Puts Can Work if You Want to Buy an Investment

Although I usually talk about covered call options, it isn’t the only way to make extra money if you have cash available in your IRA, ROTH IRA, or brokerage account. Last week I had interest in buying shares of NVDA in my traditional IRA and shares of FTNT in my ROTH IRA. There are at least three ways I can use to buy shares. I only used one method last week.

The First Way: Market Price

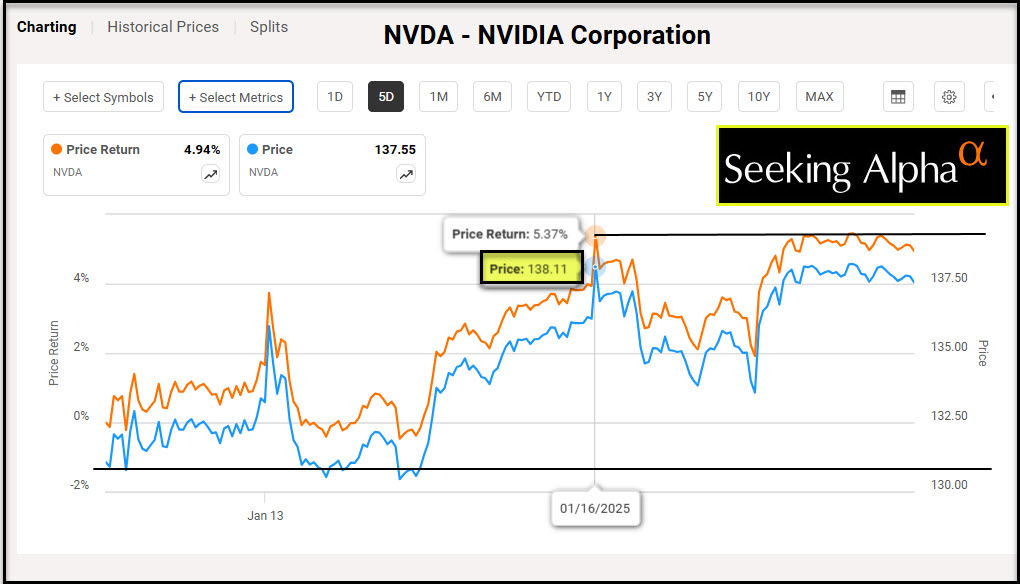

The first way is to buy the shares at the market price. If we look at NVDA as an example, during the last five trading days, the price of a share of NVDA has dropped as low as $130.45 and rose as high as $138.50. Not that long ago the shares were trading above $150 per share (January 6). The question I always ask myself is, “Is this a good price?”

The problem is that I don’t know if the price will continue up or go sideways or go down. I also don’t know if I should wait one more hour, one more day, or perhaps a week or more. Let’s pretend I bought 100 shares of NVDA on January 6 for $150/share. That would have cost me $15,000. Those shares are now worth $13,771 based on Friday’s close. However, if I purchased the shares on January 14, I could have the same 100 shares for $13,045. This is just too much of a roller coaster.

The Second Way: Buy Limit Price

If on Monday, I thought I would like to buy NVDA at $130 per share, I could have entered a buy limit order for $130. That is my way of saying NVDA is worth that much. If the share price drops to that price, sign me up as an owner. I can also put a date limit on the order. Therefore if I entered a buy limit order for 100 shares at $130, I could say “until Friday’s close.” This also means that I must have $13,000 in my account to buy the shares. That money is on hold and is not available for any other transaction while the order is open.

In this case, I would not have received the shares, as the price never dropped that low. The good news is that I can try again. The bad news is that I did not earn any income.

The Third Way: Cash Covered Put Option

The assumption is that I have $13,000 and that I want to buy shares of NVDA. If that is true, then I can enter a cash covered put option order. I had several open put orders to buy NVDA shares at various prices the week of January 6th. During that week I made $341.84 by rolling the put to various prices during the week.

Then, as the price dropped, I bought back last week’s open PUT contract (price of $135) using an option roll and sold a new contract with a share price of $130 per share. That trade earned me an additional $173.63. That contract is still open and lasts until February 28. Thus far I have banked $515.47 in profits and my $13,000 continues to earn dividends as it sits in SPAXX.

The Problem with Puts

There are potential problems with using cash covered put options. Here are the three biggest issues, based on my thinking.

- If the price drops dramatically, and NVDA shares are trading for $100 for share, I still have to pay $130 per share based on my current option contract. However, I was willing to buy shares at $130, so this is a minor issue for me, if I believe it will continue to climb in value.

- The second problem is that I may not get the 100 shares. If the price continues upwards, I may never buy the shares. However, remember that buy limit orders have the same weakness. At least with the put option contract and subsequent rolls I made over $500.

- The third problem is that I cannot buy anything else with the $13,000 in cash as long as the option contract is open. I have essentially set aside this cash for a future purchase of NVDA shares.

This are minor issues from my perspective, but you should never enter into a trade unless you realize that there are always potential “problems” with any investment path you take.

