They Are Simple Fundamentals

How did I become successful as an investor? Am I smarter than others? Absolutely not. Do I know some “secrets” that are hard to find? That is ridiculous. Like most things in life, regardless of your education or skills, it is possible to become successful by doing some basic things well and then by continuing to repeat those behaviors. Here are five for you to consider.

Learn

Probably the most important thing an investor can do is learn. We spent the first seventeen years of our lives in learning. Some of the things we learn have practical value. One thing is often lacking in those school years: how to leverage the wealth you receive so that it can grow your flocks and herds (Proverbs 27:23). Even more appalling is the lack of basic money management skills.

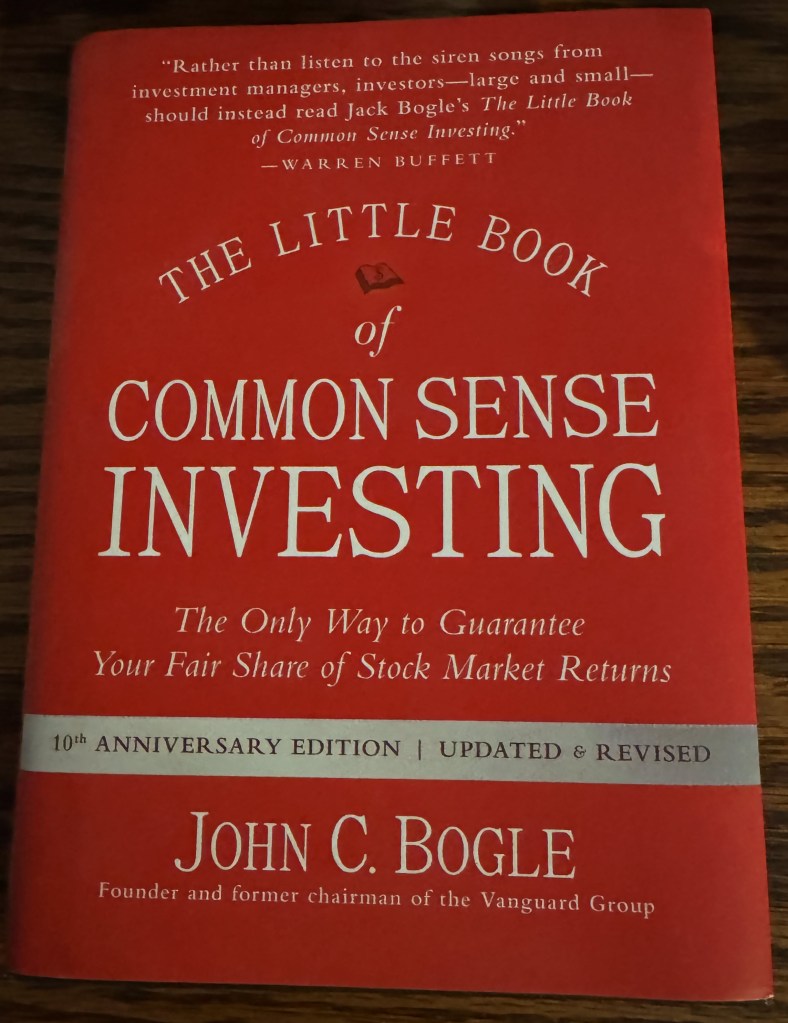

I have found some books about investing that are more helpful than others. If you are going to read only one book, then the one I recommend is John C. Bogle’s The Little Book of Common Sense Investing. Bogle was the founder of the Vanguard Group.

