Some Sectors I Like

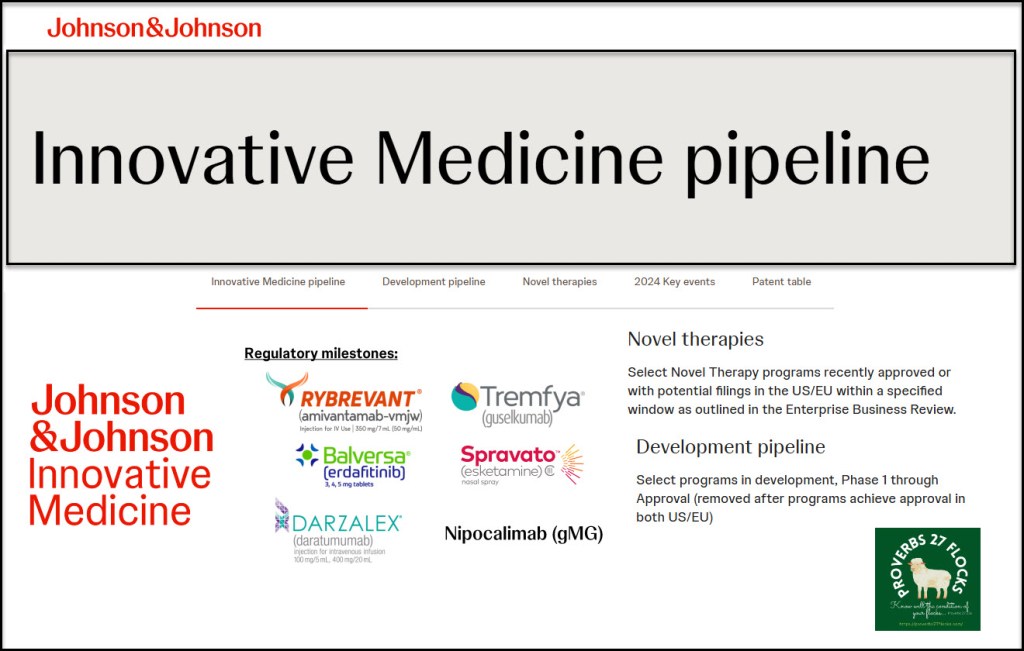

In general, my favorite sectors are technology, healthcare, and financials. Real Estate is also a big piece of our investing puzzle. I added to our health care investments this morning by purchasing 100 shares of Johnson & Johnson. I’ve owned JNJ in the past, and decided to jump back in now that the share price has dropped significantly.

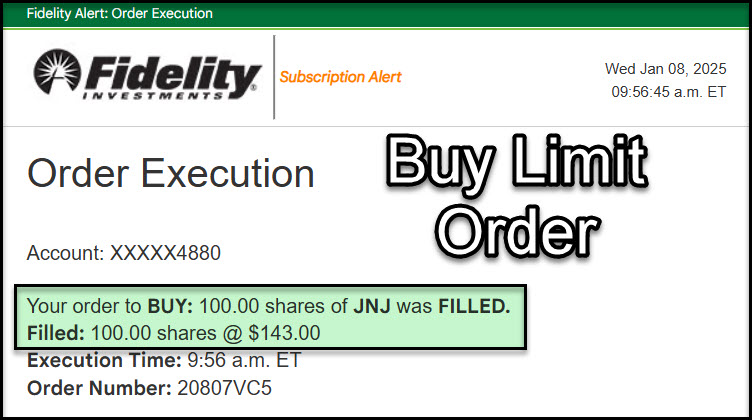

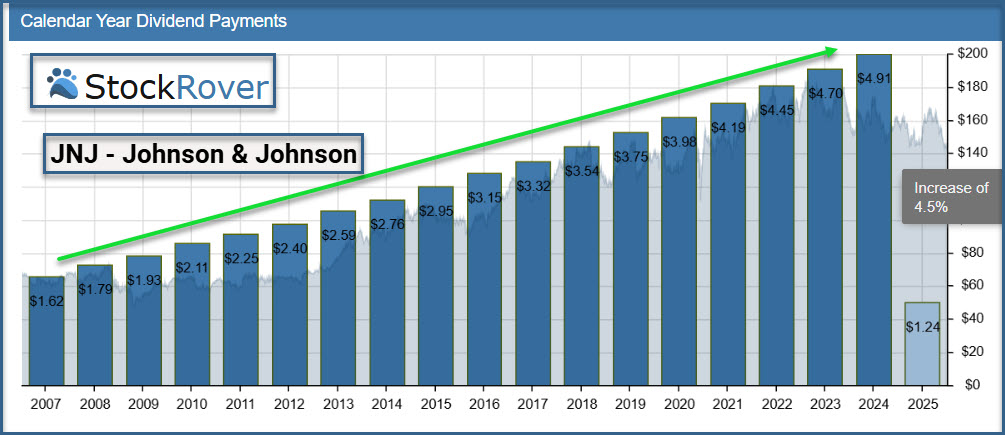

There are a couple of reasons I bought shares today. First of all the dividend growth is very good. Secondly, I can trade covered call options on my shares. JNJ will soon be announcing earnings, and I am optimistic about a positive report. Finally, JNJ’s ex-dividend date is just around the corner.