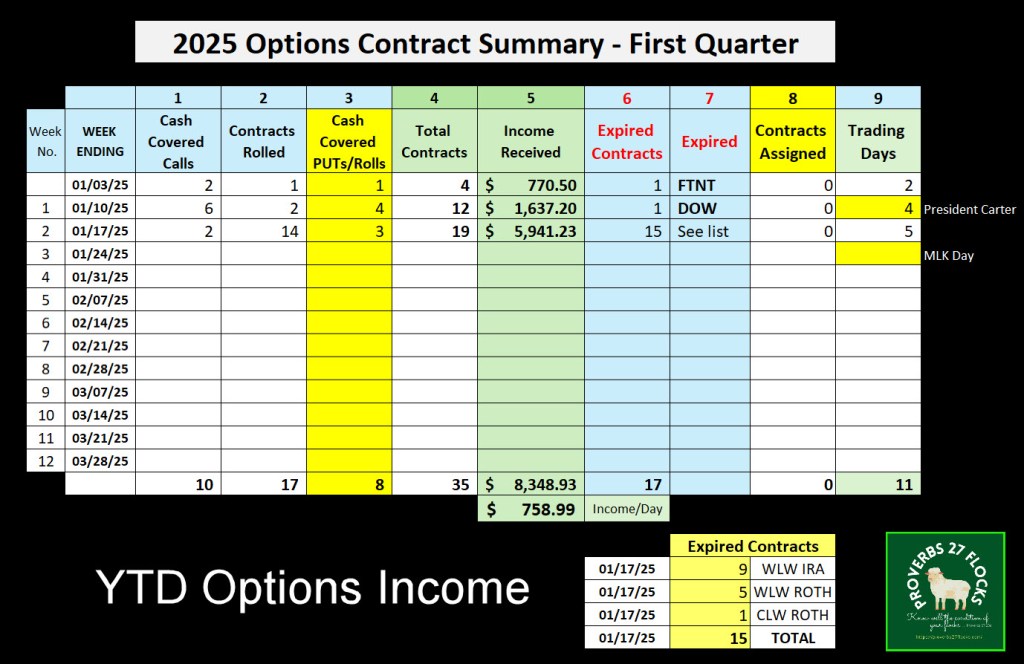

2025 Income YTD

YTD options income is $8,348.93 for eleven trading days. If I look at income per trading day, it now sits at $758.99. Give that I spend less than one hour per day trading options, I have been paid about $800 per hour for my time and effort.

Expired Options

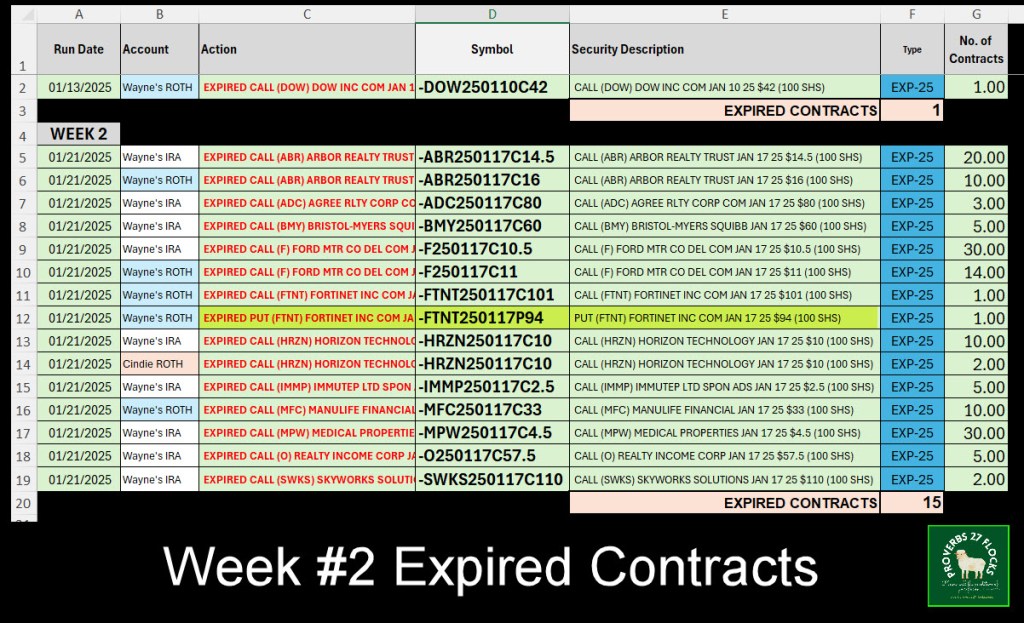

Many options expire on the third Friday of each month. When that happens, I am either assigned the shares if the contracted share price is reached, or the contract just expires. I keep what I received and keep my shares. That means I can sell new covered call options contracts on those shares.

Assigned Put Options

Lets say that my contract for NVDA shares results in my purchase of 100 shares. That presents a new opportunity. I can then sell covered call contracts on the 100 shares in my account. The combination of a put contract and a subsequent call contract is a powerful money machine.

This is even more powerful if the underlying stock or ETF pays a dividend. For NVDA shares there are three ways to create income. The first is a very small dividend. It is basically worthless because the yield is 0.03%. However, my “yield” on my put and call contracts is considerably more. My “synthetic yield” on my NVDA puts is already 3.7% based on Friday’s closing price. Bear in mind that this is after only two weeks of trading put options on NVDA shares.