ROTH Conversions Power Tax-Free Income

There are several reasons why I have been gradually converting assets from my traditional IRA to my ROTH. But even if you don’t have a traditional IRA, it is wise to understand the key elements of success within your ROTH IRA or 401(k). You want to have growth in the value of your investments, and you should want to grow your income from those investments. You can live off of income, but you cannot take your account balance to the grocery store to buy eggs.

The Four-Fold Pieces

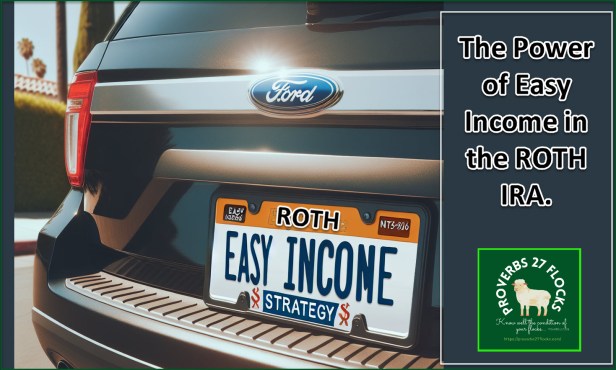

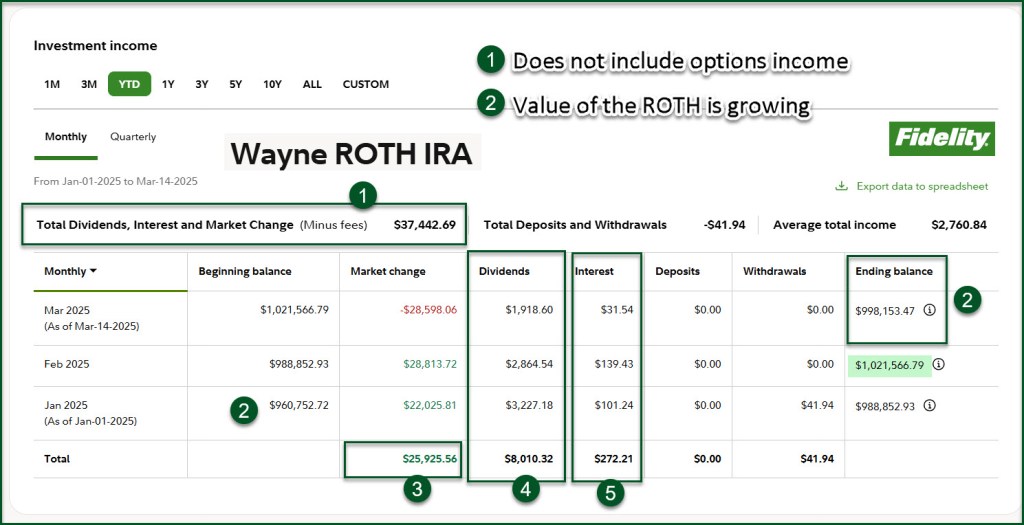

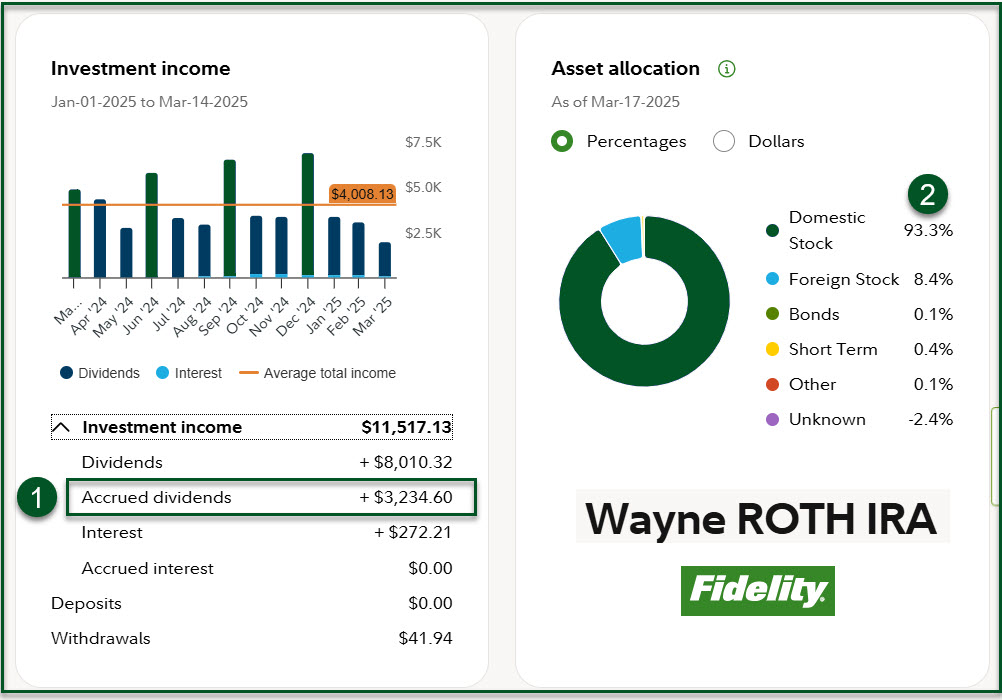

For 2025 my ROTH account has given me $8,234.49 in dividend income (including dividends that were received this morning.) I have also gained $17,140.81 in options income without having to sell any of my shares traded using options. In addition, because