Good News for Monthly Income

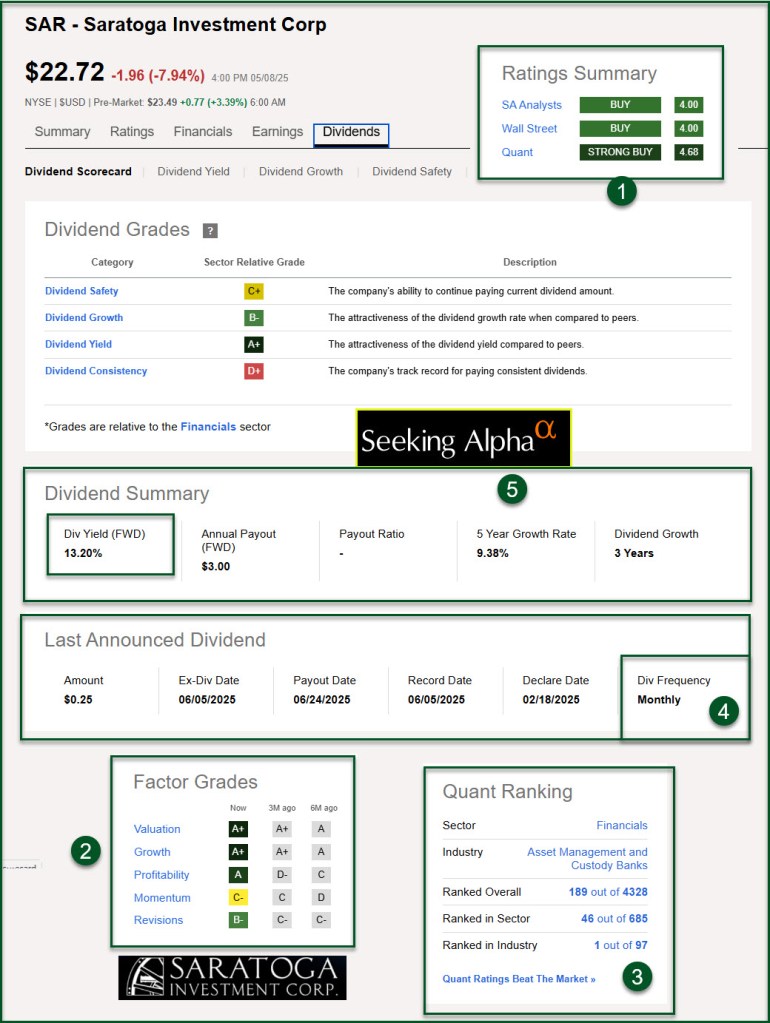

Saratoga is a BDC in the financial sector. The specific industry is Asset Management and Custody Banks. I tend to like financials investments (along with technology and healthcare.)

