VYM is a Good Example

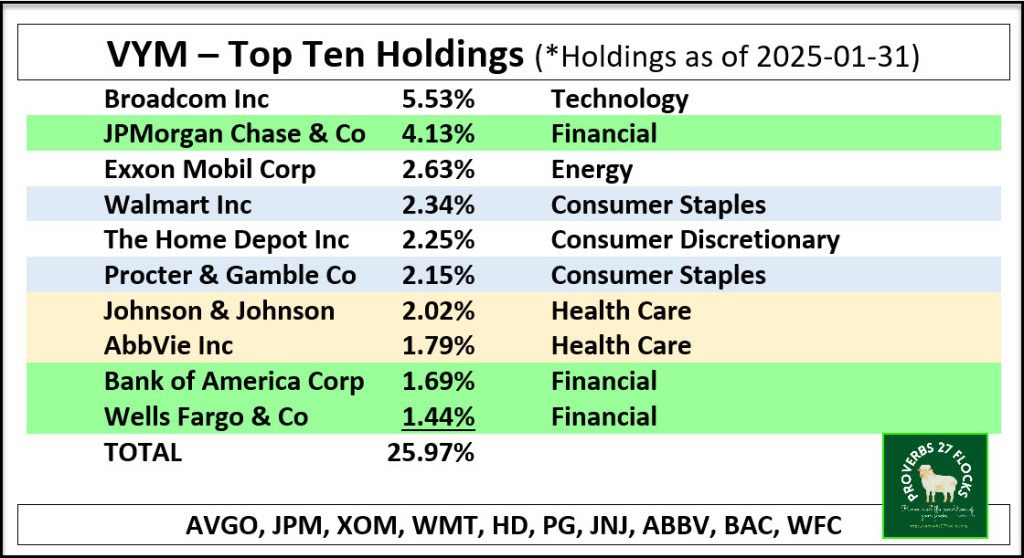

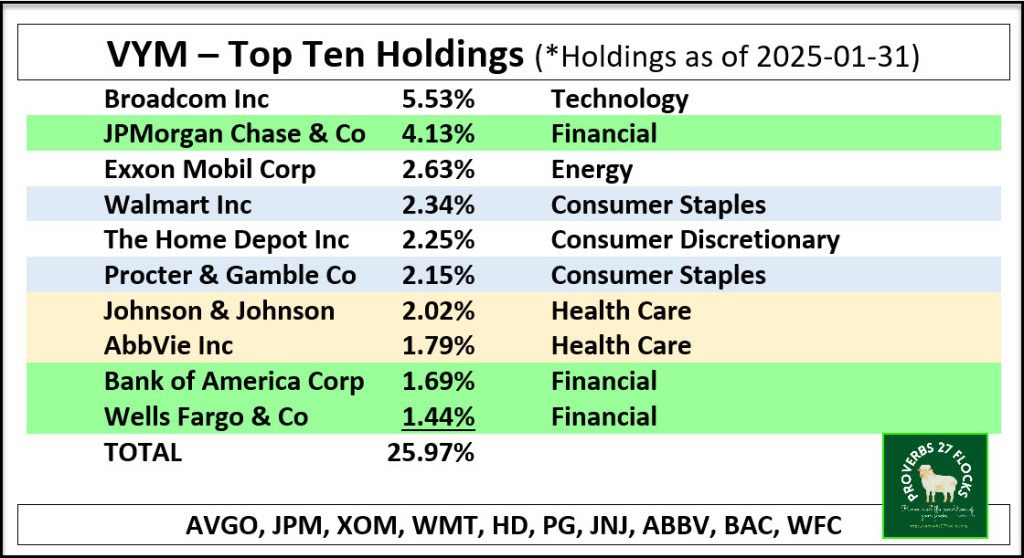

Whenever I hear about a new ETF or help a friend or reader with a review of their portfolio, I look at the “top ten” investments in each of their funds. I won’t list all of the reasons I do this, but one is to determine if there is significant overlap of the key investments that may increase risk. Too much overlap creates a lack of true diversification. VYM, for example, has a significant dollar allocation to Broadcom (AVGO) and JPMorgan Chase & Company (JPM).

Another reason is to look for opportunities for stock ownership. For example, assuming the top ten investments in an ETF are the ones the fund manager likes, then perhaps I should consider them as well. I still want to stay diversified by owning ETFs like VYM, SCHD, and DGRO, but I may want a larger piece of the AVGO pie because of the potential upside it offers for the total portfolio.

There is another reason to look at the top ten. If you want to trade covered call options, there is a good chance that the investments in the top ten of a fund have good potential for options trading. You can trade options on VYM, DGRO, and SCHD. However, ETFs typically only have monthly options, while many stocks are useful for weekly options trades.

