Managing Your Investments

There are four basic ways to manage your investments. I prefer to think of them in the following four buckets: the first is the professional handler where you have to know little or nothing and trust them to make most if not all decisions on your behalf. That is a leaky bucket.

The second bucket is to select a few broad and/or focused low-cost exchange traded funds (ETF) and ignore the market’s irrational behaviors. Most of what goes into this bucket stays in this bucket and grows over time.

The third is to do a bit of homework and add in quality stocks, BDC’s and REITs that can maximize both future growth and income. This can be even more beneficial than bucket number two. It isn’t as difficult as you might think.

The final bucket is to spend a lot of time and energy diving into technical analysis, watching the momentum of individual investments, and buying/selling investments weekly or even daily. This is a bucket with high risk. It could tip over and you would have a mess.

Bucket Number One: The Professional Handler

I have rarely seen the first option (expert advisor) work well for the people who come to me for help. When your total account balance is $100K, and the advisor is charging you 1% (or more) it may seem like a wise choice to spend $1,000 per year for the expert’s help and management efforts. Bear in mind that your balance at the end of the year can be the same as or less than your balance at the beginning of the year even with the expert’s help. If it is approximately the same, you will continue to pay the $1K even though there was no advantage to the work being done (or not being done) on your behalf.

If your balance doubles every seven years, which is not an irrational expectation (with or without the expert’s help), your $100K can grow to more than $600K in thirty years. You will then be paying the advisor at least $6,000 per year to do essentially the same work they did in year number one. However, because most prudent investors are adding more money to their 401(k) and IRA accounts, it is not unreasonable for the average person to reach $1M in retirement assets. Now you would be paying $10,000 per year for the advice.

Look at this another way. If the average of thirty years of investment advice is $3,000 per year, you will have paid $90,000 for advice. What should cause you concern is that the work being done is not very different in year 30 to what it was in year one. Secondly, none of those dollars you paid work for you. They don’t earn any dividends, and they are no longer working to grow your portfolio balance. Therefore, the impact on the fees is greater than the total dollars you paid for the advice. It is not surprising to discover that you are paying $10K per year on your $600K investment portfolio.

Funds with Active Management

Sadly, it isn’t just the $90K loss. Advisors often select mutual funds that have high expense ratios. These funds are “actively managed.” If something is “active” it is better – or so goes the thinking. The reality is far from that. If your balance is $600K and your average expense ratio is more than 0.50%, you are paying an additional penalty to the fund managers. This is on top of the advisor’s fees.

Daniel Liberto says it well: “At this point, the enduring popularity of high-paid money managers is a mystery. People trust them to manage their money, paying them handsomely to beat the market. But they rarely do. After accounting for fees, money managers’ picks often underperform much cheaper funds that simply and passively invest in a benchmark index.” – Investopedia – How Money Managers Profit More From Your Investments Than You Do

Is there a punishment for bad advice? Mr. Liberto goes on to say this: ““In most industries, failure to consistently deliver objectives is punished. Active money managers, on the other hand, continue to get paid higher rates than those running passive funds, even though it’s been well documented that active managers don’t outperform passive funds.”

Fiduciary Means Safety, or does it?

Some expert advisor/brokers do all of the work for you and they try to make you think that this means their decisions are always in your best interest. This assumes they know what they are doing. They may be a fiduciary, which might seem like you are getting a better ROI because they have to make investment decisions that are best for you and not to feather their own nest. If, however, they think bonds are in your best interest, and you don’t understand the reality of bonds, you are not likely to see the growth and income you will need in retirement.

A fiduciary advisor is a financial professional who is legally and ethically required to act in your best interest. They must prioritize your needs above their own. This means they provide objective advice and must disclose any potential conflicts of interest. Someone can have the best of intentions and still deliver results that are no better than the S&P 500 index. Why pay for that?

One of the reasons for this is that most, if not all advisors, will add bonds and bond funds to your portfolio. Don’t be misled by this approach. It is another way to lose against inflation. Nevertheless, they would say they are doing this in your “best interest.”

Bucket Number Two: ETFs Without An Advisor

The second bucket is to select a few broad and/or focused low-cost exchange traded funds (ETFs) and ignore the market’s irrational behaviors. This might include a low-cost fund with a focus on the S&P 500, a mid-cap fund, a small-cap fund, and/or some additional funds with a dividend growth focus or an industry focus (like artificial intelligence). This is the best choice for 99% of the people I know. This is not what most advisors do for their clients. I have proof in the statements I have reviewed when people come to me for help.

The math makes this clear. If your account balance is $600K you won’t have to pay the $6K per year for professional management. Furthermore, your average expense ratio will drop below 0.10% for passively managed investments. That means you are paying less than $1K per year to have a diversified portfolio that will have the potential to give you inflation protection and income growth in retirement. If you look at ten-year total returns for my favorite ETFs, you will find that they often exceed the ten-year total returns of the S&P 500 – and of your advisor.

