Wise People Make Wise Plans

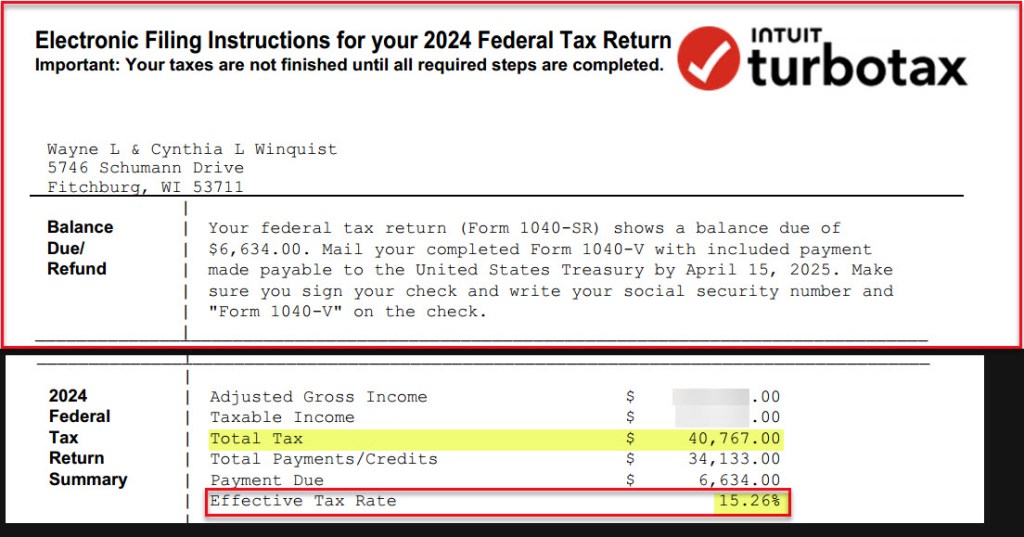

Some (if not most) taxpayers are still working on the 2024 income taxes. I am one of them. However, most of the work is completed in TurboTax Premier 2024 (desktop version). I’m now starting to think about income taxes for 2025. Having a plan to minimize income taxes and maximize charitable giving is always high on my list of things to do.

I believe there is a general misunderstanding about the tax brackets by many taxpayers. Part of this is due to the fact that many taxpayers have a professional tax preparer, or an accountant, prepare their tax returns. One misunderstanding is that if you are in the 22% tax bracket that you pay tax on 22% of your income. The reality is that your average tax is likely to be a much smaller percentage. In our case, we were into the 24% tax bracket, but our “Effective Tax Rate” is 15.26%.

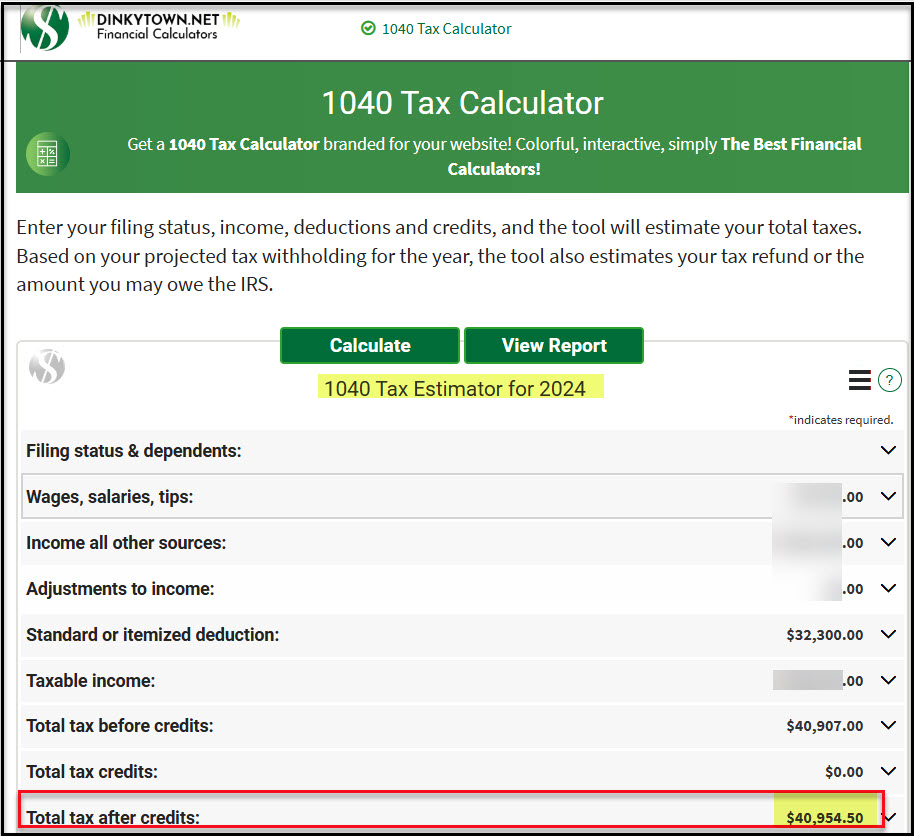

DinkyTown Results

This past year I used “DinkyTown” to estimate our tax liability. It actually works well, but I did make a mistake in entering our IRA withdrawals. I suspect my mistake was mostly due to not including a portion of my ROTH conversions for 2024. After returning to DinkyTown and reentering our total IRA withdrawals, the tax amount was accurate.