VYM’s Top Ten

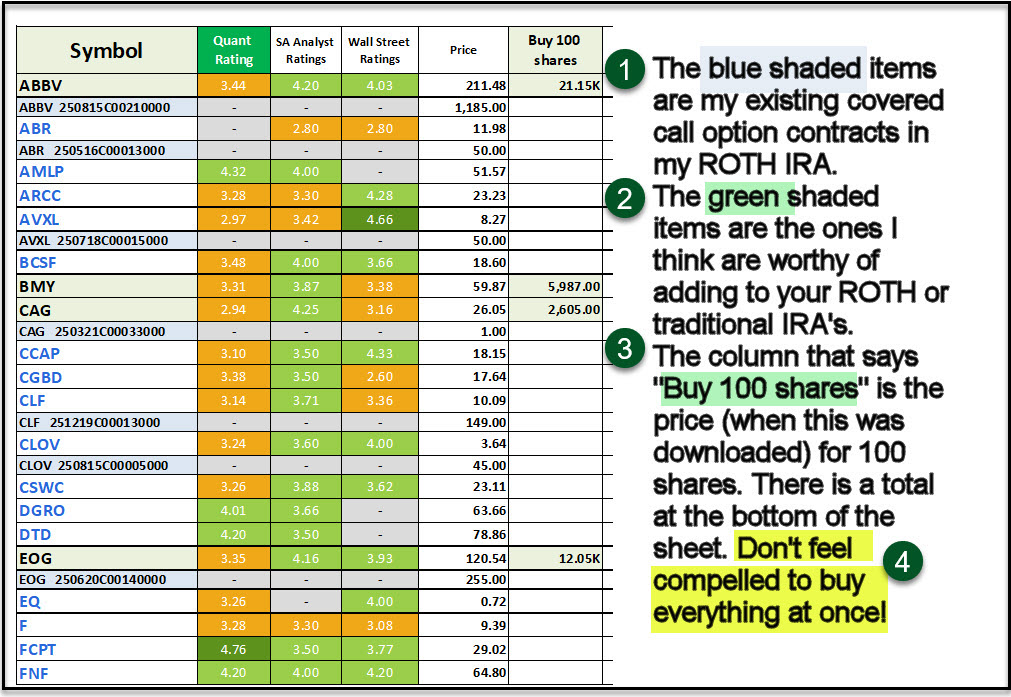

We own shares of three of the top ten investments in VYM: AVGO, ABBV, and JNJ. Each of these are good candidates for trading options. In fact, when I was training a mechanic friend this week in the way he could trade options, he told me he had cash available to purchase some more investments. I did a download of the positions in my ROTH IRA and then suggested that he buy 100 shares of several of the holdings I have in my ROTH. Included in the list was ABBV.

