Keeping It Simple

You don’t have to be a math wizard to see if an investment makes sense or not. You also don’t have to spend hours trying to determine the likelihood of success when you choose an ETF. There are four things I look for each time I evaluate an ETF. They are the Seeking Alpha QUANT rating, dividend growth, a rational expense ratio, and the 5-year dividend growth rate.

There is another data element worthy of consideration: Turnover Rate or Ratio. Most, if not all mutual funds and ETFs change over time. Even the S&P 500 does not stay constant. Some investments enter the S&P 500 and some exit.

The same is true for mutual funds and ETFs. The fund managers sell some investments and buy others. This creates a “turnover rate.”

What is a Turnover Rate or Ratio?

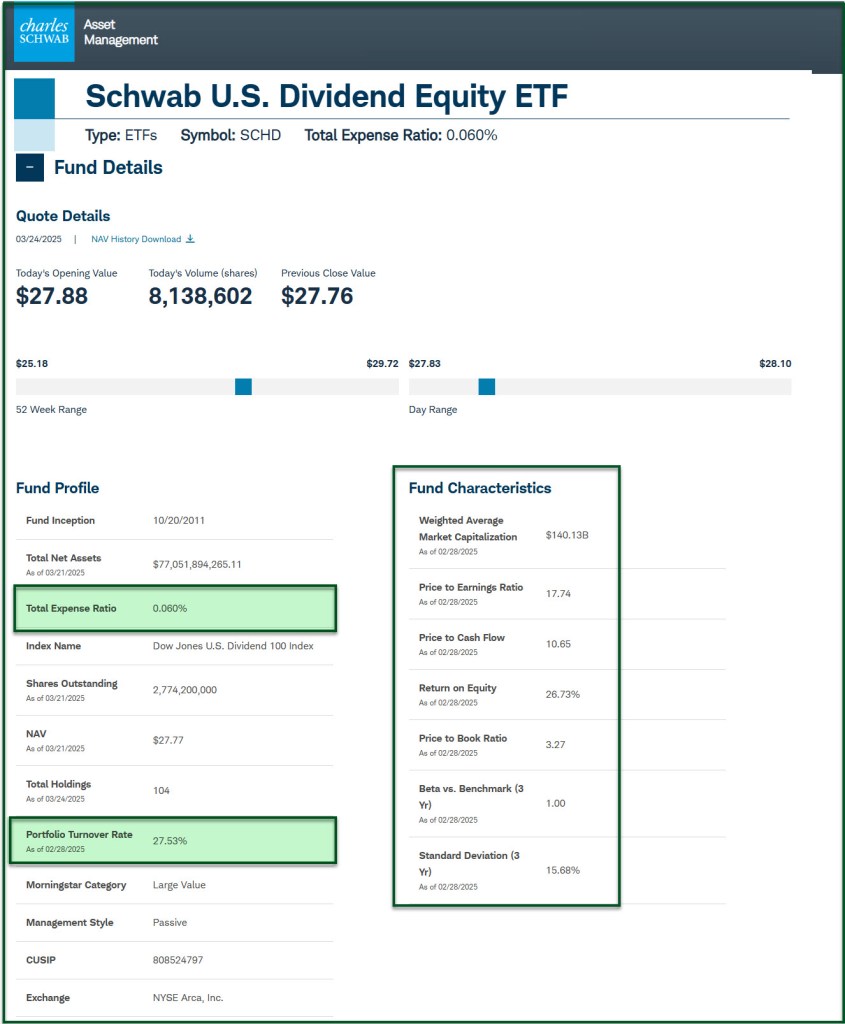

“A turnover ratio is a simple number used to reflect the amount of a mutual fund’s portfolio that has changed within a given year. This figure is typically between 0% and 100%, but can be even higher for actively managed funds. A turnover rate of 0% indicates the fund’s holdings have not changed at all in the previous year. A rate of 100% means the fund has a completely new portfolio than it did 12 months ago.” – Investopedia

Investing in funds with low turnover ratios is not a good strategy. If you have a low turnover of the investments in a fund, then it is likely that the underperforming investments are not being removed from the fund and should be replaced by other investments with more growth and dividend growth potential.

However, investing in a fund with a high turnover ratio can also be questionable or problematic. It is as if your fund manager is a day-trader, always chasing the next great idea. Fund managers need to buy and hold an investment. Too much buying and selling is not a comforting approach for most investors.

My Preference For Turnover

I prefer to invest in funds that have a more moderate approach. Therefore, SCHD’s turnover ratio of 27.53% is appealing. Of course, this assumes that the fund manager sold the underperforming assets (or assets that now have a P/E ratio that is irrational) and purchased replacement investments that have more growth and dividend growth potential.

Our SCHD Holdings

It is my plan to add more shares of SCHD over time. I have 3,500 shares in my traditional and ROTH IRA. Cindie holds 1,000 shares in her ROTH IRA. I also have been adding SCHD shares to the UTMA accounts for our grandchildren.

