The Hearse is a Reminder

How much do you plan to take with you at death? The rational answer, as far as material things are concerned, is NOTHING. In fact, that is what Paul wrote to his young protégé, Timothy. He said, “But godliness with contentment is great gain, for we brought nothing into the world, and we cannot take anything out of the world. But if we have food and clothing, with these we will be content.” 1 Timothy 6:6-8

The reminder can be seen when we see a hearse. A hearse has no trailer, and if it did, that sight would cause us to question the sanity of the funeral director, the family, or the deceased.

History of Goal Number One

In 2023 I began to take advantage of a nice tax-savings opportunity known by the abbreviation QCD. A Qualified Charitable Distribution can dramatically improve your financials and reduce your tax burden if you are at least 70.5 years old. Many of us will reach that age, so it pays to keep this in mind even if you are newly retired and have not yet reached the age of opportunity.

2023 QCD Limit was $100,000

In November 2023 I was old enough to use the QCD provision, and we were able to give $30,500 using this tool. We had already done most of our giving using normal checks, so we were able to itemize our deductions and reduce the tax liability of my IRA withdrawals by $30.5K. This was not the most tax-efficient method for giving. However, instead of being taxed on $187,285 of IRA withdrawals (and ROTH conversions), our taxable IRA withdrawal was only $157.091. We also were able to itemize our deductions, and that amount was $61,394 including non-QCD giving and property taxes.

2024 QCD Limit was $105,000

In 2024 the IRS increased the QCD limit by five percent to $105K. This was an inflation adjustment. One of our goals this year was to dramatically increase our giving. Thus far QCD giving has reached $101,263. There is other giving that was done via other methods. The important thing to note is that this has a four-pronged benefit. 1) First of all, the QCD giving satisfies the RMD requirement (about $73K) for my traditional IRA. 2) QCD giving made it possible to give more to qualified charities because there was no income tax withholding. The entire $101K went directly to the charities. 3) This makes it possible for us to take the standard deduction of $32,300. 4) Finally, makes it ROTH conversions more tax-efficient, and enables fewer taxes in future years by reducing the total balance in the traditional IRA.

Note that the $32.3K standard deduction is in addition to the $101K that won’t appear as income. In other words, we get a huge benefit from a tax perspective in using this approach. QCD’s are not itemized deductions. They reduce taxable income up-front.

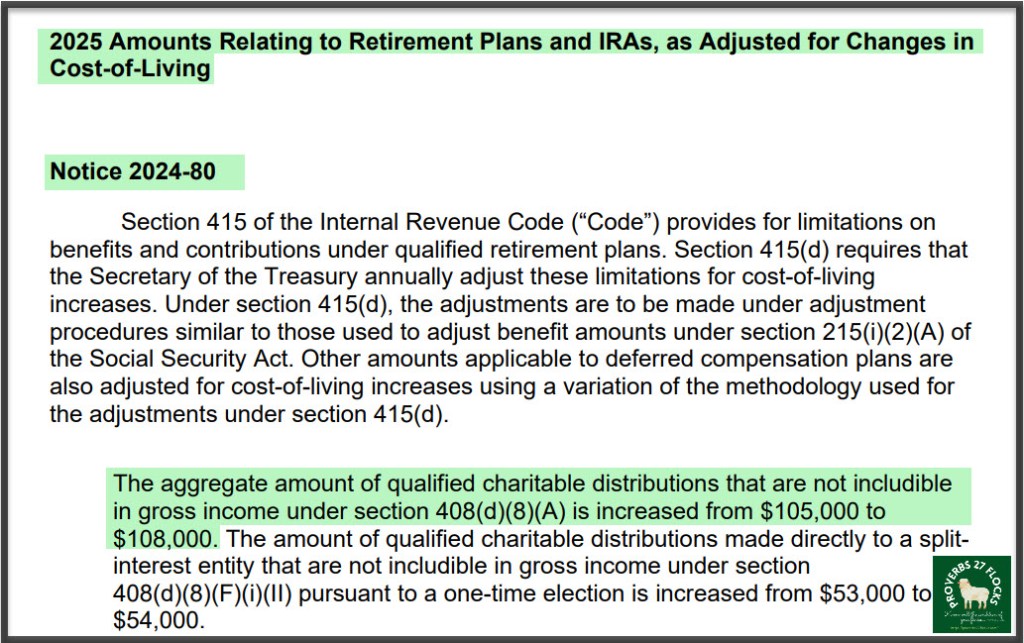

2025 QCD Limit is $108,000

The IRS announced the 2025 QCD increase amount. It is 2.86% more than 2024’s limit. Therefore, it is possible for us to give $108K directly from my traditional IRA to qualified charities. Because of the work I have done this year with both QCDs and ROTH conversions, it looks like my RMD will be about $73K for 2025. This is noteworthy, as that is the same amount I was required to withdraw in 2024. Normally, one would expect to have gradually increasing RMDs over time.

Therefore, the goal, if God permits, is for us to hit the $108K limit of giving using direct payments from my traditional IRA. The other goals will be announced in future posts.

Useful QCD YouTube Videos

What Are the Tax Benefits of Qualified Charitable Distributions (QCD)?

5 Rules to Follow When Doing a QCD (Video is a bit dated because of dollar amounts, but the concepts are the same.)

How to report a qualified charitable distribution on tax return

I told my grandkids at Christmas…learn to save and learn to invest. But beware of chasing zeros as they are God’s ultimate irony. When we die, no matter how many we have they are worth (motion with my hand)….and I let the kids say “zero”

LikeLiked by 1 person