Why I am Selling “O”

It boils down to risk based on the holdings within Realty Income. Although I like O’s yield and monthly dividends, the total returns have been disappointing.

Our Realty Income Holdings

Cindie and I currently own 1,200 shares of REIT O. Those shares are worth almost $70K and the dividend we receive is monthly. I like that, but upon further review, I don’t much care for the total 10-year returns for the shares. The dividend yield is a nice 5.83%, but I am willing to sacrifice yield for quality.

Jussi Askola, CFA, a Seeking Alpha contributor, points out a risk factor for Realty Income: “As a reminder, Realty Income is heavily exposed to Walgreens (WBA), Dollar General (DG), and Dollar Tree (DLTR) today. They are its second, third, and fourth largest tenants, representing them alone about 10% of its rental revenue.” Seeking Alpha Post: Very Bad News For Realty Income

Another Seeking Alpha Benefit

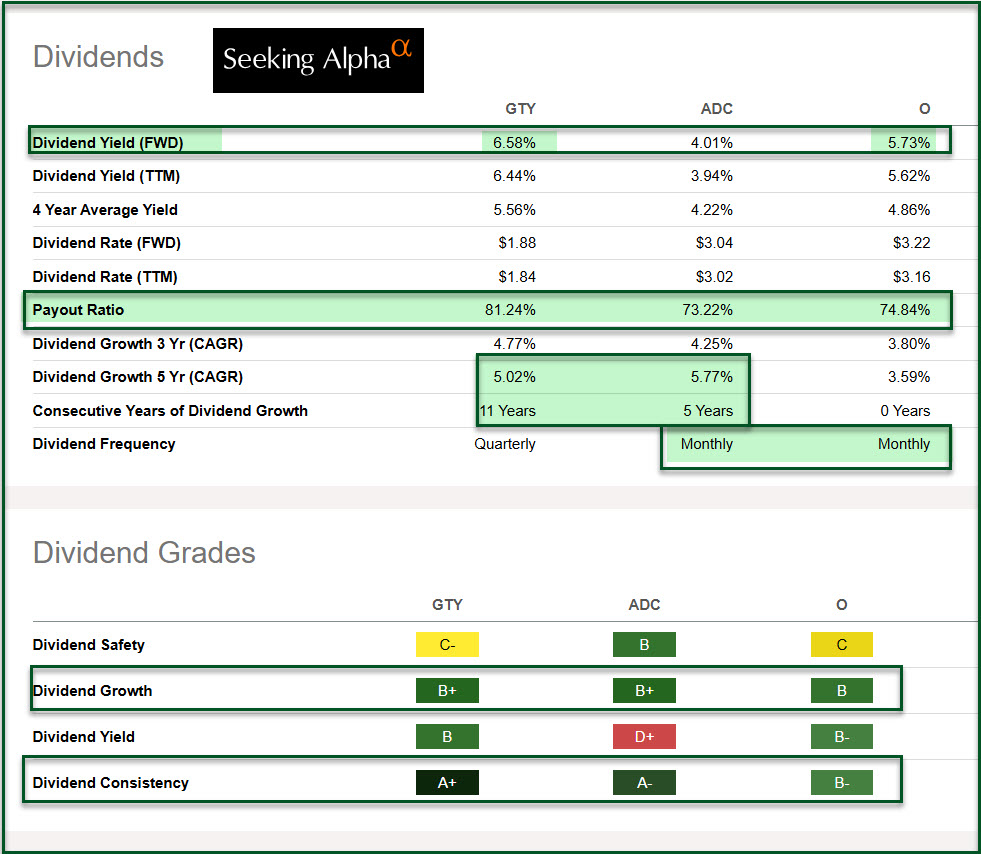

The news items I get from Seeking Alpha authors alert me to potential problems. That gives me an opportunity to reevaluate our holdings. Most of the time I don’t sell an investment based on just an author’s perspective. However, I use Seeking Alpha to compare the stock with other similar REITs that we own. We already have shares of ADC (pays a monthly dividend) and GTY. I plan to buy more shares of each of these when I sell our O shares.

There is no need to panic. You don’t have to sell today. However, if you own shares of Realty Income, I believe it is time to sell them.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.