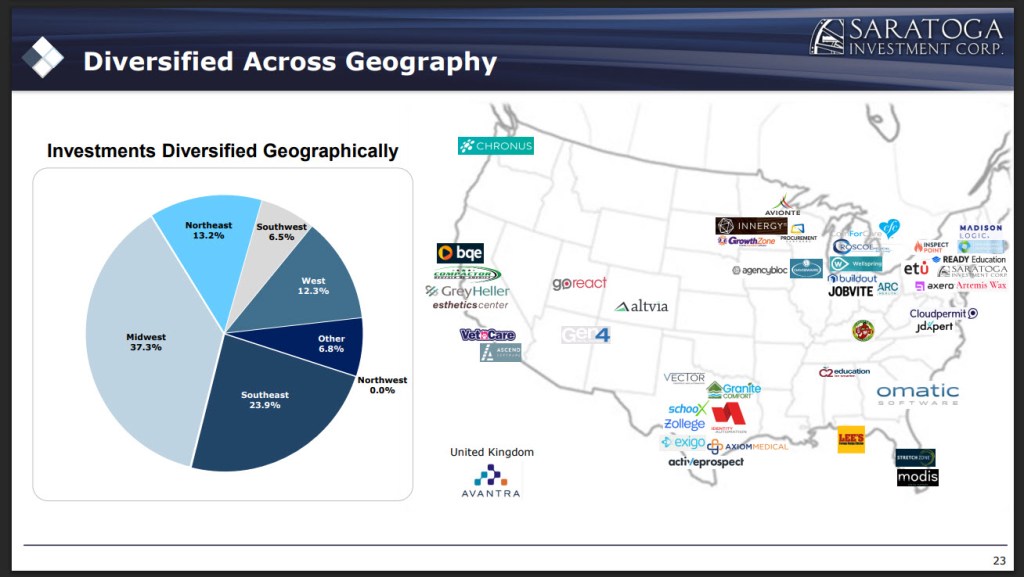

SAR Geographic Diversification (Hurricane alley; West Coast exposure?)

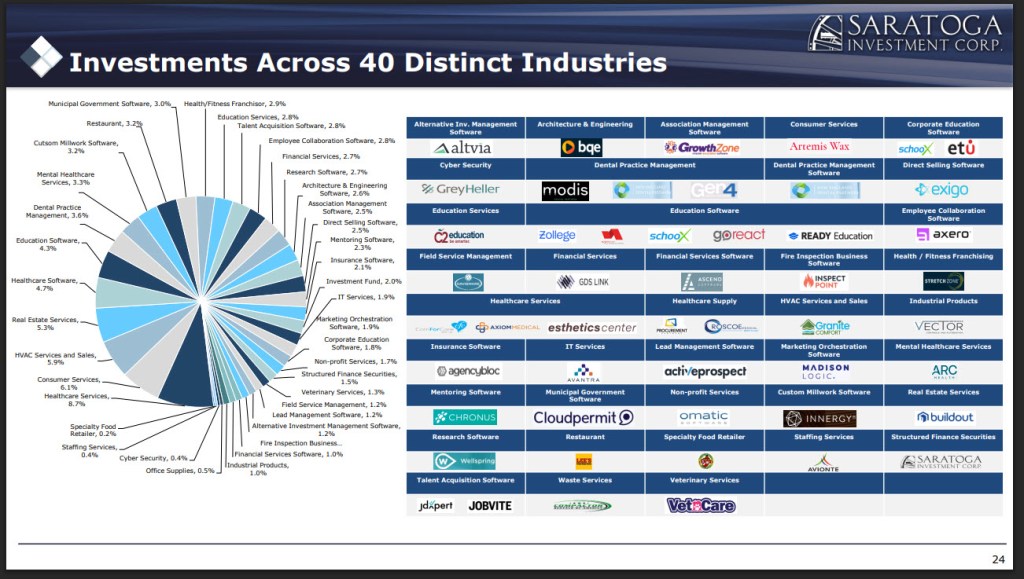

SAR Industry Diversification

Company Profile

Saratoga Investment Corp. is a business development company specializing in leveraged and management buyouts, acquisition financings, growth financings, recapitalization, debt refinancing, and transitional financing transactions at the lower end of middle market companies. It structures its investments as debt and equity by investing through first and second lien loans, mezzanine debt, co-investments, select high yield bonds, senior secured bonds, unsecured bonds, and preferred and common equity. The firm prefers to invest in aerospace, automotive aftermarket and services, business products and services, consumer products and services, education, environmental services, industrial services, financial services, food and beverage, healthcare products and services, logistics, distribution, manufacturing, restaurants services, food services, software services, technology services, specialty chemical, media and telecommunications. It seeks to invest in the United States. The firm primarily invests $5 million to $75 million in companies having EBITDA of $2 million or greater and revenues of $5 million to $250 million. The firm prefer to take a majority stake. It invests through direct lending as well as participation in loan syndicates. The firm was formerly known as GSC Investment Corp. Saratoga Investment Corp. was formed on 2007 and is based in New York, New York with an additional office in Florham Park, New Jersey.

