How to Achieve Success

What creates success when it comes to investing? There are several factors, but one of them has to do with a strategy. My strategy is to have easy income that grows year-after-year with profitable companies and diversified dividend growth ETFs. My strategy keeps costs low and focuses on the best sectors like the financials, healthcare, technology, and real estate. My strategy also includes trading covered call options, but that is an optional part of my strategy and it is not necessary for investment success. Finally, success comes when you use the right tools and know how to use those tools.

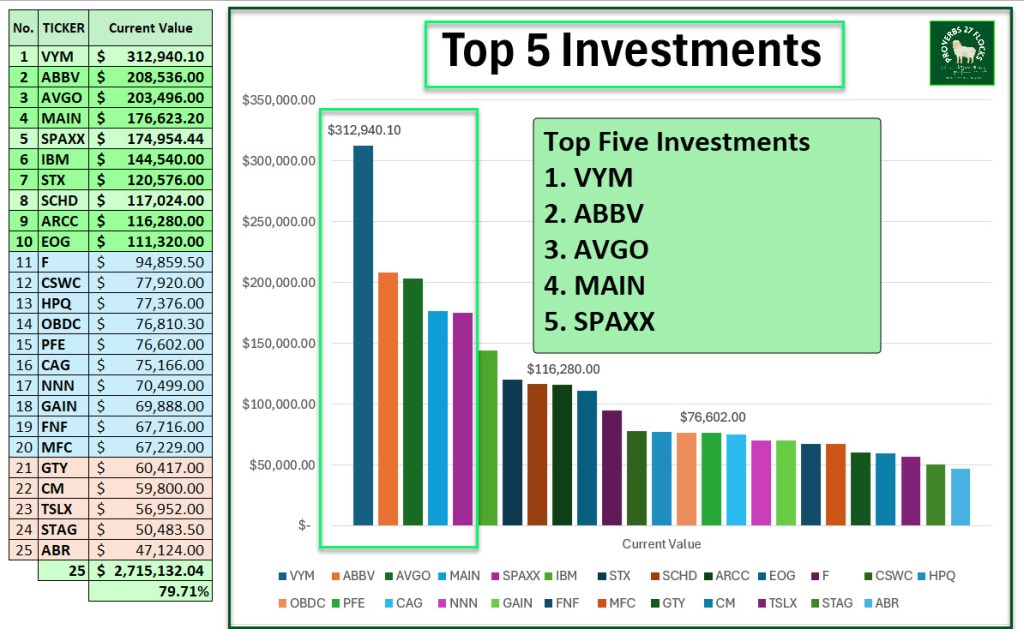

Top 5 Investments

VYM, ABBV, AVGO, MAIN, and SPAXX.

Our number one investment is VYM. The reason for this is simple. VYM holds 592 investments and VYM provides a decent dividend yield with dividend growth. It should not surprise you that I own shares of some of the companies in VYM’s top ten, including Broadcom, Johnson & Johnson, Abbvie Inc, and Coca Cola. In fact, in our top five investments, ABBV and AVGO are in VYM’s top ten.

- MAIN is a BDC that pays a monthly dividend, and MAIN has a yield of 7.92%. That is very high, and it is high because many investors perceive MAIN to have high risk. I disagree.

- SPAXX (Fidelity Government Money Market Fund) is the holding fund for cash I want to have available for RMDs, QCDs, and other investment purposes.

- You should also note that my top five are diversified. VYM is by itself diversified, ABBV is in the Healthcare sector, AVGO is technology, and MAIN is a Financial stock.

- I like ABBV and AVGO for options trading.

