Easy Income is Relaxing

There is nothing quite like a natural wood fire in the fireplace to warm up our family room and give us some relaxing comfort. The same is true of dividends that repeat quarter after quarter. Some investments also pay monthly dividends.

Four Corners Property Trust, Inc.

I believe FCPT will continue to grow sales and FFO (Funds from Operations). FCPT, headquartered in Mill Valley, CA, is a real estate investment trust primarily engaged in the ownership, acquisition and leasing of restaurant and retail properties. The Company seeks to grow its portfolio by acquiring additional real estate to lease, on a net basis, for use in the restaurant and retail industries.

The current Seeking Alpha QUANT rating for FCPT is a “BUY” at 4.23.

Microsoft Corporation

Cindie has owned shares of MSFT for a long time. I sold my shares, but decided MSFT was a good investment for her ROTH IRA. We use MSFT products like Office 365 and Windows.

Microsoft Corporation develops and supports software, services, devices and solutions worldwide. The Productivity and Business Processes segment offers office, exchange, SharePoint, Microsoft Teams, office 365 Security and Compliance, Microsoft viva, and Microsoft 365 copilot; and office consumer services, such as Microsoft 365 consumer subscriptions, Office licensed on-premises, and other office services. This segment also provides LinkedIn; and dynamics business solutions, including Dynamics 365, a set of intelligent, cloud-based applications across ERP, CRM, power apps, and power automate; and on-premises ERP and CRM applications.

Agree Realty Corporation

I own 300 shares of ADC in my traditional IRA. It pays a monthly dividend and I also trade covered call options on my shares.

Agree Realty Corporation is a publicly traded real estate investment trust that is RETHINKING RETAIL through the acquisition and development of properties net leased to industry-leading, omni-channel retail tenants. As of September 30, 2024, the Company owned and operated a portfolio of 2,271 properties, located in 49 states and containing approximately 47.2 million square feet of gross leasable area.

The current Seeking Alpha QUANT rating on ADC is a “BUY” at 4.30.

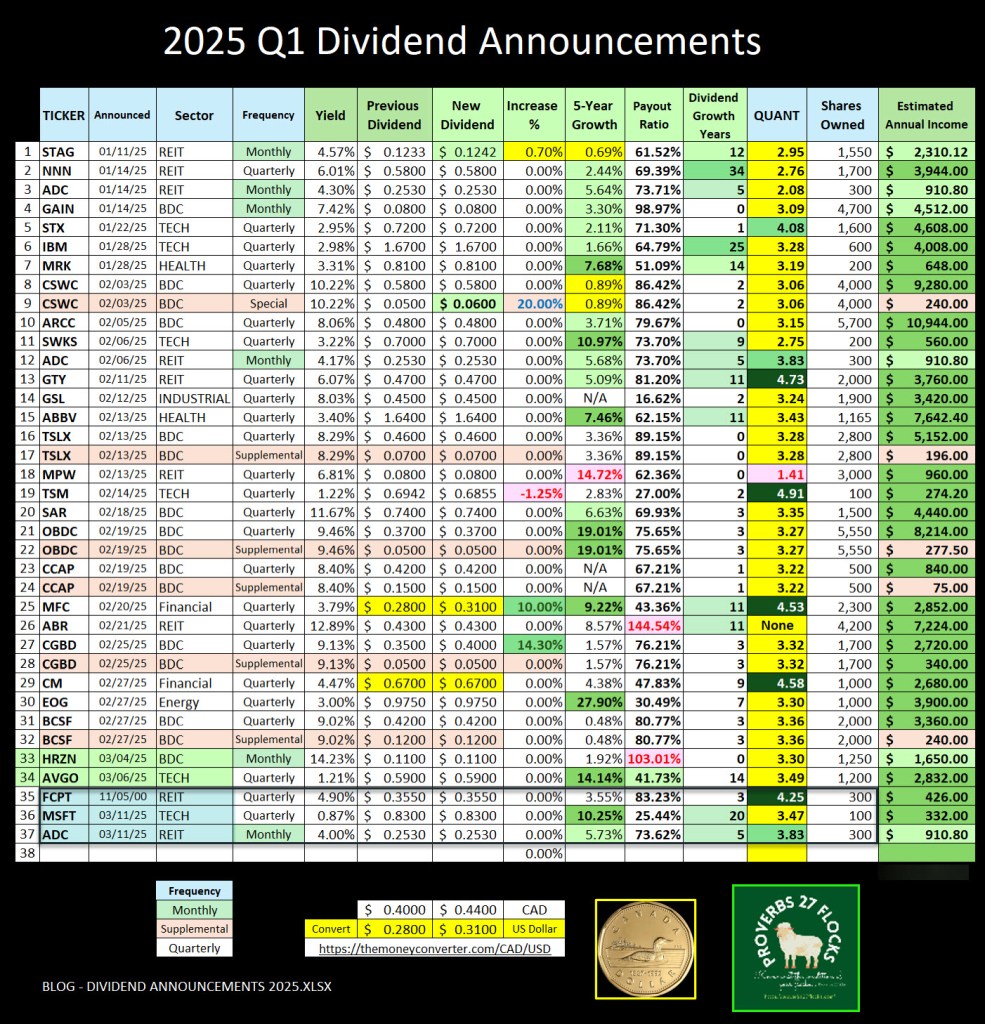

2025 Q1 Announcements

A good mix of investments continues to make sense for a reliable income stream.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.