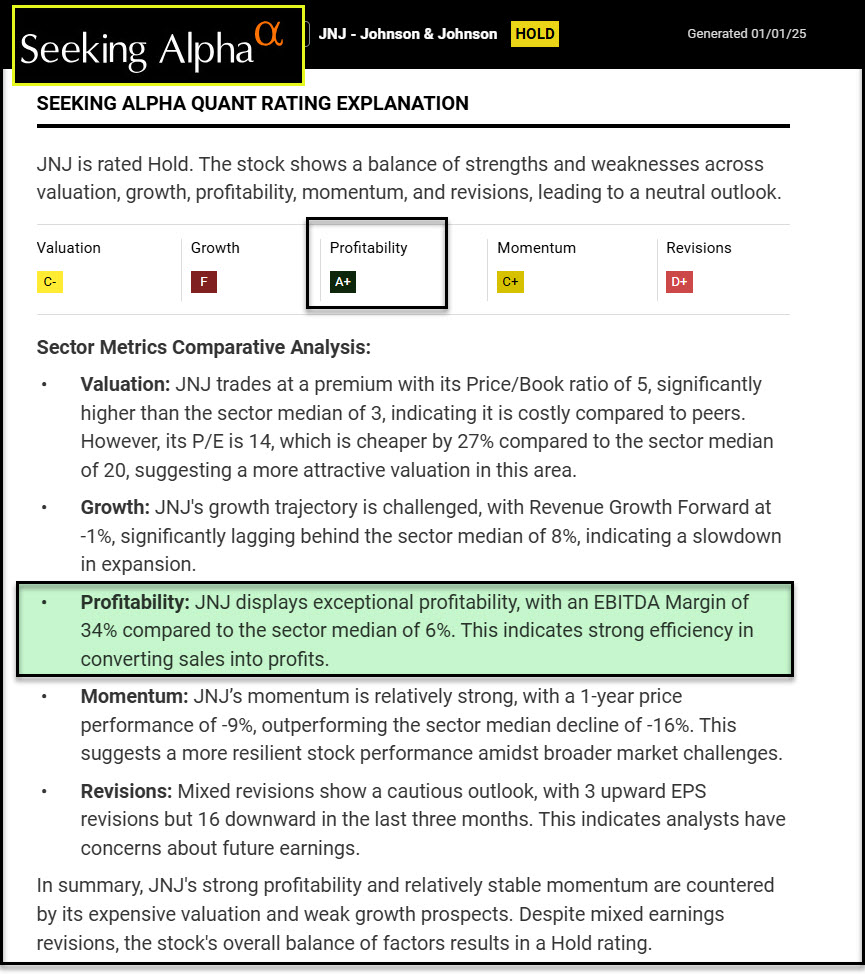

Seeking Alpha Image

One of the things that is so impressive about JNJ is their dividend growth history. They are more than a superstar. They have 62 years of dividend growth. The dividend yield isn’t bad either, at 3.39%.

