Are You Catching Cash?

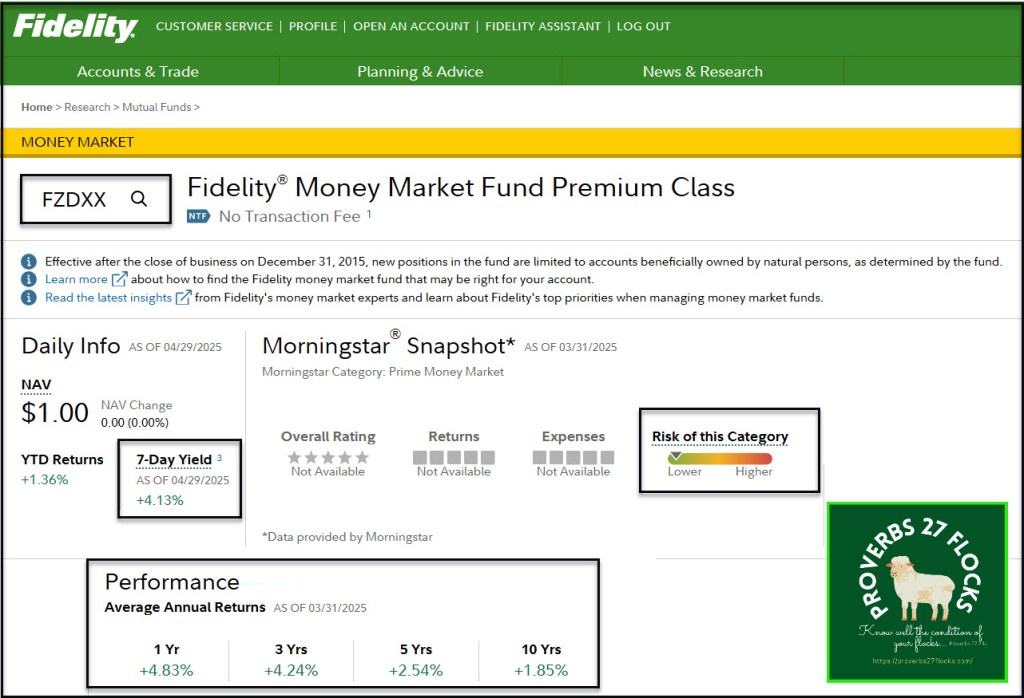

At least two of my readers have had questions about my cash holdings in the last month. One was: “In your recent post, you mentioned you park your RMD money in SPAXX. The question is why not FDRXX (core MM) or even FZDXX? . Both pay a higher interest rate compared to SPAXX. Just curious!”

