Was Q1 Successful?

In this update I will review my buys and sells during the first quarter, the Q1 dividends compared to 2024 Q1 dividends, Covered call options income and results, income from interest and Fidelity’s Fully Paid Lending Program (FPLP), and progress towards fulfilling my RMD (the IRS Required Minimum Distribution) using the IRS-approved QCD (Qualified Charitable Distribution. I will celebrate the success of one UTMA account journey. All of this will be, of necessity, a high-level overview. If any reader has specific questions about the details behind this update, please ask. The key takeaway is that dividend growth investing works.

I will also comment on the huge drop in the market at the beginning of this month. What do I think and what am I going to do?

The other opportunities I had to invest in the lives of others were more satisfying. I was able to teach a couple of lessons to some high school students covering the Old Testament book of Joshua. I have been invited back to the high school to teach a lesson on the book of Judges later this month. In addition, Cindie and I were able to travel to Illinois and hear our son preach. That was a huge blessing.

Training opportunities continued as well. I gave covered call options training to a couple of friends and readers of my blog. At least one of them has already started trading options. While they aren’t making tons of extra income, the skill can become more valuable as their retirement account grows in size.

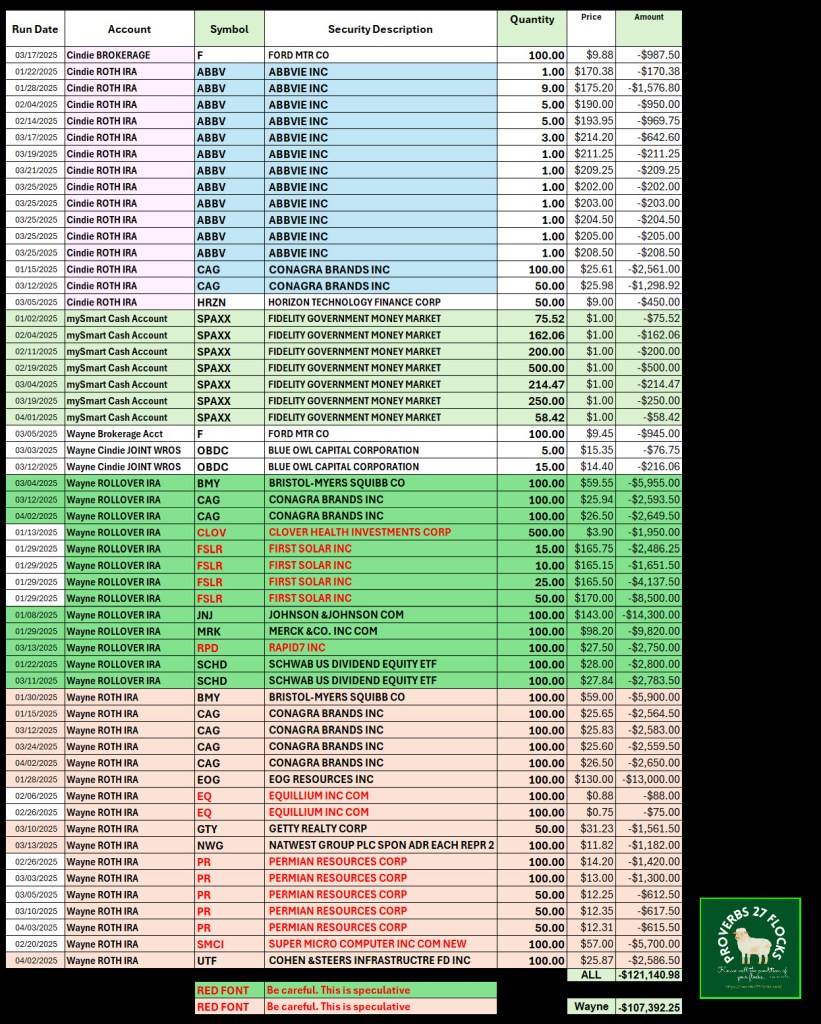

Investment Buys and Sells

I help a friend who has done some work on our home with investing. I purchased shares of DGRO and SCHD for his retirement account. I also added 139 shares (in total) of SCHD to the UTMA accounts of our grandchildren. In addition, because I sold all of their shares (15 each) of MAIN in their accounts, I bought ten shares of ARCC for each grandchild. ARCC is ARES Capital Corp. Most of the income from MAIN went to buy more shares of SCHD.

