Inflation Doesn’t have to Win

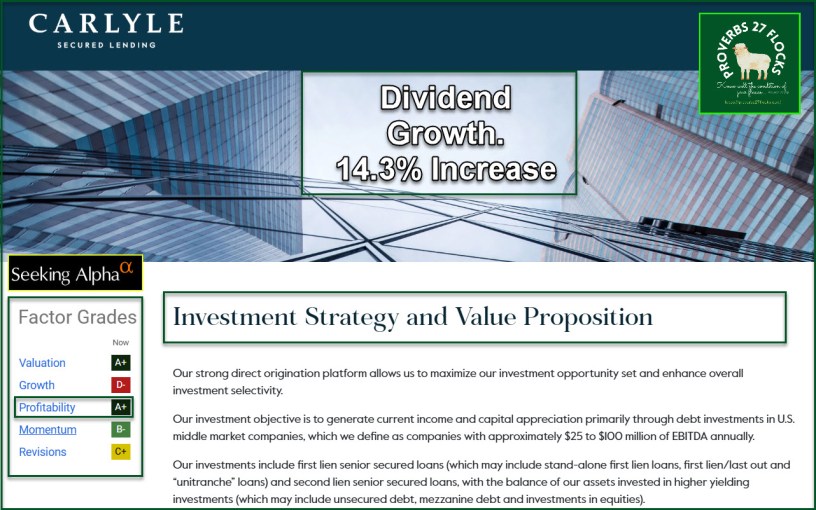

A dividend increase of 14.3% is far more than I expect. Then, to make it even sweeter, there is another supplemental dividend. Therefore, the total announced dividend is $0.45 per share.

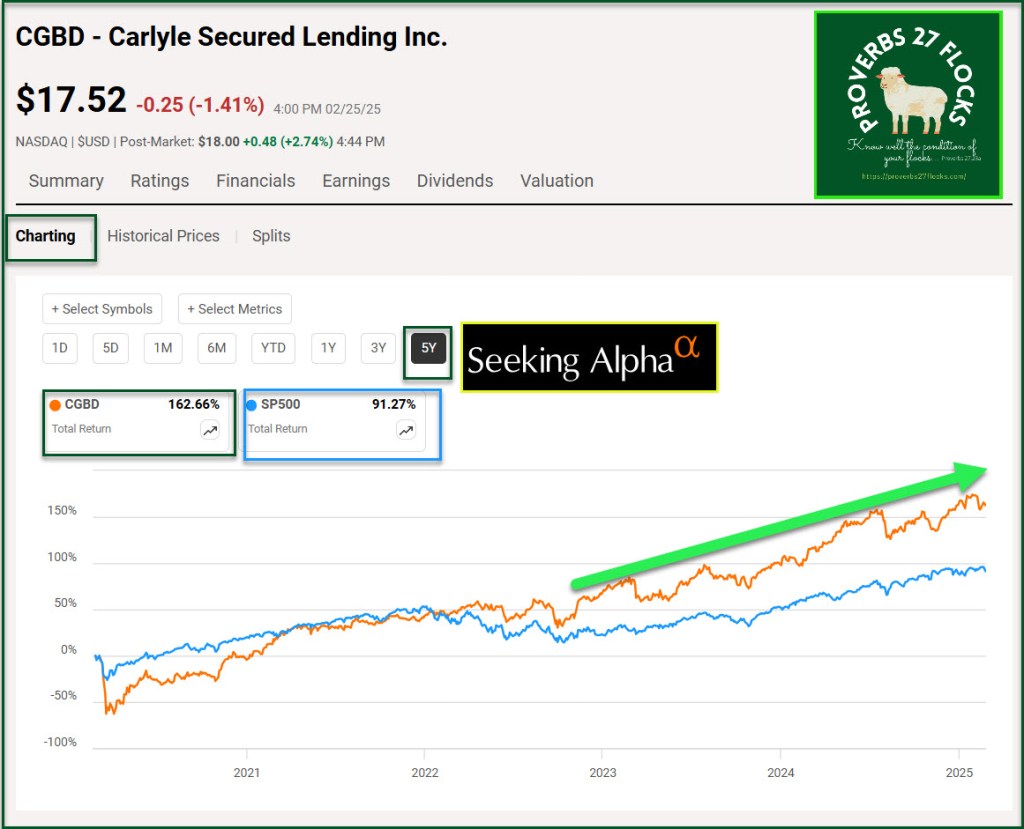

CGBD Total Returns

It isn’t possible to see 10-year total returns for this BDC because they don’t have ten years of history. Therefore, it isn’t possible to see a good comparison with the S&P 500. However, the 5-year returns paint a different picture. CGBD’s 5-year returns are an amazing 162.66%. It is always wise to pay attention to NII (Net Investment Income). Income is what pays for the dividends.

2025 Q1 Announcements

We still have another month to go for possible dividend increases. I’m pleased with the progress and think our mix of REITs, BDCs and dividend growth stocks makes sense for a solid income stream.

March 2025 Forecast

At the beginning of every new month I usually download our positions from Fidelity as a “csv” file. It is possible to sort and filter by dividend pay date. This image shows that our expected March 2025 dividend income will exceed $17K. However, it is highly likely that the real number will be more like $20K. The reason is that ETFs like VYM, DGRO, and SCHD will announce their dividends near the end of March and pay within March. Money Market fund SPAXX will also pay a handsome dividend.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.