A Reader’s Question

Because I believe in “easy income” from regular, sustainable, dividends and dividend growth, I would be concerned if a stock (or ETF) I held decreased its dividend. There are three things to remember when looking at dividends. A reader’s question reminded me that not everyone understands these three fundamental pieces of dividend investing.

Scot’s Question

“I have a position in MAIN that I established over a year ago and have enjoyed the success with that. However, this year, I was looking at my Schwab account regarding dividend income and it shows the projected 2025 income to be $2,000 less than what I got in 2024. All of my other dividend stocks project an increase for 2025. I was just wondering if you see the projected decrease in your income from MAIN?” – Scot

The Short Answer

If we compare 2024 with YTD 2025, the answer is “yes” and it is also “no.” The key is in the understanding of the different types of dividends. There are regular monthly or quarterly dividends and there are sometimes special dividends that are “other” dividends. You can generally count on the normal quarterly dividend or monthly dividends if the company is solid. You cannot depend on special dividends as a normal expected income stream. Therefore, I believe what Scot is seeing on his Schwab account is a realistic, but not true comparison of MAIN. I suspect that Schwab is telling him that he cannot count on the same “other” dividends he received in 2024 to reoccur in 2025.

Three Fundamental Pieces

The first is that some investments pay dividends that are not in a gentle upward climb. Take, for example, ETFs like VYM and SCHD. If you only compare this quarter with the previous quarter dividend you might be ecstatic or depressed. You shouldn’t be either. Rather, you need to look at the entire year’s payout to know if the dividend increased or not. Another way to do this is to compare Q1 of this year with Q1 of last year. While that may sometimes disappoint, it is best not to rush to judgment about the growth of the dividend based on a comparison of only one quarter.

The second piece is that there are some companies (especially some BDCs) that have a history of paying special “other” dividends. However, history for special dividends is extra frosting on the cake, not the cake. The cake is a regular dividend. So for monthly dividend stocks, you have a twelve-layer cake, and for quarterly dividend payers you have a four-layer cake. Don’t expect the frosting, but be delighted if your cake comes with it.

The final piece is that different providers show comparisons year-over-year differently. When you are looking at Seeking Alpha you can get a better picture of the reality of the dividend history and track record for just about any investment. Also, note that while Seeking Alpha calls some dividends “other” they can also use the word “special” and sometimes you will see “supplemental” to describe the “other dividend. Here is a helpful link on INVESTOPEDIA.

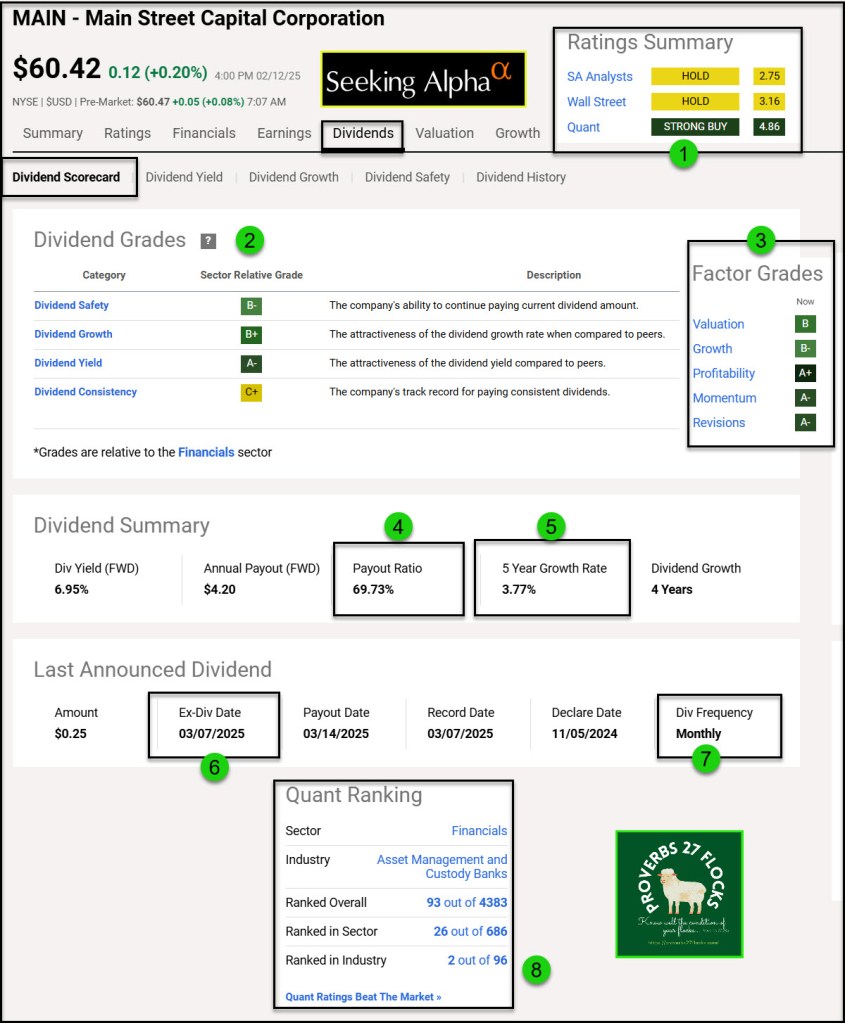

Here is what we can learn about MAIN’s dividends on Seeking Alpha.

Recommendation

If you are going to buy dividend growth stocks and ETFs, you should use some good tools. Of all of the resources I use, the most helpful is Seeking Alpha. The QUANT rating is very helpful. The Dividend Scorecard is a huge help as well. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

Seeking Alpha Terms of Use

It pays to know the fine print.