How Long Did You Study in High School and/or College?

The hours I spent in high school and in completing assignments were considerable. Then, to get my bachelor’s degree I spent another huge chunk of time. I don’t really know how many hours were involved, but I would be surprised if it was less than 3,000 hours. That time paid off, with God’s blessing and enablement, so that I was able to earn a good salary for the last 20 years of my working life in Information Technology.

The time I spent learning about dividend growth income and the pieces of the dividend income puzzle was far less. I have no idea what the total time has been, but it is probably about 50 hours. That study has paid off handsomely.

The time I spent learning to trade covered call options was probably less. If I had to guess, it was probably at least 20 hours. Because I already had knowledge about percentages and Excel, and I had a good working knowledge of Fidelity’s Active Trader Pro software, I was able to put that short study time to good use in generating income in retirement.

The good news is that it doesn’t have to take 20 hours to learn how to trade covered call options successfully. I taught one of our nephews the skill using Fidelity’s Active Trader Pro in less than four hours. Here is one YouTube video I created to help show the basics of options trading: LINK

It is also possible to “roll” a covered call option. This essentially creates more income and reduces the likelihood of having the shares called away. Here is the video LINK for that type of trade.

Let me show you what is possible if you build a good dividend growth portfolio with ETFs and a nice selection of dividend growth stocks. I will use January 2024 and 2025 to help you see the power of learning how to trade covered call options.

Easy Income Includes Dividends with Dividend Growth.

Our total January 2025 dividend income was $12,302.39. This was better than January 2024’s dividend income of $11,880. What is even more amazing is the options income for January 2025: $18,627. In other words, the income I thought we would have based on my thinking five years ago has more than doubled by adding options trading to the plan. Total January 2025 income (excluding Social Security) was $30,929.

My conclusion is that the 20 or so hours I spent learning to trade options has a very good ROI. (Return on Investment.)

