The Costs of Investing Can Be High

Yesterday I went to the Fidelity Investments (Middleton Wisconsin) office with a friend. She is moving her investment accounts from one high-cost broker to Fidelity Investments. I estimate that she is giving her “advisor” about $6,000 per year to “manage” her investments. I think he spends about, and probably not more than, two hours per year helping her. In other words, he is getting a very nice income for very little work.

Fidelity would like to do something similar. During our meeting it became clear that the advisor did not want to talk about management fees. However, when I pressed him on the topic, he started to share the true costs of his hands-on services. While he and I agree on many things, including the topic of annuities (a bad idea for most people), there are clearly some things where we are not in agreement. I will be advising my friend to avoid the high-fee solutions being offered.

There is a better way. An annual subscription to Seeking Alpha gives investors a wealth of information at a cost of less than $300 per year.

Three Things That Don’t Change

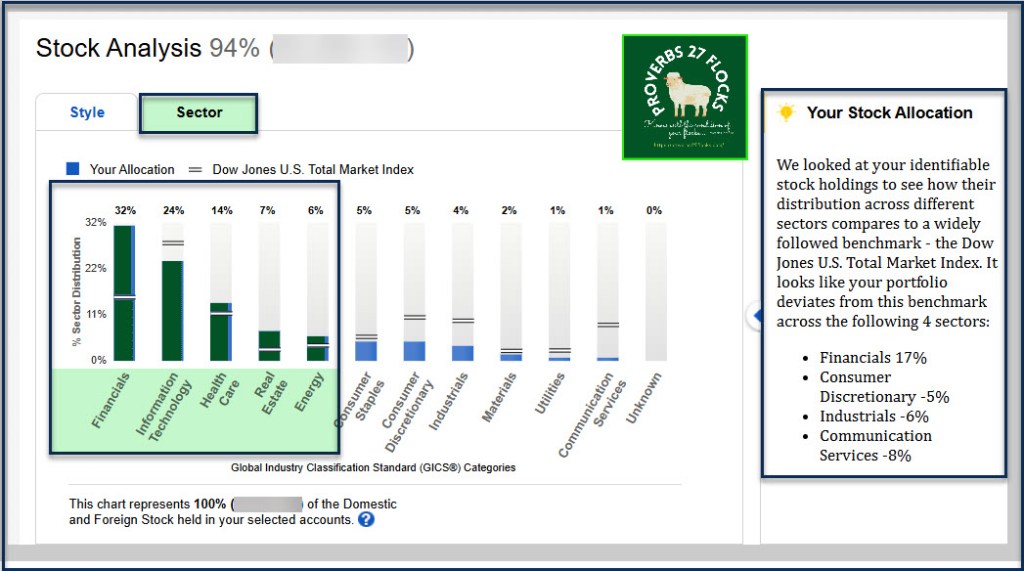

During the market turbulence of April, there are three things that did not change. The first is our asset allocation. We are still focused on dividend-producing stocks and ETFs. The second is our sector allocations. Regardless of the market’s volatility, I still see careful investments in the financial, information technology, healthcare, real estate, and energy sectors as the way to go. When I say “financial” I include BDCs, insurance companies and banks. When I say “Real Estate” I am talking about REITs that are in our traditional and ROTH IRA accounts.

The third thing that doesn’t change is my overall focus on value investments with a preference to diversify in large-cap, mid-cap, and small-cap value stocks. Diversification by sector and market cap is always a wise approach.

