Do You Know the Forecast?

While we were traveling I checked the weather forecast several times. Some of the early forecasts seemed like the weather would be less than desirable. I wasn’t hopeful. According to the forecast West Virginia was going to be cool and rainy. Some days that was true, but most of the time it was warmer and sunnier than the original forecasts. The same is true with retirement income. As time goes on it can be sunnier – if you have chosen good investments.

When someone is in their working years, it is generally easy to predict how much income you will receive as salary or hourly wages. This month’s income is most likely going to be similar to last month’s, unless you get some overtime hours or a bonus. Sometimes you might even see a raise. But it is also wise to think about monthly income in retirement and retirement income before retirement. In retirement there can be more uncertainty, but you can see trends.

Forecasting With or Without Excel?

Let’s begin with the easy way (without Excel or any spreadsheet) to start to understand your retirement income. Some brokers provide better statements than others. I have seen statements from Charles Schwab, Vanguard, Voya, Edward Jones, RBC Wealth Management and others. None of them is as complete and helpful as the ones provided by Fidelity Investments.

In a second post I will talk about a second way to tackle this that does require the use of a spreadsheet. However, you can get more income information without a spreadsheet as well, so I will talk about the advantages of both next time. This time we can just use the statement.

The Fidelity Statement Summary Page

There are four key parts to this summary page. There is the “Income Summary”, “Top Holdings”, “Asset Allocation” graph, and “Asset Class” as a percentage of the portfolio. Because Cindie and I both share our information with each other, we each receive identical statements each month. I recommend that married couples do this to simplify their big picture view of their investments.

It is reasonably easy to determine what our monthly average dividend income will be for all of our investments. After five months our total dividend income is $69,480. If we divide this number by five, the monthly average is $13,896. If we don’t sell any investments, and if none of our investments decreases or suspends their dividends, our income for 2025 should be at least $166,752. I just multiplied the average monthly income by twelve.

However, this does not consider any supplemental dividends or dividend increases. For example, I own 1,000 shares of EOG Resources, Inc. EOG just raised their dividend to $1.02/share quarterly dividend, which is a 4.6% increase from prior dividend of $0.97. Therefore, my forecast will be “off” by the increase amount. This, however, is likely to be the final dividend for EOG for 2025. EOG pays four times each year.

Forecasting Taxable or Not Taxable

Some income is tax free. Therefore, the dollars buy more than income in a tax-deferred or taxable account. This can also be calculated using the summary page because Fidelity breaks out the income into categories. For example, our tax-free income YTD is $26,290. This means we have $5,258 average monthly income that can be spent without having to pay taxes when we withdraw the dollars. This also means we can expect to have about $63,000 in tax free income in 2025. That is more than our total Social Security income for the year.

Again, because 600 of my EOG shares are in my ROTH IRA, that dividend income is tax free. If I multiply the new dividend by 600 shares, I will receive $612 on the next dividend pay date.

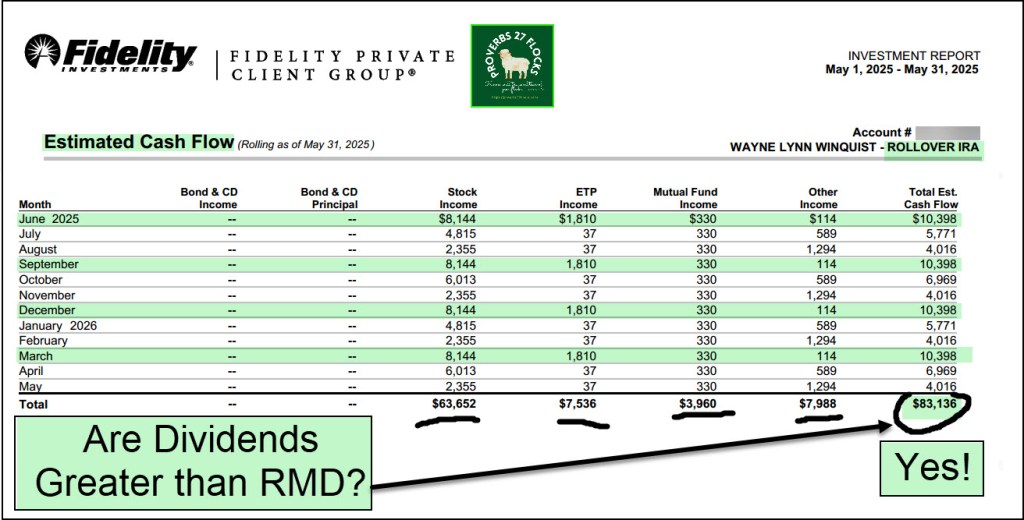

Account Level Analysis: Estimated Cash Flow

The other thing Fidelity does well is presenting a rolling twelve month “Estimated Cash Flow.” In the following three images for our three largest accounts, you can see the EAI for my traditional IRA is $83K for the next twelve months. That covers my RMD so I won’t have to sell any investments to satisfy my RMD.

