Three Reasons to Consider Stocks Too

When it comes to investing, diversification is of prime importance. Therefore, low-cost mutual funds or similar ETF investments make this much easier for the Easy Income investor. ETFs like SCHD, DGRO, and VYM make our portfolio much more diversified. However, there are some limitations with most funds.

The Limitations of ETFs and Mutual Funds

First of all, companies are paying dividends throughout the quarter, but funds only pay you the dividend at the end of their quarter. I prefer to have income arriving in our accounts every month. Funds prefer to hold onto your cash and at least get interest from those dividends. That helps them keep their costs low and their income can be greater behind the scenes.

Secondly, ETFs often include investments that I wouldn’t buy individually. In other words, they often pick losers I would avoid and invest in businesses I prefer to avoid like utilities, airlines, tobacco, and telecommunications.

Finally, ETFs are often available for trading covered call options and cash covered puts, but they are very limited for weekly options trades. I want to have tighter control over the potential income from options trades. That is one reason I invest in stocks like STX (Seagate Technology Holdings plc).

An Example: Seagate Technology Holdings

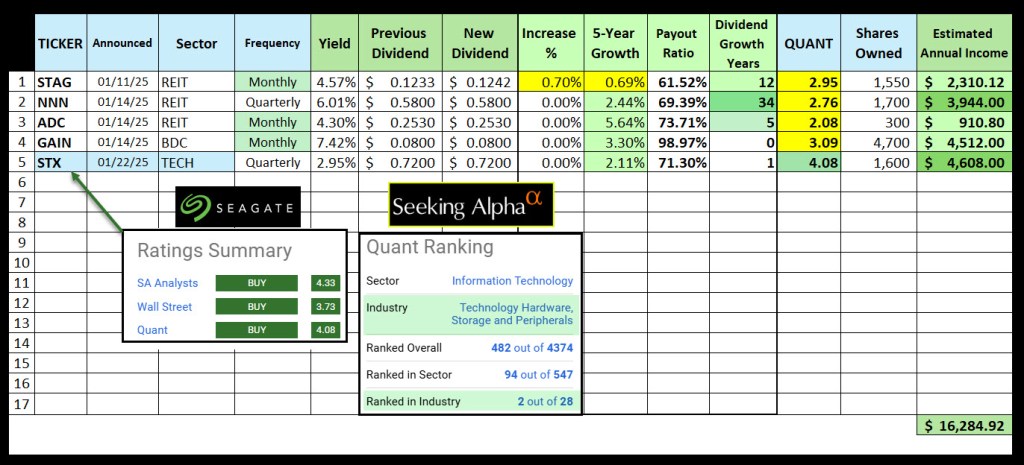

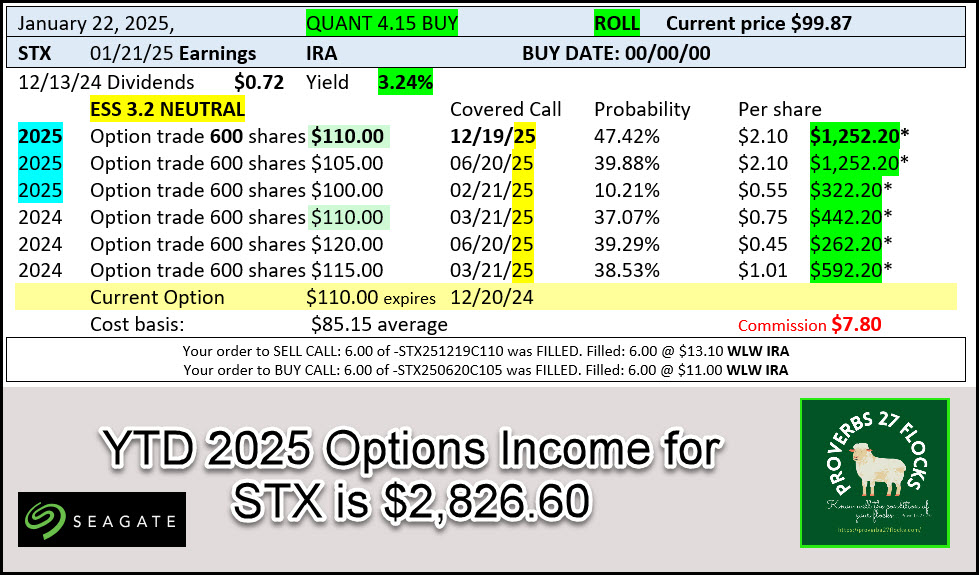

I am keeping track of dividend announcements for each position in our portfolio. STX announced a regular quarterly dividend of $0.72 per share. Here is the update from my spreadsheet.

