How Do I Evaluate an ETF?

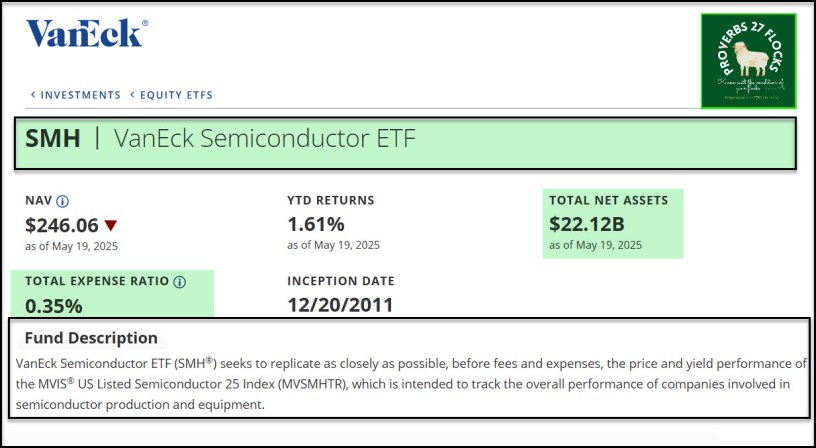

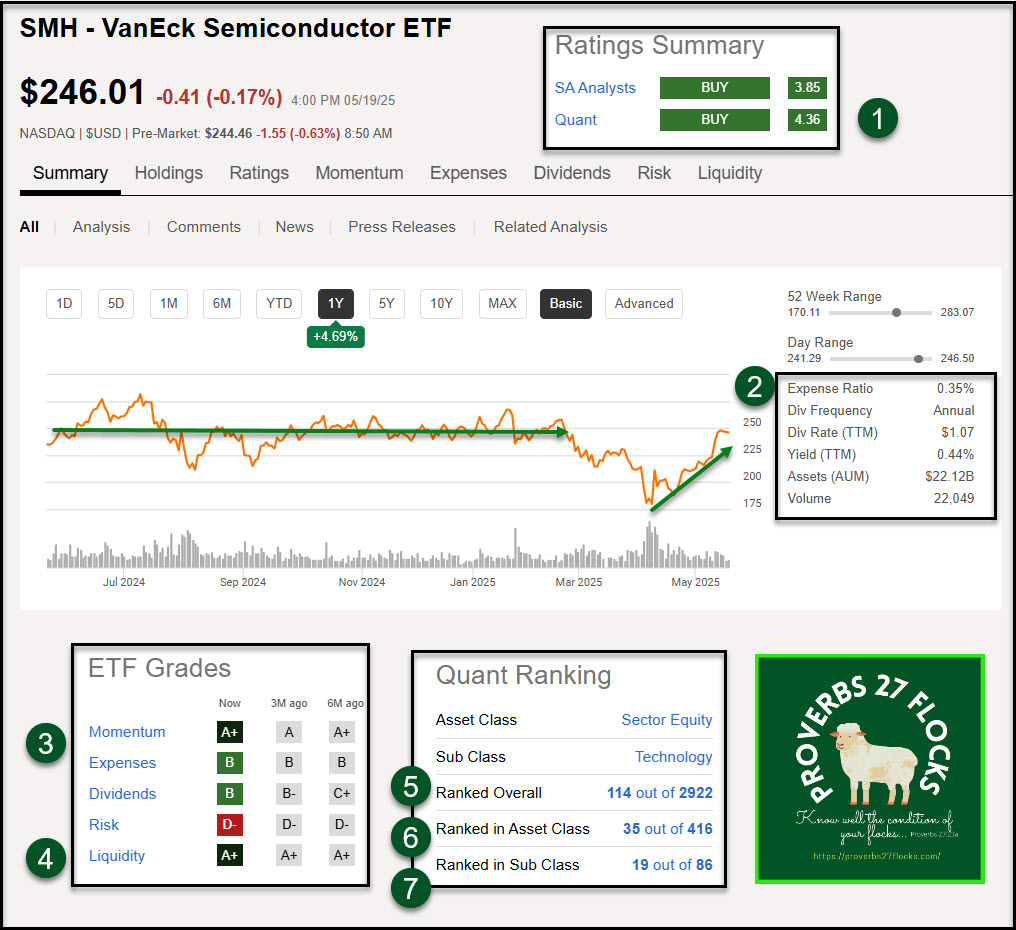

A friend (Paul) asked me what I thought of SMH (VanEck Semiconductor ETF). He said, “I wondered what your thoughts were on the VanEck Semiconductor ETF (SMH). Have you looked at it previously? Given the big AI push, I believe having some semiconductor investments would be good. I hadn’t heard of this one before.”

In general, I prefer focused ETFs as opposed to broad ETFs and funds like those that mirror the S&P 500. That is why I like VYM, SCHD, and DGRO. I also like ETFs that have a focus on an industry that has great upside potential. I believe the companies that provide products and tools for artificial intelligence (AI) are great candidates for growth. They can also be fuel for covered call options trades. My short answer is that I really like SMH.

My longer answer to Paul included the following comments:

