Quick Looks at Your Account(s)

Although I do not use the Fidelity iPhone app for buying or selling investments, it is a place where I can quickly see some information that can be useful when traveling. It also has a feature to deposit checks, although I recently learned from a friend that Fidelity has a $1,000 limit for deposits using that functionality. (That seems odd to me.)

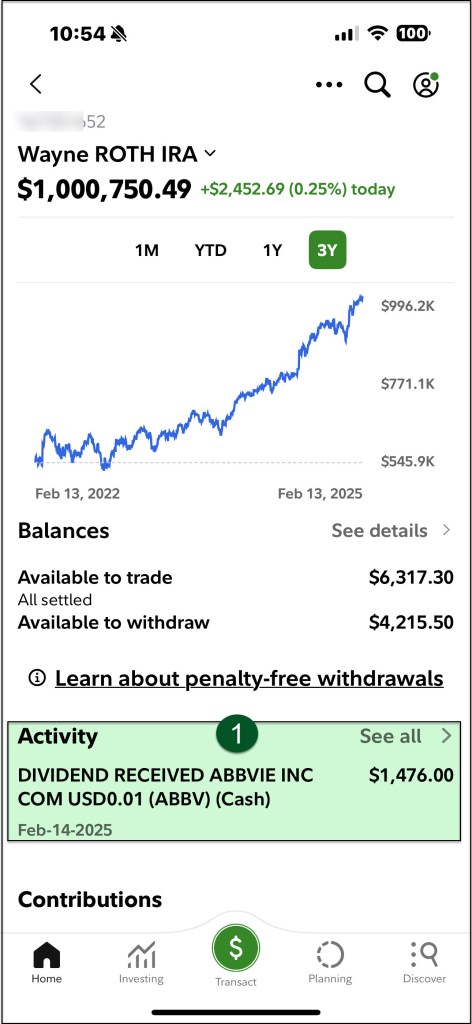

Account Activity and a 3-Year Graph

It is helpful to look at a graph. In this image I can see the growth of my ROTH IRA over the last three years. Some of this is the result of ROTH conversions, but I did not reach $1M just by converting assets from my traditional IRA. This image also reminds me that $1,476 of dividend income was posted to my ROTH IRA account.

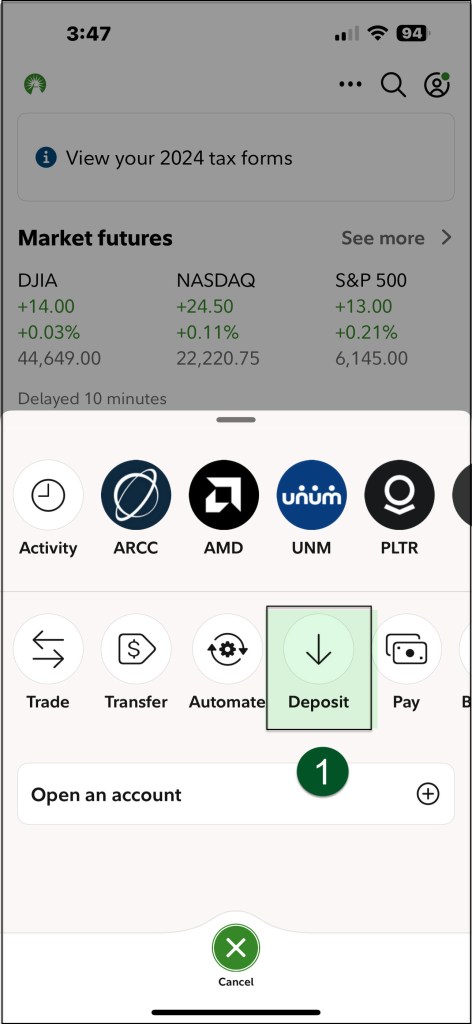

Deposit Checks and Earn Interest and Dividends

I use the deposit feature about once each month. The money is deposited to our Fidelity cash account. This account is used to pay the bills like our VISA monthly payments and our utility bills. I would not return to a regular bank for any reason. We can get cash from an ATM and in the last five years we have earned over $1,000 in dividends ($414 of that was from money market fund SPAXX) and $546 in interest. Our bank gave us nothing when we had our money in their checking account.