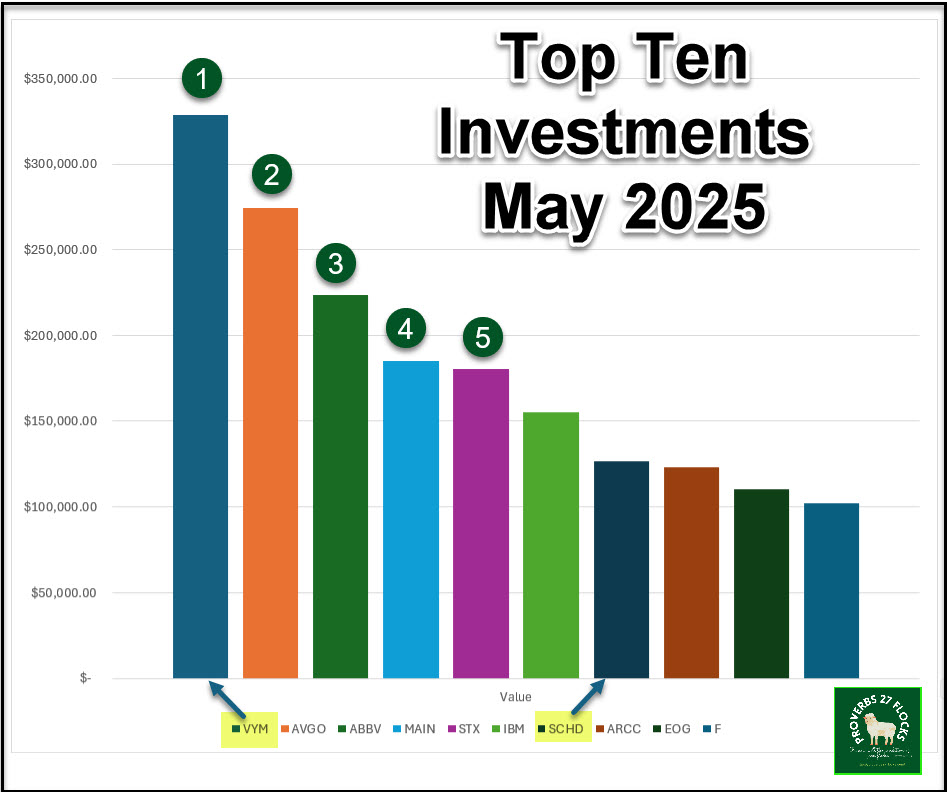

It isn’t hard to find low-cost diversification using ETFs like VYM, SCHD, and DGRO. Seeking Alpha is a wonderful way to find the best investments, including ETFs that can be compared using Seeking Alpha’s tools. VYM and SCHD are in our top ten investments.

Bucket Number Three: Diversification and Homework

The third bucket is to do a bit of homework and add in quality stocks, BDC’s and REITs that can maximize both future growth and income. Most professional advisors avoid BDCs and REITs for their clients. I don’t belong to that herd. There is nothing wrong with buying shares of a few select BDCs, REITs, and investments in specific companies with growing income, profits, and dividends. This creates a bit more risk, but it also offers more potential for returns.

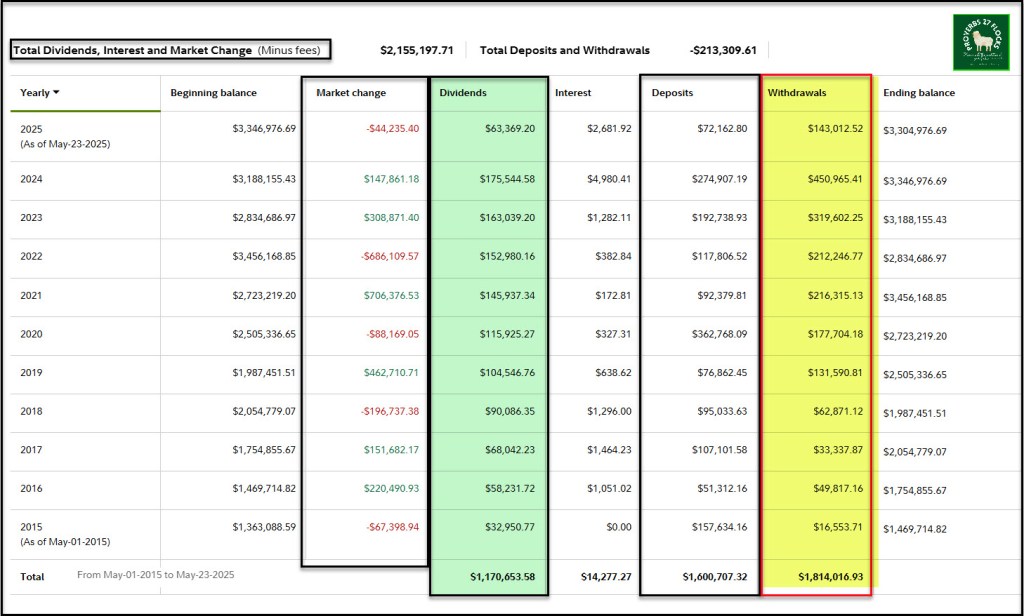

You can see this in my list of our top ten investments. VYM and SCHD are ETFs. VYM is our largest investment. However, we also own shares of AVGO, ABBV, MAIN, STX, IBM, ARCC, EOG and F in our top ten.

Bucket Number Four: Day Trading Technical Analysis

The final bucket is to spend a lot of time and energy diving into technical analysis, watching the momentum of individual investments, and buying/selling investments weekly or even daily. This is not a good use of time or effort. I’ve experimented with day-trading, and it provides mixed results. I find it more profitable to trade weekly covered call options.

Conclusion

Don’t be enticed by the suggestion that you need professional help with your retirement portfolio. The best buckets are buckets two and three. Neither of them requires the help of a professional. Bucket number one leaks, and bucket number four might tip over and you won’t like that.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.