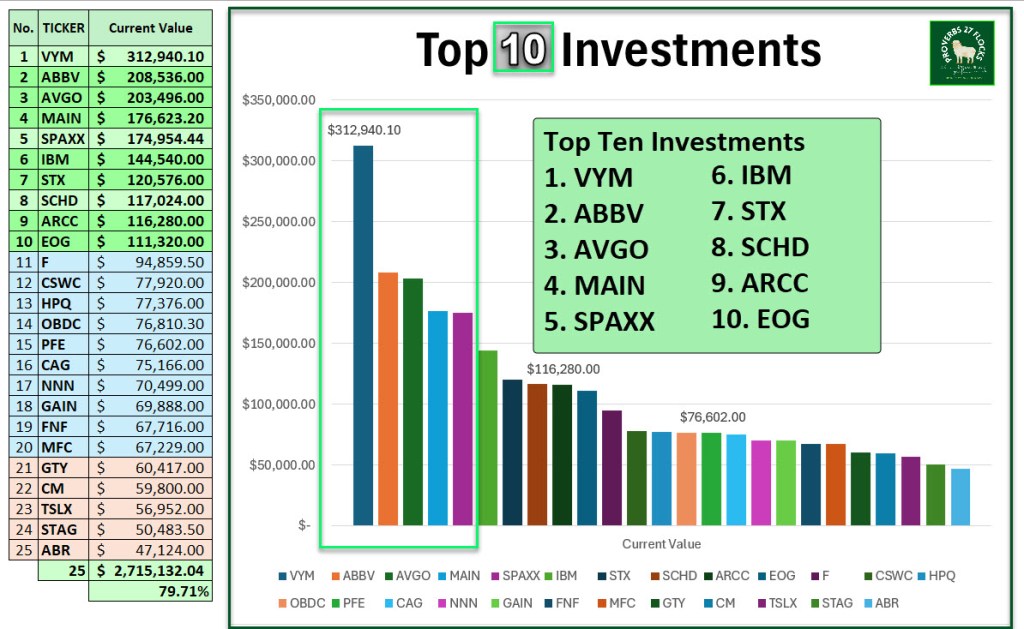

Top 10 Investments

VYM, ABBV, AVGO, MAIN, SPAXX, IBM, STX, SCHD, ARCC, and EOG.

The next five to round out the top ten are IBM, STX, SCHD, ARCC, and EOG. I want to grow our SCHD holdings, so I don’t have any plans to increase our allocation to VYM shares. IBM and STX are in the Technology sector, ARCC is another solid BDC that yields 9.41%, and EOG is EOG Resources, or an energy company in the Oil and Gas Exploration and Production industry.

- The reason I like ETF SCHD is that it is focused with 103 holdings and it has a commendable dividend growth history. The 5 Year Growth Rate is an amazing 11.44% and SCHD has had Dividend Growth for 13 Years and currently yields 4.09%.

- SCHD has the following holdings in their top ten: Coca-Cola Co (4.58%), Verizon Communications Inc (4.42%), ConocoPhillips (4.35%), Altria Group Inc (4.27%), Lockheed Martin Corp (4.22%), PepsiCo Inc (4.06%), The Home Depot Inc (3.96%), Chevron Corp (3.91%), Amgen Inc (3.82%), and Cisco Systems Inc (3.75%).

- I like IBM, STX, and EOG for options trading.

