Reading a Balance Sheet

One of my readers, who is bright and asks great questions, is Mary Martha. She has made excellent progress in restructuring her investments and has asked me many questions since we first “met” via Zoom in 2022.

Her most recent request was, “In the future, I would like to see blog posts that describe how to read a company’s balance sheet and how to determine whether or not it’s a good company to invest in based on the EPS and its dividend as a carryover from the one today. And how does debt play into a company’s stability, if any?”

Because I try to keep most of my posts to around 700-800 words, I will attempt to do the same this time. Several links to other resources are included for those who want to dive deeper into this topic.

Let’s start with a good quote from Accounting Insights: “Debt is a fundamental component of corporate finance, playing a crucial role in how companies manage their resources and plan for growth. Understanding the various forms of debt that appear on a balance sheet is essential for investors, analysts, and business leaders alike. The significance of debt extends beyond mere numbers; it influences financial health, operational flexibility, and strategic decision-making.” – Accounting Insights

What is a Balance Sheet?

“A balance sheet is a financial statement that shows the relationship between assets, liabilities, and shareholders’ equity of a company at a specific point in time.” – Finance Strategists

The balance sheet shows a “balance.” In the simplest form, assets are equal to the sum of liabilities and shareholder equity.

Companies with Tons of Debt

Just because a company has a lot of debt doesn’t make it a bad investment. For example, the top fifteen “Most Indebted Companies in the US for Jan 2025,” according to “Finance Charts” are Ford, Verizon, General Motors, Apple, Comcast, Charter Communications, Oracle, T-Mobile, Duke Energy, Nextera Energy, Amazon, United Health Group, Microsoft, Abbvie, and Pfizer. I own shares of Ford, Microsoft, Abbvie, and Pfizer. In addition, if you own any ETFs or mutual funds based on an index, you own most, if not all of these.

Wikipedia also has some (dated) information about companies with high levels of debt.

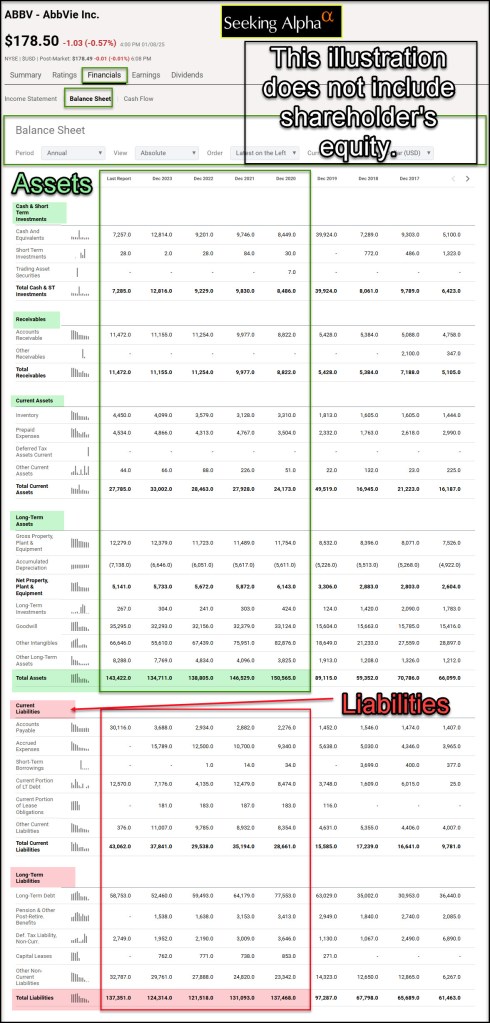

ABBV’s Debt

It is easy to see the balance sheet for any company by using Seeking Alpha. Here is an image that shows some of the balance sheet information for Abbvie. As you can see, there is a lot of information. I only look at this in very rare circumstances. I’m more interested in profitability and the growth of the business and the rational growth of the dividend.

Types of Foolish Debt

If a company has income that is less than the dividend, be concerned. They are probably financing the dividend with debt. That is never a good thing.

Some investors make an even bigger mistake by trading using “margin.” “Margin trading is when investors borrow money to buy stock. It’s a risky trading strategy that requires you to deposit cash in a brokerage account as collateral for a loan, and pay interest on the borrowed funds.” – Source: Forbes

I view this as foolish debt because you can loose a lot of money if you have investments that drop in value.

You can make personal debt mistakes in a less obvious way. You can either buy a new vehicle with cash, or you can take out a loan to finance some or all of the purchase. If you pay cash, let’s pretend that the new vehicle costs $30,000. You can use cash to buy it. Or you can put down $1,000 and finance $29,000 with debt for 72 months. (Carvana)

Carvana says you will pay $524/month based on a 9.09% APR (Estimate based on your credit rating). If this looks good to you, be certain to understand that you will pay $37,728 over the loan’s life plus the $1,000. In other words, your new car really costs you $38,728 plus repairs, maintenance, insurance, and fuel. At the end of six years, by the way, you do have an asset, but it isn’t worth what you paid for it.

Why Did I Use This Illustration?

The real question about a company’s debt isn’t just the debt. It has more to do with what the company is doing with the debt. You want the value of the company to increase, and sometimes borrowing money can cause a company to have more opportunities to invest in the business, to increase research and development, and to build new facilities or add equipment. Don’t rush to judgment just because a company has a lot of debt.

Recommendation

It certainly doesn’t hurt to consider debt when investing. However, I believe it is far more important to look at other factors. That is why I tend to focus on things like earnings growth, profits, and the long-term growth of a business. If the ten-year total returns are at least 100%, then I am interested, assuming that the business is continuing to reinvest in the business. This can include taking on more debt.

Thank you, Wayne ! I didn’t expect my question to make it so soon to the blog.

LikeLiked by 1 person