Using Seeking Alpha to Build a Portfolio

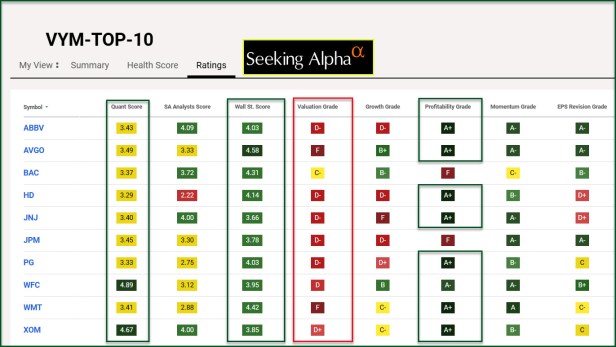

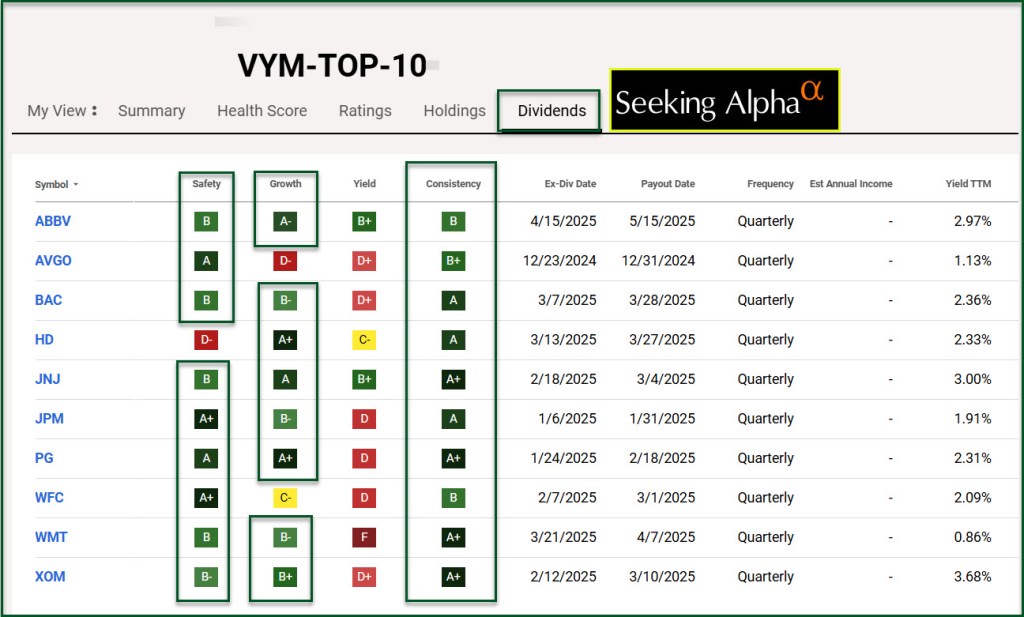

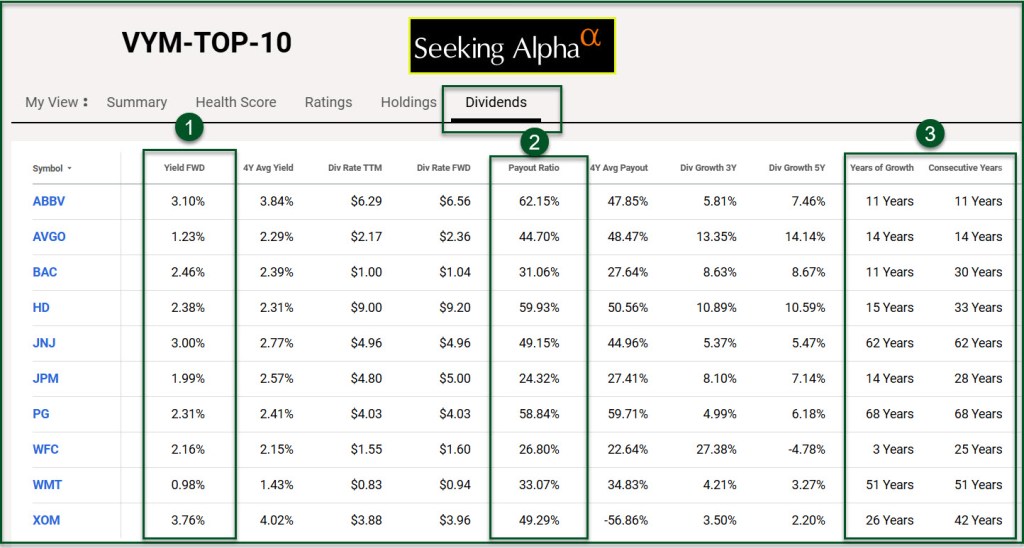

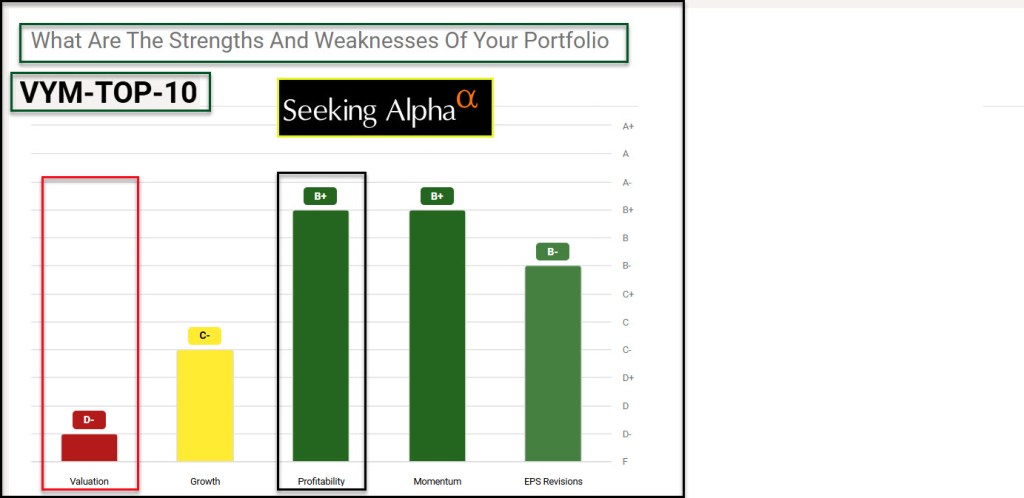

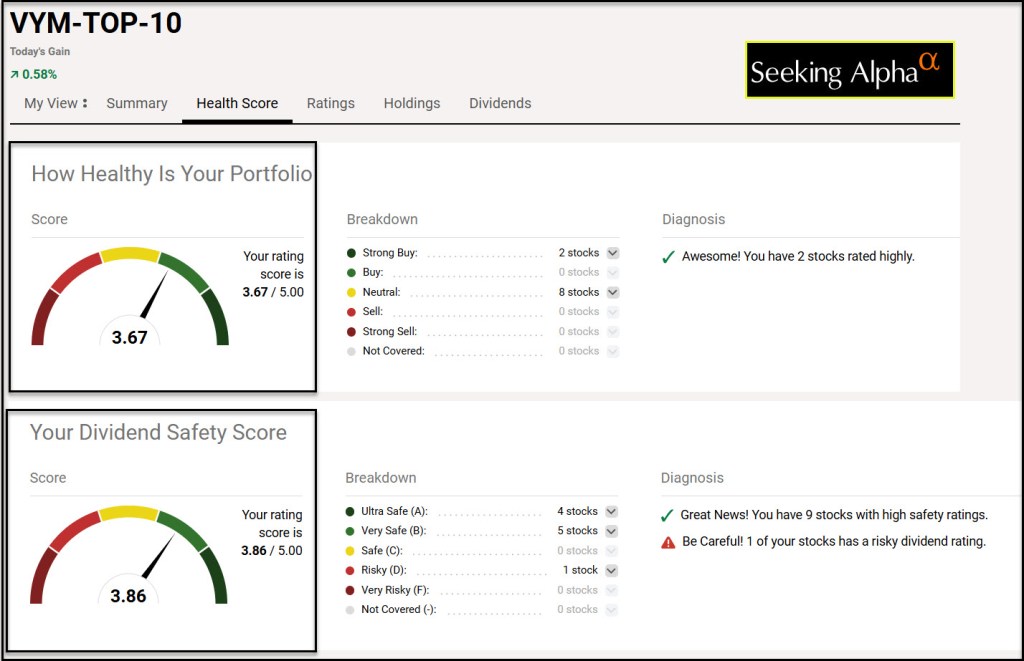

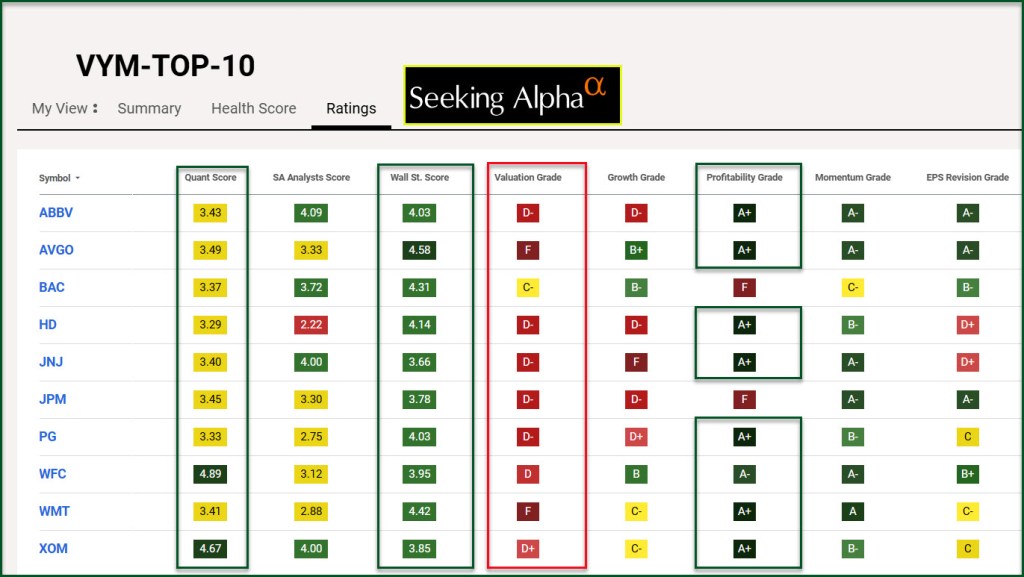

One of the ways I use Seeking Alpha is to build a “portfolio” to see if a group of investments makes sense. I created a portfolio I called VYM-TOP-10. I added the following ticker symbols to this make-believe portfolio: AVGO, JPM, XOM, WMT, HD, PG, JNJ, ABBV, BAC, and WFC. These are the top ten investments in VYM.

That makes it easy for me to do analysis about the top ten, including QUANT rating comparisons, dividends, dividend growth, the dividend payout ratios, and the “health score” of the top ten investments in VYM. What follows are some images that illustrate the information you can quickly see my using this tool for the analysis of any ETF that holds stocks.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.