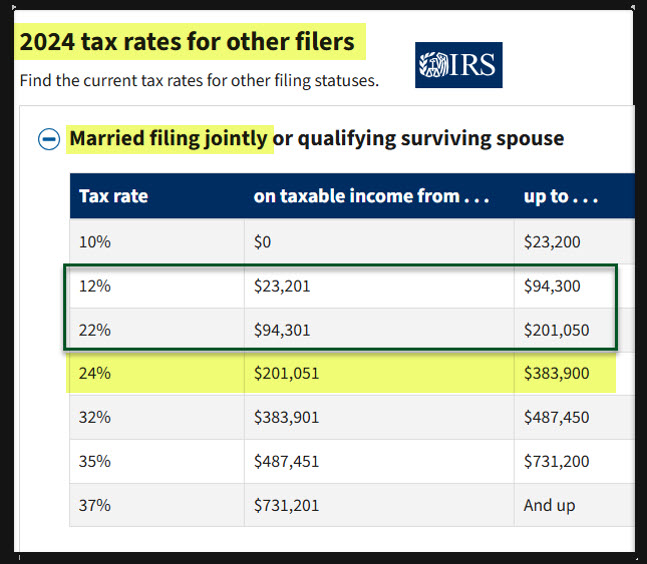

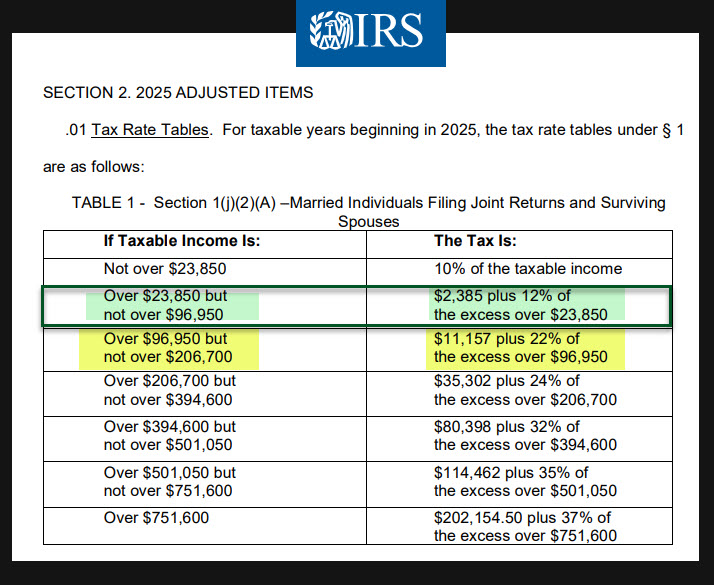

2024 Versus 2025 Married Filing Jointly Tax Rates

For this year the income levels have increased in the tax brackets. For 2024 the top income level for the 24% bracket was $383,900. In 2025 it is $394,600.

Another important number for Medicare recipients is the Adjusted Gross Income (AGI). In our case we will just squeak under the amount needed to avoid an even bigger IRMAA Medicare tax payment. IRMAA stands for “Income-Related Monthly Adjustment Amount.” It is a good thing to avoid paying extra taxes for Medicare and it is something to watch if you are doing ROTH conversions when you are on Medicare.

Therefore, when doing my ROTH conversions during 2025, my first goal is to stay within the same IRMAA bracket. This means I need to monitor our AGI total, which includes IRA withdrawals, ROTH conversions, income from taxable account investments, income from Cindie’s parttime job, and our combined Social Security income.

The Second Goal for 2025

God has given us many financial blessings. We believe that we are blessed to be a blessing. We don’t need more stuff. Therefore, the second goal is to maximize charitable giving in a tax-advantaged manner. We want to be generous, and one way to do that at my age is to take advantage of the QCD. (Qualified Charitable Distribution)

Think Biblically and Think about Eternal Treasures

Several scriptures come to mind when I think about taxes, treasures and giving. Here are some of them.

“Then the Pharisees went and plotted how to entangle him in his words. And they sent their disciples to him, along with the Herodians, saying, ‘Teacher, we know that you are true and teach the way of God truthfully, and you do not care about anyone’s opinion, for you are not swayed by appearances. Tell us, then, what you think. Is it lawful to pay taxes to Caesar, or not?’ But Jesus, aware of their malice, said, ‘Why put me to the test, you hypocrites? Show me the coin for the tax.’ And they brought him a denarius. And Jesus said to them, ‘Whose likeness and inscription is this?’ They said, ‘Caesar’s.’ Then he said to them, ‘Therefore render to Caesar the things that are Caesar’s, and to God the things that are God’s.’ When they heard it, they marveled. And they left him and went away.” Matthew 22:15-22

“Beware of practicing your righteousness before other people in order to be seen by them, for then you will have no reward from your Father who is in heaven. Thus, when you give to the needy, sound no trumpet before you, as the hypocrites do in the synagogues and in the streets, that they may be praised by others. Truly, I say to you, they have received their reward. But when you give to the needy, do not let your left hand know what your right hand is doing, so that your giving may be in secret. And your Father who sees in secret will reward you.” Matthew 6:1-4

“Do not lay up for yourselves treasures on earth, where moth and rust destroy and where thieves break in and steal, but lay up for yourselves treasures in heaven, where neither moth nor rust destroys and where thieves do not break in and steal. For where your treasure is, there your heart will be also.” Matthew 6:19-21

“Better is a little with the fear of the Lord than great treasure and trouble with it.” Proverbs 15:16

“As for the rich in this present age, charge them not to be haughty, nor to set their hopes on the uncertainty of riches, but on God, who richly provides us with everything to enjoy. They are to do good, to be rich in good works, to be generous and ready to share, thus storing up treasure for themselves as a good foundation for the future, so that they may take hold of that which is truly life.” 1 Timothy 6:17-19

Do you have a plan for 2025? If not, let me encourage you to at least think about creating a plan.

All scripture passages are from the English Standard Version except as otherwise noted.