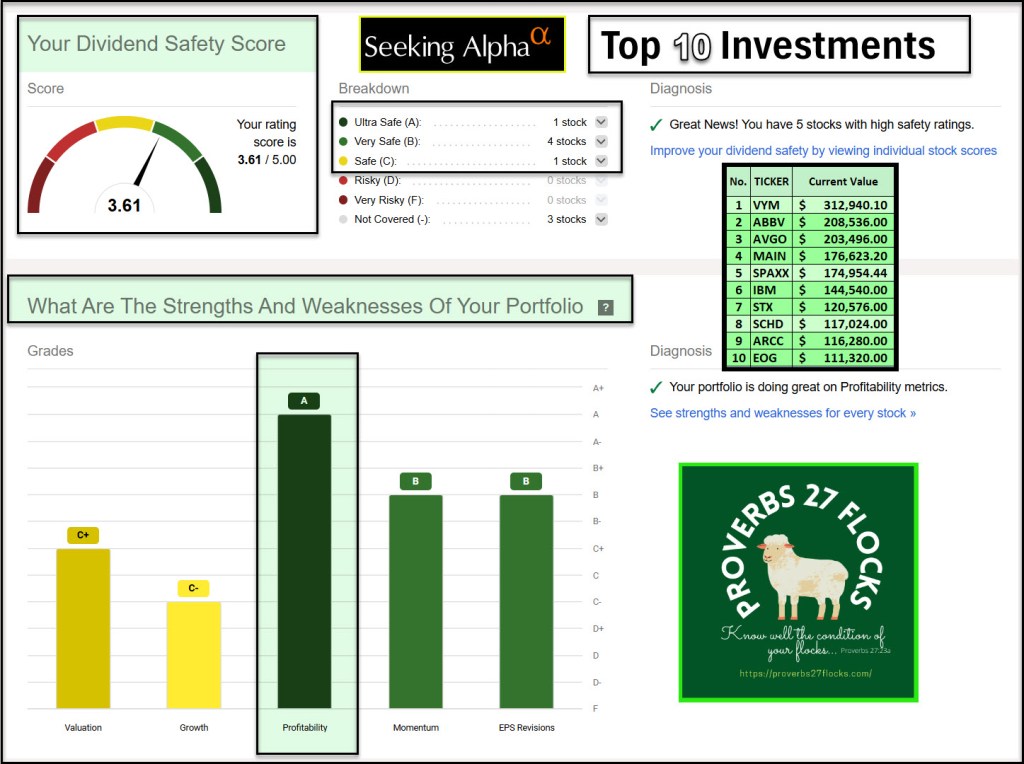

- Using Seeking Alpha’s portfolio tool, I can quickly create my own “portfolio” by adding the ten ticker symbols to a portfolio I called “TOP TEN April 2025.” That resulted in the following analysis about the “Dividend Safety Score” for our top holdings. I want to have “safe” dividends whenever possible. This has worked for me during bear markets and during the Covid-19 turbulence.

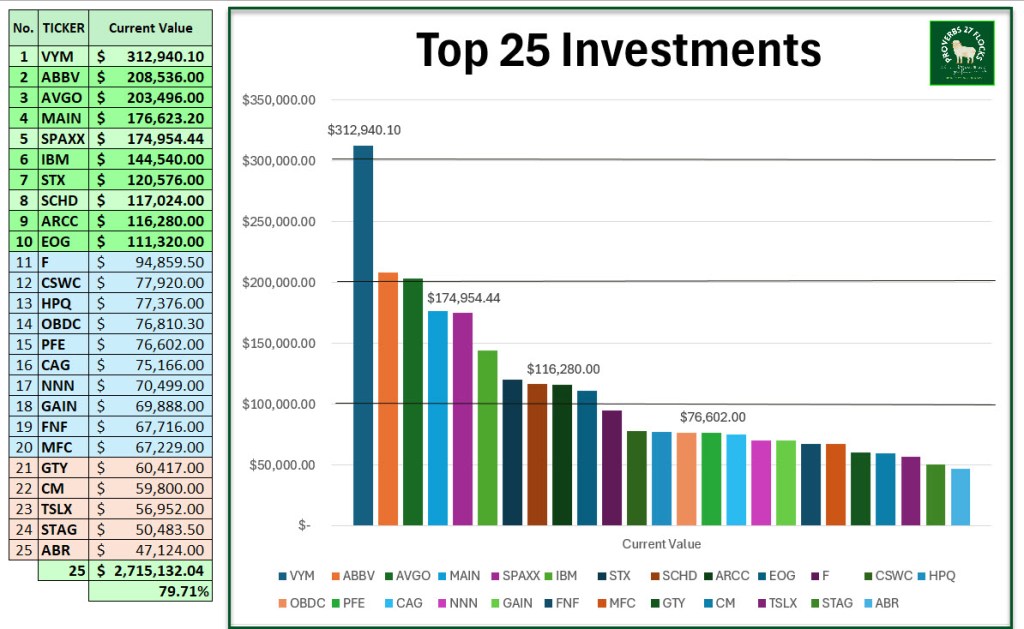

Top 25 Investments

Our top twenty-five investments include Ford, additional BDC and REIT investments, Pfizer, Conagra Brands, various financials like Canadian bank CM (Canadian Imperial Bank of Commerce) and even some of questionable value like ABR. I mention this because I don’t want you to rush out and buy my top 25.

- Understand the risks. ABR has no QUANT rating and is speculative.

- The Top 25 are: VYM, ABBV, AVGO, MAIN, SPAXX, IBM, STX, SCHD, ARCC, EOG, F, CSWC, HPQ, OBDC, PFE, CAG, NNN, GAIN, FNF, MFC, GTY, CM, TSLX, STAG, and ABR.

- The total investment in current value for the top 25 is $2.7M, which is almost 80% of our total investment dollars.

- We hold a total of 66 positions (with many duplicates) in our eight Fidelity accounts. For example, we own shares of ABBV, MAIN, GTY, CSWC, DGRO, CAG, Ford and Pfizer in several accounts. In other words, you do not see 41 of our unique holdings. They would include stocks and ETFs like BMY, GSL, MSFT, GEN, RIO, SAR, SMCI, DTD, MRK, BCSF, DGRO, CGBD, ADC, DRI, UAL, JNJ, MPW, TSM, UTF, FSLR, PYPL, PR, SWKS, and HRZN.

Seeking Alpha Tools and the Health of your Portfolio

Seeking Alpha is not just a good tool for analyzing and finding investments. It is a good way for you to check up on the health of your investment portfolio.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.