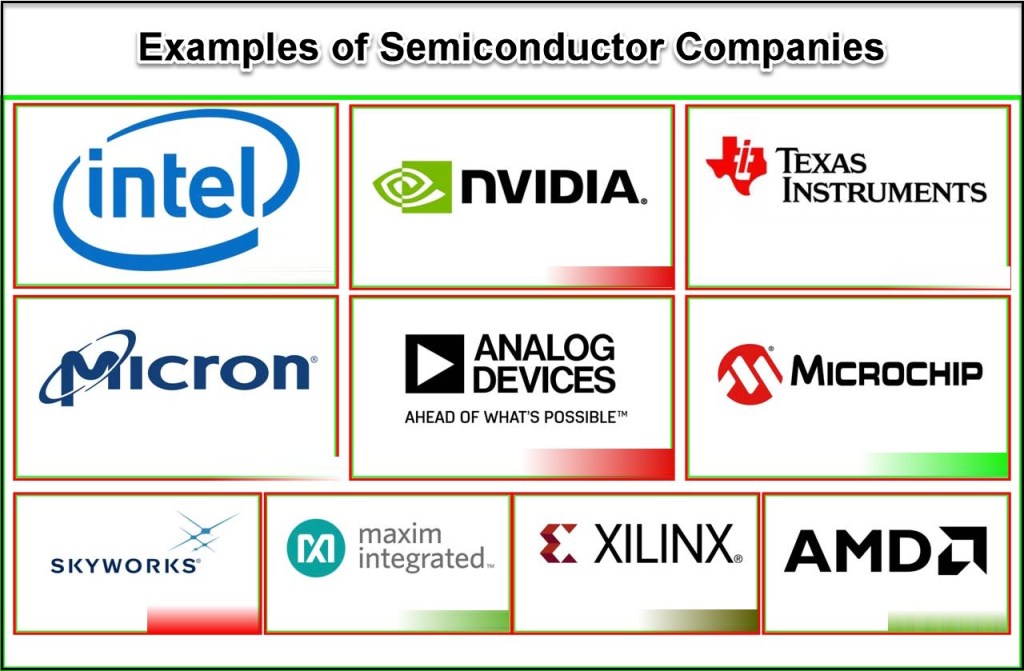

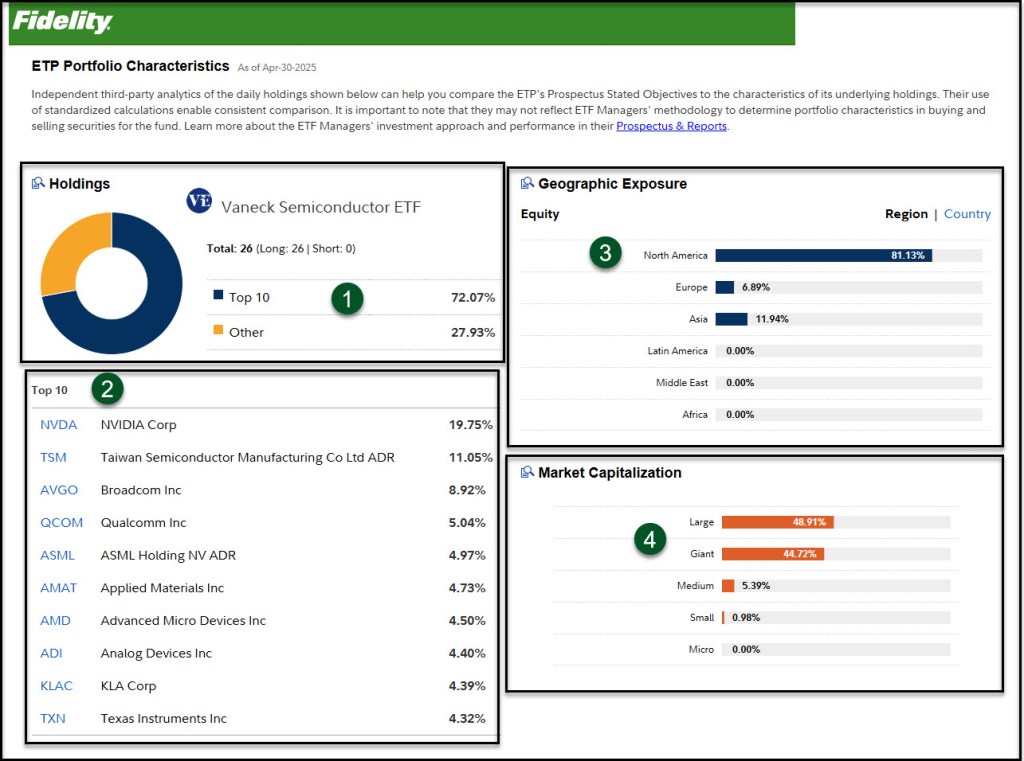

Interesting ETF with a nice mix of Semiconductor companies. We own shares of the top three (NVDA, TSM, AVGO), which is a huge chunk of the total. AVGO is one of my top ten holdings.

If I were going to sell my shares of the top three I would be tempted by this ETF. Having said that, I like the odds of owning the top three over SMH and I can trade covered call options on my individual stocks.

During the time I have owned AVGO shares I have received $45,736 in extra income selling covered calls on my shares. I started doing that in 2021. 2025 YTD I already received $5,405 in additional income trading covered call options on AVGO. I have options income from NVDA and TSM as well. My YTD covered call income on TSM is $2,658.