The sales of our investments were minor. We no longer have any CDs in our accounts. A total of $27K was sold and the cash went into SPAXX. This money market mutual fund currently pays almost what we could get from CDs and it keeps the cash more liquid for other investing or expense purposes. The only other sale was 100 shares of DOW in my ROTH IRA.

Investment purchases for our eight accounts were significant during the first quarter. Cindie saw additions of F, ABBV, CAG and HRZN. I am gradually adding ABBV shares so that I can trade covered call options in her ROTH IRA.

The addition of SPAXX in our Fidelity checking account (mySmart Cash Account) is for future payments of property and income taxes.

Of the approximately $121K used to buy investments, most of it was for purchases of investments in my traditional and ROTH IRAs: $107K. Some of these purchases are highly speculative and are shown in red. Do not just mimic what I do. Understand the risks before you buy shares of an investment like SMCI or FSLR.

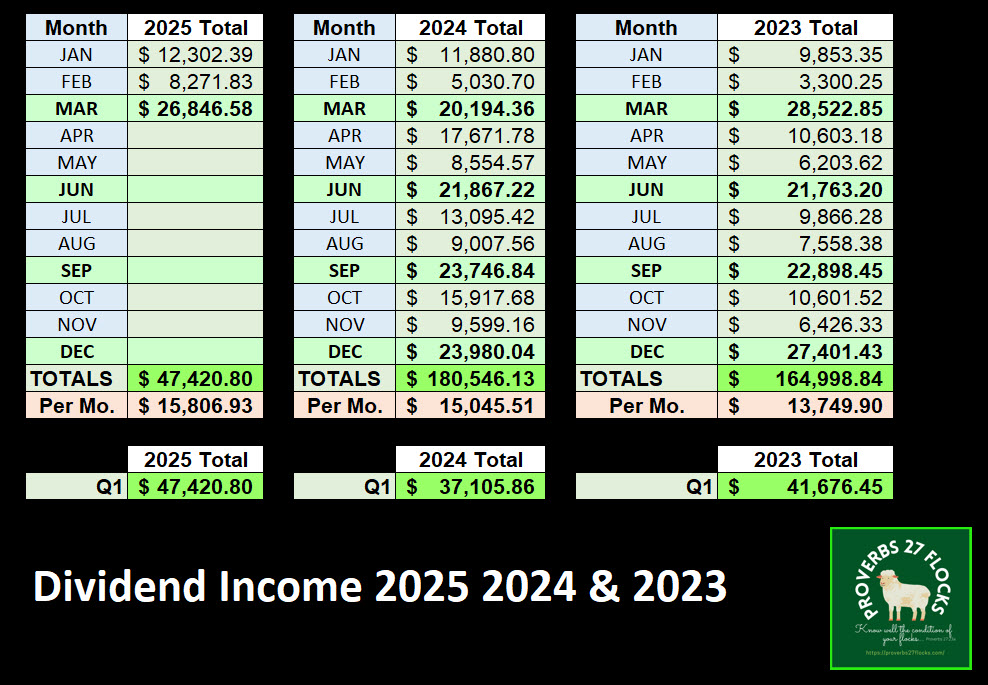

2025 Q1 Dividends Versus 2024 Q1 & 2023 Q1

Because our investment mix changes slowly over time as we buy or sell investments, this comparison is not without some noise. I believe it illustrates, however, that it is possible to grow your income passively with dividend growth investments. The vast majority of our holdings have not changed in the last three years. VYM, ABBV, AVGO, and MAIN are still in our top ten investments. We still hold investments that do not pay a dividend like SMCI.

