What to do with Cash?

Our investments in CD’s are winding down now that interest rates are falling. On Fidelity, the interest rate for a 3-month CD is now 4.40%, and that is satisfactory, but not great. SPAXX, the Fidelity Government Money Market Fund, has a seven-day yield of 4.25% and an expense ratio of 0.42%. My current yield on the positions in my traditional and ROTH IRAs is at 4.81%, which translates into about $135K in estimated annual dividend income.

Therefore, I will not be buying CDs if interest rates stay at this level or continue to drop. I’m not saying CDs are a bad choice, I just think there are better ways to put cash to work earning dividends while not being locked into a CD timeline. For now I will keep most of our excess cash in SPAXX.

In my ROTH IRA I have slowly been adding shares of UTF (Cohen & Steers Infrastructure Fund). This fund has some positives and negatives.

The Positives

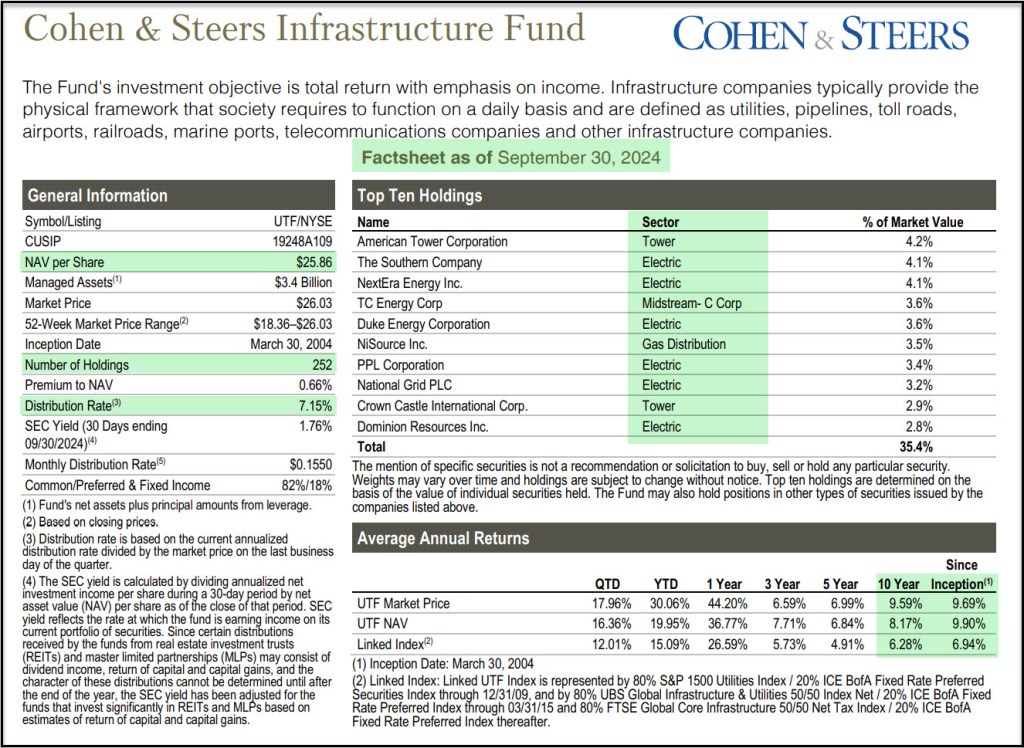

First of all, the fund has $2.35 billion in assets. There are other funds I considered, but I excluded them due to their small assets under management. UTF has a respectable forward yield of 7.62% and the dividend is paid monthly. Many CDs do not pay monthly.

UTF’s managers invest primarily in value stocks of infrastructure companies across all market capitalizations, employing fundamental analysis to choose investments.