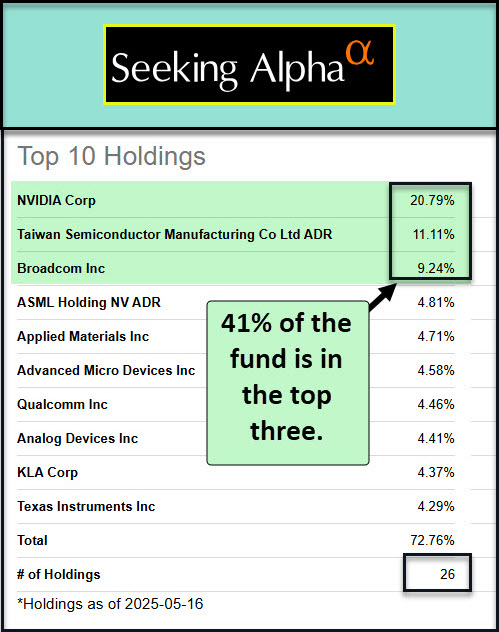

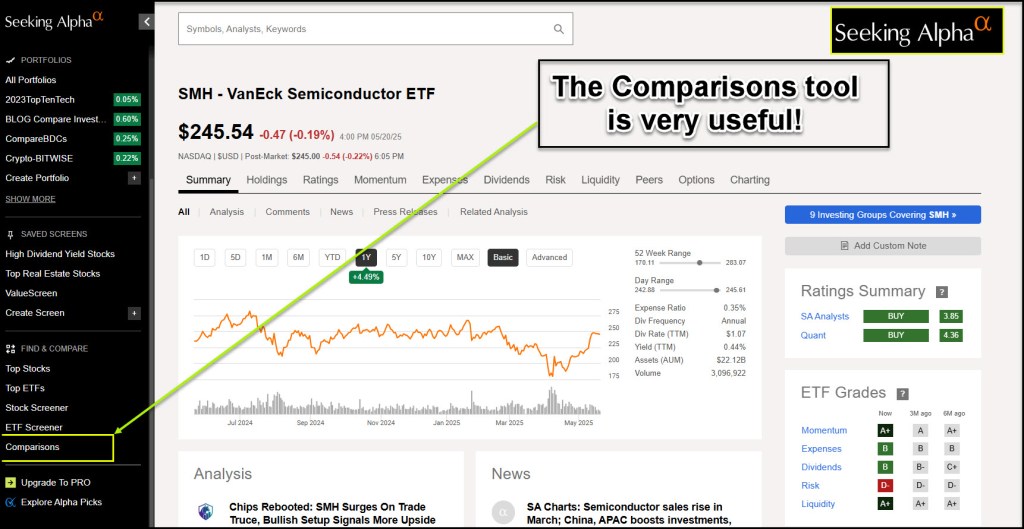

Seeking Alpha’s Comparison Tool

One great advantage of the Seeking Alpha website is their comparison tool. I used this tool to create the following spreadsheet image. After entering the ten ticker symbols of SMH’s largest holdings I was able to save the results to an Excel spreadsheet. That way it is easy to look at how each holding within SMH compares. The second image shows where you can find the comparison tool.

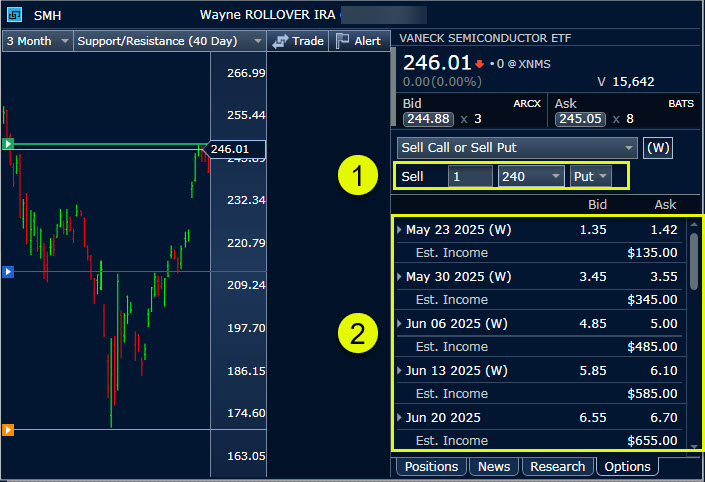

SMH and Covered Call Options or Cash Covered Put Options

If an investor wants to dip their toes in the water of options trading, there are ETFs that work well for this. Granted the price of 100 shares of SMH is currently $24,554, so for some that is a huge investment. While it is generally wise to hold most stocks at 5% or less of your total portfolio, it is perfectly reasonable to buy ETFs and have them be more than 5% of your total portfolio. That is due to the fact that they contain diversification. SMH is a diversified ETF with a focus in the semiconductor industry. Therefore, I think anyone with a portfolio of $250K or more can afford to have 100 shares of SMH.

Another plus SMH for options traders: It is possible to trade weekly covered call options and cash covered put options on SMH, so that is a rare plus for most ETFs I have seen. Of course you need 100 shares to trade one cc option. Here are some images from Fidelity’s Active Trader Pro. If I ever sell some of my AVGO shares, I will probably replace them with SMH shares.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.