I participate in Fidelity’s “Fully Paid Lending Program” I have received an additional $248.93 in interest from my shares on loan. Finally, and much to my surprise, I am beating the S&P 500 index YTD. This is due to my smaller exposure to big tech names that have been hammered by market fearfulness.

Staying With Stocks

As my readers know, I am not a fan of bonds. The best long-term strategy is, in my opinion, to invest in dividend growth stocks and low-cost dividend growth ETFs like DGRO, SCHD, and VYM. It is a bouncy ride due to market volatility, but it is a ride that is worth it over the long-term.

Performance YTD

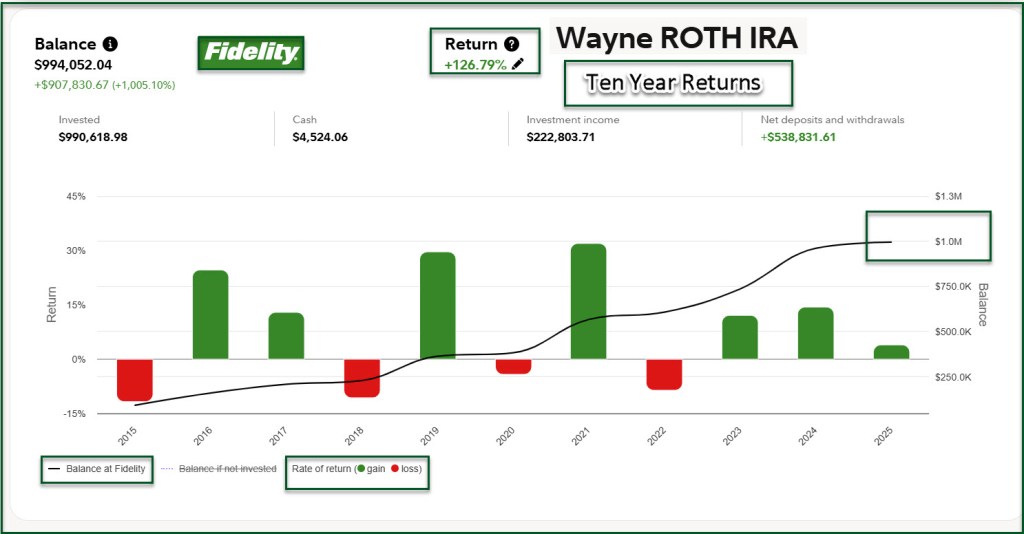

The following screen shots from Fidelity show just my ROTH IRA. The ROTH account is smaller in total dollars than my traditional IRA, but I hope someday to reverse that by continuing to roll investments from my IRA to my ROTH.

