REITS ADC and STAG

Monthly income is a monthly reminder of easy income. REITs and BDCs sometimes have a monthly payment schedule. In addition to GAIN (a BDC), we own shares of two REITs that pay a monthly dividend: STAG and ADC. ADC covers the retail space and STAG is an industrial REIT.

Dividend Announcements During Market Volatility

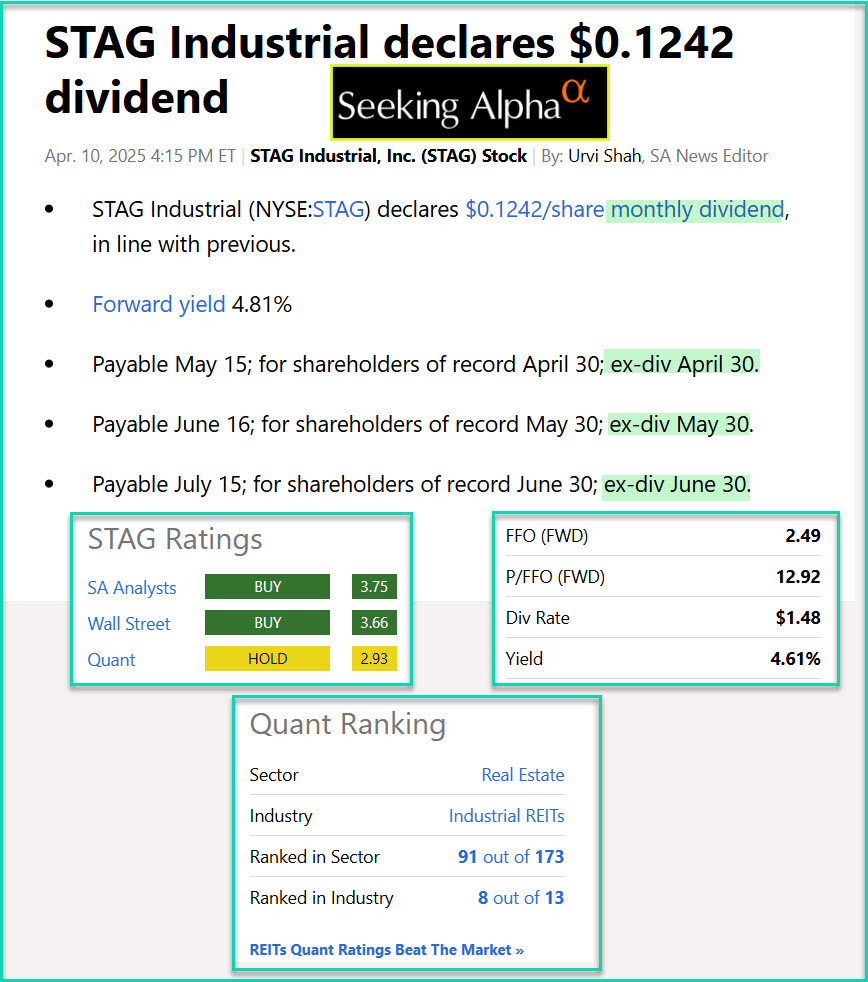

STAG announced their next three monthly dividends. The forward yield on this investment is about 4.8%, so that is a decent amount. Notice that the FFO amount is greater than the projected annual dividends. Funds From Operations should always be sufficient to cover the dividend. If it doesn’t, then don’t buy shares of the REIT.

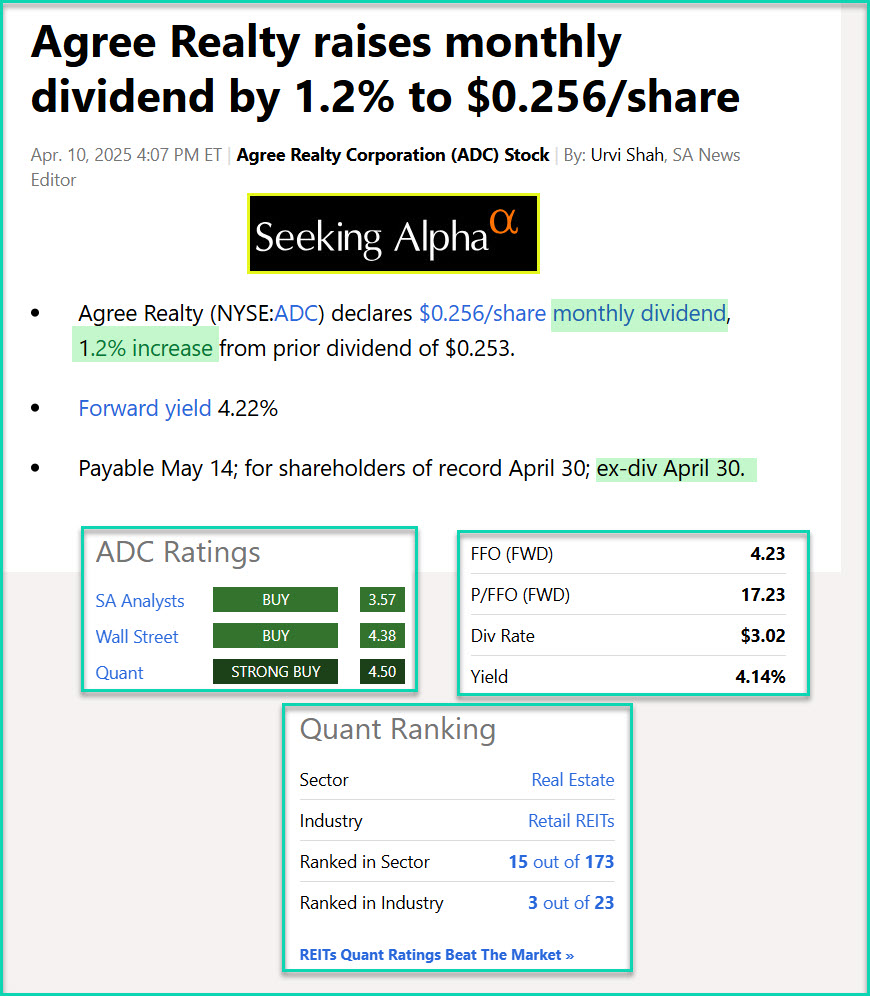

Agree Realty (ADC) also announced their next monthly dividend. The dividend yield on this investment is just over four percent and the FFO covers the dividend nicely. Note that Seeking Alpha currently has a STRONG BUY QUANT rating for ADC shares. Although the dividend increase is a small 1.2%, any increase is a positive for easy income. I did not have to raise the rent. ADC does that for me.

ADC Covered Call Option Income

I also trade covered call options on our STAG and ADC investments. In my traditional IRA I own 300 shares of ADC. The three current ADC options contracts are for $80/share and the contract expires on April 17, 2025. It is highly unlikely that my shares will be called away. The STAG options expire in June as shown below from my ATP screen.

Our Ownership of GAIN

GAIN also pays a monthly dividend. In my last post I said that we own 4,700 shares of GAIN. Yesterday I purchased another 500 shares bringing our total ownership to 5,200 shares. Therefore, the supplemental dividend of $0.54 per share is an additional bonus dividend income of $2,808. While supplemental dividends are nice to have, don’t depend on them as a regular occurrence.

Thanks For Using My Link to Seeking Alpha

I have received two payments from Seeking Alpha from my readers who used the subscription link. I don’t know who you are, but I want to say “Thank you!”

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.