What are the Flavors?

Although I focus on Easy Income and desire to have growing dividends, and those characteristics make up the majority of our stock and ETF investments, there are other pieces of the puzzle. Some investments don’t pay a dividend and others do not have dividend growth.

In addition to dividend growth, I am satisfied with REIT investments that have a decent yield and a good history of dividend payments. For example, STAG Industrial, Inc. has good Funds from Operations (FFO) and a nice dividend rate of 4.57%. If you were to try to buy CDs or a CD ladder, you would have to be willing to have your money locked up for five or ten years to exceed that cash flow. There is no way that I would buy a five-year CD, much less a ten-year CD.

Dividend Announcements 2025

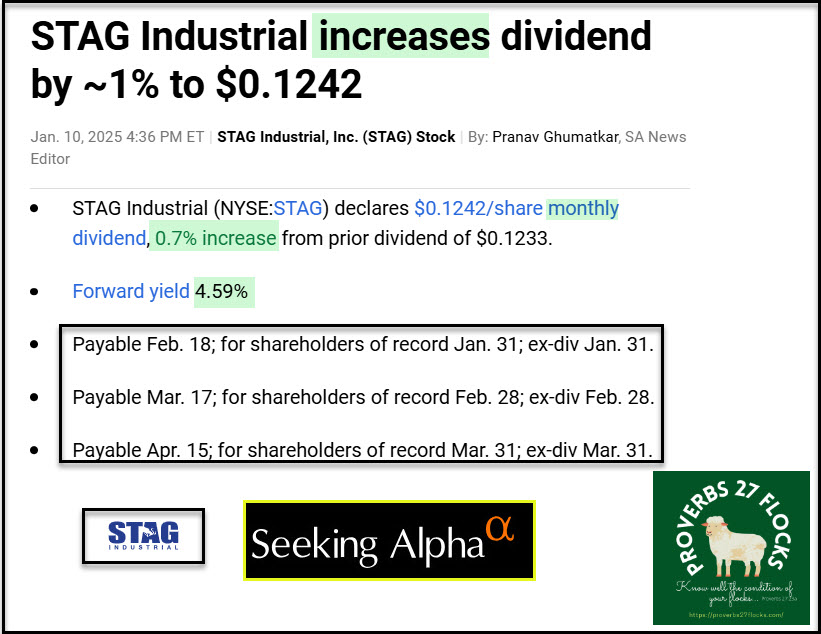

Each time a position in our portfolio announces a dividend, whether it is an increase or not, I hope to tell you about it. Although STAG’s next three monthly payments are only a 0.7% increase, that is just fine. I don’t really expect dividend increases from STAG.

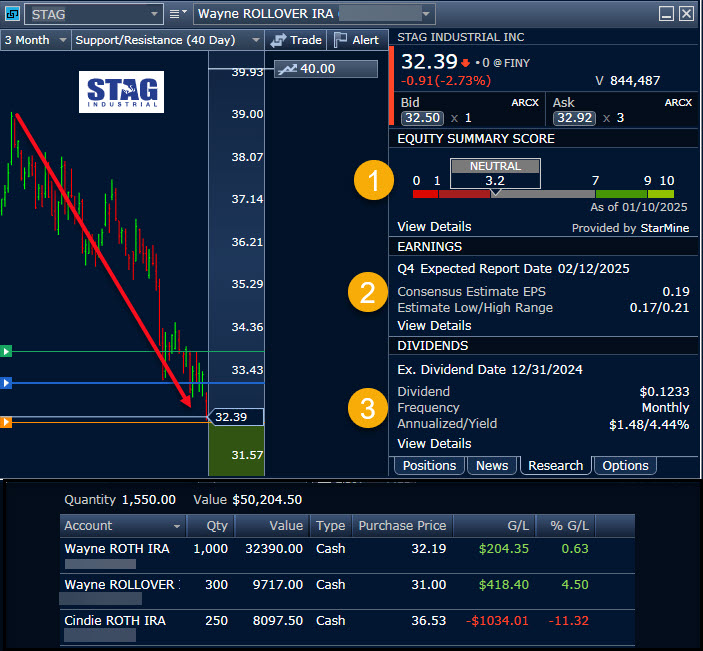

Our STAG Holdings

We currently own 1,550 shares of STAG. I strategically moved shares of STAG from my traditional IRA to my ROTH during 2024. That increases our monthly tax-free income. Even though STAG has seen pricing pressure, the fundamentals of the business are good.

By that I mean that STAG is profitable, and they are experiencing growth. I also like the real estate sector for industrial and warehousing properties.

Company Profile: STAG Industrial, Inc.

STAG is a REIT focused on the acquisition, ownership, and operation of industrial properties throughout the United States. Their platform is designed to (i) identify properties for acquisition that offer relative value across CBRE-EA Tier 1 industrial real estate markets, industries, and tenants through the principled application of their proprietary risk assessment model, (ii) provide growth through sophisticated industrial operation and an attractive opportunity set, and (iii) capitalize their business appropriately given the characteristics of our assets. They are organized and conduct their operations to maintain their qualification as a REIT under Sections 856 through 860 of the Internal Revenue Code of 1986, as amended (the “Code”), and generally are not subject to federal income tax to the extent they currently distribute their income to their stockholders and maintain their qualification as a REIT. As of December 31, 2023, they owned 569 buildings in 41 states with approximately 112.3 million rentable square feet, consisting of 493 warehouse/distribution buildings, 70 light manufacturing buildings, one flex/office building, and five Value Add Portfolio buildings.