The Stock Market is Crazy

If you have been paying attention to the market since last Thursday, you probably wonder if investing is a good idea. Our investments on Thursday through Tuesday went down 13.2%. The worst day was Friday when our portfolio declined 5.31%. Today things went in a different direction. Managing assets and investments means you don’t do what everyone else does when short-term emotions override long-term experience and logic.

Asset Managers

Asset Management companies and Banks are a great source of more dollars of income. That is one reason I like both MAIN and GAIN. “Asset management is the practice of increasing total wealth over time by acquiring, maintaining, and trading investments that have the potential to grow in value.” – Investopedia

One type of asset manager is the business development company (BDC). “A business development company (BDC) is an organization that invests in small- and medium-sized companies as well as distressed companies. A BDC helps these firms grow in the initial stages of their development. With distressed businesses, the BDC helps the companies regain sound financial footing.” – Investopedia

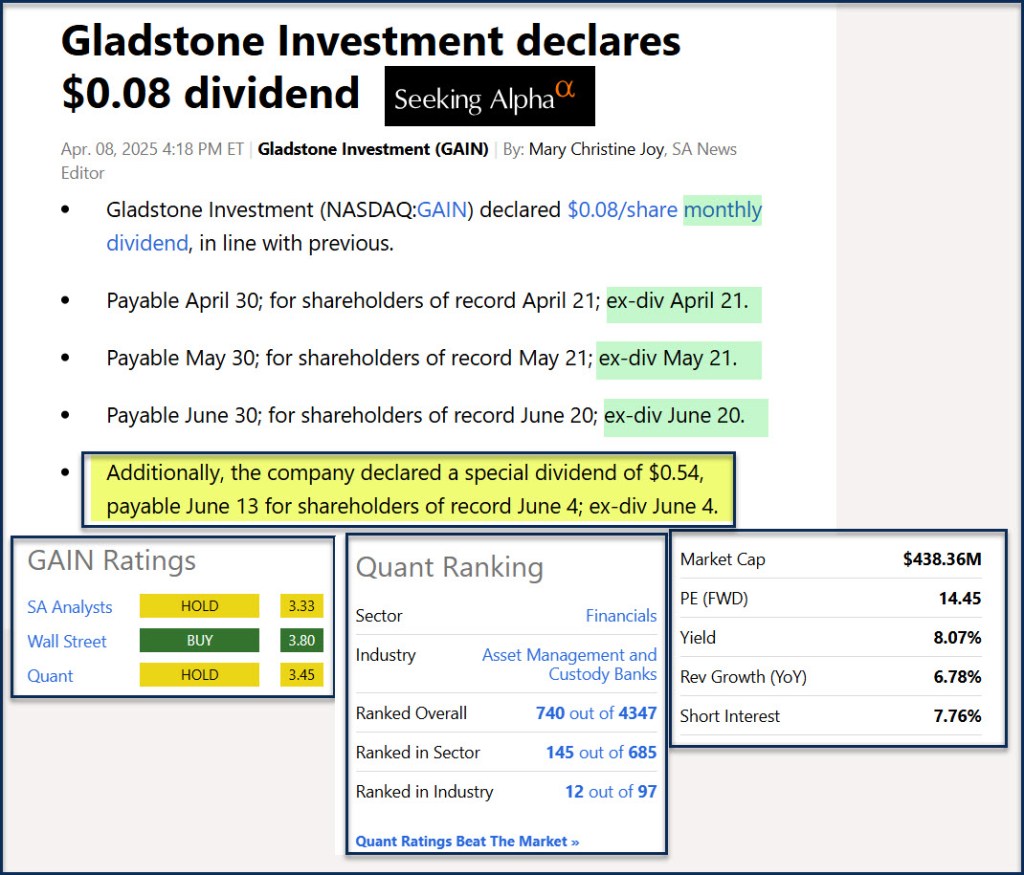

GAIN is a BDC and operates in the Financial Sector. The specific industry within that sector is “Asset Management and Custody Banks.”

Our Ownership of GAIN

GAIN dropped to $11.77 per share yesterday. Today it closed up at $13.06. That is a 10.96% price increase. Those that sold at $12 fell victim to the fear mentality.

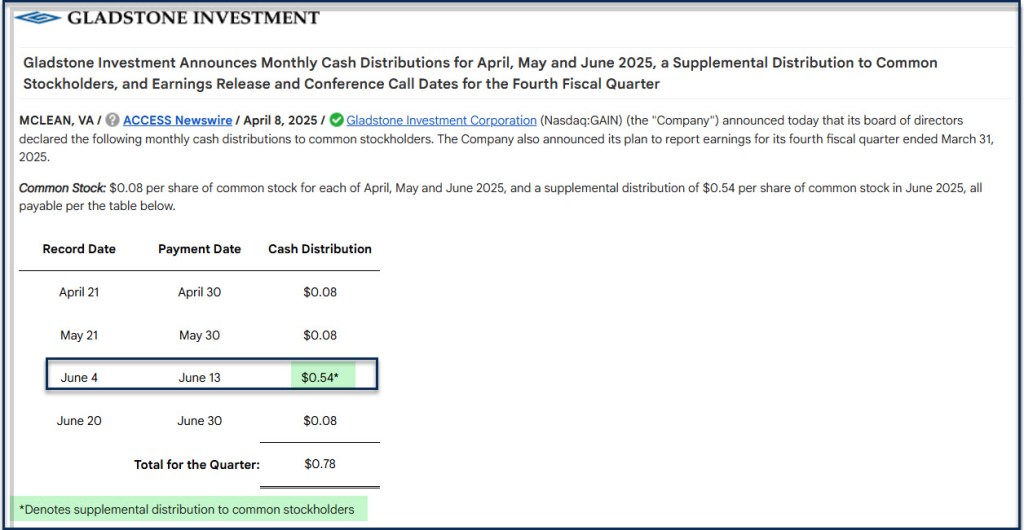

We own 4,700 shares. Therefore, the supplemental dividend of $0.54 per share is an additional bonus dividend income of $2,538. While supplemental dividends are nice to have, don’t depend on them as a regular occurrence. However, the monthly dividend of $0.08 per share is worth $376 every month. That is a dividend that is reasonably dependable based on GAIN’s history of dividend payments.

Other Business Development Companies

Using Seeking Alpha is one way to find similar investments. I like to review the BDC investments by Seeking Alpha’s QUANT rating. In the top 20 “Asset Management and Custody Banks” we own four: MAIN, GAIN, BCSF, and SAR. MAIN is our largest holding in the BDC space at the present time.

GAIN’s Business Description

Gladstone Investment Corporation is business development company, specializes in lower middle market, mature stage, buyouts; refinancing existing debt; senior debt securities such as senior loans, senior term loans, lines of credit, and senior notes; senior subordinated debt securities such as senior subordinated loans and senior subordinated notes; junior subordinated debt securities such as subordinated notes and mezzanine loans; limited liability company interests, and warrants or options. The fund does not invest in start-ups. The fund seeks to invest in manufacturing, consumer products and business/consumer services sector. It seeks to invest in small and mid-sized companies based in the United States. The fund prefers to make debt investments between $5 million and $30 million and equity investments between $10 million and $40 million in companies. The fund invests in companies with EBITDA from $4 million to $15 million. It seeks minority equity ownership and prefers to hold a board seat in its portfolio companies. It also prefers to take majority stake in its portfolio companies. The fund typically holds the investments for seven years and exits via sale or recapitalization, initial public offering, or sale to third party.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.