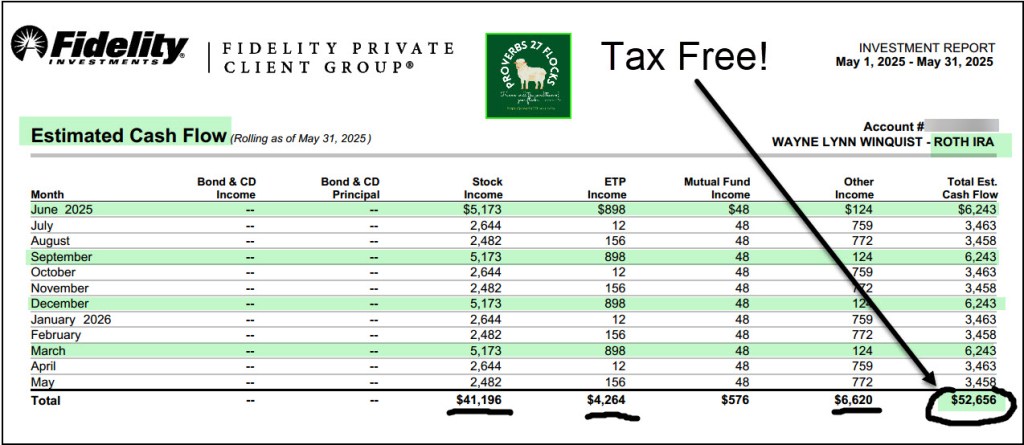

My ROTH IRA has estimated cash flow of $52.6K. Again, if you look at the months you can see that Fidelity is not able to forecast dividend increases, and they assume you won’t be buying or selling any investments. However, it is a good rough estimate.

Cindie’s ROTH IRA has estimated cash flow of $13.4K. She also has dividend growth investments, so this estimate is probably under what we can expect.

Finally, there are some weaknesses in Fidelity’s statement. It doesn’t include some types of income, so the numbers presented tend to be conservative.

What About Future Dividends?

This is why I look at investments, whether individual stocks or ETFs for their pattern of dividend growth. Even if you don’t keep adding income from other sources, you would be wise to consider buying investments with dividend growth in mind. I think five percent average annual growth is a good target.

DGRO, for example, has a 5 Year Growth Rate of 7.62%. SCHD has a 5 Year Growth Rate of 11.44%. VYM comes in with a lower 5 Year Growth Rate of 1.67%, but it has other attractive benefits including 590 holdings for better diversification. DTD has a 5 Year Growth Rate of 3.29%. Why does this matter? In one word: Inflation.

Does your current investment advisor or broker share this type of information with you? I have found very few advisors are interested in dividends or dividend growth. However, if you are going to retire, you might want to think about income in retirement.

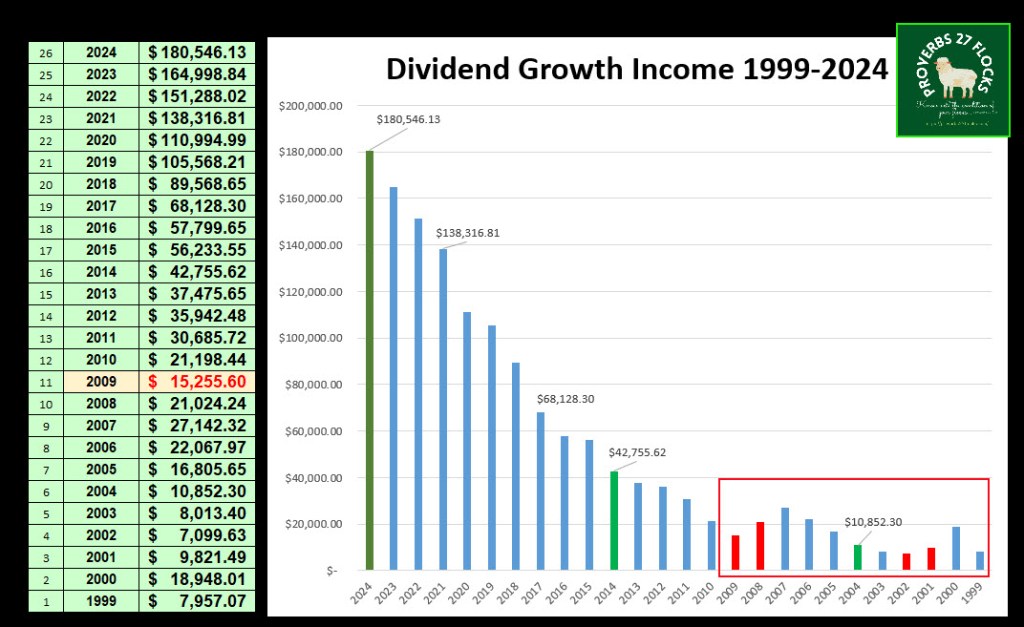

Measuring Your Past Growth

After you have four or five years of statements, it is easy to see what your dividend growth looks like. Take the last statement of the year and look at your total dividend and interest income. Then compare the changes each year. In the following example I took all of our statements from 1999-2024 and created a table and a graph using Excel. This makes it easy to see the dividend growth in dollars and the percentage change each year.

I got serious about dividend growth in 2010. Therefore, I took more of a stocks and equity ETFs approach and did not do a lot of trading. As dividends arrived in our accounts I reinvested them in more dividend-paying stocks and ETFs.

Even if the dividend growth rate of an investment is less than five percent, you can increase your dividends by continuing to buy more investments with your dividends. I can still do this in retirement because we don’t need $180K for living expenses and a good portion of that income can be given to charitable causes. We can easily live on our Social Security benefits because we have zero debt.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. It helps me find solid investments with dividend growth. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

Fantastic knowledge and expertise accompanied by detailed steps on how to track past and current income. Love it !!

LikeLike