Dividends or Option Income or Both?

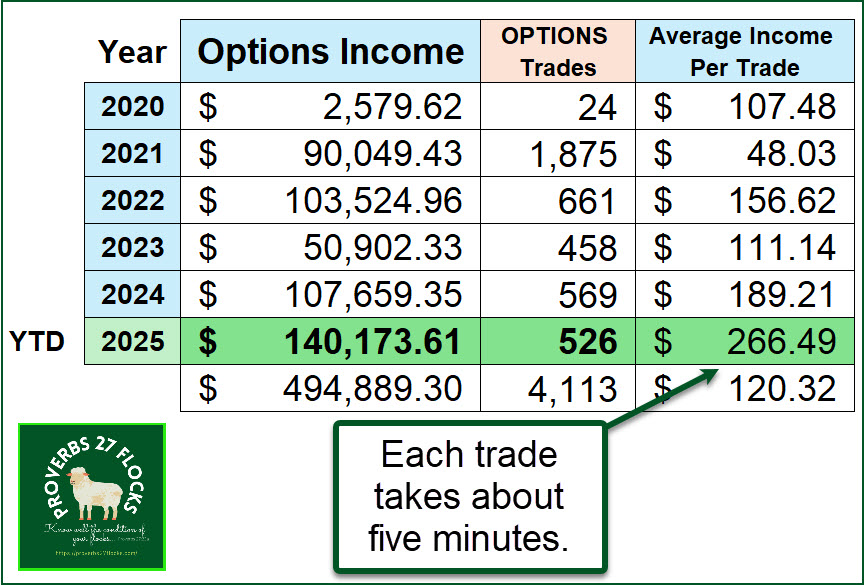

There is much to be said for the easy income strategy. If you pick good stocks and ETFs that pay increasing dividends there is no need to trade options. However, in about fifteen to thirty minutes each Monday, Tuesday, and Wednesday, time permitting, I can make more trading covered call options than I can make from dividends.