Some Active Trader Pro Images

Another handy tool is Fidelity’s Active Trader Pro. It is an easy tool to master. Some of the features include…some key data points like the current share price, the ESS, Earnings and Dividends information.

A quick look at our holdings. If an investment is in multiple accounts, you can see all of them at a glance.

A view of stocks and options within each individual account. This image shows the 900 shares I have that are not currently covered by an option contract and the 600 shares that are part of an option contract. In my traditional IRA I hold 1,500 shares of STX.

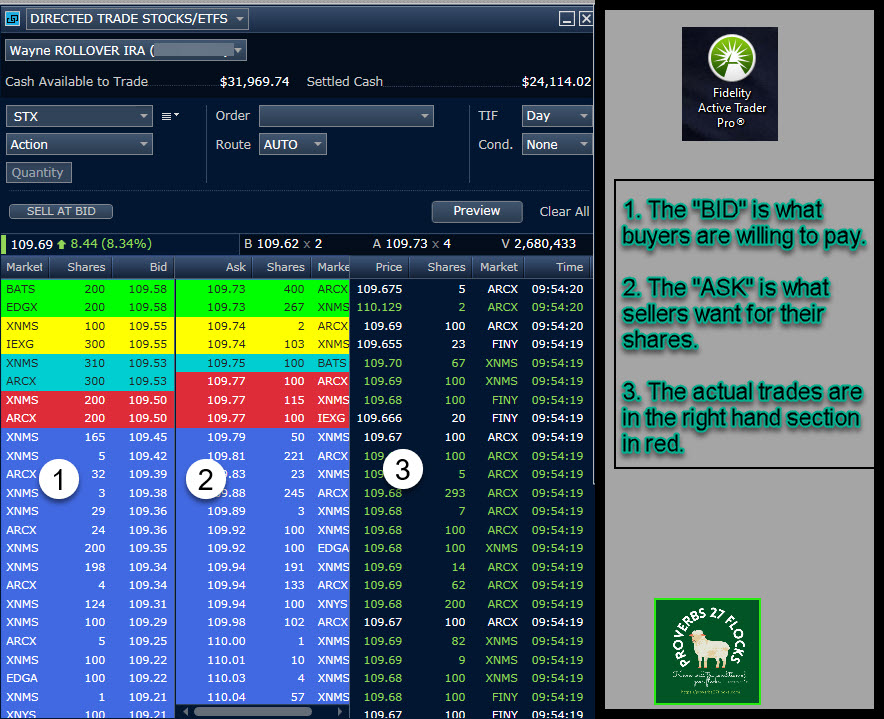

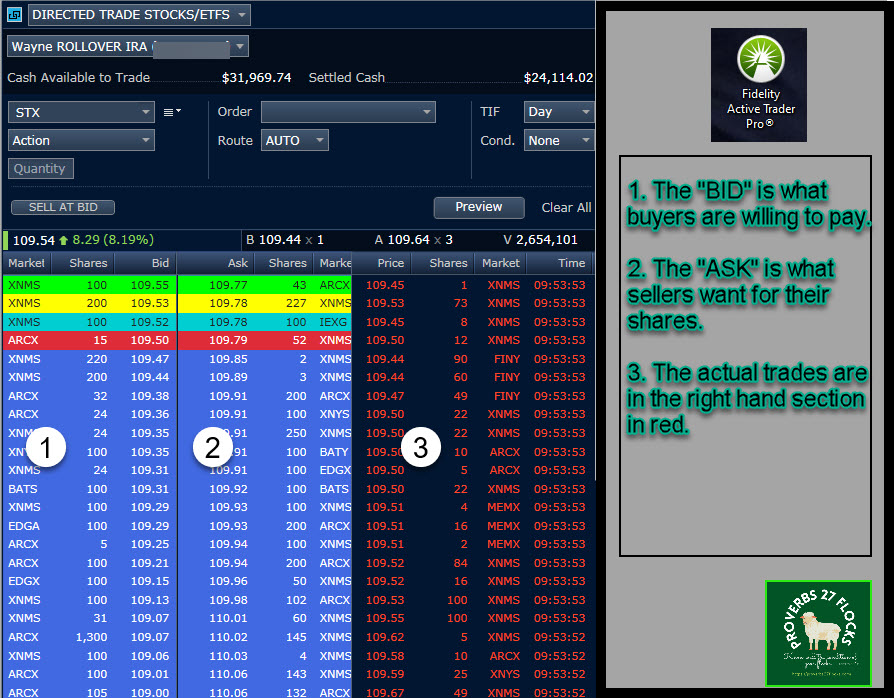

The next two images show how the shares traded during the day. When the right side has a red font, it indicates the prices for actual trades are going down. When it is green, it indicates the share price is on an upward trajectory.

