Recent News and New ETF Investments

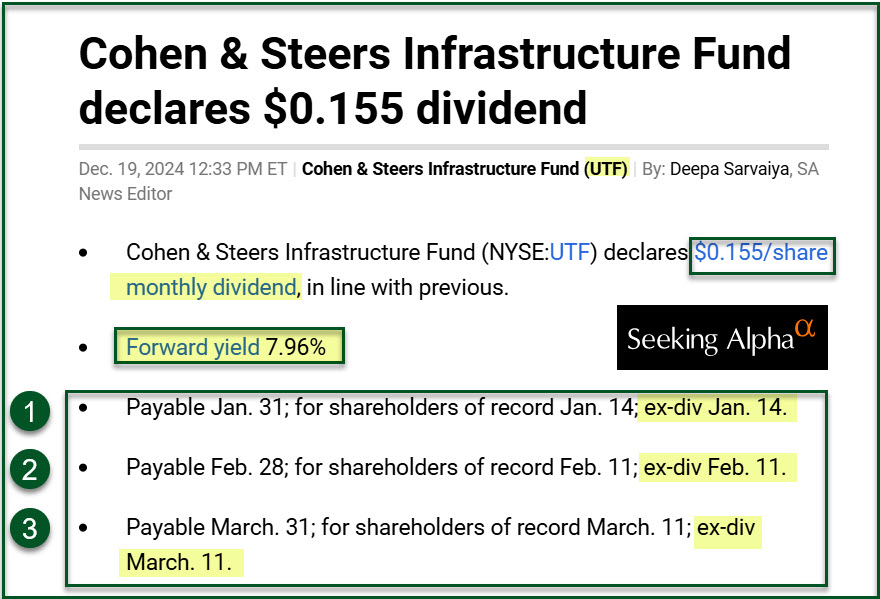

While I still have a focus on my existing investments, there are times when I add new investments to our portfolio. Recently I have been growing our investment in UTF. UTF is “Cohen & Steers Infrastructure Fund.” We now have 400 shares of UTF in my ROTH IRA. This ETF pays a monthly dividend, and the next three months of dividends have been announced. I am treating this investment as a replacement for the CDs that are expiring in my ROTH IRA.

AMLP (Alerian MLP ETF) is another energy-focused ETF. I generally dislike individual MLP investments because they are a tax nightmare. They issue K-1’s and create a mess during the annual filing of our income taxes. However, AMLP takes care of the taxes (hence the higher expense ratio) and issues dividends instead. I purchased 100 shares of AMLP recently to add to our energy-related holdings.

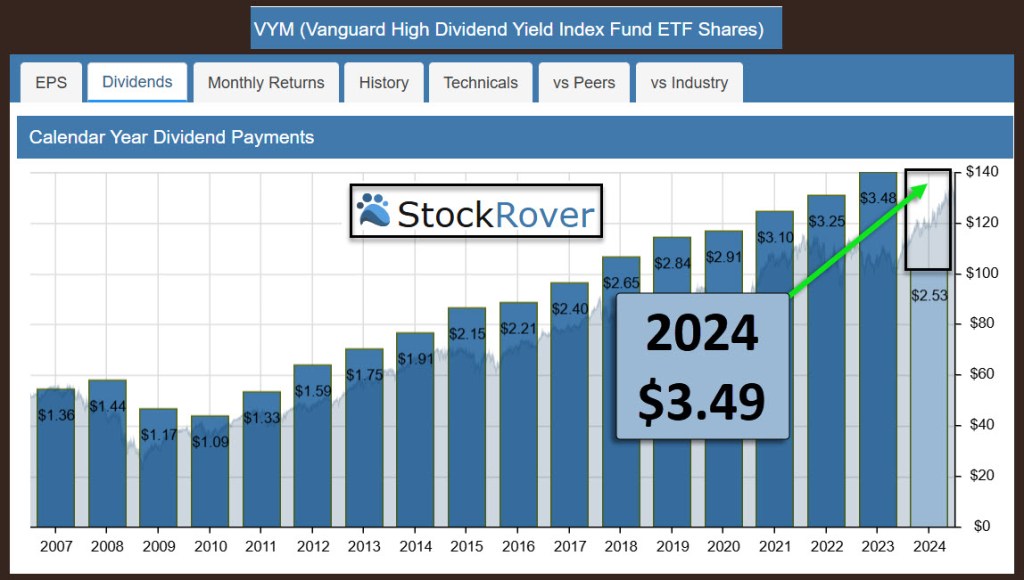

The Final Dividend for VYM

VYM announced their final 2024 dividend which will be paid tomorrow. Cindie and I own a total of 2,585 shares of VYM that are currently worth about $329K. This makes VYM our largest investment.