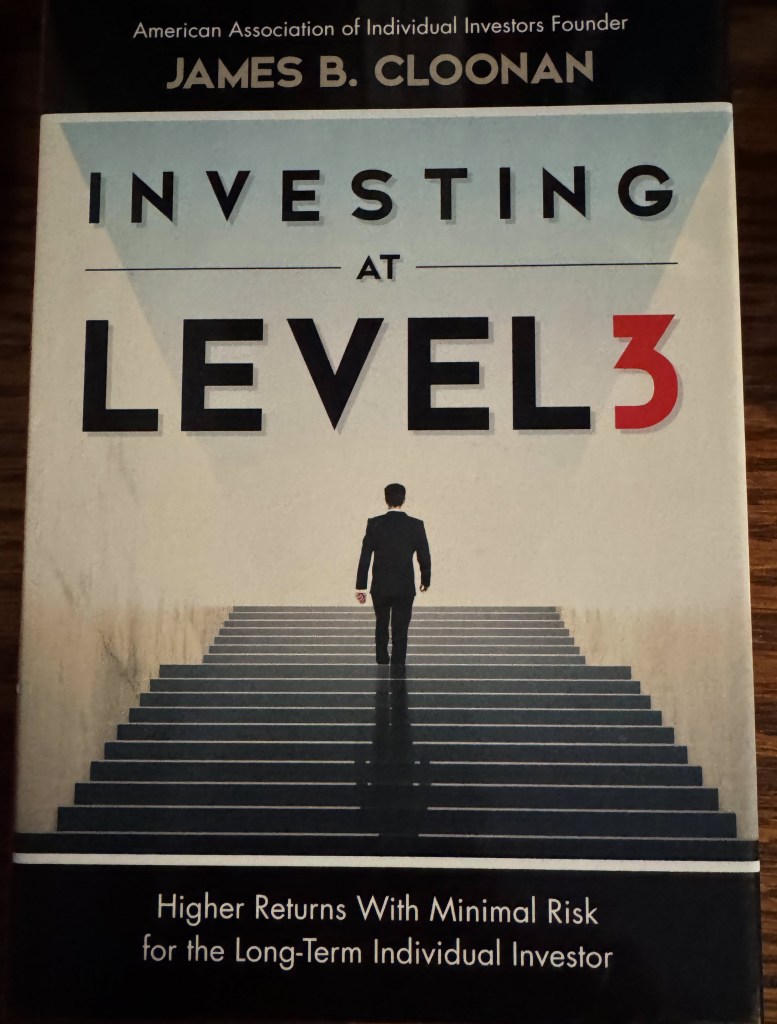

The second most valuable book is James B. Cloonan’s Investing at Level 3.” Cloonan was the founder of the AAII (American Association of Individual Investors).

The next choice would be a book about dividend investing. Most of the ones I have are dated, but the principles that are discussed are still valid.

Start Early

The first $10,000 you save is far more valuable than the last $10,000. Start early to set aside money for your retirement. The money we invested in the first ten working years of my time at Universal Foods Corporation are the fuel that became the powerhouse of my traditional IRA.

That is one of the reasons I opened UTMA accounts for our grandchildren. It is also why Cindie and I give each teen grandchild $2,000 to fund their Fidelity Youth Account when they reach the age of thirteen.

Do Not Listen to Everyone

The guys or gals at the water cooler or in the lunchroom are not necessarily informed investors. I can say with certainty that most of the next hot investment ideas have room for skepticism. I say this because more often than not I have personally seen the results in the investment statements of the people I help. If you get an idea from a friend, family member, or coworker, check out the QUANT rating on the Seeking Alpha website to verify that it isn’t a ship ready to run aground or be torn apart on a rough and rocky coastline.

Do Not Hope for Home Runs

Stay in the game and keep hitting singles. Most investors can do this, and you will win more frequently with patient progress than by wild swings of the investment “bat” looking for triples or home runs. This is related to “Do Not Listen to Everyone.” The best way to hit singles is to buy and hold good ETF funds with low expense ratios and ten-year total returns that exceed 150%.

For example, the ten-year total returns for ETF VYM (Vanguard High Dividend Yield Index Fund ETF Shares) are 163.4% (Source: Seeking Alpha). DGRO has a ten-year total return of 205.5% (much better than the S&P 500), and SCHD has a return of 196.8%. By way of comparison, VOO (Vanguard S&P 500 ETF) has a ten-year total return of 234.7%. Clearly VOO is the big winner but be careful. The top ten investments in VOO make up 36% of the S&P 500. Furthermore, it is unlikely that you can live off of the dividends from VOO, as the yield is a paltry 1.26%.

Buy Low and Sell High

That is easier said than done, but you can learn something important from this statement. When there is a bear market and the price of the shares of most investments drop, buy more. Do not sell good investments during bear markets or during times of market volatility.

Another discipline is knowing when to sell. If your advisor tells you that you can “buy and hold forever” any investment you should start to hear alarm bells. You should have “rules” for when you will sell. If, for example, a stock does so well that it goes from three percent of your portfolio to six percent, it is time to sell half of your shares. A good rule is to avoid holding more than five percent of your portfolio in any single stock.

This rule does not apply to ETFs. It is perfectly fine to hold more than five percent of any good ETF. For example, VYM makes up seven percent of the total investments in my traditional and ROTH IRA’s combined. If we include all of the accounts Cindie and I have at Fidelity, then VYM makes up nine percent of the total.

I have learned much from what others have written on Seeking Alpha. That is another benefit of using that resource.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.