The thing I am looking for is year-over-year, quarter-by-quarter growth. For Q1 for the three years in question, 2025 started with a positive gain over the previous two years. This was accomplished without adding significant dollars from outside of the accounts. Most of the investment buys were funded with incoming dividends or with earnings from trading options.

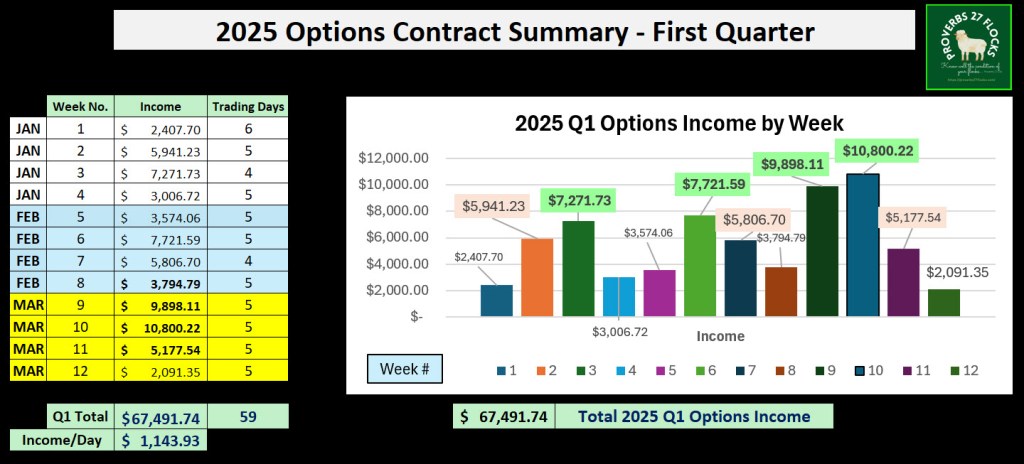

Covered Call Options Income and Results

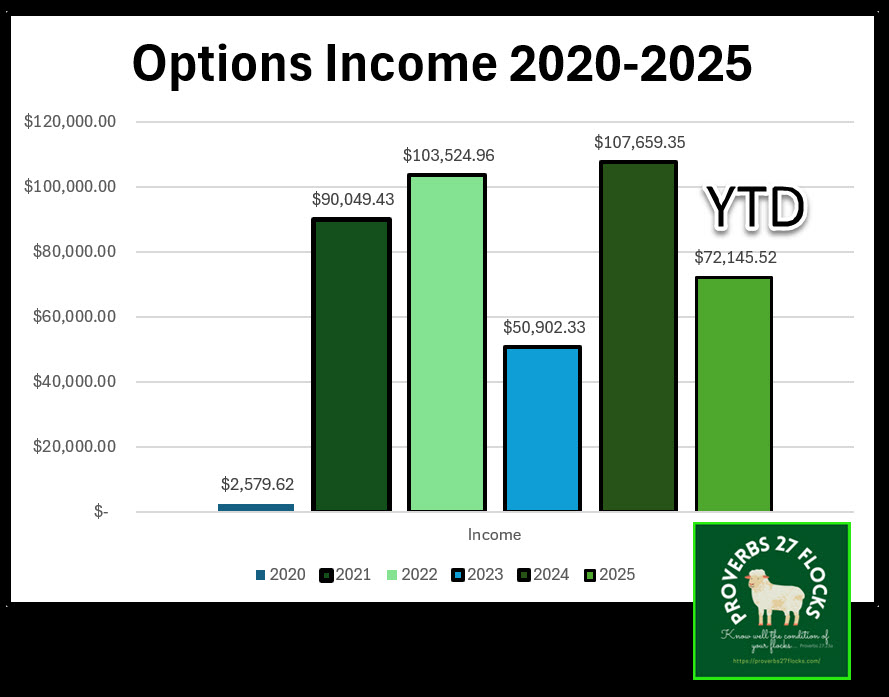

This year has started with a very positive result. The first three months brought in $67,491 and April’s first week took me over the $72K mark. When we compare this to the first three months of 2024 the results are even more amazing. YTD I am beating last year by over $60K. A word of caution is in order. I don’t anticipate the same trend going forward. This is simply because down markets are not as profitable for trading covered calls as upwards moving markets are. Still it seems likely that I can beat last year’s options income without much effort.