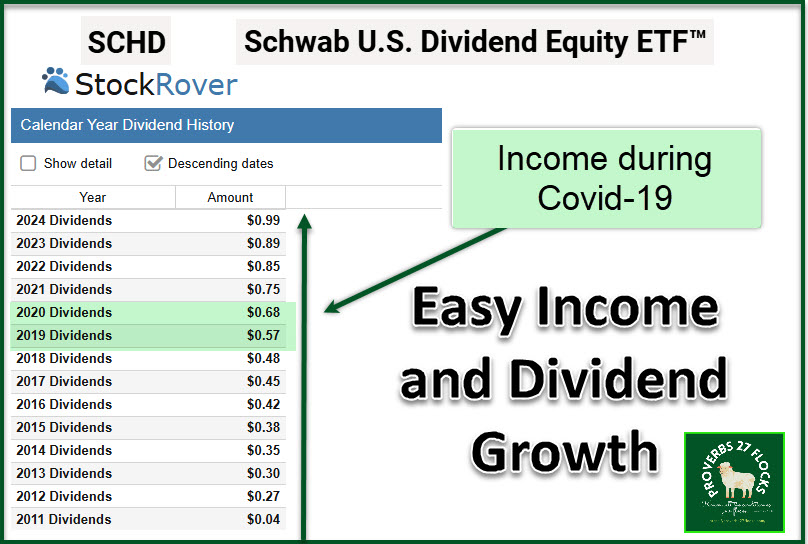

StockRover Views

It is helpful to use tools to examine any investment. While Seeking Alpha is my number one go-to source for information, StockRover is also a helpful tool for visualizing dividend growth. I want to see both the growth in the dividend and the total growth over time.

Another Seeking Alpha Benefit

Another benefit of a Seeking Alpha subscription is the contributions of various authors. One author who calls themselves “The Sunday Investor” wrote a helpful piece entitled “SCHD: Your Complete Guide To The March 2025 Index Reconstitution.”

The author summarized his main ideas, and I think a couple of them are of special value. He noted that there were 20 additions and 17 deletions. “The Index deleted Pfizer and BlackRock, while the addition ConocoPhillips is SCHD’s new top holding.”

Of significance is that the total energy sector exposure is now above 20%. This could cause some concerns if energy underperforms. However, because I am somewhat light on energy stocks, I see this as a positive.

The author further noted that “…weak sales and earnings growth reminds us SCHD is not perfect, and investors should seek complementary funds. In addition, SCHD’s high 63% dividend payout ratio was a big disappointment.” I don’t think a 63% payout ratio is unacceptable. I like to see the payout ratio between 20-70% for most investments.

Of particular note was his comment that “Importantly, SCHD retained its quality, value, and dividend growth advantages over other dividend ETFs.” Those are important considerations for long-term investors.

SCHD Stocks Added and Deleted

If you read the article, you will see the specifics, but the list of company stocks added were: ConocoPhillips (COP): 4.59% (Energy), Merck & Co., Inc. (MRK): 4.05% (Health Care), Schlumberger Ltd. (SLB): 2.30% (Energy), Target Corp. (TGT): 1.90% (Consumer Staples), General Mills, Inc. (GIS): 1.28% (Consumer Staples), Archer-Daniels-Midland Co. (ADM): 0.87% (Consumer Staples), Halliburton Co. (HAL): 0.86% (Energy), Ovintiv, Inc. (OVV): 0.43% (Energy), American Financial Group, Inc. (AFG): 0.36% (Financials), Autoliv, Inc. (ALV): 0.26% (Consumer Discretionary), FMC Corp. (FMC): 0.21% (Materials), Moelis & Co. (MC): 0.17% (Financials), Flowers Foods, Inc. (FLO): 0.14% (Consumer Staples), Murphy Oil Corp. (MUR): 0.14% (Energy), Federated Hermes, Inc. (FHI): 0.12% (Financials), Signet Jewelers Ltd. (SIG): 0.10% (Consumer Discretionary), Interparfums, Inc. (IPAR): 0.08% (Consumer Staples), CNA Financial Corp. (CNA): 0.04% (Financials), Ennis (EBF): 0.02% (Industrials), and First Financial Corp. (THFF): 0.02% (Financials).

The deletions were: Pfizer, Inc. (PFE), BlackRock, Inc. (BLK), U.S. Bancorp (USB), M&T Bank Corp. (MTB), Huntington Bancshares, Inc. (HBAN), Tapestry, Inc. (TPR), KeyCorp (KEY),C.H. Robinson Worldwide, Inc. (CHRW), Dick’s Sporting Goods, Inc. (DKS), Zions Bancorp (ZION), H&R Block, Inc. (HRB), Synovus Financial Corp. (SNV), Bank of Hawaii Corp. (BOH), Leggett & Platt, Inc. (LEG), Cracker Barrel Old Country Store (CBRL), Heritage Financial Corp. (HFWA), and Guess?, Inc. (GES).

I did not do an exhaustive review of the additions and deletions, but I tend to like the boost in energy-related holdings. Therefore, I plan to buy more shares of SCHD.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.