Optional Options Income

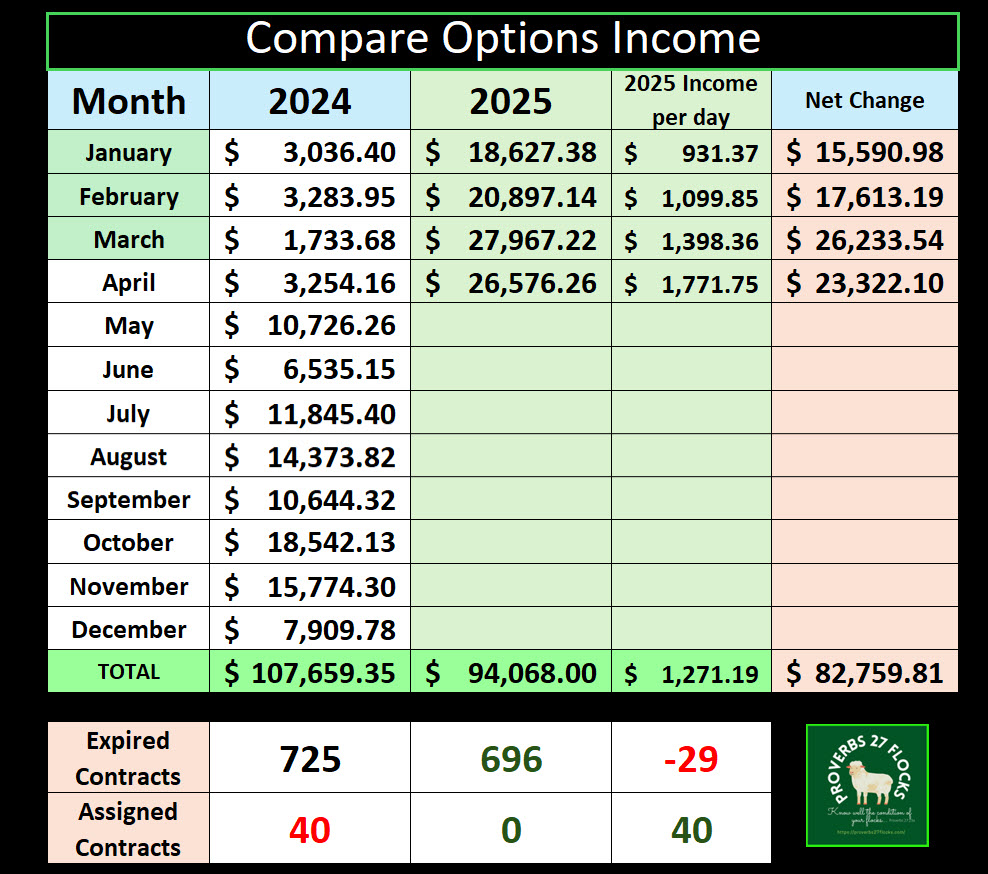

Even though April has been a “bad” month, options income has been far better than I would have expected. April MTD options income is $26,576 compared to April 2024 options income of $3,254. Next week I would not be surprised if we hit $100K in options income for January-April 2025.

In addition, total 2024 options income was $107.6K while we have already hit $94.1K in 2025 options income. Much of this is due to my willingness to roll options up or down.

Finally, 83 options contracts expired on Thursday. This included contracts for these positions: ABBV, ADC, FNF, HPQ, IMMP, MRK, PFE, PR, PYPL, RIO, RPD, and SMCI. What this means is that I have an opportunity to enter new covered call options for these positions. I will be careful about entering into covered call options contracts for ABBV, as that healthcare biotechnology company reports earnings on Friday. If I do create an options contract, it will be for a very high price.

New Seeking Alpha Spring Sale

I like sales if they are a good value. Seeking Alpha has a Spring Sale offer that runs from April 27th to May 11th. The Sale Offer includes Premium for $269, with a 7-day free trial. In addition, SA is offering the Next Alpha Pick – FREE! You may want to wait until April 27th if you are interested in the Next Alpha Pick.

What are Alpha Picks?

“The Seeking Alpha quantitative analysis team picks stocks with no subjectivity or emotion. Instead, they rely on analyzing terabytes of data and employ best-in-class optimization and risk tools to select stocks that will help improve portfolio performance.”

“Alpha Picks considers company fundamentals, valuation, momentum, forward-looking analyst estimates, and profitability. Stocks with upward momentum tend to outperform over more extended periods.”

“When a stock no longer scores well on fundamentals, valuation, and momentum (relative to the sector), or if a stock is rated as ‘Hold’ for more than 180 days, it becomes a ‘Sell’ and is removed from the portfolio.” – Seeking Alpha

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.