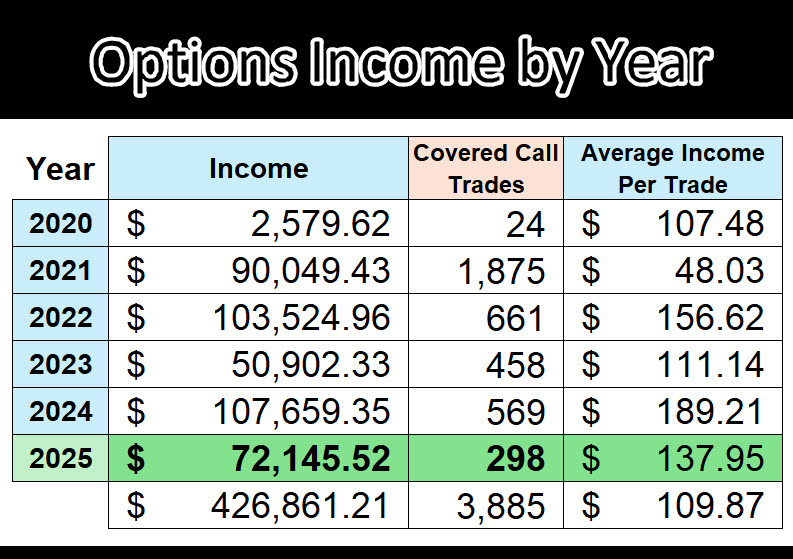

When I started trading options I had no delusions that I could reach $426K in total options income by 2025. However, as the following table and chart show, that is the case. 2020 was my year of experimentation. 2021 was the first year I had confidence in my approach.

