VYM Vanguard High Dividend Yield Index Fund ETF Shares

When an ETF announces a dividend I compare the dividend with the same quarter’s dividend from the previous year. This year, for Q1, VYM did not disappoint. The distribution is well above Q1 of 2024. We will see the dividend in our accounts on March 25. VYM is one of our top five investments.

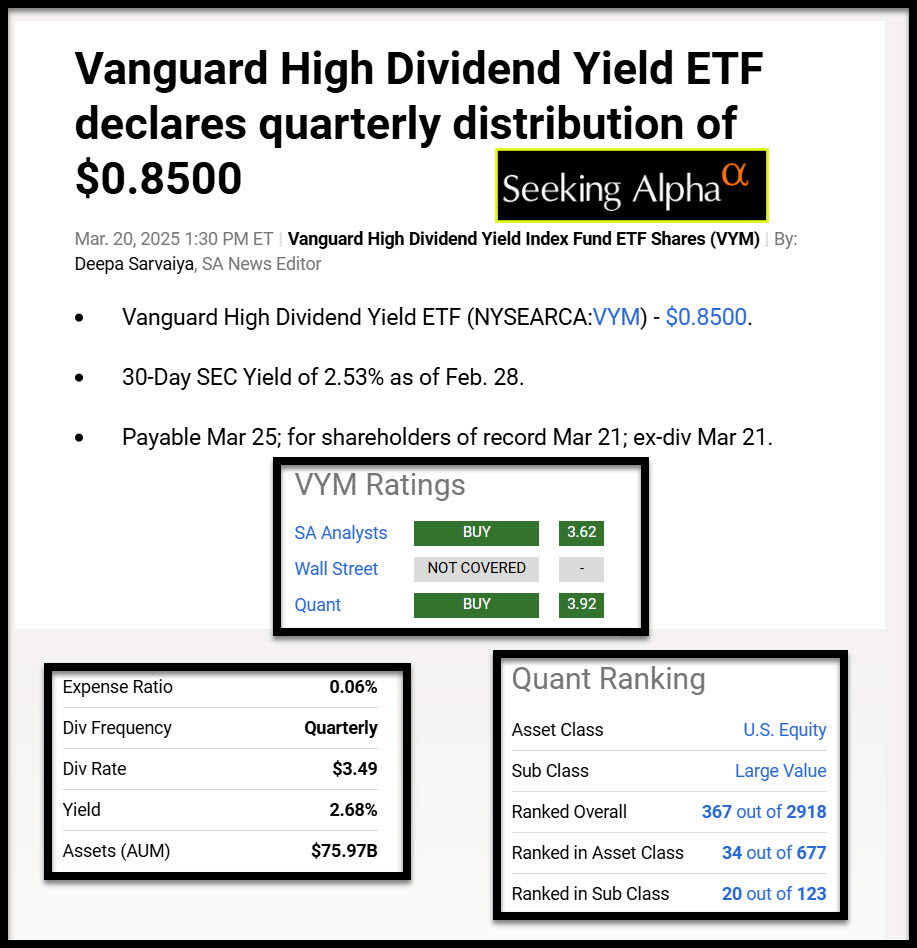

VYM declares quarterly distribution of $0.85

The 30-Day SEC Yield is 2.53% as of Feb. 28. The dividend is payable Mar 25; for shareholders of record Mar 21; ex-div Mar 21. Because we own 2,585 shares of VYM, we will receive $2,197.25 in dividends on March 25. To put this in perspective the Q1 2024 dividend for VYM was $0.6555 which meant we received $1,694.47 back then. This is a very nice increase of 29.7%. Of course, this is just one quarter. We will have to see what Q2 looks like.

Fund Profile

Vanguard High Dividend Yield ETF is an exchange traded fund launched and managed by The Vanguard Group, Inc. It invests in public equity markets of the United States. The fund invests in stocks of companies operating across diversified sectors. The fund invests in growth and value stocks of companies across diversified market capitalization. The fund invests in dividend paying stocks of companies. The fund seeks to track the performance of the FTSE High Dividend Yield Index, by using full replication technique. Vanguard Whitehall Funds – Vanguard High Dividend Yield ETF was formed on November 10, 2006 and is domiciled in the United States.

Covered Call Options Plus Dividends

I had a covered call option open for 500 shares (5 contracts) that expired today. As a result, I get to keep my shares and the income I earned from the options contract.

We also have shares of VYM in the UTMA accounts for our grandchildren and I bought shares for a friend who has given me access to his account so that I can buy investments on his behalf.