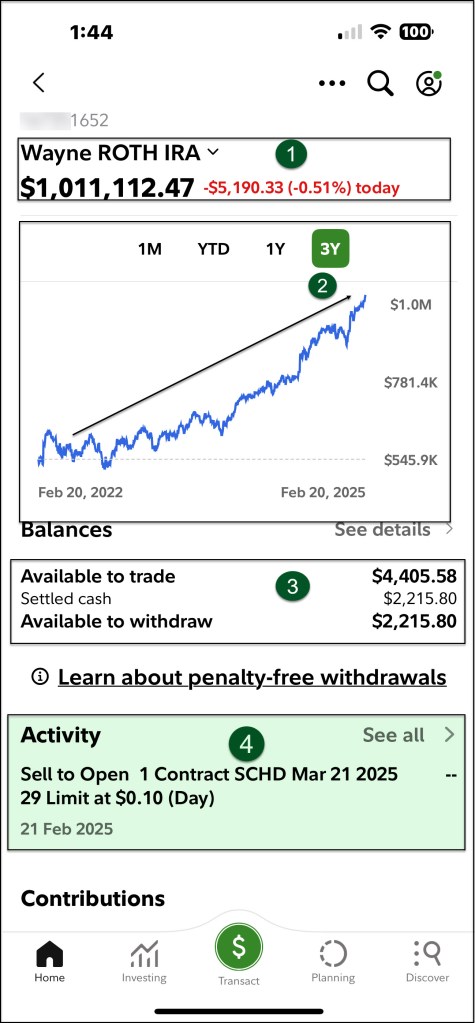

Options Covered Call Updates

This image shows me a number of helpful reminders. It tells me how much cash is available in my ROTH account for trades (3). When I took this screen image I had just traded a covered call option on 100 shares of my SCHD ETF shares in my ROTH IRA (4).

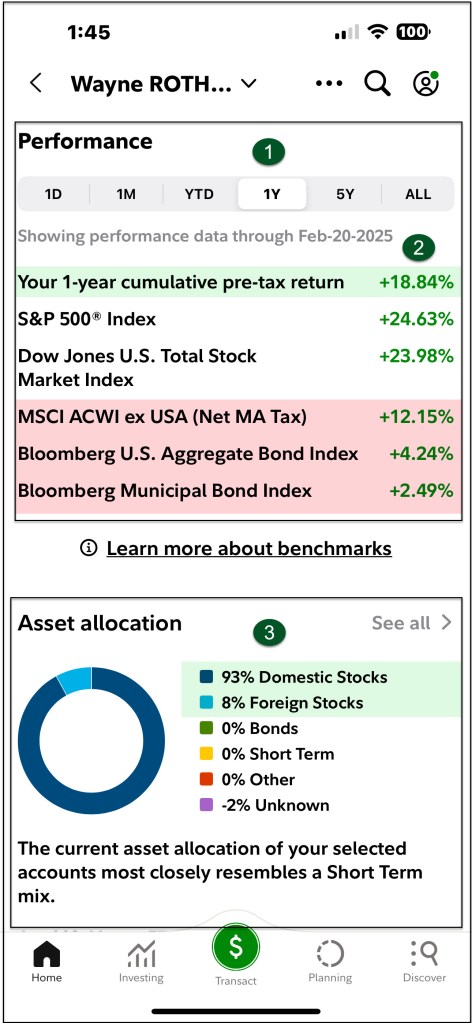

Account Performance Information – 1 Year

Another prudent benchmark is the return on your investment. For my ROTH IRA, the 1-year return currently stands at 18.84%. Some would say that I could do better if I invested in an S&P 500 ETF or mutual fund, as the 1-year returns on those funds is likely to be higher. The same is true of the Dow Jones U.S. Total Stock Market at about 24%.