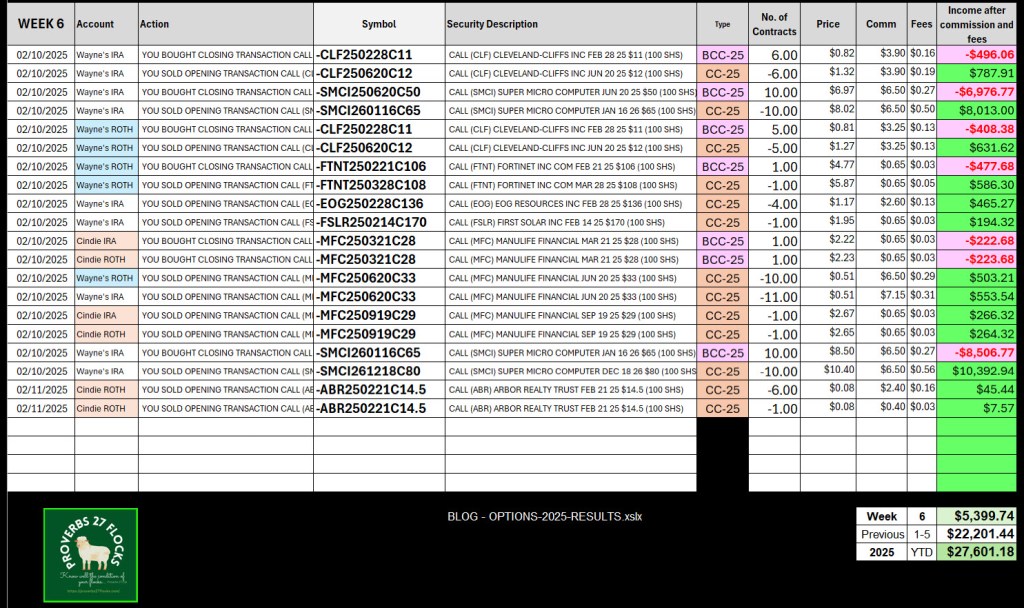

2025 YTD Options Contract Summary

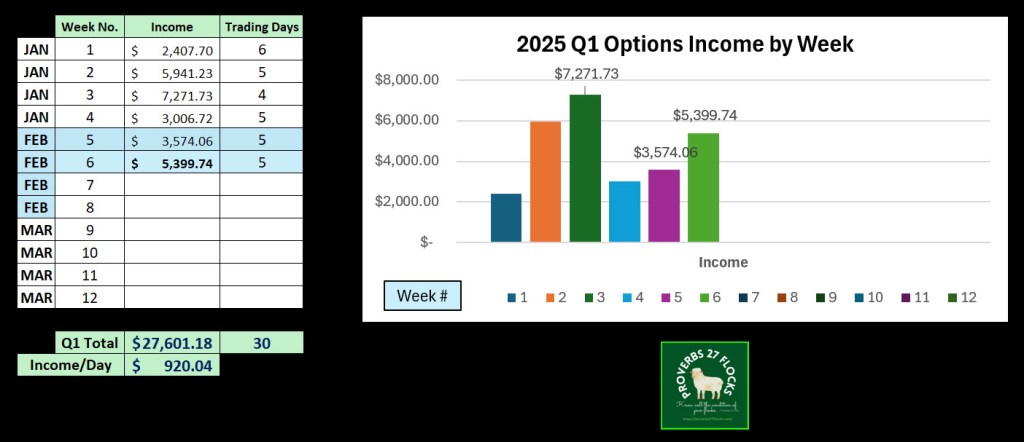

The amazing thing about trading options is that daily income far exceeds what I would have thought possible. While this might hold for the entire year, my average income per day (only days the market is open) is now $920. To put this in perspective, it takes less than two hours to enter and monitor the options trades. In addition, there are days when I don’t trade any options.

For example, I did not trade option contracts on January 7, 9, 15, or 30. I also did zero trades on February 7. Therefore, there are 25 days when I did trade, and five when I did not. That makes my income per day more than $920 if those dates are excluded: $1,104/day. If you do the math, I make about $500 per hour trading options. This is because it takes just minutes to research and enter a trade.

Options Trades 2025 Week 6

When week six began I did not have high expectations. However, the upward bounce of our SMCI shares changed that reality. I was also able to enter contracts for other positions that had expired options from the previous week.

Expired Contracts 2024-2025

In my past analysis of “expired contracts” I was using numbers that did not reflect the true number of expired contracts. I was counting each group of contracts for a stock as one expired contract. However, if I have 500 shares, and each one is a contract of 100 shares, then if the contract expires, there were five expired contracts, not just one.

In 2024 (using the better logic), there were actually 725 expired contracts. That is a good thing. It means that I got to keep 72,500 shares of stocks/ETFs that were associated with those contracts. For 2025 YTD I have 245 expired contracts, which are equivalent to 24,500 shares. This trend is a good one, as it allows me to keep receiving dividends on my shares and I can enter new contracts on those same shares again.

Assigned Contracts 2024-2025

In 2024 there were 40 contracts assigned. This means I sold 4,000 shares of stocks, including shares of UAL and SAVA. Please note that neither UAL nor SAVA paid a dividend, so I did not lose income when those shares were called away. In 2025 I have had good success in keeping my shares. So far no shares have been called, but that isn’t likely to continue. I expect my Coca-Cola (KO) shares to be called on Friday.

YTD 2025 Net Growth Over 2024

It is difficult to know how the year will play out, because there are times when trading covered call options is prone to more “risk.” However, for January 2025 I greatly exceeded the 2024 January options income. I earned $15,590 more in 2025. The same is now playing out for February. I have already exceeded last year February’s options income by $5,689. On a year-to-date basis, therefore, I am already over $21K in additional income compared to 2024.

Options Income Per Week Graph

This image helps me see the weekly income. This is also a good reminder that the new week might not be as good as the previous week. The good thing about trading options is that you don’t have to enter options trades every day to have success.

Conclusion

How long did you study to grasp and use Algebra or to learn to speak a foreign language? If you work in a trade, how long did you work under the guidance of a skilled plumber, electrician, or mechanic to gain the skills you needed?

Don’t sell yourself short. With a little bit of extra effort you can learn how to trade options. If you spent one hour per week learning more about options for two years, you would become something of an expert. Of course, this means you have to read, watch videos, and ask questions of someone who knows how to trade options contracts.

Recommendation

If you are going to trade options, you should use some good tools. Of all of the resources I use, the most helpful is Seeking Alpha. The QUANT rating is very helpful. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

Seeking Alpha Terms of Use

It pays to know the fine print.