Setting Financial Goals

Each year I set goals for various financial objectives. The goals include giving, dividend growth, reducing taxes by moving assets from my traditional IRA to my ROTH IRA, and gaining additional income from options trades. We can call that additional income “synthetic dividends.”

Although 2024 is not yet complete, I achieved a new high for options income this year. The reality is that I did not set a 2024 goal for options income. Part of this is due to the uncertainty of the stock market. Options trading is, by its very nature, opportunistic.

First of all, you have to have a minimum of 100 shares to trade a contract. Secondly, the covered call options strategy works best when the underlying stock is rising in value. Finally, while it doesn’t take much time per day, it does take time to see what is happening with your positions. It also works best with stocks, but you can trade options on ETFs as well.

Synthetic Dividends

Some call the income from options trades “synthetic dividends.” They aren’t really dividends, but they can actually be more productive because you can make income from some positions every week, even for stocks that don’t pay a dividend. If the stock does pay a dividend it can be very beneficial to your overall income. The key is to buy quality dividend growth investments and then sell options on those investments. If you have extra dollars for investing, then some non-dividend stocks can dramatically improve your income by trading options for synthetic dividends.

Options Income Historical Perspective – 2020-2024

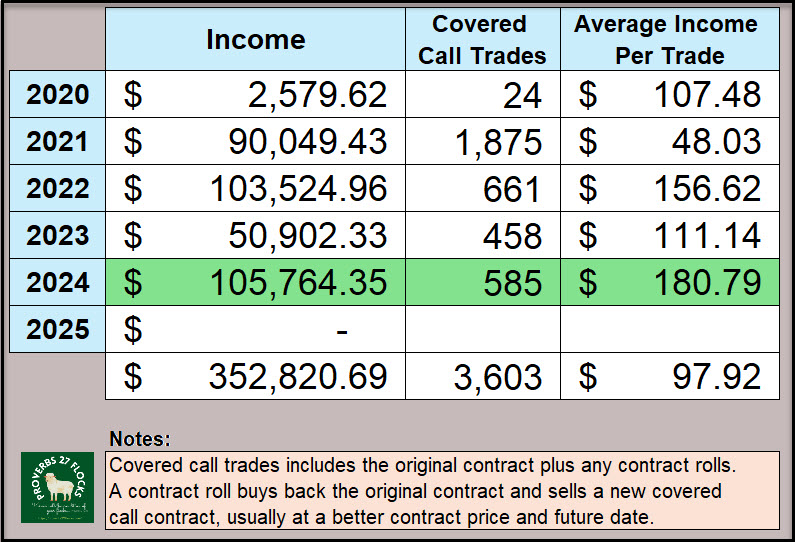

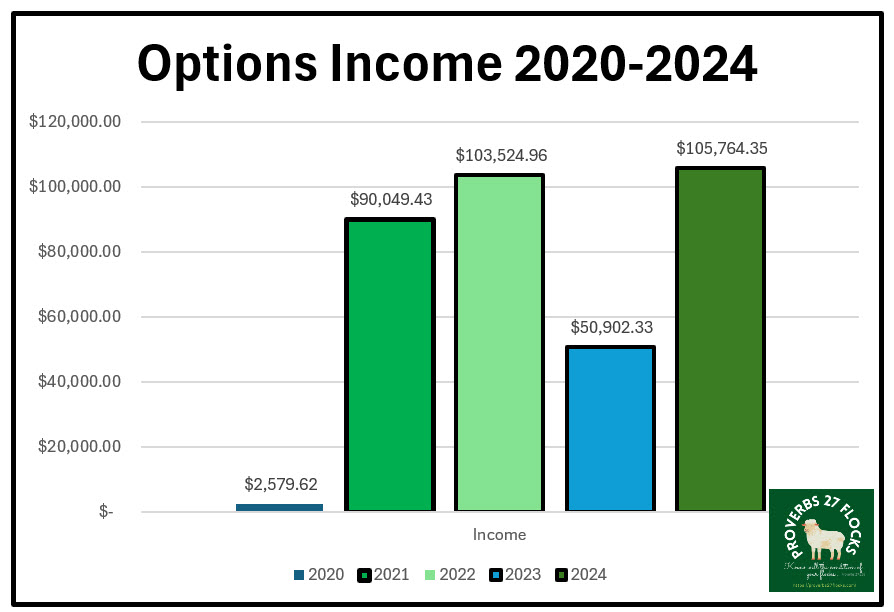

When I traded my first options in 2020 I did so very slowly and carefully. I wanted to see what worked and what did not work. I wasn’t seeking a huge amount of income, but I was seeking understanding.

In 2021 I had more confidence, but I discovered that I was wasting my time doing more options trades than I needed to make. I was trading options on any position that seemed to offer options contracts. As a result, I did 1,875 trades. That may seem like a lot of time, but it really wasn’t all that time-intensive. However, it was more time than was needed for success. The synthetic dividend income was amazing: $90K.

The next year (2022) I changed my thinking to focus on the trades that earned more per trade, ignoring the minnows. I wanted at least some perch, some walleye, and a few salmon. In other words, I wanted bigger fish for each cast of the line. As a result, my average income per trade bounced up and my total income did as well.

In 2023 I did not see as many opportunities with my stocks, so I scaled back on my trades. The results speak for themselves. I made less in total dollars, but I continued to see good results per trade. When you go into options trading, don’t expect every year to be a great year. However, continue to do the trades that make sense given the economic realities.

Finally, this year (2024) has been very satisfying. Total options income has risen to $105.7K from options trading. Furthermore, I entered fewer trades than in 2022 and reached a new high for per-trade average income. I really only did 400 actual trades during 2024 because of the way I rolled 186 covered call options during the year.

What is somewhat surprising is my total five-year income from options trades. I have gained $352.8K in additional synthetic dividend income from 3,603 trades. That works out to be about 15 hours of work per week for the five years. Bear in mind that my actual time spent, as I have grown in my knowledge and skills is far less than that per week. I now spend about 2 hours per week on options trades. It is quite easy to make $500 in an hour of options trades.

The other thing to remember is that the 3,603 trades was really 3,200 trades. This is due to the way that a covered call contract roll is entered. You enter one trade that creates, automatically, a set of trades: one to buy back the original contract and one to sell a new covered call contract.

2025 Options Income Goal

I won’t be setting a goal for total dollars. However, I want to keep my average income per trade above $150 and I want to continue to keep my total trades below 600 per year.

Recommendation

Learn how to trade options by doing some small trades in your first year. One trade per month or even two trades per month will give you the experience you will need as your portfolio grows in size and options trading possibilities.