However, many financial advisors and brokers don’t structure a portfolio for income in retirement. They also tend to increase bond holdings over time, which greatly dilutes your returns. Notice the returns on the Bloomberg bond indices is less than 5%. Even the international (ex-USA) index underperforms the returns I receive.

Do you know your returns? How much do you pay your advisor to achieve those returns? Could you live off of the income from your holdings in an economy with 3-4% inflation?

Asset allocation also matters because your allocation will impact your returns. This same image from my iPhone shows that I have 93% of my ROTH assets in US stocks and another 8% in foreign stocks. (This is obviously incorrect because this means I have 101% invested in the market.) However, the “Unknown” is negative 2% in an attempt to make the numbers rational.

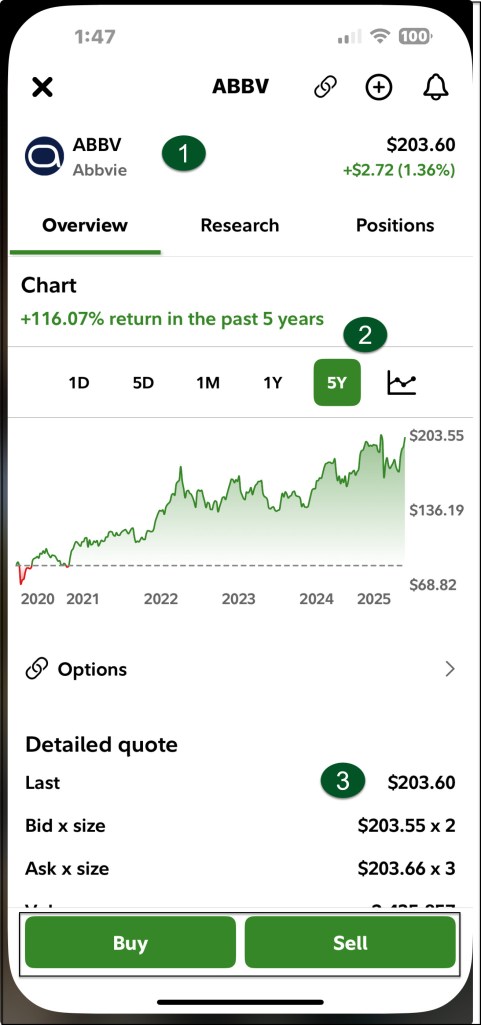

Stock Quotes

This example shows ABBV. We own 1,170 shares of this biotech healthcare company, but 900 of the shares are in my ROTH IRA. I did IRA conversions in the past when the share price dropped. That means the quarterly dividend for those 900 shares is tax-free income of $1,476. That is quarter-after-quarter income that has a history of growing. The five-year dividend growth rate is 7.46%. For 2025 I can expect to receive $5,904 in tax-free income from my ABBV shares. This is regardless of what the market does on any given day.

ABBV is the top investment in my ROTH, making it 18% of that account. However, across all of our accounts it is not that big.

For my traditional IRA plus the ROTH it makes up 8% of the total, and for all of our accounts it is about 6%. I trade covered call options on some of my shares as well. Since the beginning of this year my tax-free options income for ABBV is $3,094.61. This makes this a very profitable holding.

Summary

There are three different ways to trade using the tools Fidelity provides. My favorite is Active Trader Pro. That is software that runs on my laptop. You don’t have to be an active trader or a “pro” to use the software. However, this software makes it very easy to trade covered call options and cash covered put options. It also makes it easy to roll options. So far this year I have received $38,575 in options income on our investments at Fidelity. This is in addition to dividend income. I have been fortunate to achieve this income without losing any of our shares.

The second tool is the website. It is helpful for researching investments and monitoring our portfolio of investments. It is the tool I use to look at all income for the day and to monitor the 5-year and 10-year performance of our eight Fidelity accounts.

The third tool is the iPhone app. It is useful for a quick look during the day. I have entered a few trades using the iPhone, but Active Trader Pro is far superior for many reasons.