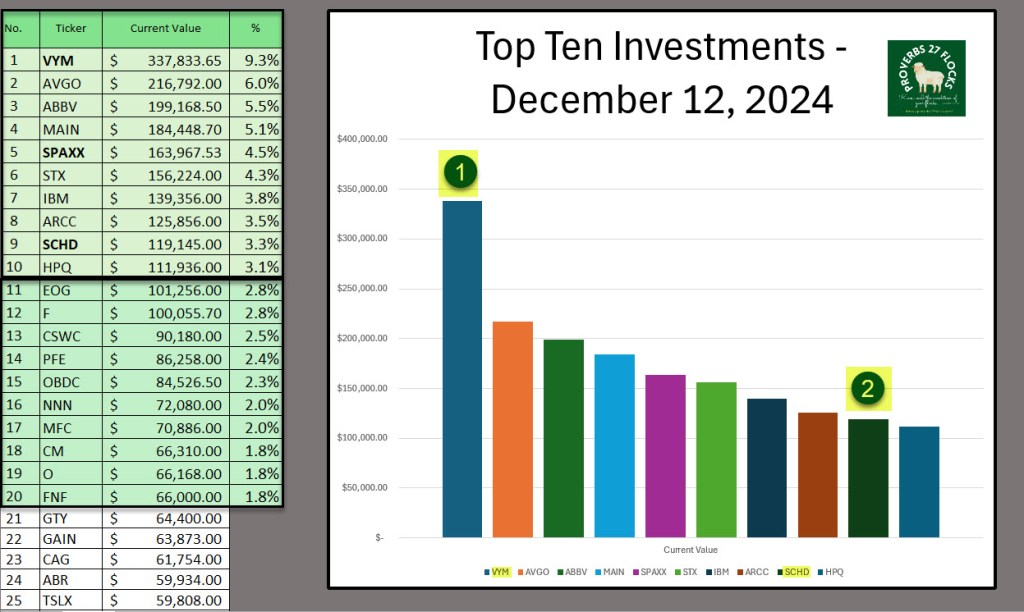

The Mix Has Changed for Better Diversification

Because of a recent purchase of SCHD shares, our top ten investment mix has changed. The top ten now include VYM and SCHD. Rounding out the top ten are AVGO, ABBV, MAIN, SPAXX, STX, IBM, ARCC, and HPQ.

SCHD and VYM provide a better level of diversification. We now hold $456,978 in those two solid ETFs. SCHD has 103 holdings with financials and health care as the largest two sectors. VYM, by contrast, has 539 holdings. Again its top sector is the financial sector, but number two is consumer defensive. While there is some overlap, their top ten has little or no overlap in the actual positions.

If you are familiar with the ticker symbols, you will quickly notice that there are four technology companies in my top ten. They are AVGO, STX, IBM, and HPQ. One of the nice things about my technology investments is that I get both dividends and income from covered call options trades.

MAIN and ARCC are financial sector investments, and ABBV is a health care company. SPAXX is a money market fund for cash to be used for investing.

Options Income Example

For example, YTD options income for my AVGO shares is $9,584.51. HPQ has added another $6,817.78 in options income since August. I don’t trade as many options on STX, but even there I have received $4,798.38 in covered call options contracts. Finally, IBM has helped me add $5,753.57 in additional options income.

Total options-related income has now reached $91,142.88 in 2024. This is less than our dividend income, but it is a significant addition to our tax-deferred and tax-free income. For example, $14,875 of the options income was earned in our ROTH IRA accounts. As I move more assets from my traditional IRA to my ROTH, I accelerate our tax-free income.

Long-Term Investing

The other thing about my top ten investments is that I bought them at reasonable prices and plan to hold them for the long-term. Certainly VYM and SCHD are both long-term in strategy, as they really increase the diversification of the total portfolio. Having said that, the other holdings are also a long-term dividend growth or high yield part of my easy income strategy.

The top ten make up about 43% of our total investment dollars. If I did not think these were good investments for the long-term, they certainly would not be in the top ten with such a high allocation of the total dollars.