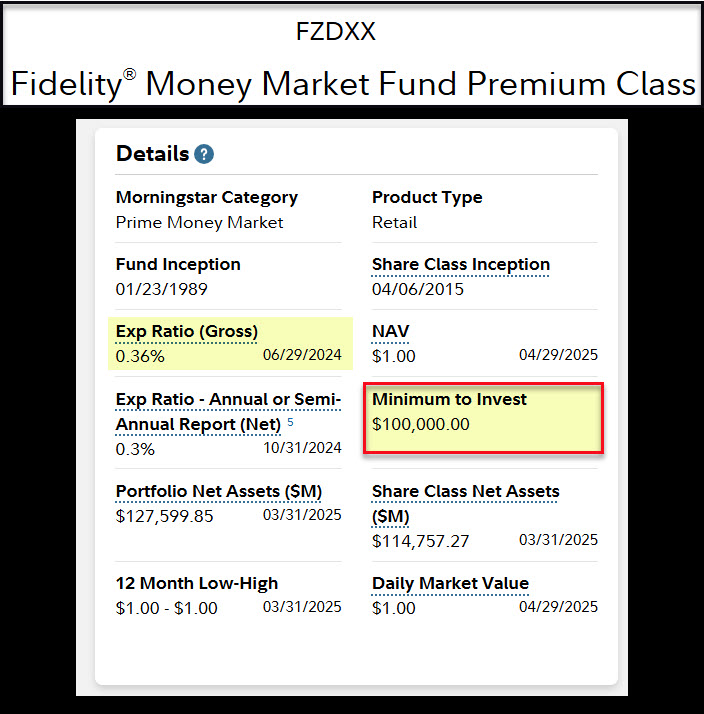

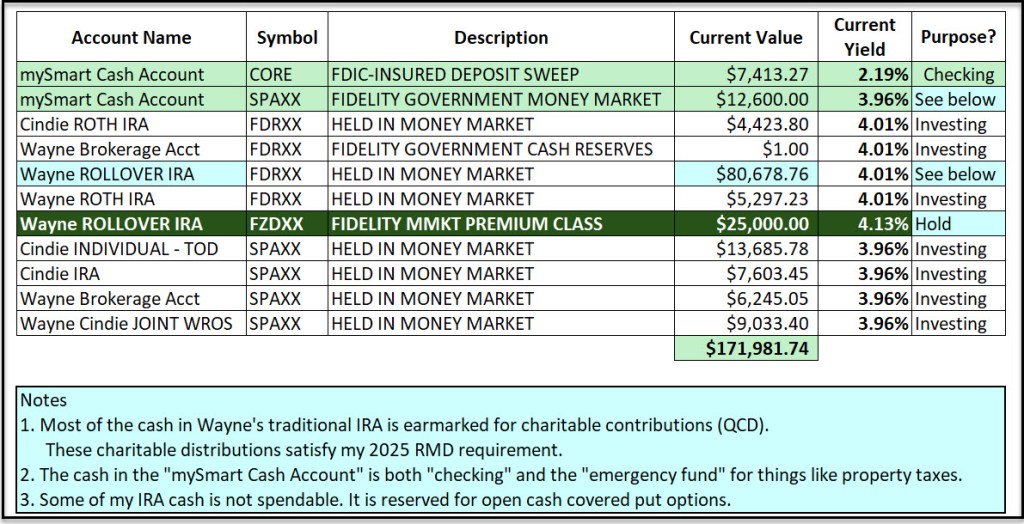

One of the reasons I was not using FZDXX (Fidelity Money Market Fund Other) is that each time I checked the “Minimum to Invest” was $100,000. Lately the cash balance in my traditional IRA has been greater than $100K, but some of those dollars are earmarked for cash covered put options. The cash has to be there to cover those options.

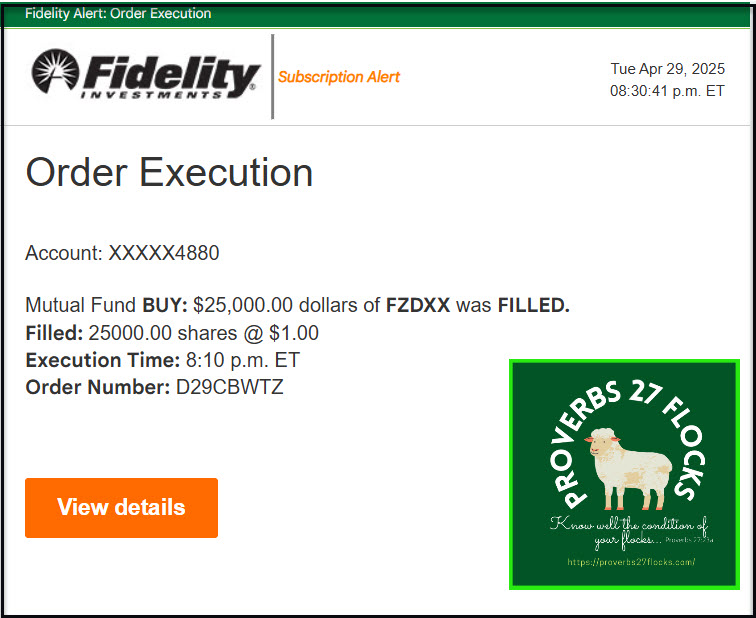

However, one reader said that I might be able to buy shares of FZDXX because of the total dollars of cash in our accounts. When I checked, I discovered that the “Minimum to Invest” in my traditional IRA was $10,000. Therefore, I took some of the pending cash ($25,000) and bought shares of FZDXX.