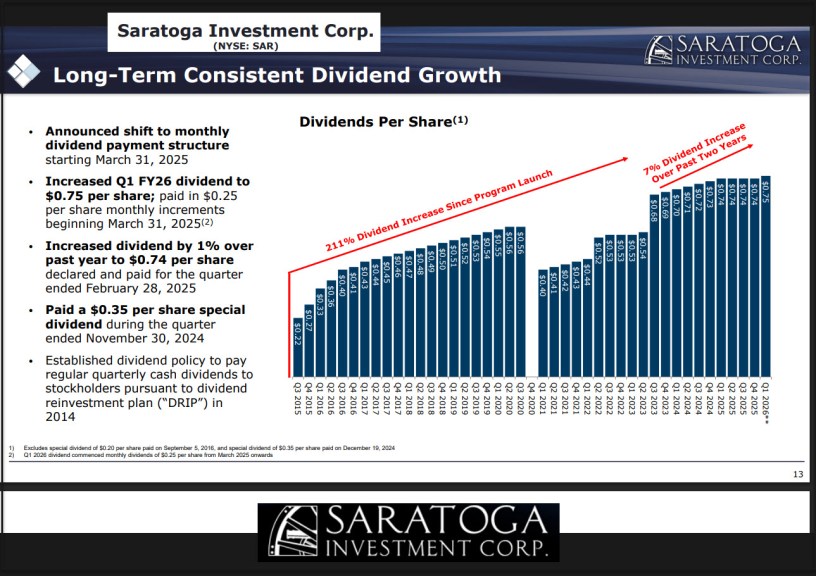

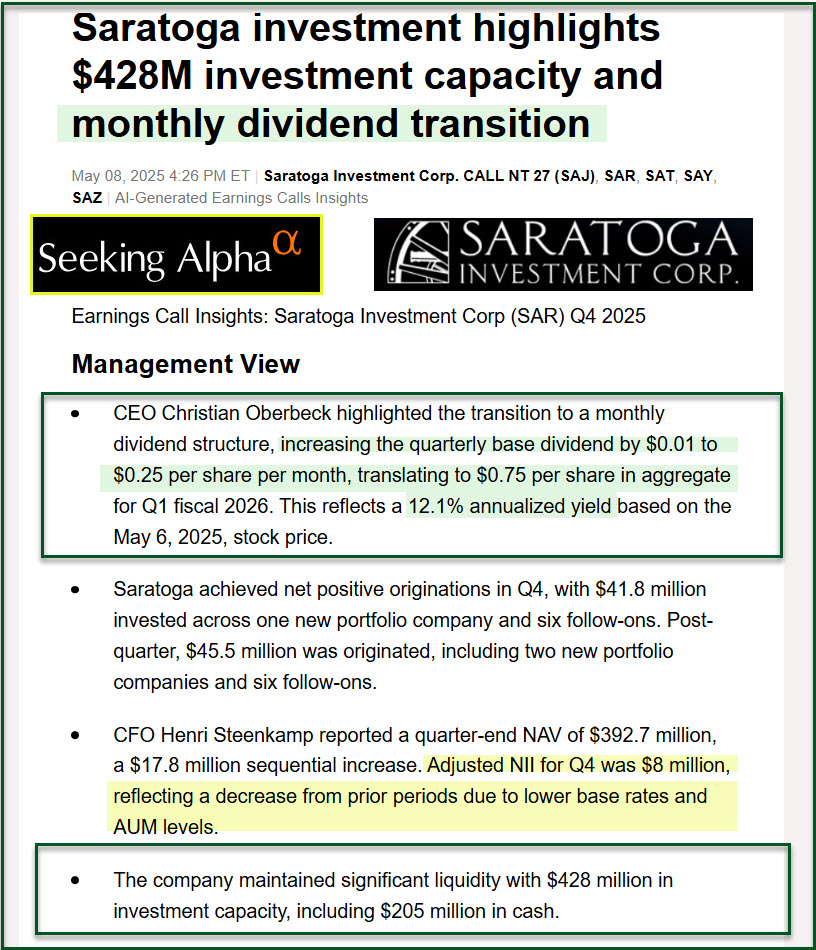

“CEO Christian Oberbeck highlighted the transition to a monthly dividend structure, increasing the quarterly base dividend by $0.01 to $0.25 per share per month, translating to $0.75 per share in aggregate for Q1 fiscal 2026. This reflects a 12.1% annualized yield based on the May 6, 2025, stock price.” – Seeking Alpha

Look at Dividends and 10-Year Total Returns

Stock price returns are a nice thing, but you cannot spend price returns for groceries or utilities. However, if the total returns of an investment are dividends and price returns, then you can spend the dividend portion. That is certainly the case with SAR. Saratoga Investment Corp.

Look At the Numbers

SAR has earnings. The forward earnings per share (EPS) is $3.07. Most of that gets put in the pockets of investors. Because the dividend is $0.25 per month, we get $3.00 of every $3.07 SAR receives in earnings. Furthermore, the PE (FWD) is a great 7.39.

The dividend yield will make some investors run and hide, because a high dividend yield is a sign of increased risk for many investments. For SAR the FWD yield is 13.20%. Most of our investments have a yield below four percent.

Not too many investors want to bet against SAR’s share price. The current short interest is low at 1.26%. However, SAR has additional risk because it is a very small BDC with a market cap of $325.95M

Company Profile

Saratoga Investment Corp. is a business development company specializing in leveraged and management buyouts, acquisition financings, growth financings, recapitalization, debt refinancing, and transitional financing transactions at the lower end of middle market companies. It structures its investments as debt and equity by investing through first and second lien loans, mezzanine debt, co-investments, select high yield bonds, senior secured bonds, unsecured bonds, and preferred and common equity. The firm prefers to invest in aerospace, automotive aftermarket and services, business products and services, consumer products and services, education, environmental services, industrial services, financial services, food and beverage, healthcare products and services, logistics, distribution, manufacturing, restaurants services, food services, software services, technology services, specialty chemical, media and telecommunications. It seeks to invest in the United States. The firm primarily invests $5 million to $75 million in companies having EBITDA of $2 million or greater and revenues of $5 million to $250 million. The firm prefer to take a majority stake. It invests through direct lending as well as participation in loan syndicates. The firm was formerly known as GSC Investment Corp. Saratoga Investment Corp. was formed on 2007 and is based in New York, New York with an additional office in Florham Park, New Jersey.

Recommendation

If you don’t own shares of SAR, then you might want to take a nibble. However, don’t make SAR more than one percent of your total portfolio of investments. Our total investment at present is 1.1% of our total Fidelity portfolio. The shares are held in three different accounts. When I get my RMD for 2025 complete I may move some of my traditional IRA SAR shares to my ROTH IRA. That will make the dividends tax-free, making them even more valuable for buying groceries or paying PureTalk for our cell phone service.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.