VYM Diversification

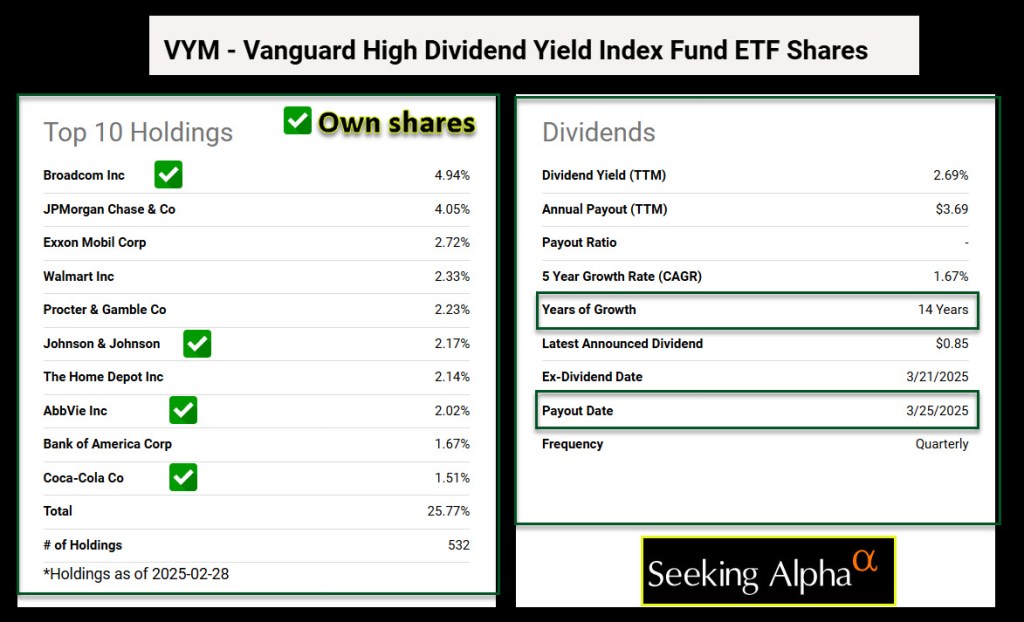

It is wise to look at the sector diversification, the top ten investments in the fund and the total number of stocks held by the ETF. VYM is well diversified.

The ETF Ratings on Seeking Alpha

Rock solid in every respect. Volatile markets generally don’t hurt VYM.

Performance Should Be Compared

I am interested in 10-year total returns. If an investment cannot hit 90-100% ten-year total returns, then I have to ask “why?” My three favorites, VYM, SCHD, and DGRO all have solid performance over the long term. Price returns are interesting, but total returns are the key to success.

Dividends Should Grow Too

This shows that VYM has been a good dividend growth investment. That isn’t surprising, as that is the goal of this ETF.

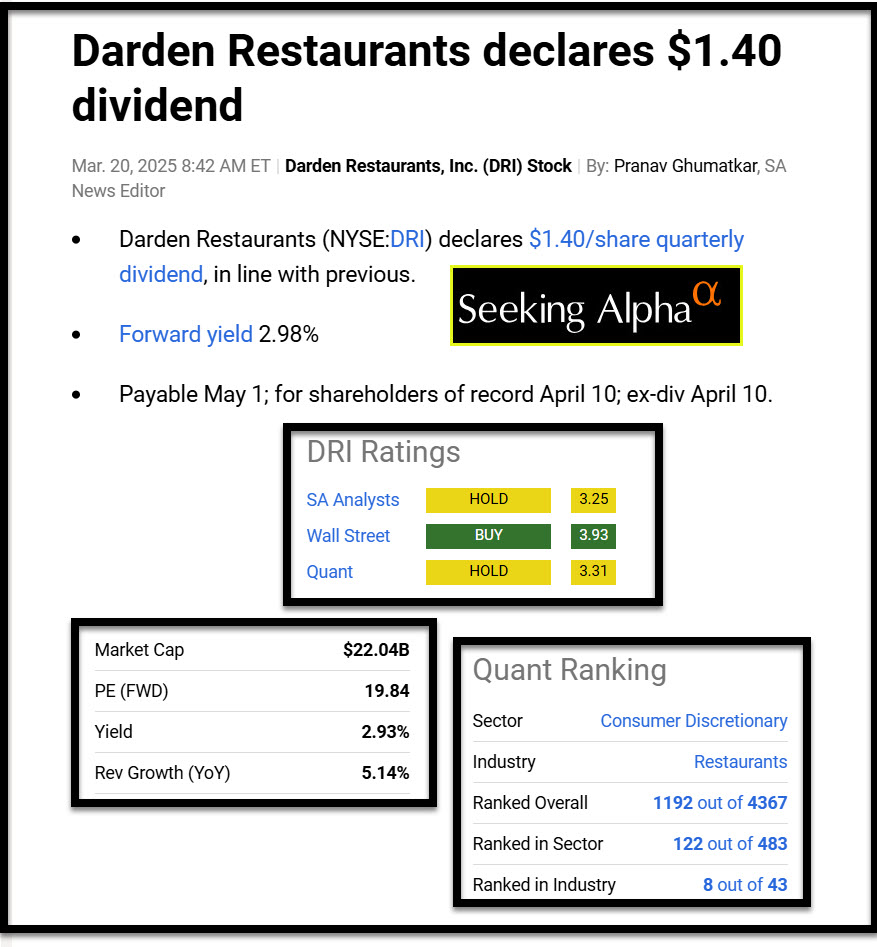

Even DRI declared a dividend, but it wasn’t an increase. Every little bit helps. I also trade covered call options on our 100 DRI shares.

2025 Q1 Announcements

A good mix of investments continues to make sense for a reliable income stream.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.