The colors on the left and center sections indicate the probability of a trade. Green says that a trade is likely or has greater potential of finding a buyer or seller. Yellow, light blue and red indicate decreasing likelihood that the price will result in a transaction. Dark blue are the people waiting for a better buy price or sell price.

Stock Rover Dividend History

Seagate Technology has a good history of solid dividends.

Options Income from Some of Our STX Shares

This type of income is not easily available with ETFs. YTD income from STX options is approaching $3,000 in just a couple of weeks.

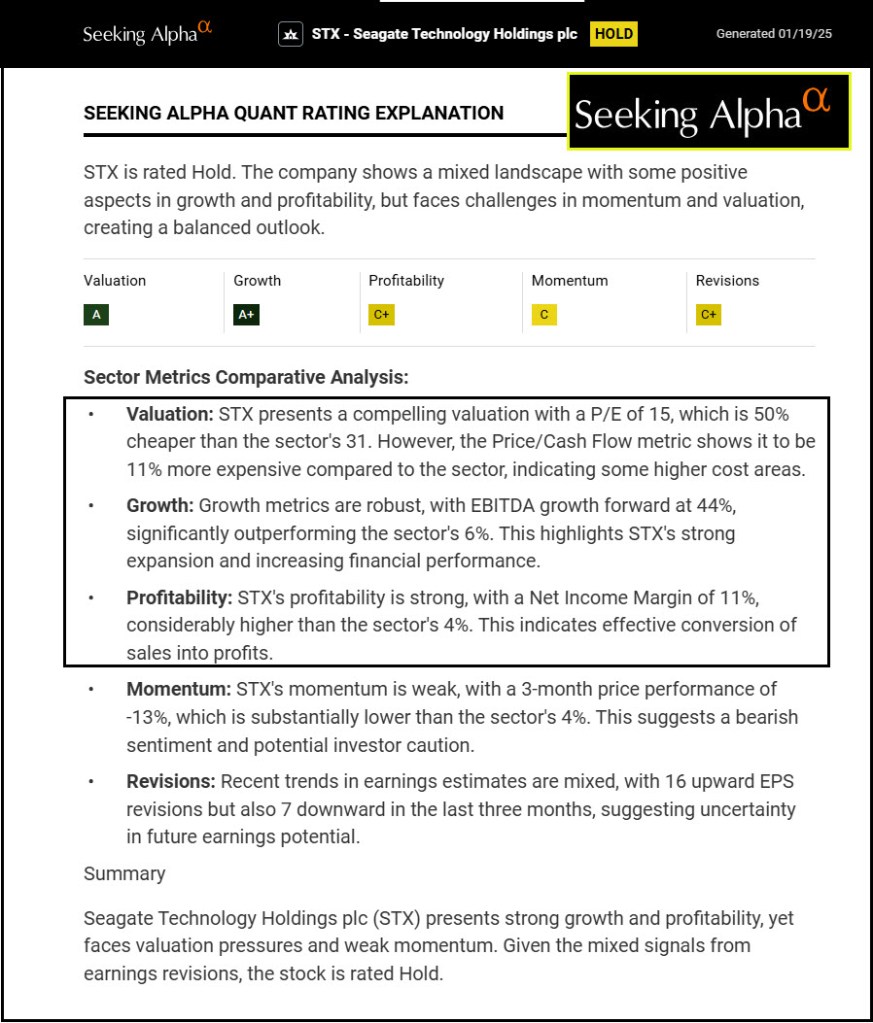

Seeking Alpha’s Virtual Analyst Report

One nice feature of the Seeking Alpha subscription in the “Virtual Analyst Report” that is shown as an orange box next to the company symbol and name. Here is a portion of the report for STX.

Recommendation

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

Seeking Alpha Terms of Use

It pays to know the fine print.