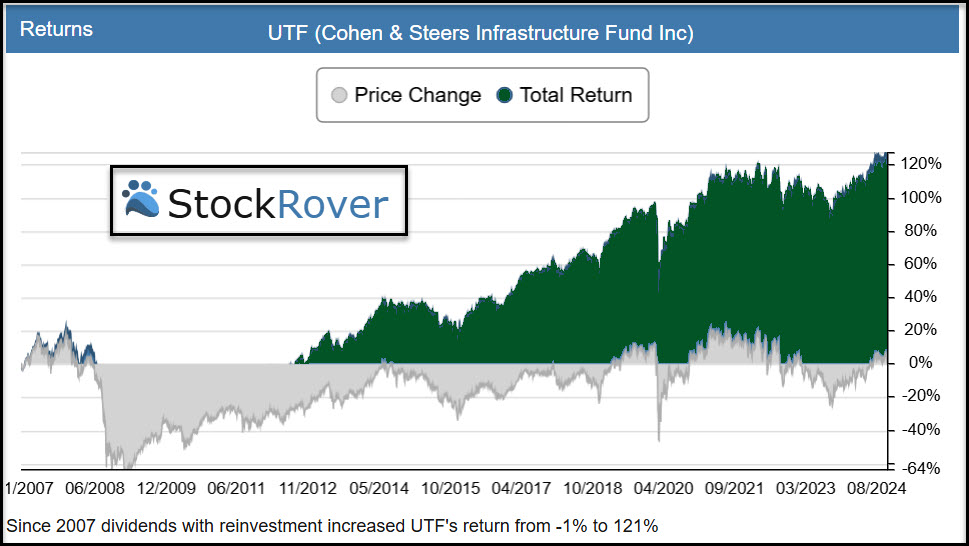

The total ten-year returns are 148.28%, which is really good when compared to any bond fund and certainly beats CDs in total ten-year returns. Even the five-year return is a respectable 40.38%.

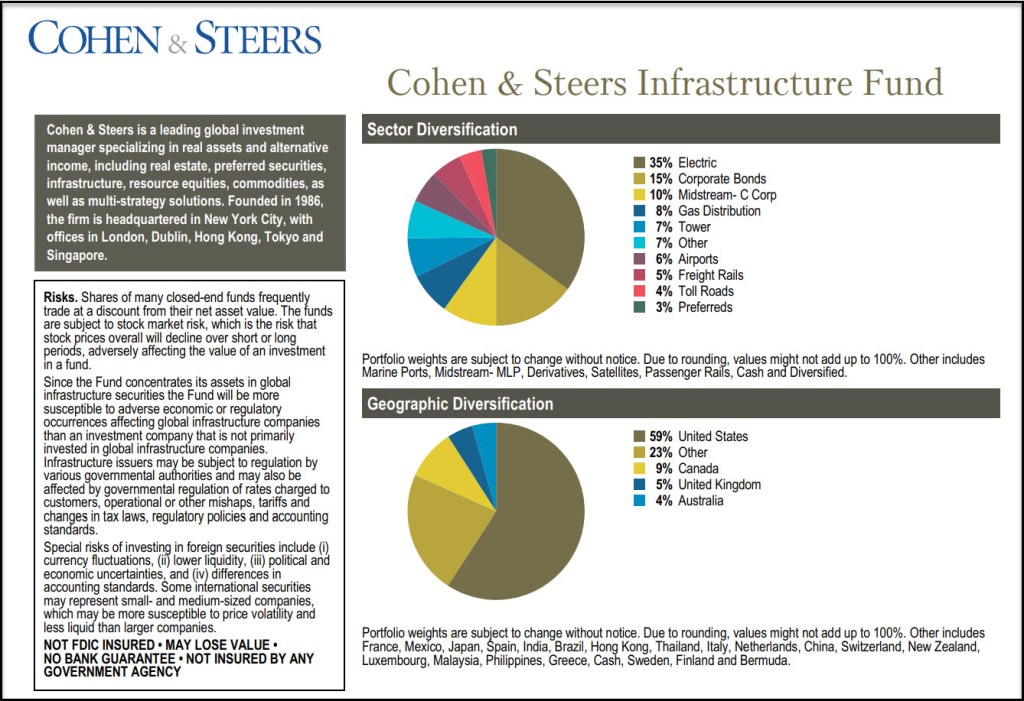

I like the fact that the fund has 273 investments, focused primarily on utilities (54%) and industrials (21%). It also contains investments in energy and real estate.