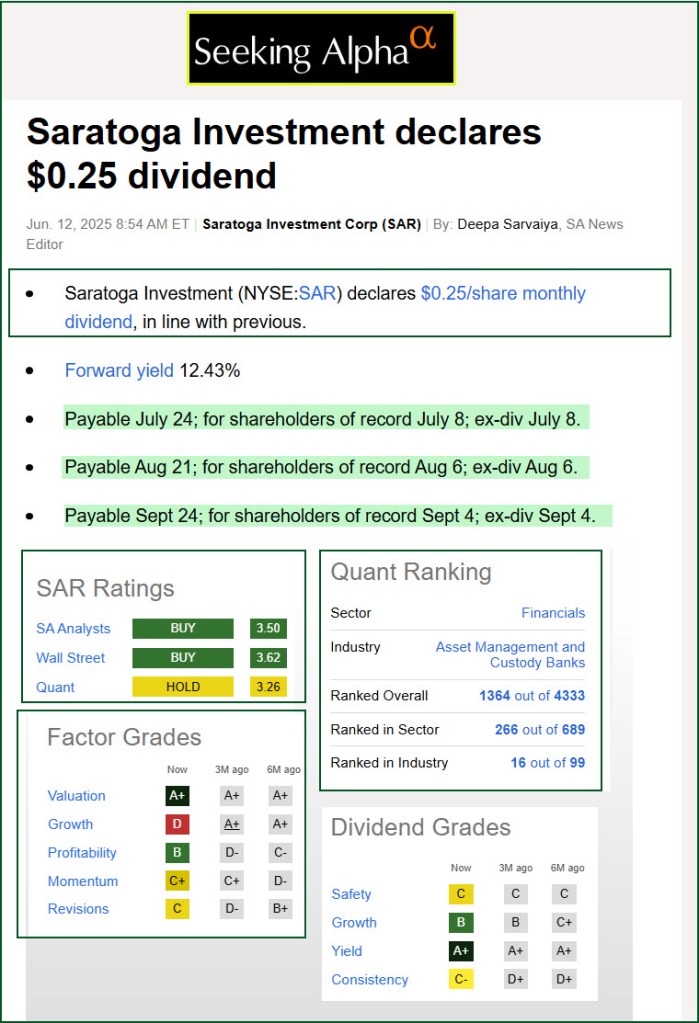

Seeking Alpha Dividend Grades

Because I am a dividend growth investor, I want to keep my eyes on various dividend factors. Seeking Alpha does a good job helping me do just that. (More information about their summer promotion is shown at the end of this post.)

Seeking Alpha breaks the dividend picture into four pieces: Safety, Growth, Yield, and Consistency.

For SAR, the “Safety” rating has remained steady at C. The “Growth” score is B. Six months ago it was C+.

One thing is certain, at a dividend “Yield” of 12.35%, the yield grade is A+ and it has been A+ for six months. The yield on any investment tends to go up when the stock price goes down. One year ago SAR shares were trading at $24.42 and they are now down to $24.29. Therefore, the reason to buy SAR is not for price growth but for impressive dividend payouts. I’d be tempted to add shares if I had a lot of cash sitting on the sidelines.

The final dividend grade is called “Consistency.” Consistent dividends are like a consistent Social Security payment. You want consistency. SAR’s current grade is C-. It had been D+ and six months ago it was D+. I don’t believe there is risk associated with a dividend cut. However, the current QUANT rating is a HOLD at 3.26.

Seeking Alpha QUANT Evaluation

A good mix of investments continues to make sense for a reliable income stream. I usually like to know the status of the QUANT ratings for our investments. BDC’s, as noted in yesterday’s post, are usually not as profitable for options trading. That doesn’t matter when the yield is over 10%.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

Seeking Alpha is running a major sale from June 11 to July 4, 2025. Sale Prices: All prices are 20% off.

Premium: $299 → $239/year ($60 off) – this is the one I use

Alpha Picks: $499 → $399/year ($100 off)

Premium + Alpha Picks Bundle: $798 → $638 ($160 off)

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.