What Does It Look Like?

In reality, true investing is not really gambling. There is one word that better describes the lack of rational thinking when it comes to putting your dollars to work: Speculation. Speculation is reasoning based on inconclusive evidence; conjecture or supposition. “An investor who purchases a speculative investment is likely focused on price fluctuations. While the risk associated with the investment is high, the investor is typically more concerned about generating a profit based on market value changes for that investment than on long-term investing.” – Investopedia

Five Warning Flags

There are probably dozens of examples of gambling with your investments. The first is buying a stock with a share price lower than $5 dollars. That isn’t to say every investment that costs less than $5 is a gamble, but the reality is that lower share prices should cause you to ask, “Why isn’t this costing me more?” If you go into a clothing store and one shirt is $5 and another is $40, there is a good reason one is being sold for less.

The second is related to dividends. If the dividend yield is greater than five percent, pause and think carefully. Cindie and I own shares of many investments with a dividend yield greater than five percent, but I won’t buy just any investment that has a high yield. One investment we own is Ford (F). Cindie and I own 9,830 shares of Ford and the dividend yield is currently almost six percent. By way of comparison, shares of AGNC (AGNC Investment Corp) have a dividend yield of almost sixteen percent. I don’t own shares of that company. Ford, I believe, as a far better future and it is a company that makes the vehicles we drive. They are solid and very reliable vehicles.

The third potential evidence of gambling is buying an investment with a dividend payout ratio greater than 80%. It is far better to have payout ratios in the 20-60% range (there are exceptions). You should seek investments based on sustainable earnings and dividend growth. If the payout ratio is too high, there is some risk of a dividend cut in the future. That is something wise investors want to avoid.

Another way to be a gambler is to buy on the “hot tip” from the internet, a coworker, a relative, or a friend. I have investigated many of these over the years when someone asks me about a particular investment someone says they should buy. Rarely do I think of the investment as an investment. It is usually speculative. Here is one way to think about hot tips: I want to make a lot of money in a very short timeframe. That is the thinking of a gambler.

The fifth is really just a simple failure to understand mathematics. If you don’t understand percentages or ratios and what they mean, then you are likely to buy things without understanding the true value of an investment. For example, Tesla (TSLA) shares have a P/E ratio of 148.96. AMZN (by way of comparison) has a P/E ratio of 30.12. Pause for a moment and ask a question: Which business has a larger customer base? Which one has greater risks? TSLA’s share price has fallen from $479 to $286. Amazon’s share price has fallen as well, but nowhere near the fall of Tesla. There are several reasons for this, but one of them has to do with gambling on the future of TSLA.