The Negatives

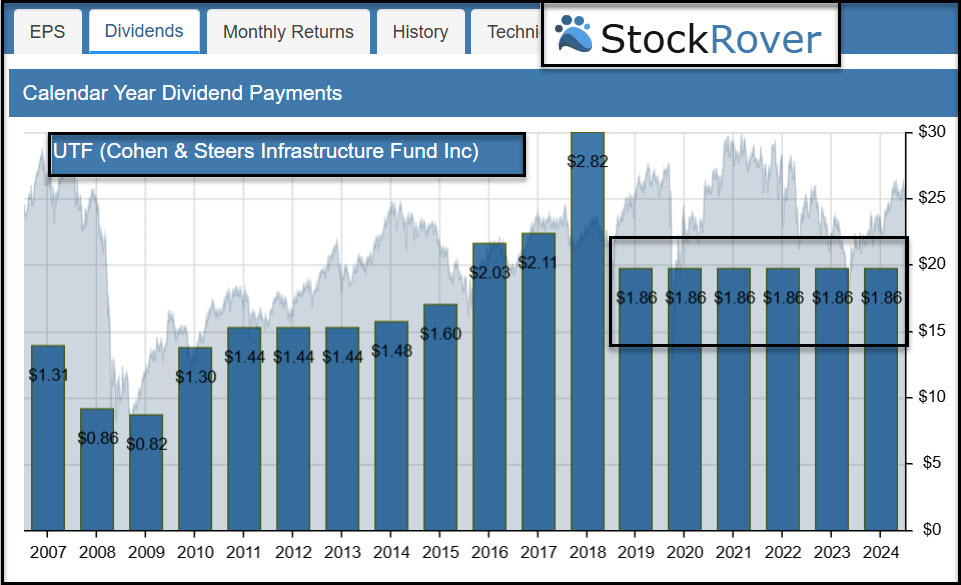

In the past I have said that I am not a big fan of utilities. Buying individual utilities is a clumsy way to invest in the utility sector. Utilities usually have poor dividend growth rates, and UTF certainly falls into that category.

Furthermore, UTF’s Expense Ratio is a staggering 2.29%. If you know anything about expense ratios, that is higher than high. Also, because the fund is thinly traded (not many shares trade on any given day), you don’t want to rush to sell your shares to raise cash. In that sense it is less desirable than a CD or SPAXX.

UTF has corporate bond investments. If you are a long-term reader, you know that I generally dislike bonds. However, the bond holdings are not a huge piece of the UTF total investments.

My Approach

I currently own 200 shares of UTF, making it now worth about $4,884. If I were to purchase a 3-month CD for $5K, I would know my capital was reasonably safe, but the yield would not be great. Furthermore, I have been buying slowly. My first 100 shares have a cost basis of $24.85, the next 25 shares were purchased at $24.75, the next 25 at $24.54 and the last 50 at the same price. If the share price drops some more, I will buy another 25-50 shares.

The best way to buy an investment like this is with a buy limit order. On Friday UTF’s share price closed at $24.42. I would be tempted to enter a buy limit order for 50 shares at $24.40. This would lower my total cost basis and increase my monthly dividend.

Cautions Regarding Utility ETFs and Closed End Fund UTF

For example, XLU is an ETF that focuses on the utilities sector. It is called “The Utilities Select Sector SPDR® Fund ETF.” Although the expense ratio is a reasonable 0.09%, the yield is a paltry 2.85%. It is true that it is a favorite of many with Assets (AUM) of $17.01B. However, the ten-year total return is 127.9% as compared to 148.28% for UTF. I just like the greater diversification of closed end fund UTF. However, don’t buy UTF shares in one big gulp and don’t buy them if you need to quickly sell them. This is an income play, not a growth investment.

Fund Profile

Cohen & Steers Infrastructure Fund, Inc. is a closed-end equity fund launched by Cohen & Steers, Inc. The fund is managed by Cohen & Steers Capital Management, Inc. It invests in public equity markets of the United States. The fund invests primarily in value stocks of infrastructure companies across all market capitalizations. It employs fundamental analysis to make its investments. The fund benchmarks the performance of its portfolio against a composite index of 80% FTSE Global Core Infrastructure 50/50 Net Tax Index (FTSE 50/50) and 20% BofA Merrill Lynch Fixed-Rate Preferred Securities Index. It was formerly known as Cohen & Steers Select Utility Fund, Inc. Cohen & Steers Infrastructure Fund, Inc. was formed on January 8, 2004 and is domiciled in the United States.

The Funds objective is to achieve total return, with an emphasis on income. Under normal market conditions, the Fund will invest at least 80% of its managed assets in securities issued by infrastructure companies, which consist of utilities, pipelines, toll roads, airports, railroads, ports, telecommunications companies and other infrastructure companies.