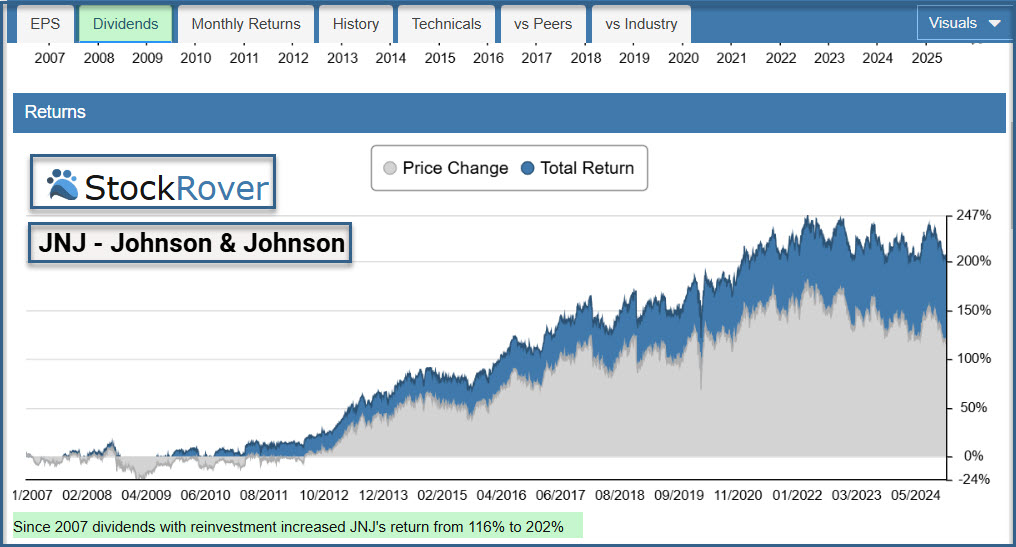

StockRover Images

I look at Stock Rover to see total returns. Although JNJ’s ten-year returns are lacking, I think it is now time to take a small bite of this large-cap healthcare giant.

Options Trading

I won’t be entering any options trades until after January 22, 2025. I don’t want to risk selling my shares at a price that is too low. If there is a good earnings report, and the price spikes up, I will be ready to enter a covered call trade.

Fidelity Active Trader Pro Research Page

I like the ATP view that gives me three key pieces of information: the Equity Summary Score, Earnings, and Dividends. Always compare expected earnings with the dividend. The earnings should be greater than the dividend by a healthy margin. (Pun intended!)

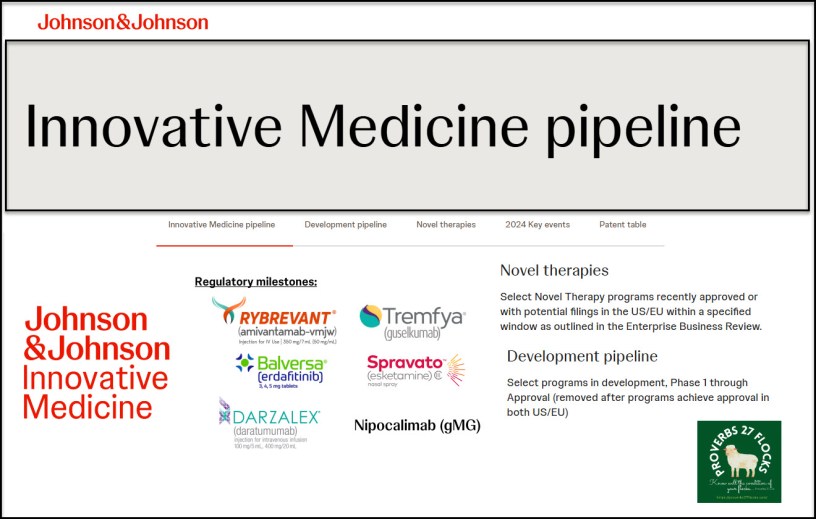

Company Profile

Johnson & Johnson, together with its subsidiaries, researches, develops, manufactures, and sells various products in the healthcare field worldwide. The company’s Innovative Medicine segment offers products for various therapeutic areas, such as immunology, including rheumatoid arthritis, psoriatic arthritis, inflammatory bowel disease, and psoriasis; infectious diseases comprising HIV/AIDS; neuroscience, consisting of mood disorders, neurodegenerative disorders, and schizophrenia; oncology, such as prostate cancer, hematologic malignancies, lung cancer, and bladder cancer; cardiovascular and metabolism, including thrombosis, diabetes, and macular degeneration; and pulmonary hypertension comprising pulmonary arterial hypertension through retailers, wholesalers, distributors, hospitals, and healthcare professionals for prescription use. Its MedTech segment provides Interventional Solutions, including electrophysiology products to treat heart rhythm disorders; the heart recovery portfolio, which includes technologies to treat severe coronary artery disease requiring high-risk PCI or AMI cardiogenic shock; and neurovascular care that treats hemorrhagic and ischemic stroke. this segment also offers an orthopaedics portfolio that includes products and enabling technologies that support hips, knees, trauma, spine, sports, and other; surgery portfolios comprising advanced and general surgery technologies, as well as solutions for breast aesthetics, ear, nose, and throat procedures; contact lenses under the ACUVUE Brand; and TECNIS intraocular lenses for cataract surgery. It distributes its products to wholesalers, hospitals, and retailers, as well as physicians, nurses, hospitals, eye care professionals, and clinics. The company has a collaboration agreement with Stand Up To Cancer for research testing a combination of teclistamab and daratumumab to treat a rare disease AL amyloidosis. Johnson & Johnson was founded in 1886 and is based in New Brunswick, New Jersey.