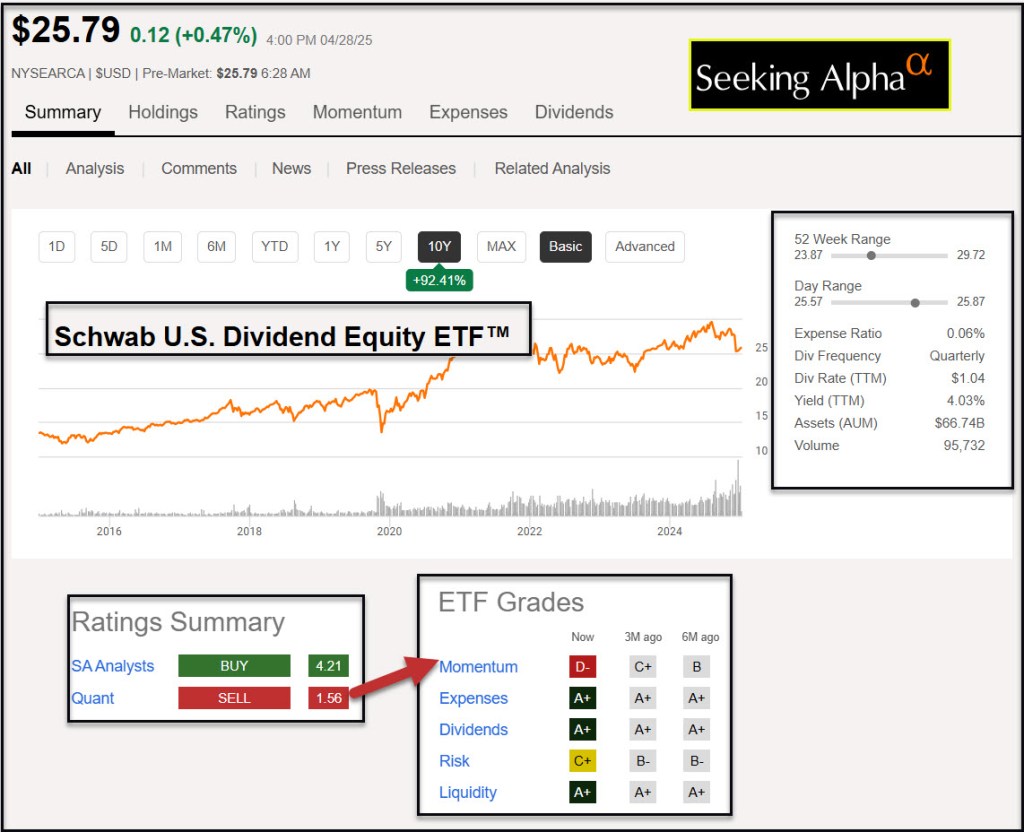

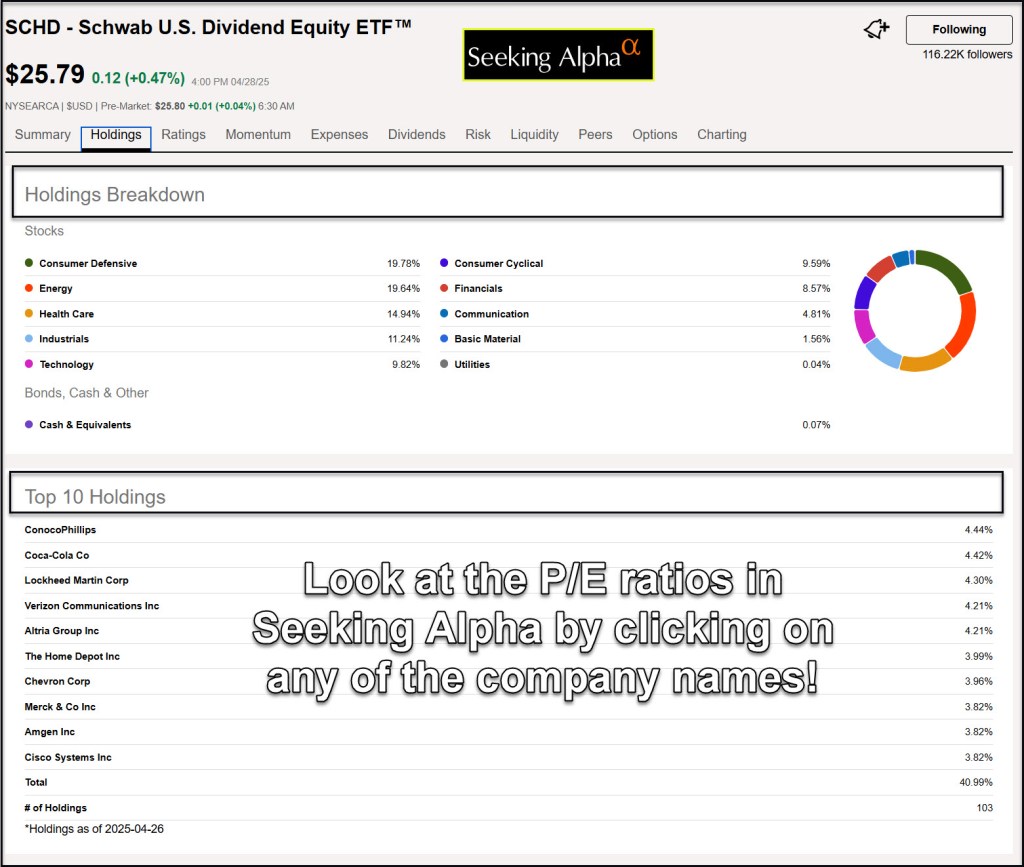

If you were to look at the P/E ratios of the top ten investments in ETF SCHD, you would see they are much lower than both of those values.

What I Bought Recently: AMZN and SCHD

On April 23, 2025 I purchased 100 shares of AMZN. I paid $183 per share. I then sold a covered call option (-AMZN250502C210) to sell those shares for $210 if the share price hits that price by this Friday – 25/05/02. This could happen. Amazon will be announcing earnings on Thursday. I made $51.32 in options income. The good news is that I don’t think my shares will be called, and I can do another covered call contract next week.

