UTMA MAIN Shares

In February 2020, when Covid fears were high, I purchased three shares of MAIN for each of our six grandchildren for $38.85 per share. Then in March, when emotions were still high, I added one share each to their UTMA accounts for $38.30 per share. A couple of days later I bought one more share for each of them for $31.50 per share. One day later, on March 12, 2020, I was able to add one more share for the astounding price of $25.00 per share.

The opportunities didn’t stop there. On March 27, 2020, I was able to grab one more share at $22.00 per share. Some might say I was being foolish. I was certainly taking on some risk, but this risk was only in the minds of panicked investors. Yesterday, after five years of holding MAIN and receiving monthly dividends, I sold our grandchildren’s shares for an 83.26% profit. That excludes the dividends.

For example, our granddaughter Violet has received a total of $200.65 in dividends since 2020. To put this in perspective, Violet’s total cost to buy her 15 shares over the course of the last five years was $470. For the $470 she received the dividends and now she received an additional $421 in capital gains. That was a risk that paid off handsomely.

Her total profit was over $600. The purchase of MAIN during panic selling was just another example of buy when others are fearful. However, one must also sell when greed creates a potential problem.

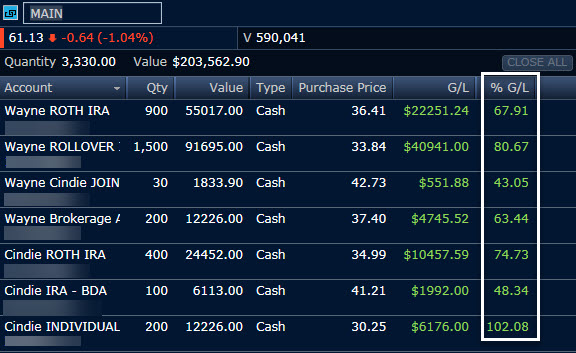

Wayne and Cindie Still Hold MAIN

Cindie and I still have over $200K invested in MAIN. This isn’t crazy. This is a huge revenue stream. Our 3,330 shares will provide almost $10,000 in dividends in total during 2025. That buys a lot of eggs (even at today’s prices.) Our investment in MAIN is about 5.9% of our total investable assets. That is slightly above my desired threshold of five percent.

Why I sold the UTMA Shares

Why am I keeping my MAIN shares but sold the shares for our grandchildren? The reason is quite simple. As the value of the MAIN investment grew for our grandchildren, the percentage of dollars allocated to MAIN had grown so that about ten percent of their accounts were in MAIN shares. I believe it is prudent to keep any individual (non-ETF or mutual fund) investment under five percent of the total investable assets in one’s holdings.

I could have sold half of their shares and brought the exposure down to five percent, but I think it is best to reallocate the dollars to an ETF like SCHD. In the meantime, the cash will be earning about four percent. To put this in perspective, MAIN currently yields 4.86%, so I’m not giving up too much to make this change.

Trading Options on MAIN

There is one other reason I am keeping MAIN. If we look at my 1,500 shares in my traditional IRA, they are worth about $92K. On January 22 I sold covered call options (15 contracts) for $1,490 in immediate income on those shares. The contract price is $65, and the contract expires September 19, 2025. The shares have to rise to $65 by that date (today the price closed at $61.11) or I keep my shares, continue to collect the dividends, and can enter a new options contract if I desire.

While I am waiting, I’m still collecting the monthly dividend on my 1,500 shares. That is about $375 per month in February, March, April, May, June, July, August, and September.

Summary and Recommendation

If you own MAIN shares, I’m not recommending that you sell them. However, do you know what percentage of your total assets are in MAIN? Do you know of any other holdings that are over five percent of your total assets (excluding ETFs and mutual funds)? If not, it would be prudent to consider selling shares to bring you down to four or five percent of your total.

Remember this principle: you want to have diversification, and you don’t want to have too many eggs in one basket! If one big egg breaks, it can be very discouraging.