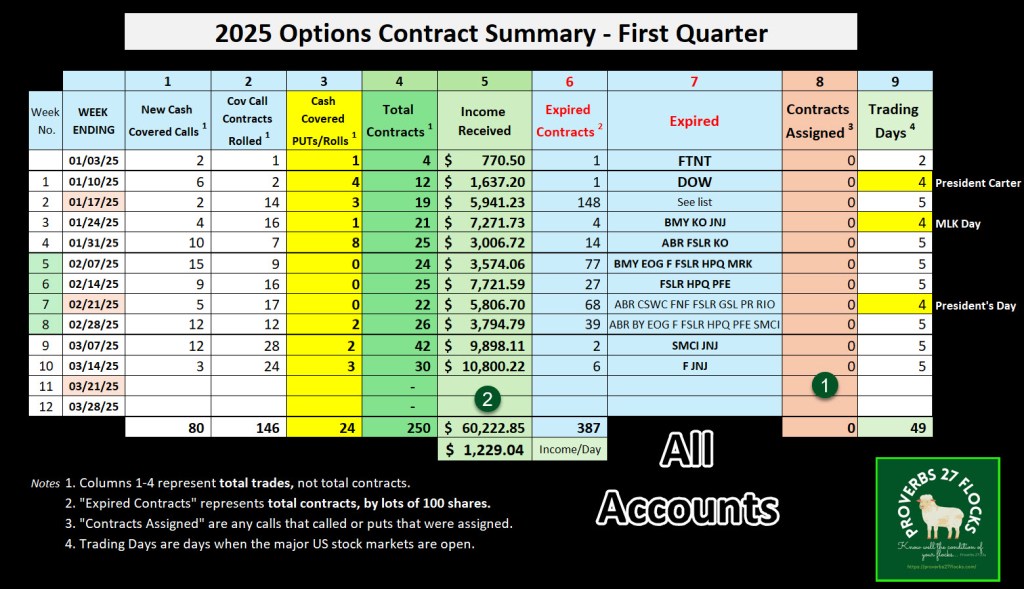

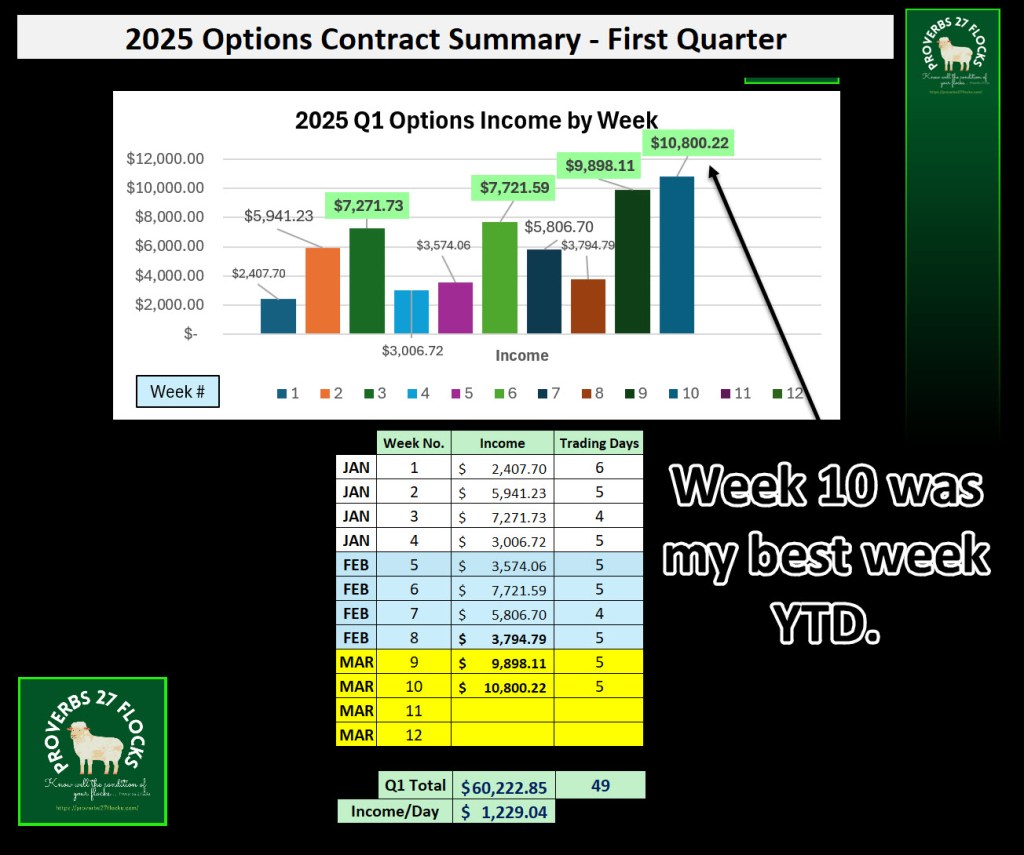

Options Income YTD

I have had far better success this year with trading options than I could have imagined. The following images show the options income for all six accounts we have where I have options trading turned on. Most of the options income comes from my traditional IRA and my ROTH IRA. In fact, of the $60K in options income for all six accounts, $17K is from just my ROTH IRA.

Training Others For Options Trading

I have found that I can communicate the basics of trading covered call options in about an hour. Recently I trained a friend, and he picked up on the concepts quickly and has already started to earn income from trading options. Bear in mind that this works best if you have the right kind of investments. You also need a minimum of 100 shares of a stock or ETF where options are traded. One good stock to start with is Ford (F). A good ETF to start with is SCHD.

What is a Covered Call Option?

The short answer is that it is a contract for 100 shares of stock which you already own. The contract has a known expiration date and price. Each time you sell an option you make immediate income. If you earn the income in a ROTH IRA it is tax-free income. If you earn it in a brokerage account, the income is taxable. If you earn the income in a traditional IRA, the income tax is deferred.

Here is a technical explanation of a “covered call” from Investopedia: “The term covered call refers to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security. To execute this, an investor who holds a long position in an asset then writes (sells) call options on that same asset to generate an income stream. The investor’s long position in the asset is the cover because it means the seller can deliver the shares if the buyer of the call option chooses to exercise.”