Easy Income Must Be Sustainable

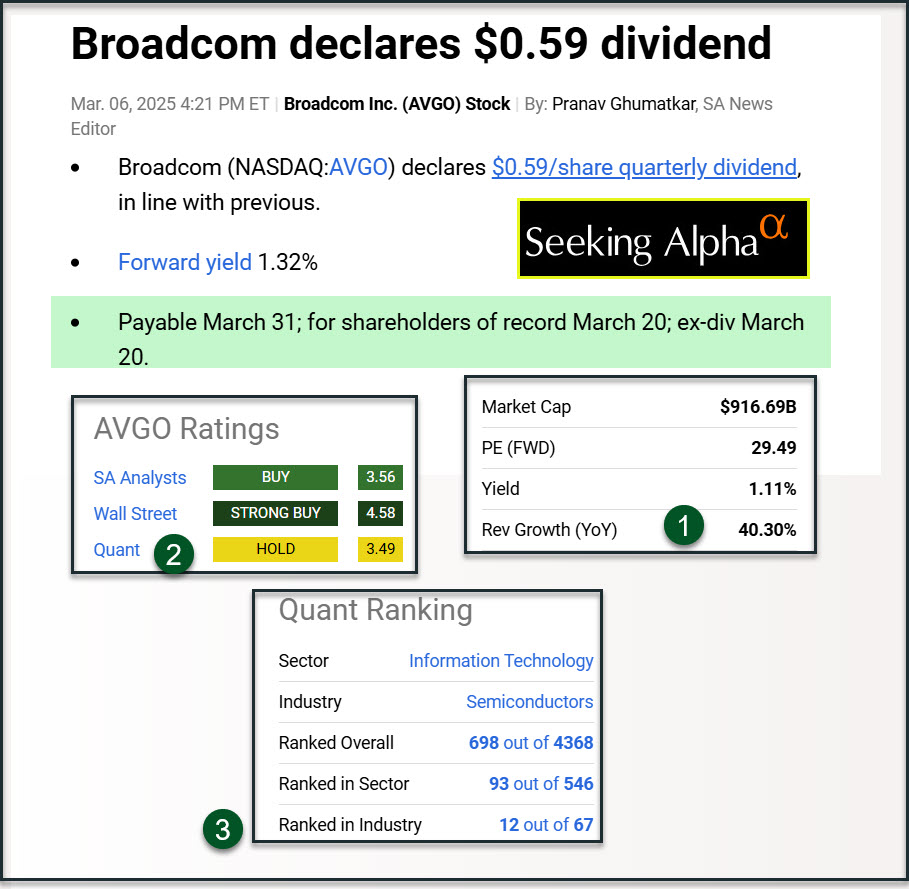

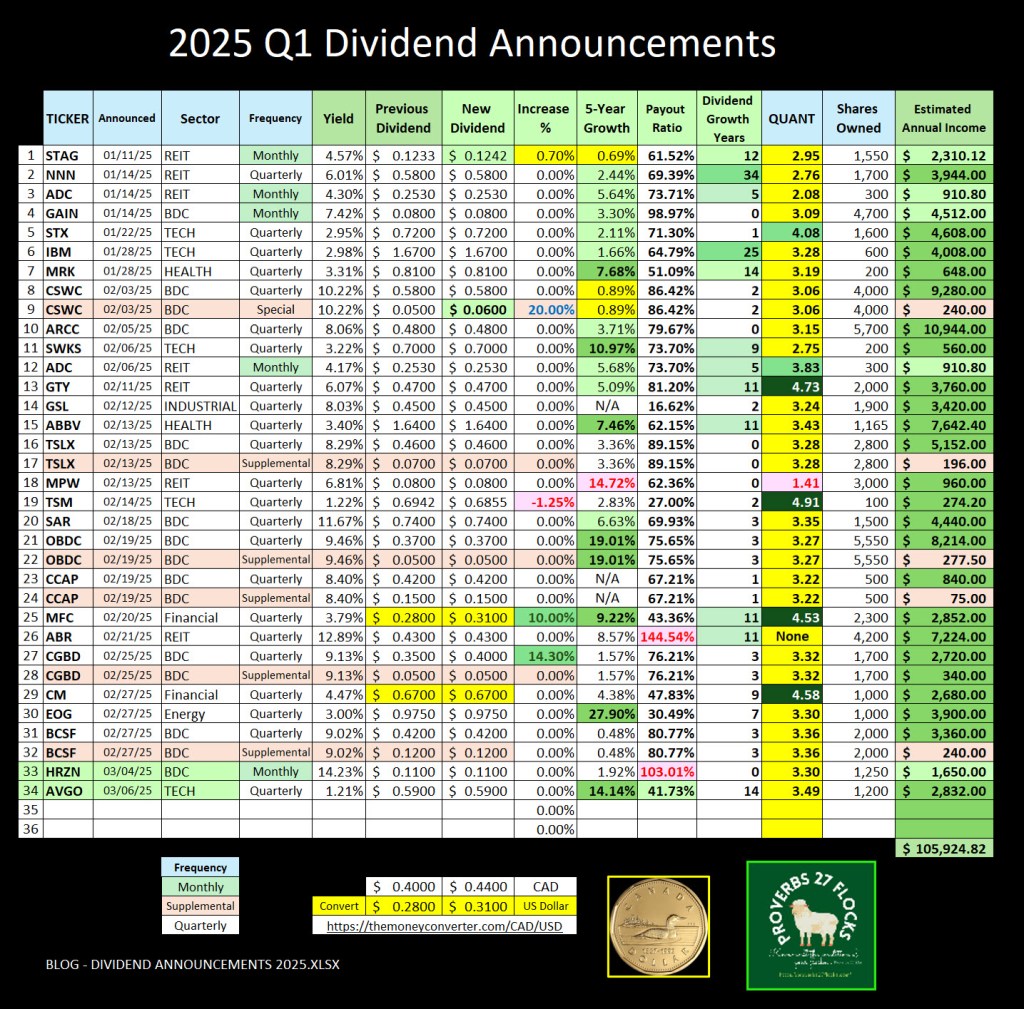

One mistake novice investors make is chasing yield. For example, if one compares AVGO with HRZN purely on dividend yield, the easy mistake is to assume that HRZN is a better choice because it yields over fourteen percent at the current stock price. AVGO, in comparison, yields only 1.21 percent. Clearly, on a yield only basis, HRZN looks tempting.

We own shares of both investments. However, our 1,200-share investment in AVGO is worth about $234K at Friday’s closing price while our 1,250 share investment in HRZN is only worth about $11,500. If you can only afford one of these two, then buy AVGO.