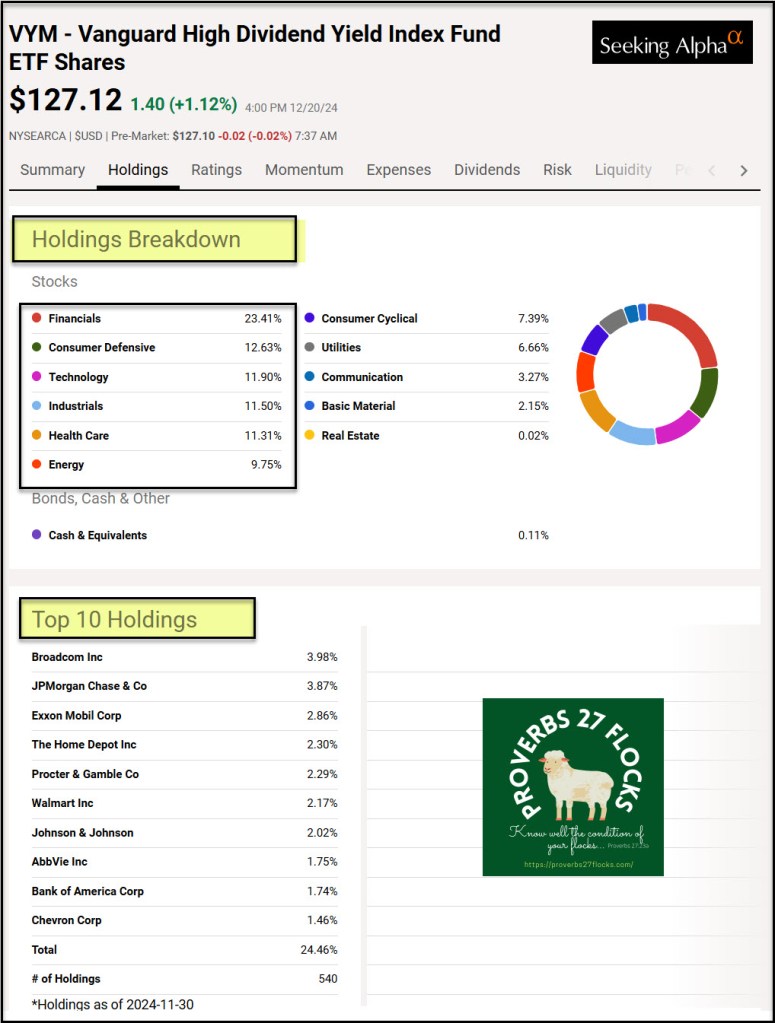

The dividend is $0.9642. As a result, we will see $2,492.46 in dividends to wrap up the year. I am a bit disappointed in the 2024 dividend growth for this investment. 2023’s total dividend was $3.48 per share and this year’s total was just a penny more at $3.49. However, I still like the diversification of VYM, and the top ten holdings are all solid.

VYM’s TOP TEN are 24.5% of the Total Investment

Broadcom Inc (AVGO) is 3.98%. I also own shares of AVGO. JPMorgan Chase & Co is 3.87%. Exxon Mobil Corp (XOM) is 2.86%. The Home Depot Inc comes in next at 2.30%. Procter & Gamble Co is a consumer-focused company at 2.29%. Walmart Inc is 2.17%. Johnson & Johnson clocks in at 2.02%. AbbVie Inc (another favorite of mine) is 1.75% and number nine is Bank of America Corp at 1.74%. Chevron Corp rounds out the top ten at 1.46%.

VYM has 540 holdings and yields 2.75%. This is far better than the S&P 500 yield.

AMLP Alerian MLP ETF

ALPS ETF Trust – Alerian MLP ETF is an exchange-trade fund launched and managed by ALPS Advisors, Inc. The fund invests in the public equity markets of the United States. It invests in MLPs operating across energy, transportation, storage, and processing of energy commodities sectors. It invests in growth and value stocks of companies across diversified market capitalization.

UTF Cohen & Steers Infrastructure Fund

Cohen & Steers Infrastructure Fund, Inc. is a closed-end equity fund launched by Cohen & Steers, Inc. The fund is managed by Cohen & Steers Capital Management, Inc. It invests in public equity markets of the United States. The fund invests primarily in value stocks of infrastructure companies across all market capitalizations.

VYM Vanguard High Dividend Yield Index Fund ETF Shares

Vanguard Whitehall Funds – Vanguard High Dividend Yield ETF is an exchange traded fund launched and managed by The Vanguard Group, Inc. It invests in public equity markets of the United States. The fund invests in stocks of companies operating across diversified sectors. The fund invests in growth and value stocks of companies across diversified market capitalization. The fund invests in dividend paying stocks of companies.