Current Cash Holdings

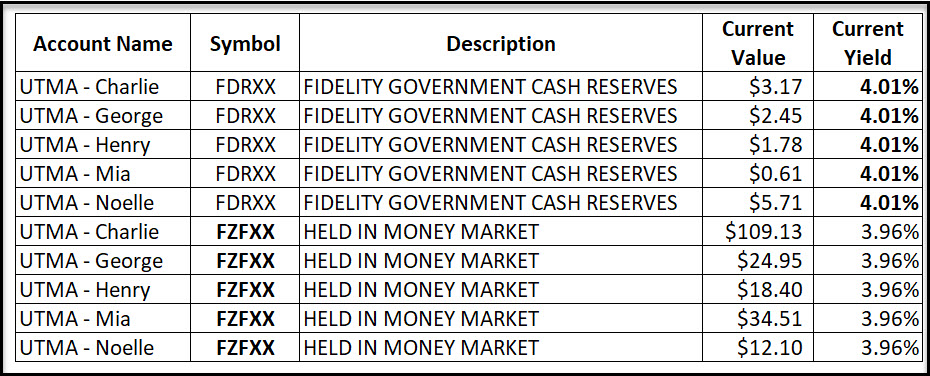

Here are our current cash holdings by account. The second image shows how I manage the cash in our grandchildren’s UTMA accounts. One of the things I have noticed when I help friends and readers is that they tend to keep their money in a bank’s checking account that pays them zero percent interest. I like the Fidelity Cash Account as a far better solution. Our bank was paying us 0%, but by careful cash management we are now getting far more at Fidelity. Fidelity also provides free checks and will even print the checks and mail them for us. We don’t have to pay the postage.

As interest rates rose, it should have become obvious to most thoughtful people that keeping savings in a traditional bank is loaning money with no return. If your bank is offering you less than 4% interest on your savings, then you might want to move your savings to a different bank or to a place like Fidelity Investments.

Fidelity® Cash Management Account (FCMA)

The FCMA is a one-size fits all solution for cash, direct deposit of your pay or Social Security income, bill payment, ATM access, CDs, paying income taxes, and check writing.

The FCMA features that help you spend and save include “No account fees or minimums”, digital wallet compatible, mobile check deposit, a secure debit card, ATM fees reimbursed globally, FDIC insurance on cash balances and competitive rates. Remember, your current checking account is probably paying you nothing. I have tried just about every feature including mobile check deposits, ATM withdrawals, check writing using checks connected to the account, and checks mailed to payees at no additional cost or postage. Much of the cash is FDIC insured, but some is set aside in a money market fund to gain more interest.

Why Keep Cash?

We all keep cash for various reasons. It is prudent to have an emergency fund and cash availability is great for paying bills or for gift-giving. Some want to build up cash to make a down payment on a home and others want to be able to pay cash for their next vehicle or home improvement. The FCMA can assist you in saving and pay you while you gather the dollars you need for each goal you want to achieve.

What is the Core Position at Fidelity?

Every account you open has a position called the “core.” This is where the money lands when you deposit a check, have your pay or Social Security direct deposited, or receive interest or dividends. The default choice is called “CORE**” and has the name “FDIC-INSURED DEPOSIT SWEEP.” The ** says the core contains the amount of uninvested cash which can be used for processing transactions. In other words, you can use this cash for anything at any time. You can buy CDs with the cash or buy shares of whatever you like.

Are there other choices without FDIC Insurance?

I’m glad you asked. There are four good potential money market mutual funds that might make sense for your extra cash. They are SPAXX, FDRXX, FZDXX, and FZFXX. Each of these is similar, but FDRXX might be the best choice at the present time. FZDXX makes sense if, like me, you have a bigger pile of cash. However, you can also purchase CD’s that have no expenses or costs, and that can give you more than 4% interest.

Recommendation

Take a look at your bank or credit union statement. Do you like what you receive in interest? Are the CDs that your provider offers available in 1-month, 2-month, and 3-month durations paying at least 4%? Will they let you buy CD ladders using their website? If not, then you may want to consider taking the time to move to a better solution. Yes, I know there is some work involved, but your money should be working as hard as you do.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

Seeking Alpha has a Spring Sale Their “Limited-Time Offer” is a Premium subscription for $269. This comes with a 7-day free trial and a “Next Alpha Pick” for free. The sale runs from April 27th to May 11th (End-of-Day – Eastern Time).

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.