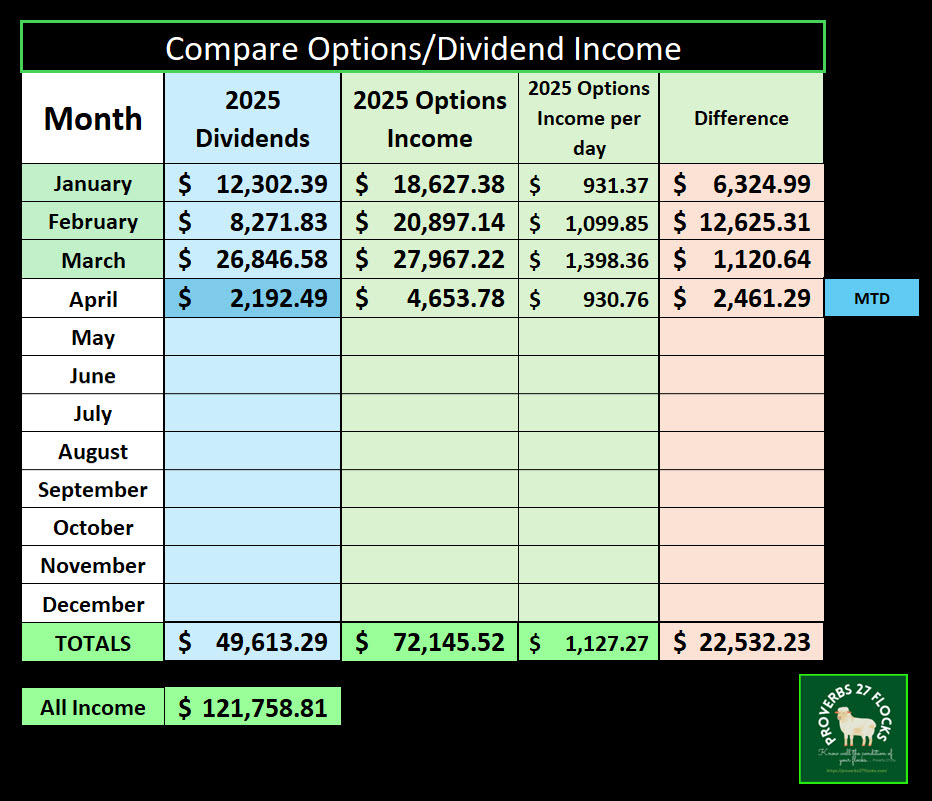

The final image shows all of the Q1 income (excluding minor interest income) for dividends and options income. Including the first week of April, income was $121,759. Bear in mind that this was achieved without losing any of our investments by having the option called. Said another way, all of the options I have traded have expired so far this year. This won’t be sustainable, but it is rather remarkable. I believe this shows that my method for determining the right values for each options trade is working. It also has to do with rolling options up and down as the market price for various investments move up and down over time.

Interest Income

Because most of our cash is in the SPAXX money market, very little of our income is interest. YTD interest income is $166.28. Because I don’t plan to buy any CDs I expect interest income to be minimal for 2025.

Fidelity’s Fully Paid Lending Program (FPLP)

Although Fidelity’s Fully Paid Lending Program is not a major driver of income, it does provide some income. The first quarter of income totaled $2,177.97. Much of this income came in January and February. March was down considerably and I expect the same for the months going forward.

RMD Progress Report

The 2025 RMD for my traditional IRA is $71,425.50. Because this is taxed at regular income rates, it is best to try to keep this off of the 1040 at income tax time. The balance of the RMD at this time is $38,000 due to QCD giving. I write checks directly from my traditional IRA to qualified 501c3 non-profts. The goal is to give the entire $71,425.50 to non-profits. Using that approach there are no income taxes.

IRS-approved QCD

The maximum QCD gift for 2025 is $108K. I hope to hit that mark by the end of the year. One of the reasons for this approach is to reduce my IRA balance going into 2026. That keeps next year’s RMD lower, further improving our income tax situation.

Dividend Growth Investing Works

Even if you don’t trade options, there are good ways to grow your income simply by purchasing good dividend growth ETFs like VYM, DGRO, and SCHD. Bear in mind that I had growing dividend income before I started trading covered call options. This is easy income.

UTMA Success Story

Our oldest granddaughter turned 21 years old today. A couple of days ago I called Fidelity and had them transfer all of the stocks and ETFs from her UTMA account to her own Fidelity brokerage account. This made me smile. She has already shown discernment in the world of study, saving, spending, living, giving, serving, and sharing the gospel at work. Cindie and I are delighted to call her our grandchild. She is indeed “grand!”

April’s Huge Market Turmoil: Tariffs and My Response

“It is ideal to have a couple of years’ worth of expenses in cash to protect from having to sell when markets are down. The money to cover medium-term needs of up to 10 years or so should be in fairly conservative investments, such as bonds. Money for longer-term needs can be invested in stocks.” WSJ (Emma Tucker, Editor in Chief, The Wall Street Journal)

Growth stocks and ETFs usually suffer when there is a bear market. Therefore, wise investors look at their dividend value stocks as a way to relax. It is highly unlikely that more than a couple of companies will cut their dividend if their payout ratio is sensible. Even so, I continue to hold sufficient cash to meet our needs. Because dividends replenish the cash supply, the need for a huge pile of cash is generally unwarranted.

Closing Thoughts

It pays to keep things in perspective. There are a couple of ways to do that. First of all, we live in a land of wealth and most of us receive more wealth in a year than most of the world’s population receives in a lifetime. Secondly, wealth never really makes anyone happy or secure. If that were true, there would be more happy and secure people in this country. Finally, bear in mind what Anne Frank said in the most dire of personal circumstances: “Think of all the beauty still left around you and be happy.” Anne Frank