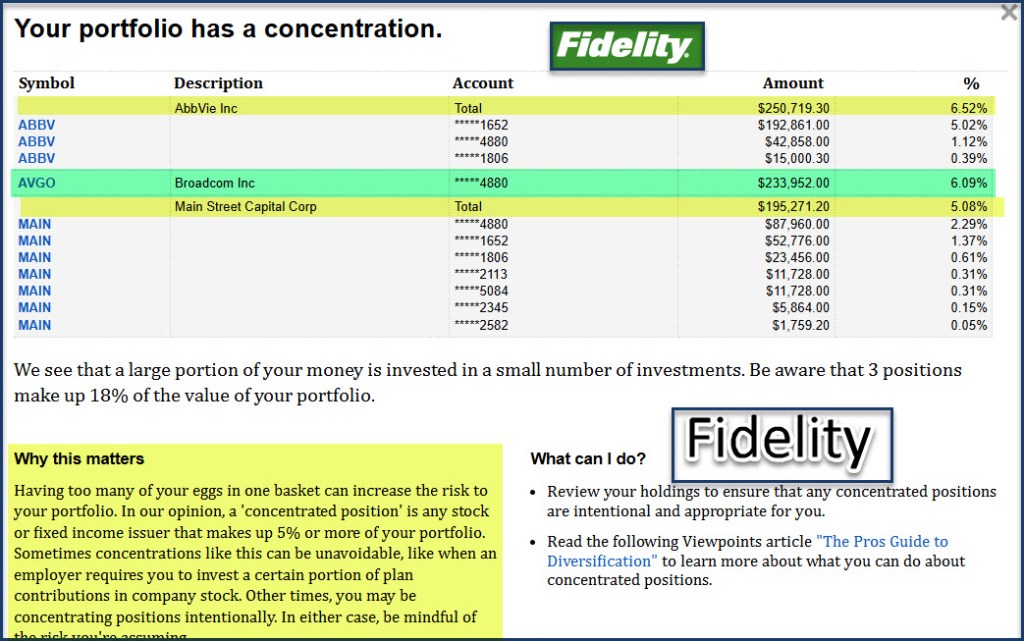

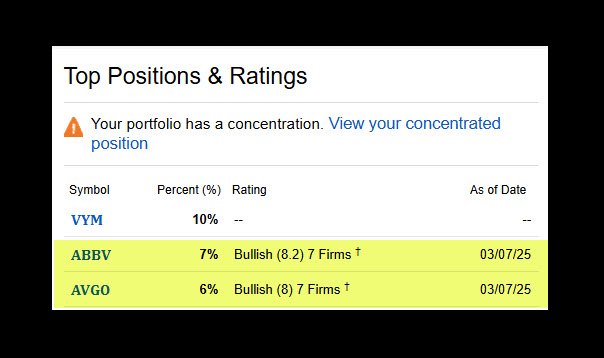

Fidelity Concentration Reminders

One of the nice things about the Fidelity Investments’ website is the ability to see the concentration of different investments. As you can see, AVGO, ABBV, and MAIN are big players in our portfolio. VYM, of course, is as well, but it doesn’t merit a warning because VYM is a diversified dividend growth ETF. VYM holds 533 positions and the top ten are only about 26% of the total. However, it is important to note that ABBV (AbbVie Inc) is in VYM’s top ten. So our ownership of ABBV is greater than Fidelity presents.

It doesn’t stop there. If you look at ETF DGRO, you will see ABBV is also in the top ten of this iShares Core Dividend Growth ETF. I also checked my ETF favorite SCHD: It has ABBV as number one in its top ten.

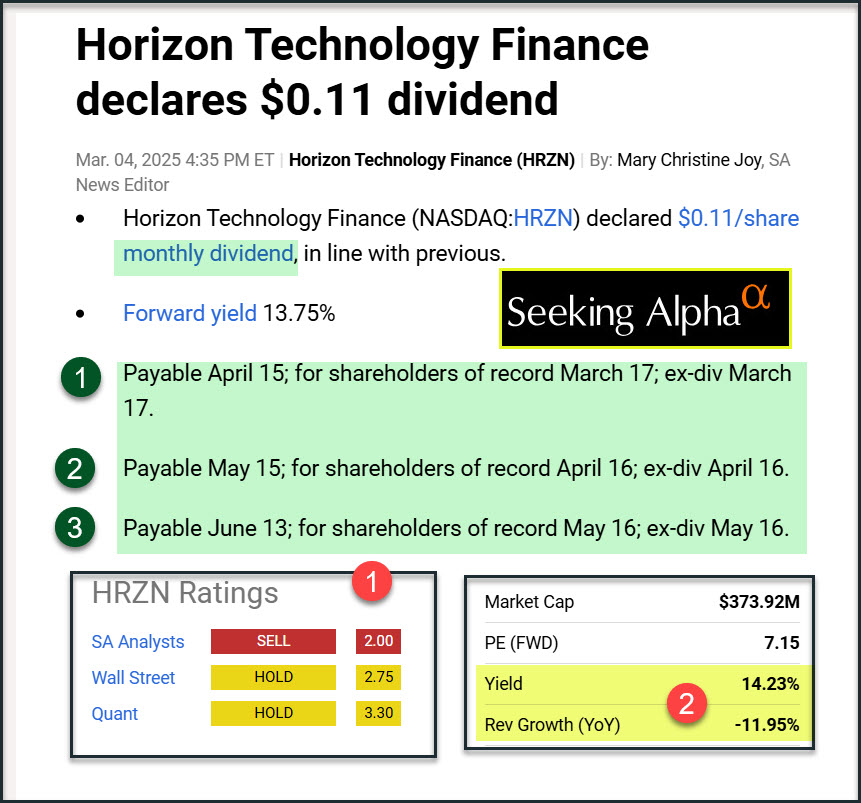

Horizon Technology Finance

HRZN announced three more monthly dividends. While this is a higher risk BDC, I will hold the shares and probably trade covered call options on the shares as well. However, wise investors will note that the payout ratio for this investment is over 100%. That is not sustainable. This is not a dividend growth investment.

Broadcom Inc.

This is clearly a dividend growth investment. It also has given us considerable covered call options income in 2025. YTD options income for AVGO is $2,178.55. Furthermore, in 2024 options income was $11,017.95. This is clearly an easy income play for dividend growth and options income. Furthermore, the dividend payout ratio is a very sustainable 41.73%.

We actually hold AVGO shares four ways: 1) The 1,200 shares in my traditional IRA, 2) the top-10 allocation in VYM, 3) the top-10 allocation in DGRO, and 4) the top-10 allocation in SCHD. Prudent investors pay attention to this overlap.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.