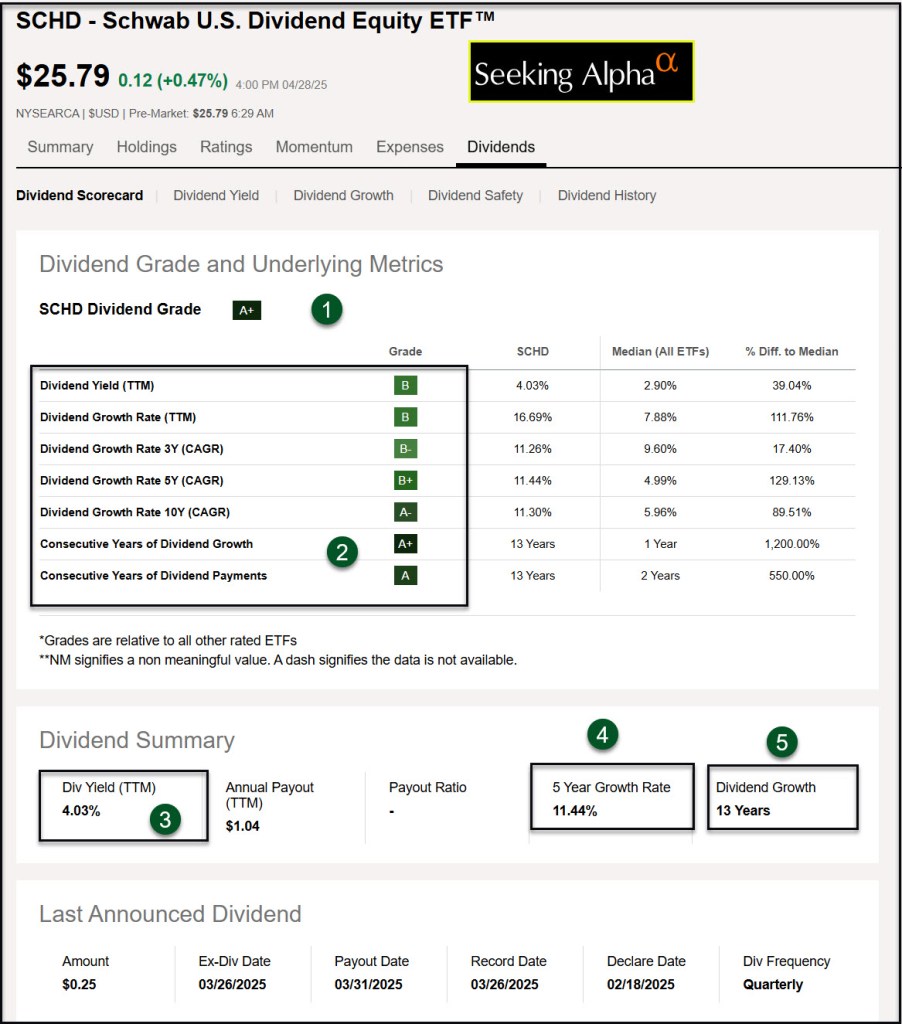

I also bought another 200 shares of SCHD yesterday. This brings our total SCHD holdings to 4,800 shares. Our grandchildren also own shares of SCHD in their UTMA accounts. I like SCHD because it has a history of paying a growing dividend. The 5 Year Growth Rate is 11.44% according to Seeking Alpha.

Is Covered Call Options Trading a Gamble or Speculative?

The answer depends on what types of options you trade. I would argue that there is very little gambling involved with my covered call option trade for my AMZN shares. The only real risks are that my shares will be called away at $210 and I will make a nice profit. I guess there is one other risk: if the share prices fall below $183 and stay there for the next five years, then it was a bad investment.

Don’t Overlook the One Sure-Fire Investment

Matthew 6:19-21 says this: “Do not lay up for yourselves treasures on earth, where moth and rust destroy and where thieves break in and steal, but lay up for yourselves treasures in heaven, where neither moth nor rust destroys and where thieves do not break in and steal. For where your treasure is, there your heart will be also.”

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

Seeking Alpha has a Spring Sale Their “Limited-Time Offer” is a Premium subscription for $269. This comes with a 7-day free trial and a “Next Alpha Pick” for free. The sale runs from April 27th to May 11th (End-of-Day – Eastern Time).

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

All scripture passages are from the English Standard Version except as otherwise noted.