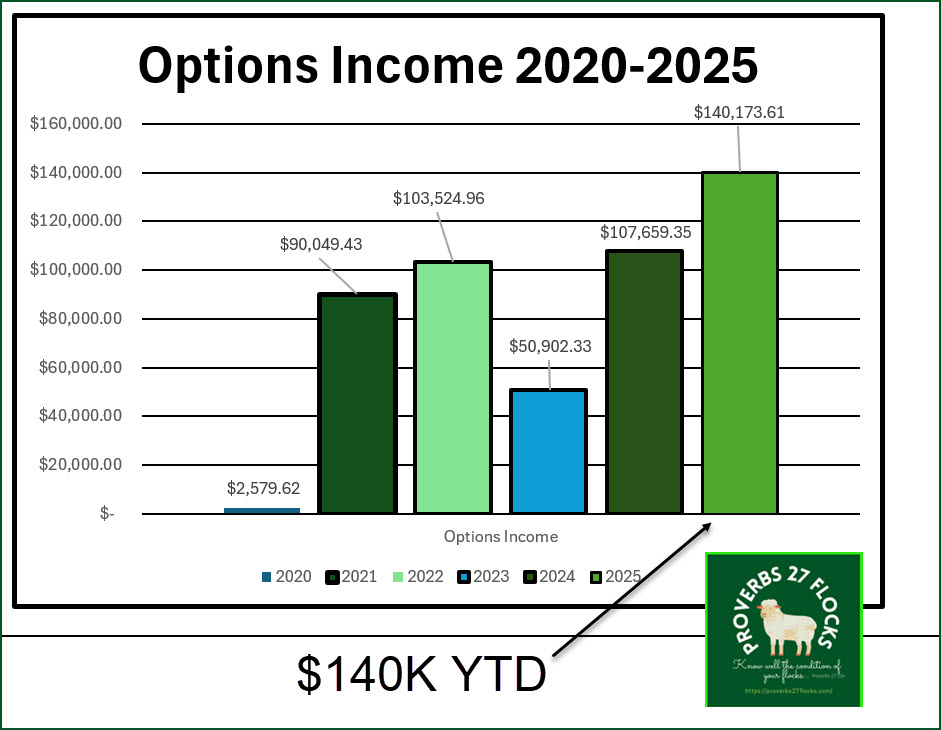

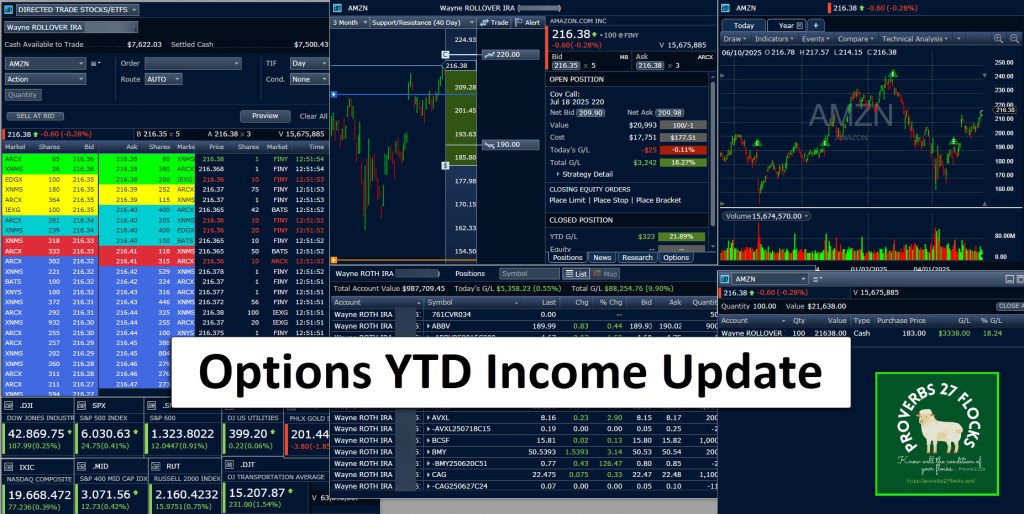

This month, with still a half of a year to go, I reached $140K in options income. What makes this even sweeter is that none of my shares have been called, so they continue to spill dividends into our accounts as well. I realize, however, that there is an increasing probability as the year unfolds for some of my options to be called. When that happens I will have cash to use for other investing purposes.

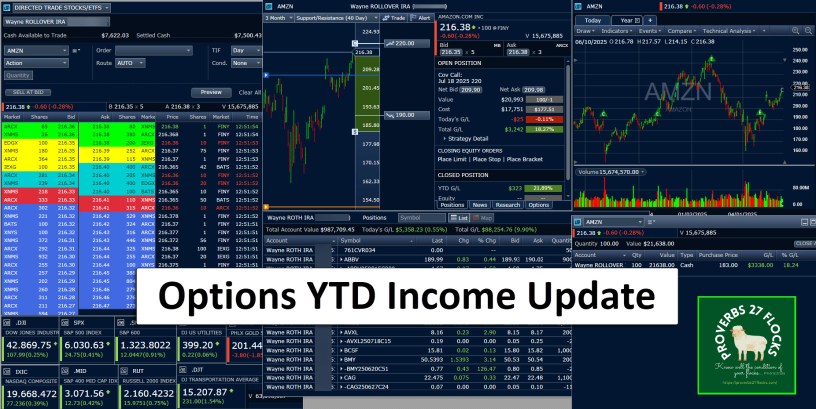

Active Trader Pro

If you want to begin to trade options, I highly recommend that you download Fidelity’s Active Trader Pro software and start to use it for your trades or to monitor your portfolio of investments. Then, if you have interest in trading options at some point in the future, you will have the best tool for options trading. The tool makes it simple, just like other tools simplify baking, woodworking, or automotive repairs.

Trade Armor

The window that is at the top and center of the following image is the Trade Armor window. With that window you can see a lot of valuable information. Just using that one tool I can learn what I need to know to determine if an option trade makes sense or not. Then, using the same tool, I can enter the option trade.

Dividend Income Versus Options Income

To put the $140K of options income into perspective, our YTD dividend income through the end of may is $60K. That means our total income, excluding Social Security and Cindie’s parttime pay as a baker, is over $200K so far this year.

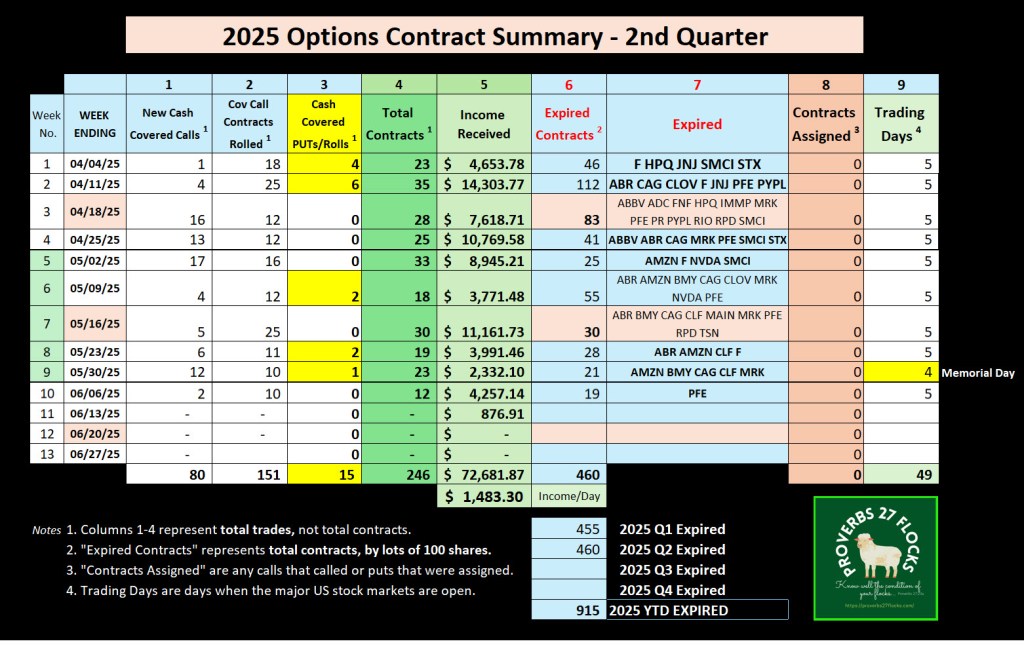

2nd Quarter Activity